Saudi Arabia Corporate Wellness Market Size, Share, Trends and Forecast by Service, Category, Delivery, Organization Size, and Region, 2026-2034

Saudi Arabia Corporate Wellness Market Summary:

The Saudi Arabia corporate wellness market size was valued at USD 884.34 Million in 2025 and is projected to reach USD 1,532.26 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034.

The Saudi Arabia corporate wellness market is experiencing expansion driven by increasing employer emphasis on preventive healthcare, mental health support, and holistic employee wellbeing initiatives. The rising prevalence of lifestyle-related health conditions among the working population is compelling organizations to implement comprehensive wellness programs encompassing fitness services, nutritional counseling, and stress management solutions. Government-led health sector reforms under Vision 2030 are actively encouraging private sector participation in workplace wellness initiatives, creating a supportive regulatory environment for market growth. Strategic partnerships between corporate employers and health insurance providers are further accelerating the adoption of integrated wellness frameworks, strengthening the Saudi Arabia corporate wellness market share.

Key Takeaways and Insights:

-

By Service: Fitness dominates the market with a share of 28.03% in 2025, owing to increasing employer investments in physical wellness programs, on-site gym facilities, and structured exercise initiatives. Rising health consciousness among employees is accelerating demand for comprehensive fitness services.

-

By Category: Fitness and nutrition consultants lead the market with a share of 45.1% in 2025. This dominance is driven by growing corporate demand for personalized dietary guidance and exercise coaching to combat obesity, diabetes, and cardiovascular conditions prevalent among Saudi Arabia's workforce.

-

By Delivery: Offsite represents the largest segment with a market share of 60.08% in 2025, reflecting strong preference for flexible wellness solutions accessible through digital platforms, mobile applications, and external wellness centers that accommodate diverse employee schedules and remote work arrangements.

-

By Organization Size: Large scale organizations exhibit a clear dominance with 50.09% share in 2025, driven by substantial corporate budgets, comprehensive human resource strategies, and established partnerships with wellness service providers enabling implementation of multi-dimensional employee health programs.

-

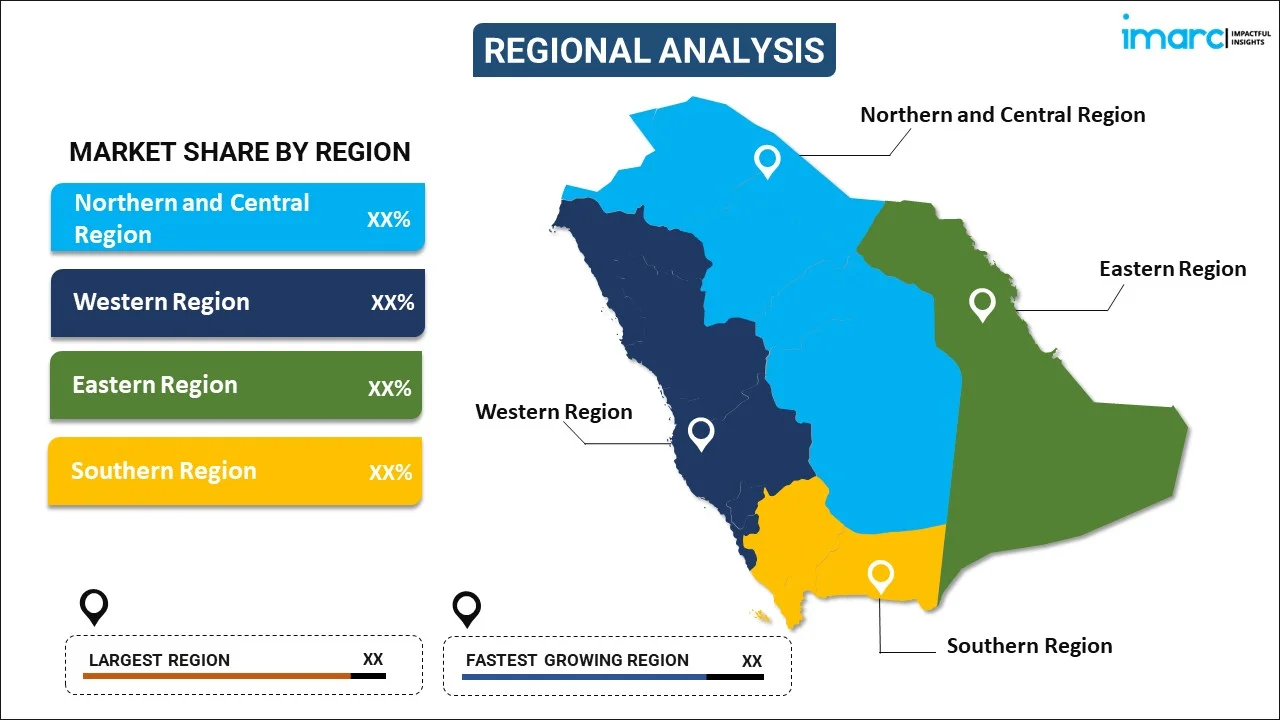

By Region: Northern and Central Region is the largest region with 33% share in 2025, attributed to the concentration of major corporate headquarters in Riyadh, extensive government sector employment, and advanced digital infrastructure supporting widespread wellness program implementation.

-

Key Players: Key players drive the Saudi Arabia corporate wellness market by expanding service portfolios, integrating digital health technologies, and establishing strategic partnerships with healthcare providers. Their investments in AI-powered wellness platforms, personalized fitness coaching, and comprehensive mental health support strengthen market positioning across diverse industry verticals.

The Saudi Arabia corporate wellness market is undergoing significant transformation as organizations increasingly recognize the strategic importance of employee health in driving productivity and reducing healthcare costs. According to the General Authority for Statistics 2024 Health Determinants Statistics Publication, the obesity rate among adults aged 15 and above reached 23.1%, while 45.1% of individuals in this age group are classified as overweight, highlighting the urgent need for workplace wellness interventions. Employers are implementing comprehensive wellness programs encompassing fitness services, nutritional guidance, mental health support, and chronic disease management to address these health challenges. The Health Sector Transformation Program under Vision 2030 is actively promoting preventive healthcare and digital health integration, encouraging private sector organizations to invest in employee wellbeing initiatives. Strategic collaborations between insurers and employers are creating integrated wellness ecosystems that deliver measurable health outcomes while reducing long-term healthcare expenditures.

Saudi Arabia Corporate Wellness Market Trends:

Digital Transformation and AI-Powered Wellness Platforms

The corporate wellness landscape in Saudi Arabia is experiencing rapid digitalization with widespread adoption of mobile wellness applications, wearable fitness devices, and artificial intelligence-driven health coaching platforms. Organizations are leveraging telemedicine solutions and virtual wellness programs to provide accessible healthcare services to employees regardless of location. The Seha Virtual Hospital, recognized by Guinness World Records as the world's largest virtual healthcare facility, connects over 230 hospitals worldwide. It has recently also won the 2025 Excellence Award in Virtual Healthcare Solutions, which was offered by the PX Initiative Awards.

Growing Emphasis on Mental Health and Stress Management

Corporate wellness programs in Saudi Arabia are increasingly prioritizing mental health initiatives as employers recognize the impact of workplace stress on productivity and employee retention. Organizations are implementing employee assistance programs, counseling services, mindfulness workshops, and resilience training to address rising burnout and anxiety levels among the workforce. The partnership between the Saudi Yoga Committee and the Ministry of Human Resources and Social Development in 2024 exemplifies government support for holistic wellness integration, promoting yoga as a lifestyle choice to enhance stress management and concentration.

Integration of Preventive Healthcare and Insurance Partnerships

Strategic alliances between health insurance companies and corporate employers are creating comprehensive wellness frameworks that incentivize preventive care adoption. Insurers are offering premium discounts and customized coverage for organizations implementing structured wellness programs, funding digital wellness platforms, biometric screening initiatives, and employee health assessments. This synergy is generating integrated ecosystems where both employers and insurance providers benefit financially from improved employee health outcomes and reduced long-term healthcare claims.

How Vision 2030 is Transforming the Saudi Arabia Corporate Wellness Market:

By emphasizing worker health, productivity, and quality of life as strategic foundations of economic diversification and national growth, Saudi Arabia's Vision 2030 is transforming the corporate wellness sector. In order to address the growing burden of lifestyle diseases affecting workforce productivity, the Health Sector Transformation Program creates an unprecedented demand for comprehensive workplace wellness programs that integrate cutting-edge digital health technologies, mental health support systems, and preventive care solutions. The Quality of Life Program aims to enhance infrastructure for sports and wellness participation, encouraging corporate adoption of fitness initiatives. Government policies are incentivizing private sector organizations to implement employee wellness programs through collaborative frameworks with healthcare providers, creating a supportive ecosystem for sustained market growth.

Market Outlook 2026-2034:

The Saudi Arabia corporate wellness market is poised for sustained growth as organizations continue prioritizing employee wellbeing as a strategic business imperative aligned with Vision 2030 objectives. The market generated a revenue of USD 884.34 Million in 2025 and is projected to reach a revenue of USD 1,532.26 Million by 2034, growing at a compound annual growth rate of 6.30% from 2026-2034. Increasing adoption of digital health technologies, expansion of mental health services, and growing employer investments in holistic wellness programs will drive market expansion across all segments. Strategic partnerships between corporate employers and health insurance providers will strengthen integrated wellness ecosystems, while government initiatives promoting preventive healthcare and workplace health standards will create favorable conditions for sustained industry development throughout the forecast period.

Saudi Arabia Corporate Wellness Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service | Fitness | 28.03% |

| Category | Fitness and Nutrition Consultants | 45.1% |

| Delivery | Offsite | 60.08% |

| Organization Size | Large Scale Organizations | 50.09% |

| Region | Northern and Central Region | 33% |

Service Insights:

To get detailed segment analysis of this market Request Sample

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening Nutrition and Weight Management

- Stress Management

- Others

Fitness dominates with a market share of 28.03% of the total Saudi Arabia corporate wellness market in 2025.

The fitness segment leads the Saudi Arabia corporate wellness market as organizations increasingly invest in structured physical wellness programs to enhance employee health and productivity. Companies are establishing on-site gym facilities, subsidizing fitness club memberships, and organizing group exercise sessions to encourage regular physical activity among employees. Under Vision 2030, the government aims to increase physically active individuals from 13% to 40% by 2030, driving corporate adoption of fitness initiatives. Major corporations are integrating fitness programs into their employee engagement strategies to reduce absenteeism and improve workforce retention.

Employers are partnering with fitness technology providers to offer personalized workout programs, wearable fitness trackers, and virtual fitness classes that accommodate diverse employee preferences and schedules. The rapid expansion of hybrid work models has accelerated demand for flexible fitness solutions accessible both onsite and remotely. The inaugural FIBO Arabia event held in October 2025 at the Riyadh Front Exhibition and Conference Center attracted over 12,399 visitors, demonstrating the significant growth momentum in the Kingdom's fitness and wellness sector and creating new opportunities for corporate wellness program development.

Category Insights:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

Fitness and nutrition consultants lead with a share of 45.1% of the total Saudi Arabia corporate wellness market in 2025.

The fitness and nutrition consultants category dominates the market as organizations prioritize professional guidance for employee health transformation. Corporate employers are engaging certified nutrition specialists and fitness experts to develop customized wellness programs addressing obesity, diabetes, and cardiovascular health concerns prevalent among the Saudi workforce. These consultants conduct comprehensive health assessments to identify individual employee needs and design targeted intervention strategies that align with organizational wellness objectives and cultural considerations.

Consultants are delivering integrated programs combining personalized dietary plans, fitness coaching, and ongoing health monitoring to achieve sustainable employee wellness outcomes. Their expertise enables organizations to implement evidence-based wellness interventions that drive measurable improvements in employee health metrics and productivity levels. Organizations are leveraging technology-enabled consulting services that provide remote nutritional guidance, virtual fitness coaching, and data-driven progress tracking to maximize program accessibility and effectiveness across geographically dispersed workforces while ensuring compliance with cultural and religious dietary requirements. The growing demand for specialized expertise is encouraging consultants to expand service offerings incorporating mental wellness counseling and chronic disease prevention strategies.

Delivery Insights:

- Onsite

- Offsite

Offsite exhibits a clear dominance with a 60.08% share of the total Saudi Arabia corporate wellness market in 2025.

The offsite delivery model commands the largest market share as organizations embrace flexible wellness solutions accessible through digital platforms, mobile applications, and external wellness facilities. The rapid expansion of telemedicine and virtual wellness services enables employees to access fitness programs, nutritional counseling, and mental health support remotely. This delivery approach eliminates geographical barriers and accommodates diverse work schedules, significantly improving employee engagement with wellness initiatives across all organizational levels.

Hybrid wellness models are gaining significant traction as they provide flexibility for both office-based and remote workers while reducing infrastructure costs for employers. Organizations are partnering with external fitness centers, wellness clinics, and digital health platforms to offer comprehensive wellness packages that employees can access according to their individual schedules and preferences, enhancing program participation rates and delivering measurable health outcomes. The growing preference for work-life balance among Saudi Arabia's workforce is accelerating demand for offsite wellness solutions that integrate seamlessly into daily routines. Additionally, offsite delivery enables organizations to offer specialized services without investing in dedicated facilities or equipment, making comprehensive wellness programs accessible to businesses of all sizes.

Organization Size Insights:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

Large scale organizations represent the leading segment with a 50.09% share of the total Saudi Arabia corporate wellness market in 2025.

Large scale organizations dominate the market due to substantial financial resources enabling comprehensive wellness program implementation, dedicated human resource departments managing employee health initiatives, and established partnerships with healthcare providers and insurance companies. Major corporations, oil and gas companies, and government-sponsored enterprises invest significantly in multi-dimensional wellness programs integrated with occupational health and safety policies to enhance workforce productivity and retention. These entities recognize that strategic wellness investments deliver measurable returns through reduced healthcare costs, decreased absenteeism, and improved employee engagement.

These organizations leverage economies of scale to negotiate favorable terms with wellness service providers while implementing enterprise-wide digital health platforms accessible across multiple locations. Their sophisticated human resource infrastructure enables systematic program monitoring, outcome measurement, and continuous improvement of wellness initiatives. The Health Sector Transformation Program allocated SR180 Billion (USD 50.3 Billion) in health and social development spending in 2023, with substantial commitment to digital healthcare initiatives encouraging large organizations to adopt sophisticated wellness technologies and preventive care solutions for their extensive workforces.

Regional Insights:

To get detailed regional analysis of this marketRequest Sample

- Northeast

- Midwest

- South

- West

South holds the largest share of the market

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. According to the report, South was the largest market for the United States organic food.

The South region leads the US organic food market for several reasons. The area's favorable climate conditions and extensive arable land contribute to higher agricultural output, including organic farming. There's a growing consumer base with increased awareness of the health and environmental benefits of organic food, supported by a rise in disposable income. Furthermore, the region has seen significant investment in distribution channels, such as farmers' markets, specialty stores, and supermarkets that offer organic products, making them more accessible to consumers. Local government support and incentives for organic farming practices also foster the market's growth. Additionally, the presence of key organic food producers and processors in the South enhances the local supply chain efficiency, which, in turn, is propelling the market growth.

Competitive Landscape:

The competitive landscape of the United States organic food market is characterized by a dynamic interplay of established industry players, emerging entrants, and evolving consumer preferences. A variety of well-established companies, including organic-focused brands and conventional food manufacturers, compete to capture market share. These companies leverage their brand recognition, distribution networks, and diverse product portfolios to meet the demand for organic offerings across various categories, ranging from dairy and produce to packaged goods. Simultaneously, smaller and niche players have entered the market, emphasizing specialization and unique value propositions to target specific consumer segments. The market's competitive dynamics are influenced by factors such as pricing strategies, product innovation, sustainable sourcing practices, and marketing efforts that emphasize health benefits and ethical considerations. As consumers become more discerning and prioritize transparency in labelling and sourcing, companies that can adapt and differentiate themselves by delivering high-quality organic products while addressing evolving consumer preferences are well-positioned to excel in this fiercely competitive environment.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Saudi Arabia Corporate Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia corporate wellness market size was valued at USD 884.34 Million in 2025.

The Saudi Arabia corporate wellness market is expected to grow at a compound annual growth rate of 6.30% from 2026-2034 to reach USD 1,532.26 Million by 2034.

Fitness dominates the market with a share of 28.03%, driven by increasing employer investments in physical wellness programs and rising health consciousness among employees.

Key factors driving the Saudi Arabia corporate wellness market include rising prevalence of lifestyle diseases, government health reforms under Vision 2030, digital health integration, and growing employer focus on employee productivity and talent retention.

Major challenges include high implementation costs for comprehensive wellness programs, limited mental health budget allocation among organizations, workforce diversity considerations, and cultural barriers to wellness program adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)