Saudi Arabia Construction Equipment Rental Market Report by Equipment Type (Wheel Loader, Crane, Excavator, Bulldozer, Dump Truck, Diesel Genset, Motor Grader and Telescopic Handler, and Others), Vehicle Type (Earthmoving Equipment, Material Handling, and Others), Propulsion Type (IC Engine, Hybrid Drive), End User (Residential, Commercial, Industrial), and Region 2025-2033

Market Overview:

The Saudi Arabia construction equipment rental market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The rising large-scale infrastructure projects, the increasing demand for cost-efficiency and flexibility, significant technological advancements, the country's economic diversification strategies are some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Market Growth Rate (2025-2033) | 6.50% |

Construction equipment rental refers to the practice of leasing heavy machinery and equipment needed for construction tasks rather than purchasing them. This service provides contractors and construction firms access to a variety of specialized tools and machines such as excavators, cranes, bulldozers, and backhoes for a specific period and at a fraction of the cost of ownership. Renting offers several advantages, including reduced capital expenditure, maintenance costs, and the flexibility to access the most suitable equipment for specific projects. This model is increasingly popular due to its cost-effectiveness and the ability to meet project-specific demands without the burden of ownership and long-term maintenance.

The large-scale infrastructure projects represents one of the key factors driving the growth of the market across Saudi Arabia. This is primarily attributed to government initiatives, which are leading to the increased demand for construction equipment. Renting becomes a viable option for companies aiming to manage capital expenditure efficiently. The volatility in oil prices is making the construction industry more cautious, pushing firms towards the cost-effective rental model as opposed to outright purchases. The regulatory environment in Saudi Arabia, which often requires the use of modern and well-maintained equipment, aligns well with rental companies that offer such assets. The expanding private sector and foreign investment in construction projects are further driving the need for readily available and diverse construction equipment. Maintenance and operational costs, typically covered by the rental companies, offer an added incentive for companies to opt for renting rather than owning, which, in turn, is creating a positive outlook for the market across the country.

Saudi Arabia Construction Equipment Rental Market Trends:

Large-Scale Infrastructure Projects

Saudi Arabia investing heavily in mega-projects, many of which are backed by the government. These projects range from smart cities like NEOM to extensive transportation networks, healthcare facilities, and more. The sheer scale and complexity of these ventures require a wide array of specialized construction equipment. Companies involved in these projects often find it more cost-effective and flexible to rent the necessary machinery rather than purchase it outright. Renting allows for better capital management, freeing up funds for other critical aspects of construction, such as labor and materials. It also enables companies to access the latest, most efficient equipment, which is especially crucial given the regulatory environment that emphasizes the use of modern, eco-friendly machines.

Economic Diversification Strategies – Vision 2030

Saudi Arabia’s Vision 2030 aims to reduce the country’s dependence on oil by diversifying its economy. This includes expanding the non-oil sectors such as construction, tourism, and entertainment. The execution of this vision involves the development of various new infrastructures, from airports to museums and entertainment zones, all of which require construction equipment. The Vision 2030 initiative is not just a blueprint but a catalyst for tangible projects that directly fuel the demand for construction equipment rental services. Moreover, the entry of foreign firms and collaborations under this vision further amplifies the need for high-quality, readily available construction equipment.

Key Growth Drivers of Saudi Arabia Construction Equipment Rental Market:

Increasing demand for flexibility in equipment usage

Rising demand for flexibility in equipment usage is propelling the market growth, as contractors and developers increasingly prefer renting over purchasing to optimize costs and project efficiency. Renting provides construction firms with access to modern and specialized equipment only when needed, reducing the burden of long-term ownership, maintenance expenses, and depreciation. This approach allows businesses to adapt quickly to varying project requirements and scale operations without heavy capital investment. With multiple infrastructure and real estate projects underway, the need for different equipment at different stages has made flexibility essential. Equipment rental companies offer diverse fleets that enable quick replacements, upgrades, and reliable performance, fueling the popularity of rentals as a cost-effective, convenient, and adaptable solution.

Increasing private sector participation

Increasing private sector participation is expanding the Saudi Arabia construction equipment rental market size 2024, as government-led initiatives are encouraging greater involvement of private firms in large-scale infrastructure and urban development projects. With more private companies entering the market, competition has intensified, catalyzing the demand for flexible and affordable rental solutions to manage construction budgets effectively. Private contractors, unlike large government-backed firms, often lack the resources to purchase and maintain heavy machinery, making rental services an attractive alternative. Additionally, the growing partnerships between private developers and rental providers ensure access to advanced equipment and tailored service packages that support timely project completion. As private investment continues to increase across residential, commercial, and industrial construction activities, reliance on rental equipment is becoming a key driver of the market growth.

Expansion of logistics

The expansion of logistics is positively influencing the market by improving the efficiency of equipment transportation, distribution, and accessibility across different construction sites. With the country investing heavily in logistics infrastructure, including roads, ports, and warehousing facilities, rental companies can deliver equipment quickly and reliably to diverse regions. This enhanced connectivity reduces downtime, ensures timely project execution, and makes equipment rental services more attractive compared to ownership, which often involves logistical challenges. Furthermore, better logistics support allows rental firms to broaden their reach beyond major cities, catering to emerging urban and industrial zones. By lowering operational bottlenecks and enabling seamless movement of heavy machinery, the logistics expansion is fueling the adoption of rental services.

Saudi Arabia Construction Equipment Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia construction equipment rental market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on equipment type, vehicle type, propulsion type, and end user.

Breakup by Equipment Type:

To get more information on this market, Request Sample

- Wheel Loader

- Crane

- Excavator

- Bulldozer

- Dump Truck

- Diesel Genset

- Motor Grader and Telescopic Handler

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes wheel loader, crane, excavator, bulldozer, dump truck, diesel genset, motor grader and telescopic handler, and others.

The demand for wheel loaders in the market is influenced by several key factors. Primarily, their versatility makes them invaluable for a wide range of tasks, including material handling, excavation, and loading, thus expanding their applicability across various construction projects. Renting wheel loaders allows companies to save on significant upfront costs of purchasing, thereby enhancing cost efficiency. The flexibility to rent wheel loaders for short-term projects or seasonal demands helps companies adapt to fluctuating workloads.

Cranes are essential for large-scale projects involving heavy lifting and material movement, making them indispensable for certain types of construction. The inherent cost-efficiency of renting over purchasing attracts companies looking to manage their capital expenditure judiciously. The flexibility offered by rental services enables firms to deploy cranes on a project-specific basis, thus accommodating variable construction needs and schedules. By renting, companies avoid the responsibility and costs associated with maintenance, repairs, and storage. Economic uncertainties make renting a viable, risk-averse option, further boosting the demand for cranes.

Excavators are crucial for tasks like digging, material handling, and demolition, making them versatile and essential in various construction projects. The cost-efficiency of renting over purchasing is a major draw, allowing companies to allocate capital to other operational areas. The flexibility of renting for specific project durations allows companies to adapt to changing workloads and project requirements easily.

The impact of the construction equipment rental market on bulldozers has been largely positive. The rental model has increased the accessibility of these heavy machines, allowing even smaller contractors to utilize them without bearing the high costs of ownership. This is leading to a broader market for bulldozers, extending their reach beyond large construction firms. The rental model helps to maintain a consistent level of utilization for these assets, reducing idle time and optimizing their operational life.

Dump trucks are essential for transporting materials like sand, gravel, and waste, thus making them a staple in a wide variety of construction projects. The rental model broadens the accessibility of dump trucks, enabling small and medium-sized construction companies to deploy them without the financial burden of outright purchase. This is leading to an expanded user base and increased overall demand. The rental model ensures higher asset utilization rates, reducing the idle time that depreciates the value of these vehicles.

Diesel gensets are critical for providing reliable power supply, especially in remote construction sites where grid electricity is unavailable, thereby making them essential for project continuity. The rental model broadens access to these essential power sources, enabling smaller companies to benefit from a reliable energy supply without the high initial costs of purchase. This is expanding the market for diesel gensets considerably. Rental options lead to higher asset utilization, ensuring these generators are actively used rather than sitting idle, thereby improving return on investment.

Motor graders are crucial for leveling and grading surfaces, while telescopic handlers are essential for lifting and placing materials, making both invaluable in diverse construction scenarios. The rental model democratizes access to these specialized machines, allowing smaller construction firms to deploy them without the financial burden of outright ownership, thus widening the overall market.

Breakup by Vehicle Type:

- Earthmoving Equipment

- Material Handling

- Others

A detailed breakup and analysis of the market based on the vehicle type has also been provided in the report. This includes earthmoving equipment, material handling, and others.

The demand for earthmoving equipment in the market is influenced by several key factors. Primarily, large-scale infrastructure projects, often backed by the government and aligned with Vision 2030, necessitate specialized earthmoving machinery, thus making rentals a cost-effective option. Economic diversification efforts are leading to increased construction activities in non-oil sectors, further driving the need for earthmoving equipment. Rentals offer flexibility in terms of project duration and equipment specifications, making it easier for companies to adapt to changing requirements. Maintenance and operational costs are typically handled by rental companies, making the rental model economically efficient. Market uncertainties make rentals a risk-averse strategy, thereby boosting demand.

The construction equipment rental market has had a positive impact on the material handling sector. Primarily, the rental model enhances access to specialized material handling equipment, enabling even smaller construction firms to leverage advanced machinery without the burden of initial purchasing costs. This expands the market considerably. Rental options promote higher asset utilization by ensuring that equipment like forklifts and cranes are more frequently in use, thereby enhancing the return on investment. Maintenance and servicing are generally covered by rental companies, ensuring that the material handling equipment stays in optimal condition, prolonging its operational lifespan.

Breakup by Propulsion Type:

- IC Engine

- Hybrid Drive

A detailed breakup and analysis of the market based on the propulsion type has also been provided in the report. This includes IC engine and hybrid drive.

IC engines are often preferred for their robust performance and capability to operate efficiently in challenging conditions, a frequent requirement in large-scale Saudi construction projects. These engines are compatible with a variety of fuel types, including gasoline and diesel, offering flexibility in fuel sourcing. IC engines are generally more cost-effective for short-term projects, aligning well with the rental model. Economic diversification initiatives like Vision 2030 have led to increased construction activities, indirectly driving demand. The rental model mitigates the burden of maintenance, thus making IC engines an attractive option.

The demand for hybrid drive systems in the market is driven by several key factors. First, the push for sustainable and eco-friendly construction practices, aligned with Saudi Vision 2030, is promoting the use of energy-efficient equipment like hybrid drives. The versatility and efficiency of hybrid systems make them suitable for a range of construction tasks, enhancing their attractiveness in the rental market. Renting allows companies to access this advanced technology without the steep upfront costs, thus making it a cost-effective option. Maintenance costs, usually covered by the rental company, are lower for hybrid systems, further incentivizing their use. Economic uncertainties make renting a risk-averse strategy, boosting demand for hybrid drives in rentals.

Breakup by End User:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes residential, commercial, and industrial.

The use of construction equipment rental in the residential sector serves multiple purposes, offering flexibility and cost-efficiency. Smaller contractors working on residential projects can access specialized machinery like mini-excavators, skid-steer loaders, and compactors without the financial burden of ownership. Rentals provide the opportunity to use up-to-date, well-maintained equipment that meets safety and environmental standards. For specialized tasks like trenching, grading, or material handling, contractors can rent specific equipment on a short-term basis, optimizing costs. Equipment maintenance and service are generally taken care of by the rental company, reducing operational headaches for the contractor.

In the commercial sector, construction equipment rental serves various critical roles aimed at enhancing efficiency and cost-effectiveness. It allows companies to access a wide range of specialized machinery like cranes, bulldozers, and backhoes for specific project needs without the high upfront costs of ownership. Renting offers flexibility in scaling operations up or down, aligning with project timelines and budgets. It provides access to the latest equipment technology, ensuring that projects are completed more efficiently and meet environmental regulations. The rental model alleviates the burden of equipment maintenance and servicing, which is typically managed by the rental company.

Construction equipment rental in the industrial sector offers several advantages, facilitating project execution while optimizing costs. It enables industrial operations to access a diverse range of specialized equipment such as forklifts, excavators, and cranes without the capital expenditure of purchase. Rentals offer the flexibility to adapt to variable project demands, allowing for easy scaling of operations. Renting provides an opportunity to utilize the latest technology, ensuring better efficiency and compliance with safety and environmental standards. Maintenance and service costs, typically handled by rental companies, are eliminated, allowing industrial firms to focus on core activities.

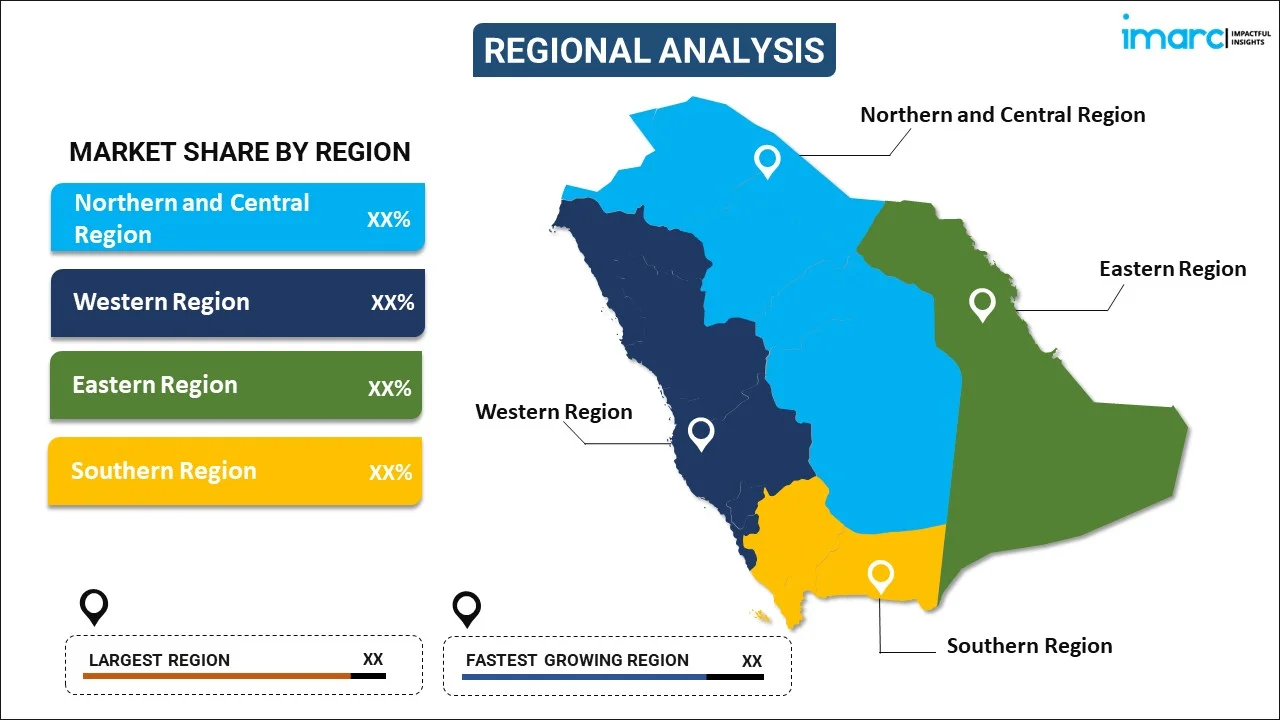

Breakup by Region:

- Western Region

- Northern and Central Region

- Eastern Region

- Southern Region

A detailed breakup and analysis of the market based on the region has also been provided in the report. This includes the western region, northern and central region, eastern region, and southern region.

The Saudi Arabia construction equipment rental market, particularly in the western region, is driven by a mix of factors. Primarily, the area is a hub for pilgrimage-related construction projects, increasing the demand for specialized equipment. The government's Vision 2030 initiative aims to diversify the economy, which is leading to increased infrastructure projects in non-oil sectors, including tourism and real estate. The rental model offers flexibility in terms of contract duration and equipment variety, making it a cost-effective choice for many firms. The maintenance and operational costs, generally covered by rental companies, further incentivize businesses to opt for rentals.

The northern and central regions of Saudi Arabia's construction equipment rental market are influenced by multiple factors. These areas are focal points for large-scale infrastructure projects, often supported by government initiatives like Vision 2030, thereby necessitating a wide range of specialized equipment. The mineral-rich northern region is seeing growth in mining-related construction, driving demand for specific machinery. The rental model's flexibility is highly appealing to contractors working on varying scales and timelines. The operational and maintenance costs, usually managed by the rental companies, make renting an economical choice. The overall economic volatility and diversification efforts in these regions make equipment rental a risk-averse and attractive option for many firms.

Saudi Arabia's eastern region is a hub for the country's oil and gas sector, which requires specialized construction equipment for various projects. This spurs demand for rentals as a cost-effective, flexible solution. Government initiatives such as Vision 2030 are promoting infrastructure development, including transport and housing, further boosting demand. Rental companies often cover maintenance and operational costs, making it economically efficient for businesses to opt for rentals. The flexibility offered by rental agreements allows companies to adapt to project-specific needs. In a climate of economic uncertainty, the rental model serves as a risk-averse strategy, thus stimulating the market.

In Saudi Arabia's southern region, several factors are driving the construction equipment rental market. Primarily, ongoing border security and military projects require specialized construction equipment, boosting demand for rentals. The government's Vision 2030 initiative emphasizes infrastructure development, leading to increased activity in road construction, housing, and utilities in this region. The rental model offers flexibility, allowing companies to adapt to varying project requirements and timelines. Operational and maintenance costs, usually borne by the rental companies, make the renting option economically attractive.

Competitive Landscape:

The key players in the market are actively adopting various strategies to consolidate their market positions and meet evolving demand. Primarily, they are investing in fleet modernization to include newer, more efficient, and eco-friendly equipment, in line with sustainability goals and to meet stringent environmental regulations. Companies are increasingly offering customized rental packages, flexible leasing terms, and value-added services like maintenance and operator training to attract a broader customer base. Many are expanding their geographic footprint within the region to be closer to key construction hubs. Some players are forging strategic partnerships and collaborations with global equipment manufacturers to offer a wider range of products.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Saudi Arabia Construction Equipment Rental Market News:

- February 2025: Johnson Arabia, a prominent rental firm in the UAE, extended its services to Saudi Arabia, introducing its premier lifting solutions to the Kingdom. This tactical decision sought to fulfill the increasing need for dependable, high-quality lifting machinery in the country.

- September 2024: Ami Abdulla Nass, the Chairman of Nass Corporation in Bahrain, announced that the firm secured a contract to build a segment of the new Aramco Stadium, under construction in Al Khobar, Eastern Province, as Saudi Arabia was set to host the 2034 FIFA World Cup. The firm intended to increase its investments in Saudi Arabia's heavy equipment rental and construction industry by listing 10 subsidiaries in the Saudi market.

Saudi Arabia Construction Equipment Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Equipment Types Covered | Wheel Loader, Crane, Excavator, Bulldozer, Dump Truck, Diesel Genset, Motor Grader and Telescopic Handler, Others |

| Vehicle Types Covered | Earthmoving Equipment, Material Handling, Others |

| Propulsion Types Covered | IC Engine, Hybrid Drive |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Western Region, Northern and Central Region, Eastern Region and Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia construction equipment rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia construction equipment rental market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia construction equipment rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The construction equipment rental market in Saudi Arabia was valued at USD 1.2 Billion in 2024.

The Saudi Arabia construction equipment rental market is projected to exhibit a CAGR of 6.50% during 2025-2033, reaching a value of USD 2.2 Billion by 2033.

Developers and contractors increasingly prefer renting equipment instead of purchasing to reduce capital investment and avoid long-term maintenance costs. Rising demand for flexibility in equipment usage across diverse projects, such as housing, transport, and energy, is fueling the rental trend. Private sector participation in construction is also promoting the use of cost-effective solutions, especially for small and medium enterprises.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)