Saudi Arabia Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2026-2034

Saudi Arabia Cosmetics Market Summary:

The Saudi Arabia cosmetics market size was valued at USD 3.97 Billion in 2025 and is projected to reach USD 4.62 Billion by 2034, growing at a compound annual growth rate of 1.71% from 2026-2034.

The market is propelled by a young, digitally engaged population increasingly influenced by beauty influencers and global cosmetic trends. Rising disposable incomes, particularly among women entering the workforce, are enabling higher spending on premium and luxury cosmetic products. The growing consumer awareness of personal grooming, combined with the expanding retail infrastructure including malls, specialty stores, and e-commerce platforms, is making international and domestic brands more accessible across urban and suburban regions. Additionally, the increasing demand for halal-certified products that align with Islamic values is strengthening consumer trust and expanding Saudi Arabia cosmetics market share.

Key Takeaways and Insights:

-

By Product Type: Skin and sun care products dominate the market with a revenue share of 43.75% in 2025, driven by heightened consumer consciousness towards skin protection against harsh climatic conditions.

-

By Category: Conventional leads the market with 82.58% share in 2025, supported by established supply chains and competitive pricing structures.

-

By Gender: Women represent the largest segment with a market share of 70.49% in 2025, reflecting higher spending patterns on skincare, makeup, and hair care products.

-

By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 60.54% in 2025, offering convenience and accessibility to mass-market consumers.

-

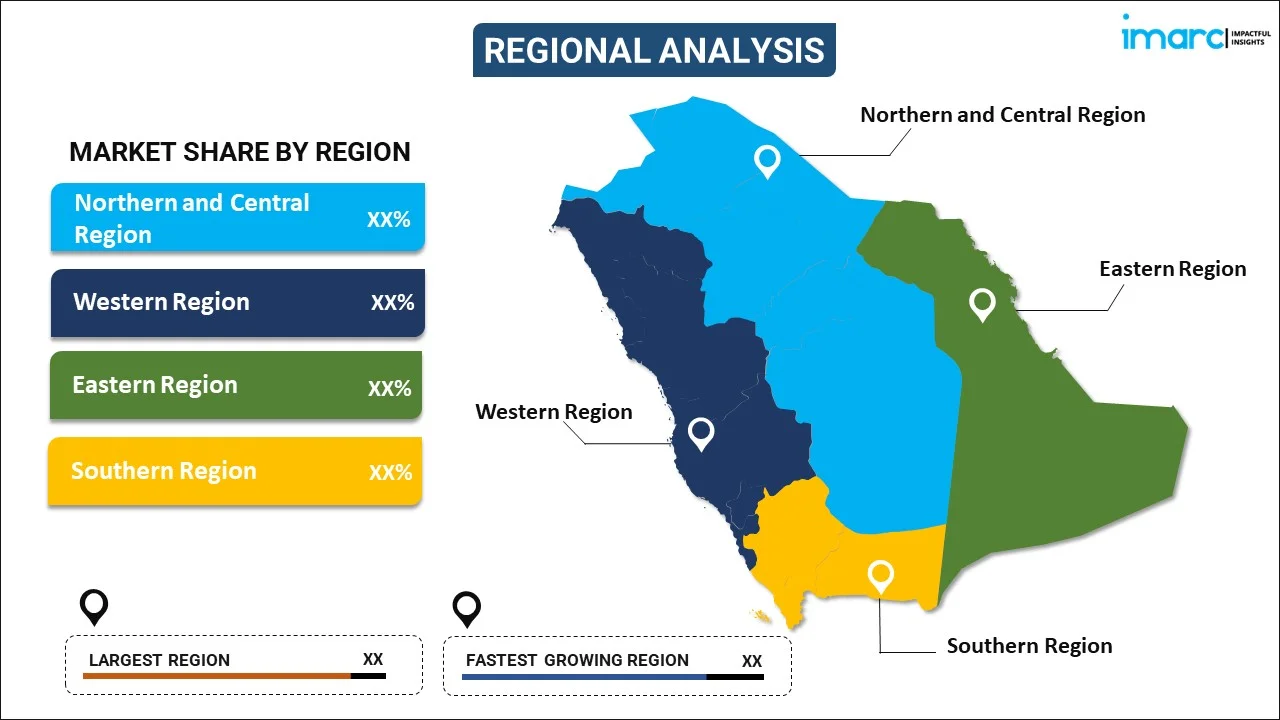

By Region: Northern and central region represent the largest segment with a market share of 37% in 2025, driven by urban concentration in Riyadh and high purchasing power.

-

Key Players: The market exhibits moderate competitive intensity, with multinational personal care corporations competing alongside emerging local brands and digital-native challengers that leverage influencer networks and regulatory familiarity to carve profitable niches. Some of the key players are Avon Beauty Arabia, Beauti.Sa, Dar Madi International Co., and Goldenscent LLC.

The Saudi Arabia cosmetics market is experiencing transformation driven by social media penetration and digital connectivity, with internet usage reaching 99 percent among the population in 2024. The rising participation of women in the workforce, which reached 36 percent in 2024, is creating a growing consumer base with distinct beauty preferences and higher disposable incomes. The government's Vision 2030 initiative is further supporting market expansion through economic diversification policies and women's empowerment programs. In January 2025, Nice One Beauty successfully raised USD 322 million through its initial public offering on the Riyadh stock exchange, demonstrating strong investor confidence in digital-first beauty platforms. The proliferation of e-commerce channels, supported by over 41,000 registered online businesses as of Q4 2024, is reshaping consumer purchasing patterns and enhancing product accessibility across diverse geographic locations.

Saudi Arabia Cosmetics Market Trends:

Digital Transformation and Influencer-Driven Marketing

Social media platforms are fundamentally reshaping beauty product discovery and consumer engagement in Saudi Arabia. Beauty influencers and content creators are driving brand awareness and product adoption through authentic reviews, makeup tutorials, and skincare routines that resonate with younger demographics. The rise of digital marketing strategies has enabled both international and local brands to reach consumers directly, bypassing traditional advertising channels and building communities around specific beauty philosophies. Virtual try-on technologies powered by artificial intelligence are enhancing the online shopping experience, allowing consumers to visualize products before purchase. This digital ecosystem has compressed brand-building cycles and enabled rapid market entry for new players willing to invest in influencer partnerships and social commerce integration. In 2024, Moonglaze, the cosmetics brand created by Saudi influencer Yara Alnamlah, is poised to mark a milestone on Dec. 4 as the inaugural Saudi beauty label to debut at Selfridges London. Alnamlah highlighted that this launch will create opportunities for the brand outside the Middle East.

Rising Demand for Halal-Certified Cosmetics

Consumer preference for halal-certified cosmetics is accelerating as religious compliance intersects with clean beauty standards and ethical consumption values. Products free from alcohol, pork-derived ingredients, and non-halal animal byproducts are experiencing heightened demand from consumers seeking assurance that cosmetics align with Islamic principles. In May 2024, the Halal Products Development Company invested in Believe, a halal cosmetics manufacturer, with plans to relocate its headquarters to Saudi Arabia and position the Kingdom as a global export hub. The government's Vision 2030 initiative is strengthening halal certification standards and regulatory frameworks, enhancing consumer confidence and attracting international brands to develop Shariah-compliant formulations. This trend extends beyond religious observance to encompass broader wellness concerns, as halal products often emphasize natural ingredients and ethical sourcing practices that appeal to health-conscious consumers across demographic segments.

Expansion of E-Commerce and Omnichannel Retail

The rapid growth of online retail channels is revolutionizing the cosmetics distribution landscape in Saudi Arabia. Digital platforms offer consumers unprecedented product variety, competitive pricing, and shopping convenience that traditional brick-and-mortar stores struggle to match. Beauty brands are implementing omnichannel strategies that seamlessly integrate physical stores, e-commerce websites, mobile applications, and social commerce capabilities. The adoption of click-and-collect services, smart kiosks, and same-day delivery options is blending the convenience of online shopping with the experiential benefits of in-store consultations. In 2024, FSN E-Commerce Ventures Ltd., the parent company of fashion e-retailer Nykaa, declared on Friday that it has established a subsidiary in Saudi Arabia for both online and offline sales of beauty products. The newly established subsidiary, titled Nysaa Trading LLC., will function under the brand "Nysaa KSA," according to an announcement in an exchange filing. Nysaa KSA will engage in the "global and local sale/trade/retail of beauty and personal care products (both online and offline) along with other associated activities," the document noted.

How Vision 2030 is Transforming the Saudi Arabia Cosmetics Market:

Saudi Arabia's Vision 2030 is reshaping the cosmetics market by promoting economic diversification and empowering women, which significantly impacts consumer behavior and demand for beauty products. The government's initiatives, such as increasing female participation in the workforce and fostering local production, are driving the demand for a broader range of beauty and personal care products. Vision 2030 encourages innovation and investment in local manufacturing, aiming to reduce dependence on imports and boost the growth of domestic cosmetics brands. The shift towards a more open and diversified market is also supported by increased online retail platforms, making beauty products more accessible to a wider audience. The rising middle class, combined with an increasing emphasis on self-care and wellness, is propelling demand for skincare, anti-aging, and personal care products. Saudi women, in particular, are at the forefront of this transformation, with more spending power and an interest in high-quality beauty products. As Vision 2030 fosters a more open market with greater international partnerships, Saudi Arabia is emerging as a key player in the global cosmetics industry. The market is expected to experience sustained growth, attracting both local and international brands to tap into the lucrative consumer base.

Market Outlook 2026-2034:

The Saudi Arabia cosmetics market is poised for steady growth, driven by favorable demographic trends and continued economic diversification under Vision 2030. The market generated a revenue of USD 3.97 Billion in 2025 and is projected to reach a revenue of USD 4.62 Billion by 2034, growing at a compound annual growth rate of 1.71% from 2026-2034. The increasing acceptance of cosmetics usage among professional women and the growing male grooming segment will broaden the consumer base. Digital transformation will continue reshaping the competitive landscape, with brands investing heavily in artificial intelligence, augmented reality, and social commerce capabilities to enhance customer engagement and streamline purchase journeys across multiple touchpoints.

Saudi Arabia Cosmetics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Skin and Sun Care Products |

43.75% |

|

Category |

Conventional |

82.58% |

|

Gender |

Women |

70.49% |

|

Distribution Channel |

Supermarkets and hypermarkets |

60.54% |

|

Region |

Northern and Central Region |

37% |

Product Type Insights:

To get more information on this market, Request Sample

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products dominates with a market share of 43.75% of the total Saudi Arabia cosmetics market in 2025.

The leadership of skin and sun care products reflects heightened consumer awareness regarding skin health and protection against Saudi Arabia's harsh climatic conditions, where temperatures rising and low humidity creates specific skincare requirements. The segment encompasses moisturizers, sunscreens, anti-aging serums, cleansers, and specialized treatments that address diverse skin concerns including hyperpigmentation, dryness, and premature aging. International brands have expanded their product portfolios specifically formulated for Middle Eastern skin types and environmental conditions. In July 2024, Nivea launched the Luminous630 Even Skin Tone body care range in Saudi Arabia, designed to tackle prevalent concerns including uneven skin tone and stretch marks that affect women in the region. The influence of Korean beauty trends has expanded skincare routines beyond basic cleansing to incorporate multi-step regimens including toners, essences, and sheet masks.

The growing demand for halal-certified and natural ingredient formulations is reshaping product development within the skin care category. Consumers are increasingly scrutinizing ingredient lists and seeking products free from harmful chemicals, parabens, and synthetic fragrances that may cause allergic reactions or long-term health concerns. The convergence of religious compliance requirements with clean beauty standards creates unique product positioning opportunities for brands that emphasize transparency, ethical sourcing, and dermatological validation. Premium skincare brands are investing in advanced formulation technologies including hyaluronic acid, retinol derivatives, and peptide complexes that deliver visible results while meeting safety and efficacy standards demanded by sophisticated users.

Category Insights:

- Conventional

- Organic

Conventional leads with a share of 82.58% of the total Saudi Arabia cosmetics market in 2025.

Conventional cosmetics maintain market dominance through established supply chains, competitive pricing structures, and consumer familiarity with trusted formulations that deliver consistent performance. Major multinational corporations have built strong brand equity over decades, providing consumers with confidence in product safety, efficacy, and availability across diverse retail channels. The widespread accessibility of conventional products through supermarkets, hypermarkets, pharmacies, and online platforms ensures reach across different income levels and geographic regions. Mass-market brands benefit from economies of scale that enable aggressive pricing strategies and extensive promotional campaigns during peak shopping seasons including Ramadan and National Day celebrations.

The widespread acceptance of synthetic ingredients and chemical preservatives among mainstream consumers reflects confidence in regulatory oversight by the Saudi Food and Drug Authority, which maintains stringent safety standards and testing protocols for all cosmetic products entering the market. Conventional products benefit from extensive research and development investments by global corporations, resulting in advanced formulation technologies incorporating hyaluronic acid, retinol derivatives, peptide complexes, and proprietary delivery systems that maximize ingredient penetration and stability. The predictable sensory experiences, familiar fragrances, and standardized textures of conventional cosmetics reduce purchase anxiety for consumers navigating crowded beauty aisles, while the lower price points compared to organic alternatives make premium skincare and makeup accessible to middle-income families.

Gender Insights:

- Men

- Women

- Unisex

Women exhibit a clear dominance with a 70.49% share of the total Saudi Arabia cosmetics market in 2025.

Female consumers drive the majority of cosmetics purchasing across all product categories, with average spending levels significantly higher than male consumers due to broader product usage spanning skincare, makeup, hair care, and fragrances. Working women demonstrate increased interest in premium and luxury cosmetics that align with corporate dress codes and social expectations in business environments spanning healthcare, finance, education, and technology sectors. The cultural shift towards greater female empowerment under Vision 2030 is encouraging women to invest money in high quality cosmetics and makeup products.

Various factors have normalized makeup application and comprehensive beauty rituals that were previously constrained by conservative social norms limiting public cosmetics usage and restricting female participation in mixed-gender professional settings. The economic empowerment of Saudi women extends beyond individual purchasing decisions to influence household-level beauty spending allocations, as employed women exercise greater financial autonomy and frequently serve as primary buyers for children's skincare products, family sun protection essentials, and personal care items for multiple household members, amplifying their impact on total market revenues beyond personal consumption patterns.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead with a share of 60.54% of the total Saudi Arabia cosmetics market in 2025.

Supermarkets and hypermarkets dominate cosmetics distribution channels through their unparalleled convenience, geographic accessibility, and comprehensive product assortments serving mass-market consumers who prefer consolidating beauty purchases with routine grocery shopping trips. Major retail chains provide dedicated beauty sections featuring both international prestige brands and affordable local alternatives across multiple price points, enabling one-stop shopping experiences that save valuable time for busy families and working professionals. These large-format stores leverage competitive pricing strategies through promotional campaigns, loyalty reward programs, and volume discounts appealing to price-conscious households seeking maximum value from beauty expenditures.

The physical presence of hypermarkets provides tangible benefits that online channels struggle to replicate, allowing consumers to physically examine packaging quality, test product textures and fragrances, compare ingredient formulations across competing brands, and receive immediate assistance from trained sales staff when navigating complex categories like foundation shade matching or skincare regimen selection for specific concerns. Frequent promotional periods during Ramadan and seasonal celebrations generate significant foot traffic and encourage trial of new product launches through discounted introductory pricing and gift-with-purchase offers that reduce purchase risk. The strategic product mix in these stores emphasizes everyday replenishment items including shampoos, conditioners, body lotions, deodorants, and cleansers that require regular replacement, generating consistent customer visits and repeat purchase behaviors supporting sustained revenue growth across economic cycles while creating opportunities for impulse purchases of complementary beauty products displayed in high-traffic checkout areas.

Breakup by Region:

To get more information on this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region exhibits a clear dominance with a 37% share of the total Saudi Arabia cosmetics market in 2025.

Northern and central region, anchored by the capital city Riyadh, commands the largest market share driven by high urban population concentration, elevated household disposable incomes, and sophisticated consumer preferences favoring premium and luxury cosmetics over mass-market alternatives. Riyadh functions as Saudi Arabia's financial, governmental, and corporate headquarters, attracting professionals, entrepreneurs, and expatriates with substantial purchasing power and exposure to international beauty trends through business travel, social media engagement, and cosmopolitan lifestyles. The city's extensive retail infrastructure encompasses luxury shopping malls like Kingdom Centre and Riyadh Park, specialty beauty stores including Sephora, and international brand boutiques offering curated assortments and personalized consultation services justifying premium pricing strategies. The concentration of Vision 2030 economic diversification initiatives and women's empowerment programs in the capital region accelerates favorable demographic shifts, including rising female workforce participation and entrepreneurship rates creating ideal conditions for sustained cosmetics market expansion.

Riyadh's status as a beauty innovation hub attracts international brands seeking to establish flagship locations, launch exclusive products, and test new retail concepts before national rollouts across Saudi Arabia and broader Gulf Cooperation Council markets. The city's affluent consumer base demonstrates willingness to experiment with emerging beauty technologies including LED skincare devices, microcurrent facial tools, and smart beauty gadgets integrating with mobile applications for personalized treatment protocols. Cultural events, fashion weeks, and beauty exhibitions hosted in Riyadh generate significant media attention and social media buzz, amplifying brand visibility and influencing purchasing decisions across demographic segments.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Cosmetics Market Growing?

Young, Tech-Savvy Population and Social Media Influence

Saudi Arabia's predominantly young demographic structure, with around 71 percent of the population under 35 years old, creates a large consumer base that is highly connected to digital platforms and social media networks. This tech-savvy generation demonstrates sophisticated understanding of beauty trends, product ingredients, and application techniques acquired through Instagram influencers, YouTube tutorials, and TikTok beauty communities. Social media platforms enable direct engagement between brands and consumers, facilitating rapid feedback loops that accelerate product innovation cycles and marketing campaign optimization. The influence of beauty content creators extends beyond product promotion to shape broader beauty standards, skincare philosophies, and makeup techniques that young Saudis increasingly embrace as expressions of personal identity and social belonging.

Rising Female Workforce Participation and Disposable Income

The increasing participation of women in Saudi Arabia's workforce represents a transformative shift that is fundamentally expanding the cosmetics consumer base and elevating spending levels across product categories. Female employment reached 36.2 percent of the national workforce in 2024, reflecting significant progress in gender equality initiatives under Vision 2030 that have removed barriers to women's participation in professional life. Women employed across industries including healthcare, finance, technology, and education demonstrate higher disposable incomes and distinct beauty preferences that prioritize professional appearance management, premium product quality, and time-efficient beauty routines that align with demanding work schedules. The average monthly disposable income for Saudi households also increased, providing financial capacity for discretionary spending on premium and luxury cosmetics that were previously considered non-essential purchases.

Government Vision 2030 Initiative and Economic Diversification

The Saudi government's Vision 2030 program is creating favorable conditions for cosmetics market expansion through economic diversification policies, tourism development initiatives, and women's empowerment programs that reshape consumer behaviors and retail infrastructure. The strategic focus on reducing oil dependency and building a knowledge-based economy is attracting international investment, modernizing regulatory frameworks, and supporting entrepreneurship across sectors including beauty and personal care. The liberalization of social norms under Vision 2030 is normalizing beauty product usage in professional and social contexts, expanding the addressable market beyond traditional luxury segments to encompass mass-market and middle-class consumers. Tourism development initiatives are enhancing retail infrastructure in Riyadh, Jeddah, and emerging destinations, creating opportunities for international brands to establish flagship stores and local brands to scale operations. IMARC Group predicts that the Saudi Arabia luxury travel market will reach USD 22.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.77% during 2026-2034.

Market Restraints:

What Challenges the Saudi Arabia Cosmetics Market is Facing?

Economic Volatility from Oil Price Fluctuations

Saudi Arabia's economy remains closely tied to global oil markets, creating inherent volatility in consumer spending patterns during periods of petroleum price weakness or geopolitical uncertainty. Fluctuations in oil revenues directly impact government budgets, employment levels in the hydrocarbon sector, and broader economic confidence that influences discretionary purchases including cosmetics. During economic downturns, consumers tend to trade down from premium to mass-market products or reduce purchase frequency to preserve household budgets for essential goods and services. Currency exchange rate movements affect the cost of imported cosmetics, which comprise a substantial portion of market supply, potentially raising retail prices and limiting accessibility for price-sensitive consumers. Inflationary pressures driven by global supply chain disruptions or domestic economic adjustments can increase manufacturing and logistics costs, compelling brands to choose between margin compression or price increases that risk demand erosion.

Higher Production Costs Associated with Halal Certification

The stringent requirements for halal certification create elevated production costs that impact both domestic manufacturers and international brands seeking to serve the Saudi market. Sourcing halal-certified raw materials often commands premium pricing compared to conventional inputs, as suppliers must maintain segregated production lines and documentation systems that verify compliance with Islamic law. The certification process itself involves audit fees, testing expenses, and ongoing compliance monitoring that represent fixed costs regardless of production volume, creating barriers particularly for smaller brands and new market entrants. These higher production costs frequently translate to premium retail pricing that can limit market accessibility among middle and lower-income consumer segments who may opt for non-halal certified alternatives that offer similar functional benefits at lower price points. Brands must carefully balance quality standards, certification requirements, and competitive pricing to serve diverse demographic segments while maintaining profitability.

Intense Competition from Established Global Brands

The entry of established multinational corporations with extensive resources, sophisticated supply chains, and strong brand recognition creates significant competitive pressure for local manufacturers and smaller international players in the Saudi cosmetics market. Global beauty conglomerates leverage economies of scale to support aggressive marketing campaigns, product innovation investments, and retail expansion programs that smaller competitors struggle to match. The extensive product portfolios and diversified category presence of major players enable cross-subsidization strategies where profits from high-margin premium lines support competitive pricing in mass-market segments. Established brands benefit from decades of consumer trust, proven product efficacy, and widespread availability across multiple distribution channels that create substantial switching costs for consumers accustomed to familiar formulations and shopping experiences. Local brands face challenges in building brand awareness, securing premium retail shelf space, and attracting talent amid competition from better-resourced international corporations.

Competitive Landscape:

The Saudi Arabia cosmetics market exhibits moderate competitive intensity characterized by multinational personal care corporations competing alongside emerging local brands and digital-native challengers. Major international players including dominate through extensive product portfolios, strong brand equity, and well-established distribution networks spanning mass-market and premium segments. These corporations leverage research and development capabilities, marketing expertise, and global supply chains to maintain competitive advantages in product innovation, pricing flexibility, and market reach. Local manufacturers focus on culturally-relevant fragrances, halal-certified formulations, and competitive pricing strategies that resonate with value-conscious consumers. Digital-first brands are disrupting traditional retail models by leveraging social media marketing, influencer partnerships, and direct-to-consumer e-commerce platforms that bypass conventional distribution intermediaries and build communities around specific beauty philosophies emphasizing clean ingredients, sustainability, or cultural authenticity. Some of the key players include:

- Avon Beauty Arabia

- Beauti.Sa

- Dar Madi International Co.

- Goldenscent LLC

Recent Developments:

-

In November 2025, Saudi Arabia's Asteri Beauty has broadened its offerings by introducing a new skincare range. Founder Sara Al-Rashed stated that the products maintain the brand's "desert-proof" philosophy, indicating they were uniquely designed to withstand intense winds, high humidity, air-conditioning, and extremely dry heat. She stated that the new collection embodies Asteri’s belief in treating skincare and makeup as interrelated.

-

In February 2025, Golden Apple, a cosmetics and fragrance retailer based in Yekaterinburg, commenced operations in Saudi Arabia through both physical and digital store openings. The expansion made Saudi Arabia the sixth nation and third Middle Eastern country for Golden Apple's operations, reflecting growing international brand interest in the Kingdom's cosmetics market.

Saudi Arabia Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Companies Covered |

Avon Beauty Arabia, Beauti.Sa, Dar Madi International Co., Goldenscent LLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia cosmetics market size was valued at USD 3.97 Billion in 2025.

The Saudi Arabia cosmetics market is expected to grow at a compound annual growth rate of 1.71% from 2026-2034 to reach USD 4.62 Billion by 2034.

Skin and sun care products dominate the market with a revenue share of 43.75% in 2025, driven by heightened consumer consciousness towards skin protection against harsh climatic conditions and growing awareness of anti-aging and sun protection benefits.

Key factors driving the market include the young, tech-savvy population with high social media engagement, rising female workforce participation and disposable income, government Vision 2030 initiatives supporting economic diversification and women's empowerment, growing demand for halal-certified products, and expanding retail networks including e-commerce platforms that enhance product accessibility across diverse consumer segments.

Major challenges include economic volatility from oil price fluctuations affecting consumer spending patterns, higher production costs associated with halal certification creating pricing pressures, and intense competition from established global brands with extensive resources and strong market presence that creates barriers for local manufacturers and new market entrants seeking to gain market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)