Saudi Arabia Dairy Market Report by Product Type (Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Paneer), and Region 2025-2033

Saudi Arabia Dairy Market:

Saudi Arabia dairy market size reached USD 5.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.8% during 2025-2033. The inflating disposable income of individuals, changing dietary habits, escalating health consciousness, innovative product formulations, cultural influences, implementation of favorable government initiatives, and the diversity of consumer preferences represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Market Growth Rate (2025-2033) | 3.8% |

Saudi Arabia Dairy Market Analysis:

- Major Market Drivers: The rising disposable income levels of the consumers, rapid urbanization, favorable government initiatives, and growing demand for organic and natural dairy products are proliferating the industry’s growth. Moreover, as the population becomes more urbanized and affluent, there's a shift towards a more Westernized diet, including increased consumption of dairy products like prebiotic drinks, cheese, yogurt, etc.

- Key Market Trends: Increasing health consciousness, escalating demand for premium products, growing popularity of e-commerce platforms, and rising cultural influences are anticipated to propel the market demand. Moreover, consumers are increasingly concerned about food safety and the origin of their food products. Dairy companies are investing in technologies, such as blockchain, to enhance traceability throughout the supply chain, ensuring transparency and quality assurance, thereby adding to the industry’s growth.

- Competitive Landscape: Some of the major Saudi Arabia dairy market companies include Almarai Company, Al-Othman Holding Company, Arla Foods amba, Fonterra Co-operative Group Limited, Saudia Dairy and Foodstuff Co., and The National Agricultural Development Company, among many others.

- Challenges and Opportunities: Water scarcity, the harsh desert climate in Saudi Arabia, competition from plant-based alternatives, and regulatory compliance are some of the key challenges that the market is facing. However, Saudi Arabia's strategic location and growing demand for dairy products in the neighboring GCC countries enhance export activities for domestic dairy producers, thereby adding to the Saudi Arabia market recent opportunities.

Saudi Arabia Dairy Market Trends:

Government Incentives and Subsidies

Government incentives and subsidies have played a significant role in driving the growth of the dairy market in Saudi Arabia. The government provides financial support in the form of subsidies, grants, and loans to dairy farmers and producers. These funds are often allocated for investments in infrastructure, technology upgrades, and expansion of dairy operations, thereby influencing the Saudi Arabia dairy market’s recent price. For instance, government subsidies pay for half of the cost of irrigation engines and pumps, all shipping expenses (including airfreight for at least 50 imported cows), and 30% of the cost of dairy farm equipment. In line with this, in January 2024, Saudi Arabia's Public Investment Fund launched a new firm to help grow the local camel dairy farming industry as part of the Saudi Arabia's economic diversification agenda. Moreover, government initiatives facilitate technology transfer and provide training programs to improve and localize dairy farming practices. Knowledge dissemination on modern farming techniques, animal husbandry, and herd management enhances productivity and quality standards in the dairy sector. For instance, in March 2023, Almarai Company, a vertically integrated dairy company, participated in the Ministry of Human Resources and Social Development's "Waad" national training campaign, which will provide over 50,000 training opportunities to the company's employees over the next three years. These factors are contributing to the Saudi Arabia dairy market demand.

Export Opportunities

Export opportunities in the Saudi Arabian dairy market primarily stem from the country's efforts to enhance its dairy production capacity and become more self-sufficient in meeting domestic demand. For instance, according to the Saudi Press Agency, in May 2024, Saudi Arabia achieved 100% of self-sufficiency in dairy products. Moreover, one of the Saudi Arabia dairy market recent developments include government initiatives to propel the food exports. For instance, in 2023, the Saudi food exports totaled roughly SAR20 billion. During the same year, the Saudi Industrial Development Fund granted near about 23 loans totaling SAR700 million to food industries, while the Saudi Export-Import Bank provided more than SAR3 billion to assist food exports. The minister also stated that the ministry, in coordination with its partners, intends to develop industrial infrastructure, stimulate investment in the food industry sector, and provide financial and technical assistance to small and medium-sized businesses in this sector. Furthermore, expanding exports of dairy products contribute to economic growth and job creation in the domestic dairy sector and related industries. Increased exports generate foreign exchange earnings, support agricultural value chains, and create employment opportunities throughout the supply chain, including farming, processing, logistics, and marketing. For instance, in December 2023, Almarai, the world's largest vertically integrated dairy firm and a prominent player in the Middle East's food and beverage industry, entered into collaboration agreements with the Food Industries Polytechnic, the Transport General Authority, and the Saudi Logistics Academy. These agreements seek to foster job localization in the food and beverage industry through comprehensive training and rehabilitation programs that lead to numerous employment opportunities. These factors are significantly contributing to the Saudi Arabia dairy market share.

Rapid Technological Advancements

Technological advancements are indeed playing a significant role in driving the growth of the dairy market in Saudi Arabia. These advancements are improving efficiency, productivity, quality, and sustainability across various aspects of dairy production and processing. For instance, in February 2024, Siemens announced that it is planning to establish food manufacturing cluster in Ras Al-Khair, Saudi Arabia. Moreover, advanced packaging technologies, such as modified atmosphere packaging (MAP) and vacuum packaging, help extend the shelf life of dairy products by creating a protective barrier against oxygen, moisture, and light. Extended shelf life reduces food waste, improves product availability, and enhances consumer satisfaction. Various Saudi Arabia dairy market companies are developing efficient packaging solutions. For instance, in December 2023, IFFCO Group signed a Memorandum of Understanding (MOU) with Tetra Pak, the world's largest food processing and packaging solutions firm, to accelerate sustainability measures across the group's manufacturing facilities. The facility focuses on creating culinary creams and maximizing efficiency while maintaining quality and food safety. These factors are further bolstering the Saudi Arabia dairy market revenue.

Saudi Arabia Dairy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type.

Breakup by Product Type:

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Paneer

The Saudi Arabia dairy market report has provided a detailed breakup and analysis of the market based on the product type. This includes liquid milk, flavored milk, cream, butter, cheese, yoghurt, ice cream, anhydrous milk fat (AMF), skimmed milk powder (SMP), whole milk powder (WMP), whey protein, lactose powder, curd, and paneer.

As per the Saudi Arabia dairy market overview, liquid milk remains a staple in the Saudi diet, with a strong demand for both plain and flavored varieties. As the population grows and incomes rise, the demand for liquid milk continues to increase, driven by factors such as convenience, nutritional awareness, and the preference for dairy products in traditional and modern recipes. While, flavored milk products, such as chocolate and strawberry milk, are popular among children and adults alike. Moreover, cream is commonly used in cooking, baking, and food preparation in Saudi households and food service establishments. The demand for cream is influenced by factors such as the growth of the hospitality sector, the popularity of Western cuisines, and the adoption of cream-based sauces and desserts in local cuisine. Furthermore, butter is a versatile ingredient used in both traditional and international cooking in Saudi Arabia. Besides this, cheese consumption in Saudi Arabia has been on the rise due to factors such as globalization, urbanization, Western influence, and the growing popularity of cheese-based dishes and snacks.

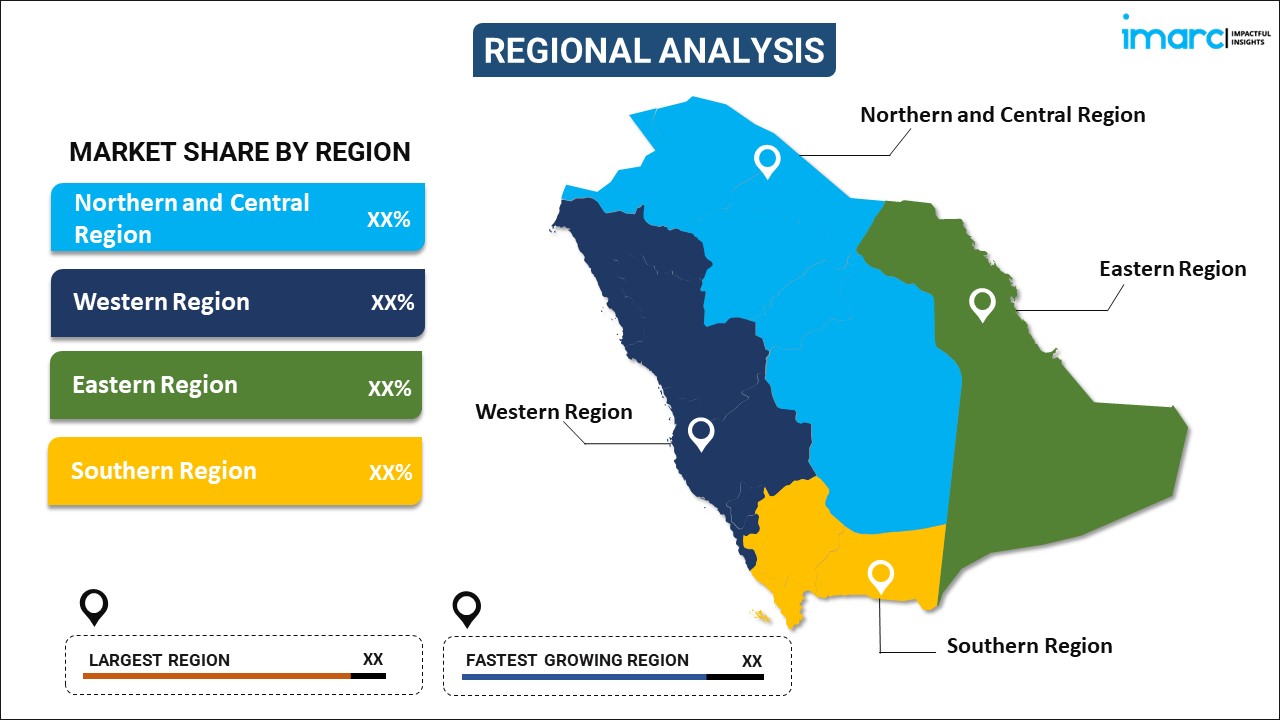

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

According to the Saudi Arabia dairy market statistics, Northern and Central Region includes major cities like Riyadh, the capital of Saudi Arabia, as well as other urban centers and densely populated areas. The demand for dairy products in this region is generally high due to the large population and urbanization. Moreover, the Western Region includes cities like Jeddah, Mecca, and Medina, as well as coastal areas along the Red Sea. The demand for dairy products in this region is influenced by factors such as tourism, cultural diversity, and international influences. Besides, the Eastern Region is home to major industrial cities like Dammam, Al Khobar, and Jubail, as well as oil-rich areas. The demand for dairy products in this region is driven by factors such as economic prosperity, urbanization, and a diverse population. Apart from this, the Southern Region includes cities like Abha, Jizan, and Najran, as well as rural areas with agricultural activities. The demand for dairy products in this region is influenced by factors such as traditional dietary habits, agriculture, and local culinary preferences.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Almarai Company

- Al-Othman Holding Company

- Arla Foods amba

- Fonterra Co-operative Group Limited

- Saudia Dairy and Foodstuff Co.

- The National Agricultural Development Company

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Saudi Arabia Dairy Market News:

- March 2024: Almarai Company disclosed its investment plan for the next five years, 2024-2028 to strengthen its leading position as the largest vertically integrated dairy company. This is in accordance with the targets of Saudi Vision 2030 and the state's support and empowerment of the private sector.

- March 2024: The Saudi Food Bank collaborated with Kiri through its "Iftaar fast-breaking program" during Ramadan. The iftaar meal included a wholesome combination of Kiri cheese with bread, juice, and fresh fruits.

- January 2024: Saudia Dairy and Foodstuff Company (SADAFCO) launched its new depot in Makkah.

Saudi Arabia Dairy Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Paneer |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered | Almarai Company, Al-Othman Holding Company, Arla Foods amba, Fonterra Co-operative Group Limited, Saudia Dairy and Foodstuff Co., The National Agricultural Development Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Saudi Arabia dairy market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Saudi Arabia dairy market?

- What is the breakup of the Saudi Arabia dairy market on the basis of product type?

- What are the various stages in the value chain of the Saudi Arabia dairy market?

- What are the key driving factors and challenges in the Saudi Arabia dairy?

- What is the structure of the Saudi Arabia dairy market and who are the key players?

- What is the degree of competition in the Saudi Arabia dairy market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia dairy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia dairy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia dairy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)