Saudi Arabia Beauty and Personal Care Market Size, Share, Trends and Forecast by Type, Category, Distribution Channel, and Region, 2025-2033

Saudi Arabia Beauty and Personal Care Market Size and Share:

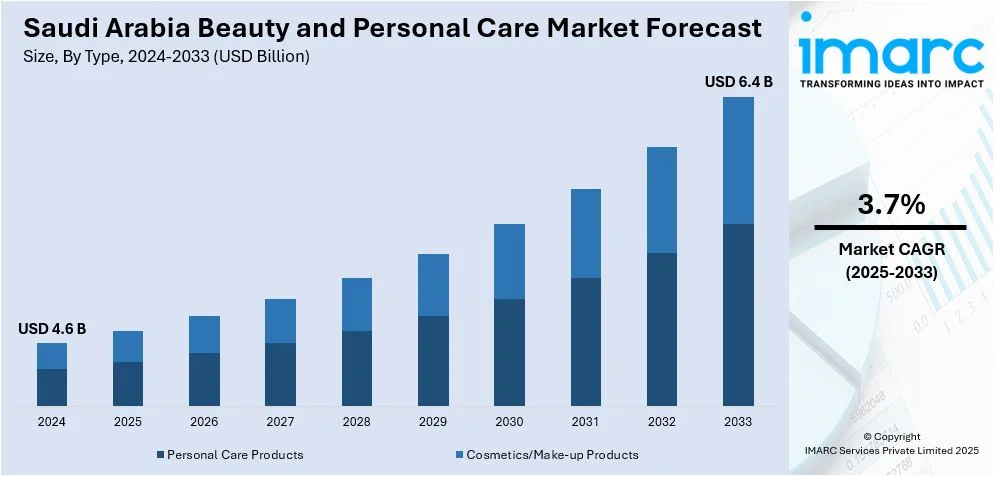

The Saudi Arabia beauty and personal care market size was valued at USD 4.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2033, exhibiting a CAGR of 3.7% from 2025-2033. The market is propelled by a youthful and tech-savvy population, rising disposable income, and growing interest in skincare and wellness. The increasing demand for premium, organic, and natural products, coupled with the influence of social media and global beauty trends, further boosts the market's growth and consumer engagement across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.6 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate (2025-2033) | 3.7% |

Saudi Arabia has a predominantly young population, with a large proportion of consumers under the age of 30. This demographic is highly connected to social media and digital platforms, making them more exposed to global beauty trends. According to industry reports, there were 36.84 million internet users in Saudi Arabia at the start of 2024, when internet penetration stood at 99.0 percent. Saudi Arabia was home to 35.10 million social media users in January 2024, equating to 94.3 percent of the total population. Influencers and online beauty communities significantly shape purchasing decisions, fueling interest in beauty products. As digital engagement grows, consumers increasingly turn to online shopping for beauty items, enhancing the market's growth and accessibility.

As Saudi Arabia's economy diversifies under Vision 2030, there is a noticeable rise in disposable income, particularly among the middle and upper-middle classes. This economic growth enables consumers to invest in high-quality and luxury beauty products. Saudi Arabia witnessed cultural shifts that influenced beauty product consumption, which is contributing to the market growth. Women's participation in the workforce and public life is on the rise, driving thus demand for beauty and personal care products. For instance, in November 2024, Moonglaze, the beauty brand founded by Saudi influencer Yara Alnamlah, is set to make history on December 4 as the first Saudi beauty label to launch at Selfridges London. As beauty standards evolve, particularly with the growing acceptance of cosmetics, grooming, and self-care, more individuals are seeking out products that align with their new needs. These shifts are expanding the market for cosmetics, skincare, and wellness products across all demographics.

Saudi Arabia Beauty and Personal Care Market Trends:

Increasing Disposable Income

As Saudi Arabia's economy diversifies and grows under Vision 2030, disposable income has risen, particularly among the middle and upper-middle classes. This economic shift allows consumers to purchase higher-end and premium beauty products, such as luxury skincare and cosmetics. The growing affluence among consumers, combined with a desire for quality, results in an expanding market for both local and international beauty brands, driving sector growth and innovation. For instance, in September 2024, The Saudi Food and Drug Authority (SFDA) updated the "Guidelines and Requirements for Cosmetic Products Listing" to enhance consumer awareness of regulatory procedures for product listing and clarify associated requirements. The updates include improved access to circulars on cosmetic products and their list of components, as well as revisions to the documents required for account sign-up and product listing in the unified online system (GHAD). Additionally, the updates feature an enhanced listing mechanism and improved access for listers. Such endeavors cater and stand in response to the steadily rising demand for quality cosmetics products of the upper-middle class and affluent population base.

Cultural Shifts and Changing Beauty Standards

Saudi Arabia has seen significant cultural changes, particularly regarding women's rights and participation in the workforce. These shifts have led to an increase in beauty product consumption, as more people engage in public life. Changing beauty standards and growing acceptance of grooming, cosmetics, and self-care routines among men and women are further driving the product demand. This shift is reshaping the beauty market, pushing for more diversity in product offerings and targeting different consumer needs. For instance, in November 2024, clean beauty brand Kosas announced its official entry to the Saudi market, offering a range of skincare-focused makeup products. Kosas also plans to connect with the Saudi community by staging workshops and events focused on clean beauty and skin health.

Expansion of Retail and E-Commerce Channels

The growth of e-commerce and the expansion of modern retail channels have made beauty and personal care products more accessible to consumers across Saudi Arabia. Online shopping platforms, along with the rise of beauty subscription boxes, offer convenience and a wider product range. Additionally, traditional retail stores are increasing their presence, with beauty sections in malls and standalone stores offering a more personalized shopping experience, further driving the market's expansion and accessibility. For instance, in December 2024, Nice One Beauty, a leading beauty care e-commerce platform in Saudi Arabia, announced that it is set to launch an initial public offering (IPO) in Riyadh, aiming to raise up to SAR1.21 billion ($322 million). It is offering 34.6 million shares (30% of the share capital) for a price range of SAR32 to SAR35 per share.

Saudi Arabia Beauty and Personal Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Saudi Arabia beauty and personal care market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, category, and distribution channel.

Analysis by Type:

- Personal Care Products

- Hair Care Products

- Shampoo

- Conditioner

- Hair Oil

- Others

- Skin Care Products

- Facial Care Products

- Body Care Products

- Lip Care Products

- Bath and Shower Products

- Oral Care Products

- Toothbrushes and Replacements

- Toothpaste

- Mouthwashes and Rinses

- Others

- Men's Grooming Products

- Fragrances and Perfumes

- Hair Care Products

- Cosmetics/Make-up Products

- Facial Cosmetics

- Eye Cosmetic Products

- Lip and Nail Products

- Hair Styling and Coloring Products

Personal care products hold a huge market share as they are essential for daily grooming and hygiene. Items such as shampoos, soaps, deodorants, and oral care are well-defined necessities to maintain health and cleanliness. Increasing awareness among consumers about personal hygiene and wellness, along with rising disposable incomes, has led to a high demand for premium and natural personal care products. Besides, the growing male grooming segment also covers this product category under its dominance.

Cosmetics and make-up products dominate the market due to the growing beauty consciousness among Saudi women and men, influenced by social media and global beauty trends. The rising focus on aesthetics, especially among the younger population, has boosted demand for innovative and premium make-up products. Changing cultural norms, greater workforce participation, and social activities have also increased the use of cosmetics. Additionally, international beauty brands expanding in Saudi Arabia and offering diverse product ranges further fuel this segment's growth.

Analysis by Category:

- Premium Products

- Mass Products

Premium products dominate a major market share owing to the increasing disposable incomes and the mounting preference of consumers for high-quality luxurious items. Premium skincare and cosmetics are becoming popular among consumers for their effectiveness, innovative formulations, as well as the aspirational appeal of newness and glamour. International luxury brands expanding in Saudi Arabia are adding to this premium segment visibility within the market. Moreover, the factors impelling premium growth include social media, global beauty trends, and a relatively wealthy population willing to spend on self-care.

Mass products influence the market because of their coverage, affordability, and accessibility. Essential personal care such as shampoos, soaps, and deodorants are used by all kinds of income groups and therefore are always in constant need. Mass items have been profiting from such widespread availability through supermarkets, pharmacies, and other convenience stores. This segment is now being taken up by local and global brands, offering quality at competitive prices for price-sensitive consumers. The affordability and necessity of mass products ensure their significant presence in the market.

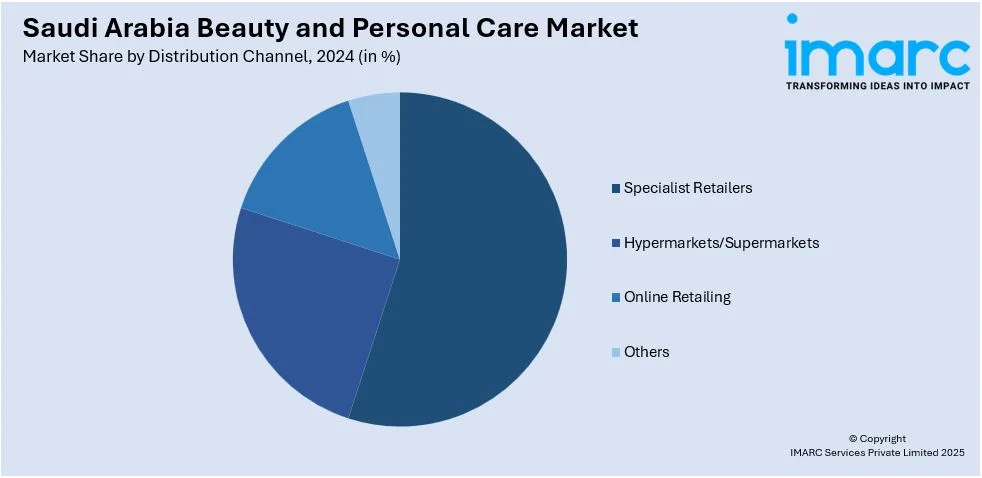

Analysis by Distribution Channel:

- Specialist Retailers

- Hypermarkets/Supermarkets

- Online Retailing

- Others

Specialist retailers hold a large share in the market because they offer a curated selection of high-quality beauty products and personalized customer service. Stores like Sephora and local boutiques provide exclusive access to premium brands and expert advice, creating a tailored shopping experience. Their focus on beauty and wellness appeals to consumers seeking specific, high-end products. Additionally, in-store sampling, demonstrations, and promotions attract customers, making specialist retailers a preferred choice for beauty enthusiasts.

Hypermarkets and supermarkets dominate due to their convenience and accessibility, offering a wide range of beauty and personal care products under one roof. They cater to a diverse customer base by providing both premium and mass-market options. Frequent promotions, discounts, and loyalty programs further attract price-conscious consumers. The availability of everyday essentials like shampoos, soaps, and cosmetics at affordable prices makes these stores a go-to destination for regular shopping, ensuring their significant presence in the market.

Several factors have contributed to the phenomenal growth of the online retailers' segment in the beauty market in Saudi Arabia, among which shopping from home, wondering prices and a wide number of products are some of the valid reasons. Consumers can avail of online stores for national and international brands that are available in the country. Social media influencers and digital marketing promote the sales initiative on the internet and fulfill customer demands with extras like doorstep delivery, discounts, and loyalty rewards. The increasing adoption of digital payment methods and mobile shopping further fuels the growth of online beauty retailing.

Regional Analysis:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The Northern and Central regions, including Riyadh, drive the market with a high population density and rising urbanization. Consumers in these areas prioritize premium and international beauty brands, driven by higher disposable incomes and exposure to global trends. The region's advanced retail infrastructure, including malls and specialist stores, supports accessibility. Increasing awareness of skincare and wellness products, alongside cultural shifts encouraging grooming and self-care, also fuels demand in this economically and socially progressive region.

The Western region, anchored by cities like Jeddah and Mecca, drives market growth due to its diverse population and cosmopolitan culture. Tourism, especially religious and leisure, increases demand for personal care products. The region’s younger demographic, influenced by social media and digital trends, supports the rising popularity of cosmetics and skincare. The presence of hypermarkets, beauty specialty stores, and expanding e-commerce platforms provides easy access to both mass and premium products, further boosting the market.

The Eastern region, known for its oil wealth, boasts a high-income population that drives demand for premium beauty and personal care products. Cities like Dammam and Al Khobar are hubs for luxury brands and specialist retailers. A growing expatriate community adds diversity to product preferences. The region’s proximity to Gulf Cooperation Council (GCC) markets ensures exposure to regional beauty trends. Rising wellness awareness and access to high-end retail outlets contribute significantly to market expansion in this region.

The Southern region, characterized by a mix of urban and rural areas, experiences growth in beauty and personal care due to improving infrastructure and rising consumer awareness. The adoption of mass-market products dominates here, catering to price-conscious consumers. However, urban centers are seeing increased interest in premium products as disposable incomes rise. Regional traditions emphasize personal grooming and hygiene, supporting consistent demand for essential personal care items, while the expansion of e-commerce improves access to diverse products.

Competitive Landscape:

The market is emerging as one of the most competitive markets, comprising international and local players. Foreign brands like L'Oréal, Estée Lauder, and Unilever have a stronghold on the premium and mass-market segments due to their high brand equity and distribution network. Local brands are fast catching up because of their customized products as per culture. Specialist retailers, hypermarkets, and online platforms intensify competition through accessibility and promotions. The growing demand for organic, halal, and clean beauty products promises innovation and new market opportunities. For instance, in July 2024, the global skincare leader Nivea launched its latest initiative in Saudi Arabia, introducing the Luminous630 Even Skin Tone body care range. This new collection is designed to tackle two prevalent skin concerns among women in the region: uneven skin tone and stretch marks.

Latest News and Developments:

- In September 2024, Beauty and fashion e-commerce brand Nykaa incorporated a wholly-owned subsidiary in Saudi Arabia, Nysaa Trading LLC, as a part of its broader plan to expand its market beyond domestic borders. The newly-incorporated subsidiary will retail beauty and personal care (BPC) products, including cosmetics, toiletry, beauty and hair care products, perfumes, and beauty soap, in the international and domestic markets through online and offline channels.

- In July 2024, Henkel, a worldwide leader in consumer and industrial goods, revealed the launch of its state-of-the-art beauty care manufacturing plant in Riyadh. The facility will manufacture a variety of products under the Pert brand, such as shampoos, conditioners, and other specialized items, catering to the increasing demand for high-quality personal care products in the Middle East.

Saudi Arabia Beauty and Personal Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Categories Covered | Premium Products, Mass Products |

| Distribution Channels Covered | Specialist Retailers, Hypermarkets/Supermarkets, Online Retailing, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia beauty and personal care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia beauty and personal care market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia beauty and personal care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Beauty and personal care refer to products and practices aimed at enhancing appearance, grooming, and overall well-being. This includes skincare, haircare, makeup, fragrance, and hygiene products. These routines promote self-care, confidence, and hygiene, helping individuals feel and look their best while maintaining healthy skin and hair.

The Saudi Arabia beauty and personal care market was valued at USD 4.6 Billion in 2024.

IMARC estimates the Saudi Arabia beauty and personal care market to exhibit a CAGR of 3.7% during 2025-2033.

The key factors driving the market in Saudi Arabia include a young, tech-savvy population, increasing disposable income, rising awareness of skincare and wellness, a growing demand for premium and organic products, and the influence of social media and global beauty trends.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)