Saudi Arabia Cloud Services Market Report by Deployment (Public Cloud, Private Cloud), End Use Industry (Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia cloud services market size reached USD 4.5 Billion in 2025. The market is projected to reach USD 13.9 Billion by 2034, exhibiting a growth rate (CAGR) of 12.69% during 2026-2034. The growing digital transformation of businesses across various sectors to improve efficiency and productivity, increasing preference for hybrid and multi-cloud environments, and rising emphasis on serverless computing represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.5 Billion |

| Market Forecast in 2034 | USD 13.9 Billion |

| Market Growth Rate (2026-2034) | 12.69% |

Access the full market insights report Request Sample

Cloud services comprise infrastructure as a service (IaaS) that provides virtualized computing resources over the internet. They also include platform as a service (PaaS), which offers a platform with tools and services for developing, testing, and deploying applications. They consist of software as a service (SaaS) and delivers software applications over the internet on a subscription basis. They encompass function as a service (FaaS), which enables developers to execute code in response to events without managing servers. They reduce the need for upfront capital investments in hardware and software and enable users to pay for resources on a usage basis, leading to cost savings. Cloud services offer scalability, enabling businesses to quickly adapt to changing needs. They make data and applications accessible from anywhere with an internet connection, fostering remote work and improving collaboration. They facilitate efficient disaster recovery planning by providing off-site data backups and redundancies. They also allow businesses to scale resources up or down as needed, ensuring optimal performance without overprovisioning. They implement stringent security measures, protecting data from threats and ensuring compliance with regulations. Cloud service providers handle infrastructure maintenance and updates, reducing the burden on internal information technology (IT) teams.

Key Trends of Saudi Arabia Cloud Services Market:

Rising cases of cyberattacks

Increasing number of cyberattacks is positively influencing the market in Saudi Arabia. According to industry reports, Saudi Arabia experienced 88 instances of ransomware attacks, a form of cyberattack, in 2024. As cyber threats are growing more frequent and advanced, businesses are looking for cloud services that provide integrated security features, including data encryption, firewalls, threat detection, and routine updates. Cloud providers are allocating resources to robust security measures to safeguard sensitive information, guaranteeing adherence to national and sector-specific regulations. Numerous organizations favor cloud platforms instead of conventional IT systems due to their superior defense against data breaches and ransomware attacks. Moreover, cloud services provide instant monitoring and rapid recovery solutions, reducing downtime and financial impact during cyber events.

Increasing adoption of artificial intelligence (AI)

Rising adoption of AI is stimulating the market growth in Saudi Arabia. According to the IMARC Group, the Saudi Arabia AI market size was valued at USD 1,073 Million in 2024. As businesses and government sectors are using AI for data analysis, automation, and decision-making, they continue to rely on cloud platforms to process large volumes of data efficiently. Cloud services offer flexible computing power and storage that support AI applications like predictive analytics, chatbots, and image recognition. Many organizations are choosing cloud-based AI tools to avoid the high cost of setting up on-premise systems. Cloud platforms also provide integrated AI services, allowing faster deployment and easier management. This is encouraging companies across sectors, such as healthcare and finance, to employ cloud solutions.

Broadening of data centers

With the establishment of additional data centers nationwide, cloud service providers can deliver quicker, more dependable, and region-specific services to companies and governmental organizations. These resources allow streamlined data storage, processing, and management, which are crucial for cloud operations. With better connectivity, lower latency, and boosted data security, companies are increasingly confident in utilizing cloud solutions for different purposes, including analytics and remote collaboration. With the increasing need for digital transformation, the presence of sophisticated data centers is facilitating the smooth expansion of cloud services throughout Saudi Arabia. According to industry reports, the data center market in Saudi Arabia is estimated to attain USD 3.90 Billion by 2030, with a CAGR of 19.64%.

Growth Drivers of Saudi Arabia Cloud Services Market:

Focus on local data residency regulations

Increasing emphasis on local data residency regulations is encouraging businesses and government agencies to adopt cloud solutions that store and process data within the country. These regulations aim to protect sensitive information and ensure compliance with national laws. Consequently, cloud service providers are investing in offering region-specific services to meet these requirements. Organizations prefer cloud platforms that guarantee local hosting, especially in sectors like finance, healthcare, and public administration, where data privacy is critical. This regulatory emphasis is boosting trust in cloud technologies and attracting more users who previously hesitated due to security concerns. By aligning cloud services with local laws, providers are gaining a competitive edge, and overall adoption is increasing.

Rising investments in smart city projects

The growing proliferation of smart city projects is driving the demand for advanced digital infrastructure to manage urban systems efficiently. Smart cities rely on real-time data from sensors, surveillance systems, traffic networks, and utilities, which require cloud platforms for storage, processing, and analysis. Cloud services enable seamless integration and management of smart city components, such as public safety, transportation, waste management, and energy distribution. These projects also depend on cloud-based solutions to support mobile apps, citizen engagement platforms, and e-governance services. As Saudi Arabia is investing in smart city developments under Vision 2030, the need for secure, scalable, and high-performance cloud infrastructure is rising. This is catalyzing the demand for advanced cloud services in the country.

Expansion of e-commerce portals

The broadening of e-commerce sites is offering a favorable market outlook. E-commerce platforms rely on cloud services to manage large volumes of customer data, product information, and online transactions in real time. Cloud solutions support seamless website performance, data analytics, payment processing, and inventory management, which are essential for smooth e-commerce operations. As more businesses are shifting to online selling, the demand for cloud-based services like hosting, cybersecurity, and customer engagement tools is growing. Cloud platforms also help e-commerce companies scale their operations quickly during peak seasons and promotional events. The flexibility, cost-efficiency, and reliability offered by cloud services make them a preferred choice for new and existing online retailers. The widespread e-commerce expansion is contributing significantly to the growth of the market in Saudi Arabia.

Saudi Arabia Cloud Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on deployment and end use industry.

Deployment Insights:

To get detailed segment analysis of this market Request Sample

- Public Cloud

- Software-as-a-Service (SaaS)

- Platform-as-a-Service (PaaS)

- Infrastructure-as-a-Service (IaaS)

- Private Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes public cloud (software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) and private cloud.

End Use Industry Insights:

- Oil, Gas, and Utilities

- Government and Defense

- Healthcare

- Financial Services

- Manufacturing and Construction

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes oil, gas, and utilities, government and defense, healthcare, financial services, manufacturing and construction, and others.

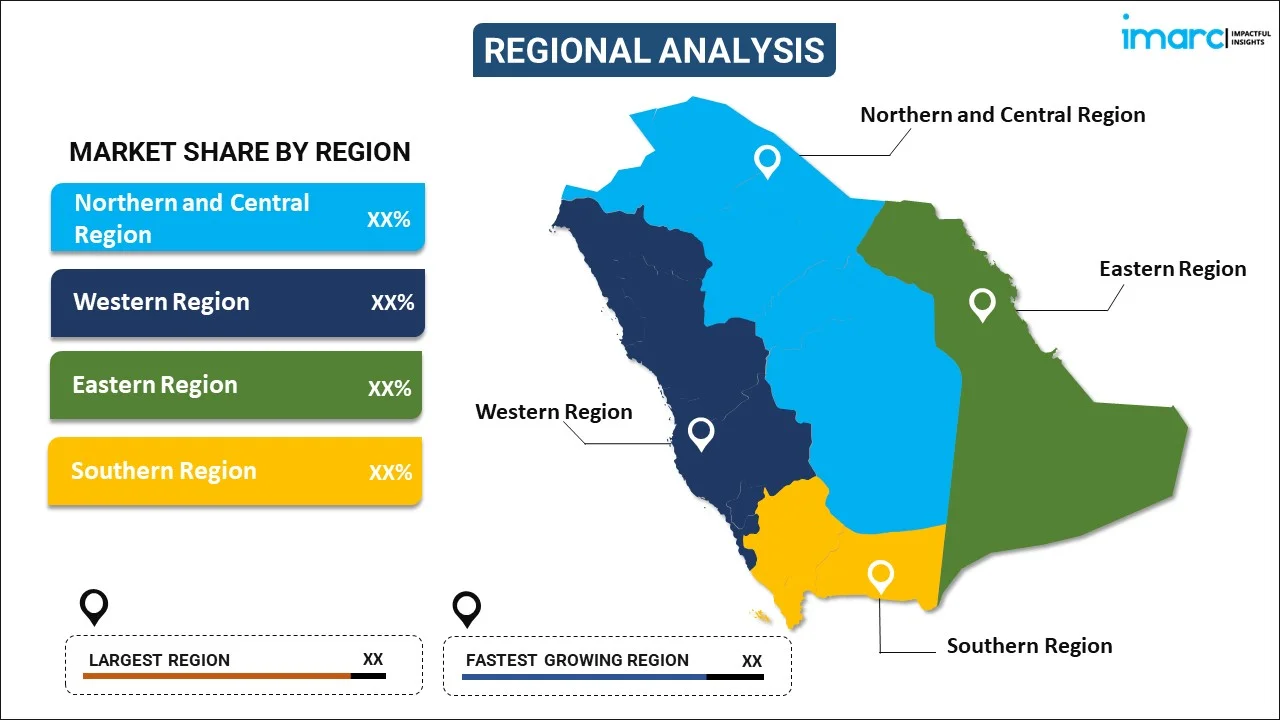

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, and Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Cloud Services Market News:

- May 2025: LTIMindtree partnered with Aramco Digital, the technology and digital division of Saudi Arabia's oil giant Aramco, to launch an IT services firm called NextEra in the nation. NextEra, relying on AI and automation, cloud services, and digital engineering as its main strengths, would provide solutions that could improve operational efficiency, facilitate smart decision-making, and ensure smooth customer experiences.

- May 2025: Amazon Web Services (AWS) and HUMAIN revealed intentions to invest over USD 5 Billion in a strategic collaboration to create an innovative ‘AI Zone’ in Saudi Arabia. Both firms aimed to offer access to the most comprehensive set of cloud technology resources and programs, including AWS Activate, and assist Saudi Arabia’s most determined founders and entrepreneurs in growing their ventures.

- February 2025: Accenture partnered with Google Cloud to enhance the use of cloud solutions and generative AI technologies in the Kingdom of Saudi Arabia to meet local data, operational, and software sovereignty requirements. The initiative sought to assist organizations in generating new business prospects and enhancing customer experiences by developing a contemporary digital foundation and expanding generative AI agents to boost operational efficiency and enterprise intelligence.

- February 2025: Tencent Cloud, the cloud division of the tech firm Tencent, revealed the establishment of its inaugural Middle East Cloud Region in Saudi Arabia. The Region would include two availability zones with complete redundancy, cutting-edge cloud services, and AI features.

- February 2025: stc Group, the largest publicly traded telecom operator in the Middle East, initiated the most extensive sovereign AI cloud platform through its new subsidiary stc.AI. Created in partnership with the Palo Alto AI firm SambaNova Systems, the platform would feature Meta’s Llama 405B, the foremost open-source large language model, along with the larger DeepSeek R1 671B, guaranteeing the quickest inference speeds.

- February 2025: Cisco, the worldwide leader in networking and security, announced a set of strategic measures to promote AI in collaboration with the Kingdom. The firm was set to implement advanced cloud service data centers, develop AI talent, and establish phased plans for local manufacturing. These efforts aimed to strengthen Cisco’s local presence and assist the Kingdom’s bold digitization objectives as part of Vision 2030.

Saudi Arabia Cloud Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployments Covered |

|

| End Use Industries Covered | Oil, Gas, and Utilities, Government and Defense, Healthcare, Financial Services, Manufacturing and Construction, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia cloud services market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia cloud services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia cloud services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cloud services encompass a variety of computing resources provided via the internet, which include storage, servers, databases, networking, software, and analytics. They offer flexibility, scalability, and cost-efficiency, allowing businesses and individuals to store data, run applications, and access computing power from virtually anywhere. They are used for data backup, disaster recovery, website hosting, software development, and remote collaboration.

The Saudi Arabia cloud services market was valued at USD 4.5 Billion in 2025.

The Saudi Arabia cloud services market is projected to exhibit a CAGR of 12.69% during 2026-2034, reaching a value of USD 13.9 Billion by 2034.

The growing demand for remote work and digital collaboration tools is increasing reliance on cloud-based infrastructure and platforms. Besides this, high internet penetration is supporting widespread adoption of software-as-a-service (SaaS) solutions. Moreover, businesses are migrating legacy systems to the cloud to improve scalability, agility, and cost-efficiency, while reducing IT overhead.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)