Saudi Arabia Calibration Services Market Size, Share, Trends and Forecast by Service Type, Calibration Type, End Use Industry, and Region, 2026-2034

Saudi Arabia Calibration Services Market Summary:

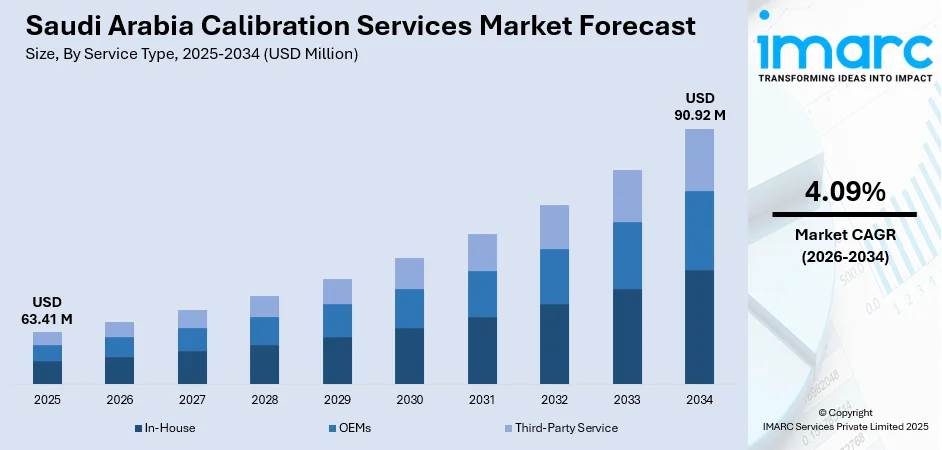

The Saudi Arabia calibration services market size was valued at USD 63.41 Million in 2025 and is projected to reach USD 90.92 Million by 2034, growing at a compound annual growth rate of 4.09% from 2026-2034.

The Saudi Arabia calibration services market is expanding rapidly, driven by the Kingdom's aggressive industrial diversification under Vision 2030, shifting the economy away from oil dependence toward manufacturing, logistics, mining, and renewable energy sectors. The implementation of stringent regulatory frameworks by authorities such as SASO mandates precision measurement compliance across critical industries including oil and gas, pharmaceuticals, food processing, and aviation. Rising adoption of smart manufacturing, automation, and Industrial Internet of Things technologies further accelerates demand for specialized calibration services to maintain system integrity and operational excellence across the Saudi Arabia calibration services market share.

Key Takeaways and Insights:

- By Service Type: In-house dominated the market with 44% revenue share in 2025, driven by large industrial enterprises establishing dedicated calibration facilities to ensure immediate equipment accuracy, reduce turnaround times, and maintain proprietary measurement standards for critical manufacturing processes.

- By Calibration Type: Electrical leads the market with a share of 32% in 2025, owing to the proliferation of electronic instruments, sensors, and control systems across industrial automation, smart grid infrastructure, and telecommunications networks requiring precise voltage, current, and resistance measurements.

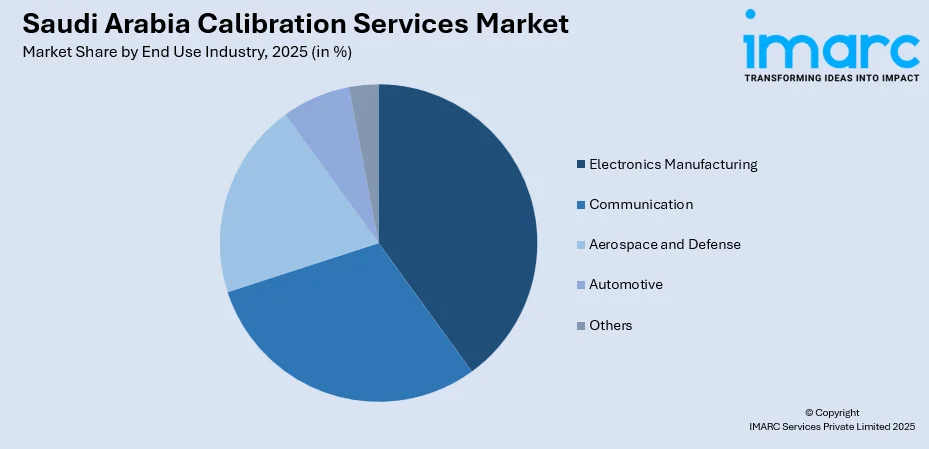

- By End Use Industry: Electronics manufacturing represents the largest segment with a market share of 31% in 2025, attributed to the Kingdom's strategic investments in semiconductor production, consumer electronics assembly, and high-technology manufacturing clusters requiring stringent measurement accuracy standards.

- By Region: Northern and Central region dominates with 34% market share in 2025, supported by Riyadh's concentration of industrial facilities, government institutions, research centers, and proximity to major manufacturing hubs driving demand for calibration services.

- Key Players: The Saudi Arabia calibration services market exhibits moderate competitive intensity, with multinational testing and certification corporations competing alongside regional specialized laboratories. International players leverage global accreditations and technological capabilities while local providers offer proximity advantages and cultural familiarity.

To get more information on this market Request Sample

The Saudi Arabia calibration services market is undergoing significant transformation as the Kingdom pursues its Vision 2030 economic diversification objectives. The establishment of mega-industrial zones and specialized manufacturing clusters has created unprecedented demand for precision measurement services across multiple sectors. Government-led infrastructure projects such as King Salman Energy Park feature high-technology manufacturing units with sophisticated instruments requiring exact tolerance calibration. In October 2024, Emerson inaugurated its 140,000-square-foot manufacturing and innovation hub at SPARK, bringing control systems, measurement instrumentation, and control valves manufacturing under one roof. This development exemplifies the growing complexity of industrial operations demanding specialized calibration expertise. The market continues to benefit from regulatory reinforcement by the Saudi Standards, Metrology and Quality Organization mandating international measurement accuracy standards, particularly in critical sectors where equipment performance directly impacts safety and operational reliability.

Saudi Arabia Calibration Services Market Trends:

Integration of Predictive Maintenance and AI-Powered Calibration Solutions

The calibration services sector is increasingly adopting artificial intelligence and predictive analytics to optimize equipment performance monitoring. Advanced calibration providers are implementing AI-powered systems that analyze historical calibration data to predict instrument drift and schedule proactive maintenance interventions. This technology-driven approach reduces equipment downtime while supporting large-scale projects including smart cities and renewable energy parks, by ensuring instrumentation accuracy under complex operational conditions. The Smart Cities Saudi Expo held in Riyadh in 2024 showcased numerous smart city projects emphasizing the growing integration of predictive technologies across industrial infrastructure.

Expansion of Accredited Local Calibration Laboratories

Saudi Arabia is witnessing the increased establishment of ISO/IEC 17025 accredited calibration laboratories to meet rising domestic demand and reduce dependence on international service providers. Government initiatives promoting industrial self-sufficiency are driving investments in local calibration infrastructure equipped with world-class measurement standards. The Saudi Accreditation Committee is expanding its role in certifying laboratories across dimensional, electrical, thermal, flow pressure, and torque calibration disciplines. Local calibration facilities increasingly utilize advanced equipment from leading manufacturers, enabling them to compete with international providers while offering faster turnaround times and cultural proximity advantages.

Growing Demand from the Aerospace and Defense Sector Localization

The Kingdom's ambitious defense localization program under Vision 2030 is creating substantial calibration services as aerospace and military manufacturing capabilities expand domestically. The Saudi Arabia defense market size reached USD 24,034.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 33,077.1 Million by 2034, exhibiting a growth rate (CAGR) of 3.61% during 2026-2034. Saudi Arabian Military Industries is developing extensive facilities for aircraft, helicopter, and unmanned aerial vehicle production, requiring precise instrumentation calibration. The National Academy of Military Industries, established by GAMI, focuses on training qualified technicians in complex systems including avionics and electronics, further driving calibration infrastructure requirements. These developments position calibration services as essential enablers of defense manufacturing excellence and regulatory compliance.

How Vision 2030 is Transforming the Saudi Arabia Calibration Services Market:

Saudi Arabia’s Vision 2030 is reshaping the calibration services market by driving modernization, industrial diversification, and stringent quality standards across sectors. Rapid expansion in oil and gas, power, construction, and manufacturing is increasing demand for precise and reliable calibration solutions to ensure equipment accuracy, safety, and regulatory compliance. Vision 2030’s emphasis on industrial localization and technology transfer is encouraging domestic service providers to adopt advanced calibration technologies, enhance technical capabilities, and achieve international certifications. Additionally, smart factories, automation, and digital quality management initiatives are creating opportunities for integrated calibration services. Strategic partnerships and regulatory reforms are further boosting market growth, positioning calibration services as a critical enabler of the Kingdom’s industrial transformation.

Market Outlook 2026-2034:

The Saudi Arabia calibration services market outlook remains positive as industrial expansion accelerates across manufacturing, energy, healthcare, and defense sectors. Continued investment in smart infrastructure, renewable energy projects, and advanced manufacturing facilities will sustain demand for precision calibration services. The Kingdom's commitment to achieving industrial self-sufficiency, combined with stringent quality compliance requirements, positions calibration providers for sustained growth. Saudi Arabia’s industrial sector is embarking on a significant growth phase, aiming to establish 36,000 factories and achieve a GDP contribution of SAR 1.4 trillion ($373.3 billion) by 2035, stated Khalil bin Salma, Vice Minister of Industry and Mineral Resources for Industrial Affairs. The market generated a revenue of USD 63.41 Million in 2025 and is projected to reach a revenue of USD 90.92 Million by 2034, growing at a compound annual growth rate of 4.09% from 2026-2034.

Saudi Arabia Calibration Services Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service Type |

In-House |

44% |

|

Calibration Type |

Electrical |

32% |

|

End Use Industry |

Electronics Manufacturing |

31% |

|

Region |

Northern and Central Region |

34% |

Service Type Insights:

- In-House

- OEMs

- Third-Party Service

In-house dominates with a market share of 44% of the total Saudi Arabia calibration services market in 2025.

In-house calibration services have gained significant traction among large industrial enterprises, energy companies, and manufacturing conglomerates seeking to maintain direct control over measurement accuracy and equipment reliability. These organizations establish dedicated calibration laboratories equipped with reference standards traceable to national and international metrology institutes. The approach enables immediate response to calibration requirements, reduces equipment downtime, and supports continuous production processes. Major energy sector players and industrial giants operating extensive instrument inventories particularly favor in-house capabilities for strategic operational advantages.

The segment benefits from Saudi Arabia's industrial expansion, with companies investing in comprehensive calibration infrastructure as part of their facility development. Organizations like Saudi Aramco and major petrochemical producers maintain sophisticated in-house calibration capabilities to ensure uninterrupted operations. The trend toward automation and digital transformation further reinforces in-house investments, as companies seek integrated calibration management systems connected to their industrial control networks. Training programs and technology partnerships enable local talent development, supporting sustainable in-house calibration operations aligned with Saudization objectives.

Calibration Type Insights:

- Electrical

- Mechanical

- Thermodynamic

- Physical/Dimensional

- Others

Electrical leads with a share of 32% of the total Saudi Arabia calibration services market in 2025.

Electrical calibration encompasses the verification and adjustment of voltage meters, ammeters, multimeters, oscilloscopes, power analyzers, and electronic measurement instruments essential for industrial automation, telecommunications, and power distribution systems. The proliferation of electronic control systems across manufacturing facilities, smart grid infrastructure, and communications networks drives substantial demand for precise electrical measurements. Semiconductor production initiatives and electronics manufacturing clusters require exceptionally accurate electrical calibration to maintain product quality and process control standards.

The Kingdom's investment in 5G telecommunications infrastructure and smart city projects has accelerated electrical calibration requirements. Testing laboratories calibrate network analyzers, spectrum analyzers, and signal generators supporting telecommunications deployment. The energy sector relies on electrical calibration for protection relays, metering equipment, and transformer testing instruments. In 2024, the Saudi government announced initiatives establishing a National Semiconductor Hub attracting over SAR 1 billion in investments, further expanding electrical calibration demand as electronics manufacturing capabilities develop across the Kingdom.

End Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Electronics Manufacturing

- Communication

- Aerospace and Defense

- Automotive

- Others

Electronics manufacturing exhibits clear dominance with a 31% share of the total Saudi Arabia calibration services market in 2025.

Electronics manufacturing represents a strategic priority under Saudi Arabia's Vision 2030 economic diversification program, with substantial investments flowing into semiconductor production, consumer electronics assembly, and technology hardware manufacturing. These operations require rigorous calibration of testing equipment, measurement instruments, and production line sensors to maintain international quality standards and product specifications. The establishment of Alat by the Public Investment Fund in February 2024 focuses on transforming the Kingdom into a global hub for electronics and advanced industries, including comprehensive semiconductor manufacturing capabilities.

Calibration services for electronics manufacturing encompass dimensional measurement, electronic testing, environmental simulation, and production quality assurance instruments. Manufacturers rely on precise calibration to verify component specifications, test finished products, and maintain production equipment accuracy. The integration of advanced manufacturing technologies including automated optical inspection, X-ray inspection systems, and statistical process control instruments creates ongoing calibration requirements. International electronics companies establishing production facilities in Saudi Arabia bring demanding calibration standards that elevate overall market sophistication and service quality expectations.

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central region represents the largest share with 34% of the total Saudi Arabia calibration services market in 2025.

The Northern and Central region of Saudi Arabia is witnessing strong demand for calibration services due to the concentration of industrial, oil and gas, and manufacturing activities. Riyadh, as the national capital and a major economic hub, hosts numerous factories, refineries, and processing plants that require precise measurement and calibration to ensure operational efficiency, compliance with safety standards, and adherence to international quality certifications. The growth of smart manufacturing, automation, and advanced process technologies in these sectors is further increasing reliance on specialized calibration services.

Government-led initiatives under Vision 2030 are also driving market growth in the region. Policies promoting industrial diversification, technological adoption, and workforce localization are encouraging companies to upgrade equipment and maintain rigorous calibration standards. Investments in large-scale infrastructure, power generation, and petrochemical projects create consistent demand for high-quality calibration services. Additionally, regulatory frameworks and quality assurance requirements in key industries are strengthening the adoption of calibration solutions, making the Northern and Central region a key hub for market expansion.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Calibration Services Market Growing?

Industrial Expansion and Diversification under Vision 2030

Saudi Arabia's Vision 2030 initiative is driving aggressive industrial diversification, shifting the economy from oil dependence toward manufacturing, logistics, mining, and renewable energy sectors. This transformation creates substantial demand for calibration services across industrial equipment, testing devices, and control systems. As sectors including automotive, aerospace, pharmaceuticals, and electronics scale up operations, precision measurement and regulatory compliance become critical requirements. Government-led infrastructure projects and industrial zones feature high-technology manufacturing units with sophisticated instruments requiring exact tolerance calibration. In June 2025, the Ministry of Industry and Mineral Resources issued 83 new industrial licenses worth over SAR 950 million while 58 new factories commenced operations with SAR 1.9 billion in combined investment, generating approximately 3,200 new jobs and expanding calibration demand.

Stringent Regulatory Framework and Quality Compliance Requirements

Regulatory authorities in Saudi Arabia are reinforcing quality control across multiple industries through expanded standards and certification requirements. The Saudi Standards, Metrology and Quality Organization mandates measurement accuracy standards ensuring safety, reliability, and legal compliance for sectors including oil and gas, pharmaceuticals, food processing, aviation, and utilities. The 2024 Product Safety Law introduced comprehensive conformity assessment procedures requiring documented, independent proof of compliance. Equipment used for temperature, pressure, flow, and dimensional measurements requires periodic calibration to maintain certifications and avoid production interruptions or penalties. Beginning in 2025, new shipment clearance requirements mandate Product Certificates of Conformity and Shipment Certificates through the SABER platform, strengthening calibration documentation requirements.

Growth of Advanced Technologies and Automation in Key Sectors

The adoption of smart manufacturing, automation, and Industrial Internet of Things technologies intensifies calibration requirements for advanced industrial systems. Automated plants and digitally controlled facilities depend on networks of sensors, meters, and programmable instruments that must function with exact calibration to ensure system integrity. Faulty readings or equipment drift can compromise entire systems, making predictive maintenance and calibration essential operational requirements. The shift toward predictive analytics relies on accurate historical data dependent on regularly calibrated equipment. As smart city projects and renewable energy installations expand, instrumentation complexity increases, encouraging specialized calibration service providers to address critical operational gaps across diverse technological applications.

Market Restraints:

What Challenges the Saudi Arabia Calibration Services Market is Facing?

Limited Availability of Skilled Calibration Technicians

The calibration services market faces workforce constraints as demand for qualified calibration engineers and technicians exceeds local supply. Training highly skilled professionals in complex measurement sciences, equipment operation, and quality management systems requires substantial time and investment. Competition with other technical sectors for engineering talent further challenges recruitment efforts, potentially limiting service capacity expansion and requiring continued reliance on expatriate specialists.

High Initial Investment Requirements for Advanced Equipment

Establishing accredited calibration laboratories requires significant capital investment in reference standards, precision measurement equipment, controlled environment infrastructure, and quality management systems. The cost of maintaining traceability to international metrology standards through primary reference instruments represents ongoing operational expenses. These financial barriers may limit market entry for smaller service providers and constrain the geographic expansion of calibration infrastructure.

Dependence on Imported Reference Standards and Equipment

Saudi Arabia's calibration infrastructure relies substantially on imported primary reference standards and advanced measurement equipment from established international manufacturers. This dependence creates supply chain vulnerabilities, potential delivery delays, and foreign exchange exposure. Limited domestic manufacturing of precision calibration instruments constrains local self-sufficiency objectives and requires ongoing international procurement relationships.

Competitive Landscape:

The Saudi Arabia calibration services market demonstrates moderate fragmentation, with international testing, inspection, and certification corporations operating alongside regional specialized laboratories and in-house facilities. Multinational players leverage global accreditations, extensive technical expertise, and standardized quality management systems to serve major industrial clients. Regional providers differentiate through local market knowledge, faster response times, competitive pricing, and relationships with government entities. The market observes increasing consolidation as larger players acquire local laboratories to expand geographic coverage and service capabilities. Strategic partnerships between international calibration specialists and Saudi industrial conglomerates facilitate technology transfer and localization initiatives aligned with Vision 2030 objectives. Service providers compete on accreditation scope, turnaround times, technical capabilities, and value-added services including training and consultancy.

Recent Developments:

- November 2024: King Salman Energy Park signed five letters of intent totaling over SAR 3 billion with prominent industry players during ADIPEC 2024, including BioChem, MAN Industries, Primetech International Company, Thermocables, and Dalipal Holdings, creating over 3,000 direct and indirect jobs at maturity and expanding calibration services requirements.

- July 2024: The Saudi Standards and Quality Law and Product Safety Law issued pursuant to Royal Decree No. M/36 came into effect, introducing comprehensive conformity assessment procedures, enhanced quality control requirements, and strengthened calibration documentation standards across all product categories.

Saudi Arabia Calibration Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | In-House, OEMs, Third-Party Service |

| Calibration Types Covered | Electrical, Mechanical, Thermodynamic, Physical/Dimensional, Others. |

| End Use Industries Covered | Electronics Manufacturing, Communication, Aerospace and Defense, Automotive, Others |

| Regions Covered | Northern And Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia calibration services market size was valued at USD 63.41 Million in 2025.

The Saudi Arabia calibration services market is expected to grow at a compound annual growth rate of 4.09% from 2026-2034 to reach USD 90.92 Million by 2034.

The in-house segment dominated with approximately 44% market share in 2025, driven by large industrial enterprises establishing dedicated calibration facilities to ensure immediate equipment accuracy and maintain proprietary measurement standards for critical manufacturing processes.

Key factors driving the Saudi Arabia calibration services market include industrial expansion under Vision 2030, stringent regulatory frameworks enforced by SASO mandating measurement accuracy compliance, and rising adoption of smart manufacturing, automation, and Industrial IoT technologies across critical sectors.

Major challenges include limited availability of skilled calibration technicians requiring specialized training, high initial investment requirements for establishing accredited laboratories with advanced equipment, and dependence on imported reference standards and precision measurement instruments from international suppliers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)