Saudi Arabia Data Center Market Size, Share, Trends and Forecast by Data Center Size, Tier Type, Absorption, and Region, 2026-2034

Saudi Arabia Data Center Market Summary:

The Saudi Arabia data center market size was valued at USD 2.43 Billion in 2025 and is projected to reach USD 8.49 Billion by 2034, growing at a compound annual growth rate of 14.93% from 2026-2034.

The market's expansion is primarily fueled by the government's Vision 2030 digital transformation initiative, massive hyperscale cloud investments from global technology leaders, and mandatory data localization policies requiring sovereign infrastructure deployment. Large enterprises across banking, telecommunications, government, and energy sectors are accelerating cloud migration while artificial intelligence workloads demand high-density computing capacity, driving unprecedented growth in both massive hyperscale facilities and dedicated large-scale deployments that support the Kingdom's emergence as a regional digital hub, thereby expanding the Saudi Arabia data center market share.

Key Takeaways and Insights:

- By Data Center Size: Large dominates the market with a share of 32% in 2025, driven by enterprise demand for dedicated mid-sized deployments.

- By Tier Type: Tier 3 leads the market with a share of 50% in 2025, balancing concurrent maintainability with cost-effectiveness for business continuity.

- By Absorption: Utilized represents the largest segment with a market share of 57% in 2025, reflecting active deployments supporting cloud migration and data localization mandates.

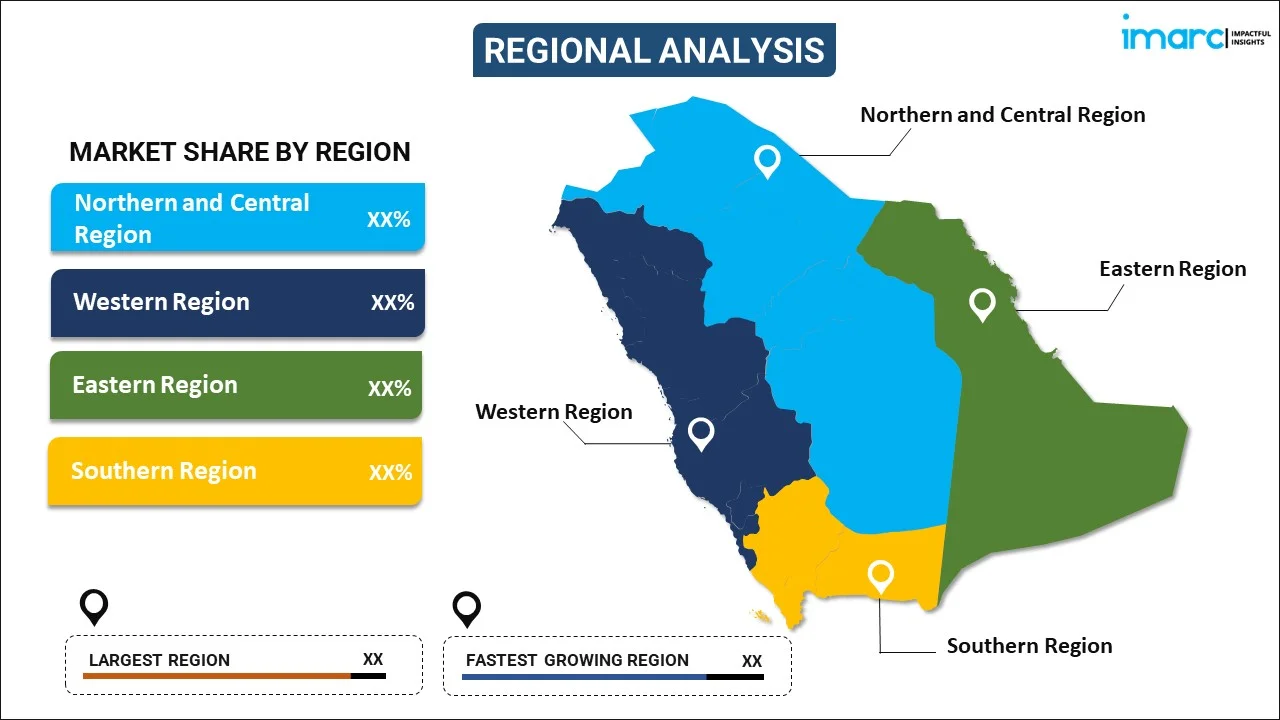

- By Region: Eastern Region leads the market with a share of 35% in 2025, posting fastest growth driven by industrial diversification and energy sector transformation.

- Key Players: Key players in Saudi Arabia’s data center market are scaling capacity, investing in energy-efficient infrastructure, adding cloud and AI services, forming alliances with global hyperscalers, and aligning projects with Vision 2030 to secure enterprise and government demand. Some of the key market players include Detecon Al Saudia DETASAD Co. Ltd., Electronia, Gulf Data Hub, Mobily, NashirNet, NourNet, Sahara Net, Shabakah Integrated Technology, and Systems of Strategic Business Solutions.

Saudi Arabia's data center market is experiencing transformative growth as the Kingdom positions itself as a digital gateway connecting Europe, Asia, and Africa through strategic submarine cable infrastructure. The market benefits from abundant low-cost energy at approximately USD 0.05 per kilowatt-hour and an extensive power generation network with over 400 terawatt-hours of annual capacity, enabling operators to deploy power-dense artificial intelligence and hyperscale campuses. In 2024, Microsoft announced advancements regarding its datacenter region in the Kingdom of Saudi Arabia, following a recent site visit by a group of government officials from the Saudi Ministry of Communications and Information Technology (MCIT) along with Microsoft executives from the company's headquarters and Saudi Arabia. The worldwide tech firm revealed the finishing of construction on all three Azure availability zones, with access expected in 2026. The National Data Center Strategy unveiled in June 2025 targets 1.5 gigawatts of capacity by 2030, with mandatory cloud-first directives requiring all ministries and public agencies to migrate legacy workloads to sovereign infrastructure, creating sustained baseline demand that supports both hyperscale consolidation and the proliferation of edge facilities along 5G corridors serving latency-sensitive applications.

Saudi Arabia Data Center Market Trends:

Hyperscale Cloud Expansion and AI Infrastructure Development

Major global hyperscalers are investing billions in Saudi data center capacity to establish regional cloud hubs and AI processing facilities, fundamentally reshaping the Kingdom's digital infrastructure landscape. The market is witnessing unprecedented capital deployment from technology giants seeking to capture growing demand for cloud services, artificial intelligence workloads, and sovereign data hosting in the Middle East region. These massive investments reflect Saudi Arabia's strategic importance as operators build multi-building campuses that anchor ecosystem partnerships with software providers, security vendors, and enterprise customers across government, financial services, and industrial sectors requiring localized compute resources with low latency and high availability guarantees. In 2025, Amazon Web Services (AWS) and HUMAIN, the newly established company in Saudi Arabia focused on advancing AI innovation both locally and internationally, have unveiled plans to invest over $5 billion in a strategic collaboration to create a revolutionary “AI Zone” in the Kingdom. This unique AI Zone will unite several groundbreaking features, encompassing specialized AWS AI infrastructure and servers equipped with top-tier semiconductors, UltraCluster networks for expedited AI training and inference, AWS services like SageMaker and Bedrock, along with AI application services like Amazon Q to enhance Saudi Arabia’s goal of becoming a global leader in AI.

Sovereign AI and Data Localization Mandates

The Saudi government is implementing strict data localization policies and building sovereign AI capabilities through massive national initiatives that require organizations to host sensitive data within Kingdom borders. The emphasis on technological sovereignty extends beyond compliance to encompass ambitious programs developing Arabic language models, training domestic AI talent, and establishing the Kingdom as a regional leader in artificial intelligence research and deployment across public and private sectors. In June 2025, the Ministry of Communications and Information Technology unveiled its National Data Center Strategy targeting 1.5 gigawatts of capacity by 2030, while the government launched the HUMAIN project in May 2025 backed by the Public Investment Fund with plans to deploy 500 megawatts of compute capacity. NVIDIA partnered with HUMAIN on a USD 10 billion investment plan as mandatory cloud-first directives require all ministries and public agencies to migrate legacy workloads to sovereign infrastructure by 2027, and the Saudi Data and Artificial Intelligence Authority's Million Saudis for AI program aims to graduate 20,000 local experts by 2030.

Advanced Cooling Technologies and Renewable Energy Integration

Operators are deploying cutting-edge cooling solutions and renewable power systems to address extreme climate challenges and sustainability goals in Saudi Arabia's desert environment where high ambient temperatures significantly increase operational expenses. The market is moving beyond traditional air cooling toward liquid cooling, immersion cooling, and AI-driven energy management systems that reduce power usage effectiveness while supporting high-density GPU deployments for artificial intelligence training and inference workloads. Sustainability initiatives align with national policy targeting 50 percent renewable generation by 2030, as operators secure power purchase agreements for solar and wind energy that provide cost advantages and environmental credentials attractive to hyperscale tenants, global cloud customers, and enterprises pursuing net-zero commitments. In July 2025, XDS DATACENTRES signed an agreement with ICS Arabia to deliver a 10-megawatt immersion-cooled data center in Riyadh and Jeddah by June 2026 utilizing Desert Dragon's Tier III certified infrastructure supporting high-density AI workloads.

How Vision 2030 is Transforming the Saudi Arabia Data Center Market:

Vision 2030 is reshaping Saudi Arabia’s data center market by pushing digital growth across government and business operations. Programs tied to e-government, smart cities, fintech, and digital health have raised demand for local data storage and high-availability infrastructure. Clear data residency rules are encouraging enterprises and cloud providers to host workloads within the Kingdom rather than overseas. Public sector digitization has also led to long-term contracts that give operators stable demand and faster capacity absorption. The strategy has opened doors for foreign investment, with global hyperscalers partnering with local firms to build large facilities. Incentives linked to energy efficiency and renewable power are influencing how new sites are designed and operated. Regional hubs like Riyadh, Jeddah, and the Eastern Province are seeing steady expansion as Vision 2030 accelerates cloud adoption and enterprise IT modernization. This policy-driven demand is turning data centers into a core pillar of the national digital economy.

Market Outlook 2026-2034:

The Saudi Arabia data center market is poised for exceptional growth through 2034 as the Kingdom solidifies its position as the Middle East's premier digital infrastructure hub attracting continued hyperscale investments and sovereign capacity buildouts. The market generated a revenue of USD 2.43 Billion in 2025 and is projected to reach a revenue of USD 8.49 Billion by 2034, growing at a compound annual growth rate of 14.93% from 2026-2034. The growth is also supported by Vision 2030 digital transformation spending, 5G and fiber infrastructure rollouts, mega smart city projects, and regulatory mandates requiring data localization and cloud-first government procurement that create predictable long-term demand for operators confident in making large-scale build decisions.

Saudi Arabia Data Center Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Data Center Size |

Large |

32% |

|

Tier Type |

Tier 3 |

50% |

|

Absorption |

Utilized |

57% |

|

Region |

Eastern Region |

35% |

Data Center Size Insights:

To get detailed segment analysis of this market, Request Sample

- Large

- Massive

- Medium

- Mega

- Small

Large dominates with a market share of 32% of the total Saudi Arabia data center market in 2025.

Large facilities are recording rapid expansion as enterprises seek control without building proprietary sites, offering scalable infrastructure for mid-sized deployments that support growing digital capabilities. Although smaller in footprint than massive hyperscale operations, large data centers appeal to organizations requiring dedicated hosting that avoids the shared multi-tenant environment while maintaining flexibility to expand capacity as business needs evolve. These facilities typically serve financial institutions, telecommunications operators, and government entities implementing digital transformation initiatives that demand high availability, data sovereignty, and customized configurations aligned with specific security and compliance requirements rather than standardized wholesale offerings.

Large data centers provide optimal balance between capital efficiency and operational control, attracting organizations transitioning from legacy on-premises systems to modern hybrid cloud architectures requiring both private infrastructure and public cloud connectivity. The segment serves medium-sized banks implementing digital banking platforms, telecommunications providers deploying 5G core networks, healthcare organizations hosting electronic medical records systems, and manufacturing companies establishing Industry 4.0 smart factory applications. These facilities typically range from 5 to 20 megawatts of IT load capacity, offering Tier III certification with concurrent maintainability, redundant power and cooling systems, and carrier-neutral connectivity enabling direct connections to multiple cloud providers and network operators

Tier Type Insights:

- Tier 1 and 2

- Tier 3

- Tier 4

Tier 3 leads with a share of 50% of the total Saudi Arabia data center market in 2025.

Tier 3 facilities are the largest segment as enterprises appreciate concurrent maintainability that allows infrastructure components to be removed for planned maintenance without disrupting operations. Organizations value the balance of reliability and cost-effectiveness where uptime guarantees reach heights without requiring the fully redundant power and cooling distribution paths that characterize Tier 3 designs commanding premium pricing. The segment's prevalence reflects pragmatic infrastructure decisions by organizations seeking reliable operations while managing capital expenditure constraints in competitive market environments.

Tier 3 data centers provide multiple distribution paths for power and cooling with only one path active at any given time, enabling maintenance activities without taking systems offline while avoiding the substantial cost premium associated with fully fault-tolerant Tier 4 architectures requiring 2N redundancy. The segment serves e-commerce platforms managing seasonal traffic spikes, telecommunications operators hosting cloud-native network functions, government agencies digitizing public services, and medium-sized financial institutions implementing digital banking platforms where uptime meets business requirements.

Absorption Insights:

- Non-Utilized

- Utilized

Utilized exhibits a clear dominance with 57% share of the total Saudi Arabia data center market in 2025.

The utilized segment dominates Saudi Arabia’s data center market, reflecting strong demand from government entities, cloud service providers, telecom operators, and large enterprises. Rapid digitalization, e-government platforms, fintech adoption, and data localization mandates are driving high occupancy levels across existing facilities. Vision 2030 initiatives have accelerated cloud migration and hyperscale deployments, pushing operators to maximize available rack capacity. Enterprises increasingly prefer colocation and managed services to reduce capital expenditure, further lifting utilization rates. As a result, most operational data centers report tight capacity conditions, with utilization remaining high even as new facilities come online in key hubs like Riyadh and Jeddah.

High utilization levels also reflect operators’ focus on optimizing infrastructure efficiency and securing long-term contracts with anchor tenants. Hyperscalers and large enterprises typically commit capacity early, ensuring steady demand even before facilities reach full maturity. As advanced technologies such as artificial intelligence (AI), big data analytics, and Internet of Things (IoT) applications gain traction, utilized capacity is expected to remain dominant. This sustained absorption highlights a market where demand is keeping pace with expansion, reinforcing Saudi Arabia’s position as a regional digital infrastructure hub.

Region Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Eastern Region leads with a share of 35% of the total Saudi Arabia data center market in 2025.

The Eastern Region holds the largest share of Saudi Arabia’s data center market, supported by its strong industrial base and strategic connectivity. Proximity to the energy sector, petrochemical clusters, and major industrial cities drives steady demand for secure and reliable data infrastructure. The region benefits from established power availability, fiber networks, and access to international subsea cable routes through the Arabian Gulf. Large enterprises and government-linked entities prefer this region for hosting critical workloads, contributing to consistently high utilization. These factors have positioned the Eastern Region as a preferred location for large-scale and mission-critical data center deployments.

Growth in the Eastern Region is further supported by investments from regional operators and global technology firms seeking stable, enterprise-focused demand. Industrial digitalization, automation, and increased use of analytics across oil and gas operations continue to generate data-intensive requirements. Data centers in this region often cater to private cloud, disaster recovery, and high-availability use cases. As industrial firms adopt advanced digital tools and regulatory focus on data residency strengthens, the Eastern Region is expected to retain its lead. Ongoing infrastructure upgrades and planned expansions indicate continued confidence in the region’s long-term demand outlook.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Data Center Market Growing?

Vision 2030 Digital Transformation and Government Investment

Saudi Arabia's Vision 2030 initiative is driving unprecedented government investment in digital infrastructure and smart city projects that fundamentally reshape the Kingdom's economic structure away from hydrocarbon dependence toward technology-driven diversification. The comprehensive national strategy emphasizes digital transformation across public administration, education, healthcare, and industrial sectors creating massive demand for data center capacity to support cloud-based government services, artificial intelligence applications, and smart infrastructure deployments. The Saudi Ministry of Investment projected in 2024 that digital transformation investments in the Kingdom will reach USD 13.3 billion by 2025 growing at an annual rate of 17.2 percent.

Explosive Growth in AI, Cloud Adoption, and 5G Infrastructure

The rapid adoption of artificial intelligence, cloud computing, and 5G networks is creating exponential demand for high-performance data center capacity as organizations across all sectors embrace data-driven decision-making and digital service delivery models. Enterprise cloud migration projects accelerated dramatically as businesses shift away from conventional information technology infrastructures to scalable cloud platforms offering enhanced operational efficiency, reduced capital expenditure, and access to advanced capabilities including machine learning, big data analytics, and internet of things integration. The proliferation of 5G networks generating massive real-time traffic requires edge computing infrastructure processing data at low latency near the point of origin, while artificial intelligence applications in healthcare diagnostics, financial services fraud detection, manufacturing quality control, and autonomous systems demand specialized high-density computing resources with advanced cooling and power distribution. IMARC Group predicts that the Saudi Arabia cloud services market is projected to attain USD 13.1 Billion by 2033.

Strategic Geographic Location and Competitive Energy Costs

Saudi Arabia's position as a digital gateway between Europe, Asia, and Africa combined with abundant low-cost energy provides significant competitive advantages attracting hyperscale operators seeking regional hub locations with superior connectivity and power economics.. The geographic centrality enables operators to serve multiple regional markets from consolidated Saudi facilities while meeting data residency requirements, as Riyadh's position at the crossroads of east-west trade routes and proximity to Gulf Cooperation Council neighbors creates natural advantages for organizations requiring centralized infrastructure supporting distributed operations. The extensive power generation and transmission network has an installed capacity to support power-dense artificial intelligence and hyperscale campuses where other developed markets struggle with grid constraints, as leading campuses such as DataVolt's Oxagon facility plan to run entirely on solar and wind contracts providing sustainability credentials and operational cost reductions attractive to hyperscale tenants and global cloud customers pursuing environmental social governance commitments. The Oxagon is one of the world’s largest AI data centers with a $5 billion investment and a capacity of 1.5 gigawatts.

Market Restraints:

What Challenges the Saudi Arabia Data Center Market is Facing?

Skilled Workforce Shortage and Talent Gap

The data center sector faces a severe shortage of qualified professionals in operations, cloud management, and advanced technologies including artificial intelligence, adversely impacting facility efficiency and delaying project execution timelines. The scarcity affects specialized areas including high-performance computing, advanced cooling systems, utility grid integration, and commissioning authority roles required throughout full project lifecycles from design through operations, raising operating expenses and constraining the Kingdom's ability to execute ambitious infrastructure buildouts at the pace required to meet Vision 2030 objectives.

Extreme Climate and Water Scarcity Concerns

High ambient temperatures in Saudi Arabia's desert climate significantly increase cooling costs creating one of the defining operational challenges for data center operators deploying infrastructure in the Kingdom. The country's data centers reportedly required massive amounts of water and face water scarcity threats due to aridity, excessive use of costly desalinated water, and cooling demands in the hot climate where traditional air cooling becomes inefficient at high temperatures. Data centers add significant additional demand pressures to already strained water resources stemming from population and economic growth, requiring operators to deploy sustainable water management strategies including recycled water systems, advanced liquid cooling, immersion cooling, and AI-driven energy management systems that reduce power usage effectiveness while addressing environmental sustainability concerns and the high costs associated with desert-specific cooling requirements.

Complex Regulatory Environment and Cybersecurity Threats

Saudi Arabia's strict data protection and localization laws create compliance challenges for multinational operators navigating complex regulatory frameworks, increasing operational complexity and costs while requiring continuous adaptation to evolving standards. Data center security faces major challenges due to the Kingdom's changing threat landscape, extensive anti-cybercrime policies, and the complicated nature of cybersecurity threats requiring continuous investment in security infrastructure and compliance systems. While regulations enhance national data sovereignty and support Vision 2030 goals providing a safe legal environment that increases investor confidence, they also necessitate that operators implement advanced security architectures including zero-trust frameworks, encryption-by-design, and real-time threat intelligence systems to protect sensitive government, enterprise, and consumer data against sophisticated cyber attacks targeting critical digital infrastructure.

Competitive Landscape:

The Saudi Arabia data center market features an evolving competitive landscape with established telecommunications operators, emerging local infrastructure developers, and global hyperscale providers competing across colocation, wholesale, and self-build segments. Major domestic players leverage existing network infrastructure and government relationships to secure anchor tenant contracts, while international hyperscalers invest billions establishing regional cloud zones requiring massive data center deployments. New market entrants bring significant capital and strategic partnerships to develop next-generation facilities optimized for artificial intelligence workloads, as operators differentiate through tier certifications, renewable energy integration, advanced cooling technologies, and proximity to submarine cable landing stations. Some of the key market players include:

- Detecon Al Saudia DETASAD Co. Ltd.

- Electronia

- Gulf Data Hub

- Mobily

- NashirNet

- NourNet

- Sahara Net

- Shabakah Integrated Technology

- Systems of Strategic Business Solutions

Recent Developments:

- In January 2026, Construction has commenced on a new data centre for the Saudi Arabian government in Riyadh, touted as the largest government data centre globally. The cornerstone of the Hexagon data centre of the Saudi Data and Artificial Intelligence Authority (SDAIA) was established late last week. The Tier IV certified data centre will eventually cover 2.78 million square metres and possess a power capacity of 480MW.

- In December 2025, A division of the Saudi technology company STC Group and the AI firm Humain have partnered to create and construct data centres in the country, aiding Saudi Arabia's effort to become a regional centre for AI. STC's digital infrastructure subsidiary, center3, has a partnership with Humain to develop infrastructure intended to support up to 1GW of AI workloads, addressing the increasing demand for AI needs and applications, announced STC in a statement on Thursday. The firms did not reveal the worth of the development.

Saudi Arabia Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Center Sizes Covered | Large, Massive, Medium, Mega, Small |

| Tier Types Covered | Tier 1 and 2, Tier 3, Tier 4 |

| Absorptions Covered | Non-Utilized, Utilized |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Detecon Al Saudia DETASAD Co. Ltd., Electronia, Gulf Data Hub, Mobily, NashirNet, NourNet, Sahara Net, Shabakah Integrated Technology, Systems of Strategic Business Solutions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia data center market size was valued at USD 2.43 Billion in 2025.

The Saudi Arabia data center market is expected to grow at a compound annual growth rate of 14.93% from 2026-2034 to reach USD 8.49 Billion by 2034.

Large data centers lead the market with 32% share representing the fastest-growing segment, as enterprises opt for dedicated premises that bridge the gap between wholesale colocation and in-house builds offering control, scalability, and customized configurations aligned with specific security and compliance requirements.

Key factors driving the Saudi Arabia data center market include Vision 2030 digital transformation initiatives, hyperscale cloud investments from AWS Microsoft and Google, mandatory data localization policies, explosive AI and 5G adoption, strategic geographic location connecting three continents, and competitive energy costs enabling power-dense infrastructure deployments.

Major challenges include severe skilled workforce shortage with a deficit of qualified engineers reported in 2024, extreme desert climate requiring advanced cooling technologies and huge quantities of water annually, complex data protection and localization regulations increasing compliance costs, and evolving cybersecurity threats demanding continuous security infrastructure investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)