Saudi Arabia Animal Feed Market Size, Share, Trends and Forecast by Form, Animal Type, Ingredient, and Region, 2026-2034

Saudi Arabia Animal Feed Market Summary:

The Saudi Arabia animal feed market size was valued at USD 6.86 Billion in 2025 and is projected to reach USD 10.80 Billion by 2034, growing at a compound annual growth rate of 5.11% from 2026-2034.

The market is experiencing robust expansion driven by the government's strategic Vision 2030 initiatives aimed at achieving food security and reducing import dependency. Rising domestic livestock and poultry production, coupled with increasing per capita meat consumption, are stimulating demand for high-quality animal feed. Government investments in agricultural infrastructure, including the Agricultural Development Fund's allocation of substantial resources to enhance feedstock production, are creating a favorable environment for market growth. The Saudi Food and Drug Authority's stringent quality standards are pushing manufacturers to develop premium feed formulations, thereby expanding the Saudi Arabia animal feed market share.

Key Takeaways and Insights:

-

By Form: Pellets dominate the market with a share of 53.12% in 2025, driven by superior feed efficiency, reduced wastage, and enhanced palatability compared to alternative forms.

-

By Animal Type: Poultry leads the market with a share of 44.24% in 2025, supported by government targets to achieve 80 percent self-sufficiency in poultry production.

-

By Ingredient: Cereals represent the largest segment with a market share of 45.45% in 2025, reflecting the dominance of corn and barley as primary feed components.

-

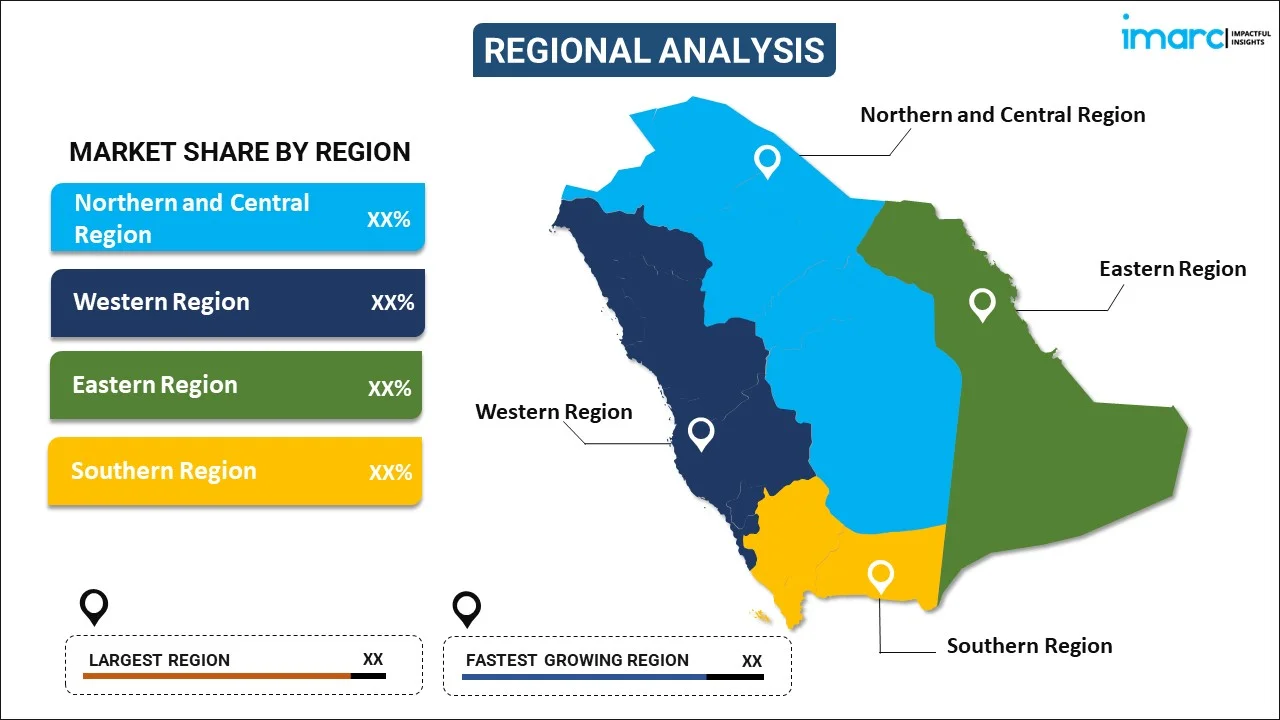

By Region: Northern and Central Region leads the market with a share of 40% in 2025, benefiting from concentrated livestock operations and established distribution infrastructure.

-

Key Players: The competitive landscape features major domestic producers alongside international corporations, with companies leveraging extensive distribution networks and vertically integrated operations to maintain market leadership.

The Saudi Arabia animal feed industry is undergoing significant transformation as producers modernize their operations to meet evolving nutritional standards and sustainability requirements. The poultry sector's rapid expansion represents a cornerstone of this growth, with domestic production surpassing 900,000 metric tons in 2023 and continuing its upward trajectory. Government-backed initiatives are encouraging technological innovation in feed formulation, with manufacturers increasingly incorporating advanced nutritional additives to enhance digestibility and animal performance. For instance, in May 2024, Almarai signed five agreements with five leading global poultry companies worth over 500 million Saudi riyals, demonstrating the sector's commitment to scaling production capacity to meet growing demand. The market benefits from strategic investments in local feed manufacturing capabilities, aimed at reducing vulnerability to global supply chain disruptions while maintaining competitive pricing structures that support livestock farmers across the Kingdom.

Saudi Arabia Animal Feed Market Trends:

Government-Led Food Security Initiatives Accelerating Market Transformation

The Saudi government's Vision 2030 framework is fundamentally reshaping the animal feed landscape through substantial financial commitments and policy interventions designed to enhance domestic production capabilities. Agricultural authorities have prioritized livestock sector development as a pillar of national food security, implementing comprehensive support mechanisms that directly benefit feed manufacturers and livestock producers. Regulatory reforms are streamlining certification processes while maintaining rigorous quality standards, enabling producers to respond more efficiently to market demands. The government allocated 1.9 billion dollars in 2024 to improve livestock and feedstock production under the Agricultural Development Fund, demonstrating sustained commitment to building resilient agricultural infrastructure. These initiatives are fostering innovation in feed technology while encouraging private sector investment in production facilities, creating a multiplier effect that strengthens the entire value chain from ingredient sourcing through final product delivery.

Aquaculture Sector Expansion Driving Specialized Feed Demand

The Kingdom's aquaculture industry is experiencing unprecedented growth as authorities pursue ambitious production targets aligned with diversification objectives and protein security goals. Coastal regions are witnessing substantial infrastructure development to support fish farming operations, creating new opportunities for specialized aquafeed manufacturers. Government investments have facilitated the establishment of modern aquaculture facilities equipped with advanced water management systems and biosecurity protocols. The Kingdom aims to increase aquaculture production to 500,000 tons by 2025. This expansion is generating demand for nutritionally optimized feeds tailored to various fish species, prompting manufacturers to develop innovative formulations that enhance growth rates while maintaining environmental sustainability. The sector's maturation is attracting international expertise and technology transfer, positioning Saudi Arabia as an emerging hub for aquaculture innovation in the region.

Advanced Feed Technology Enhancing Nutritional Standards

The industry is embracing technological sophistication as producers invest in research and development to create premium feed products that deliver superior nutritional outcomes. Manufacturing facilities are adopting precision formulation systems that enable customization based on specific livestock requirements and production stages. Digital monitoring technologies are being integrated into feeding programs, allowing farmers to optimize consumption patterns and reduce waste. In 2024, Tanmiah Food Company achieved the highest grade certification in international food safety standards for its poultry facility, exemplifying the sector's commitment to excellence. Feed manufacturers are incorporating advanced nutritional additives including enzymes, probiotics, and amino acids that improve digestibility and animal health outcomes. The emphasis on quality is driving consolidation around producers capable of meeting stringent certification requirements while maintaining competitive pricing structures that support the Kingdom's livestock sector growth objectives.

How Vision 2030 is Transforming the Saudi Arabia Animal Feed Market:

Saudi Vision 2030 is reshaping the animal feed market by pushing the country toward food security, local production, and better resource use. A major shift is the move away from heavy import dependence. Investments in domestic feed mills, grain storage, and logistics are rising, backed by public funding and private partnerships. The government is also supporting research into alternative feed ingredients like date palm by-products, algae, and food waste, reducing pressure on water and arable land. Water conservation goals under Vision 2030 are influencing feed formulation as well. Producers are adopting efficient crops and precision nutrition to cut water use across livestock value chains. Regulatory reforms and incentives are encouraging modern farming practices, larger integrated farms, and better-quality control in feed manufacturing. Growing demand for poultry, dairy, and aquaculture products is further driving feed consumption. Together, policy support, technology adoption, and sustainability targets are positioning Saudi Arabia’s animal feed market for steady, locally anchored growth through the next decade.

Market Outlook 2026-2034:

The Saudi Arabia animal feed market is positioned for sustained expansion as government policies, demographic trends, and agricultural modernization converge to support robust demand growth across all livestock segments. The market generated a revenue of USD 6.86 Billion in 2025 and is projected to reach a revenue of USD 10.80 Billion by 2034, growing at a compound annual growth rate of 5.11% from 2026-2034. Population increase coupled with rising disposable incomes will continue elevating per capita protein consumption, necessitating corresponding increases in feed production capacity.

Saudi Arabia Animal Feed Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Form |

Pellets |

53.12% |

|

Animal Type |

Poultry |

44.24% |

|

Ingredient |

Cereals |

45.45% |

|

Region |

Northern and Central Region |

40% |

Form Insights:

To get detailed segment analysis of this market, Request Sample

- Pellets

- Crumbles

- Mash

- Others

Pellets dominate with a market share of 53.12% of the total Saudi Arabia animal feed market in 2025.

The pelleting process transforms ground ingredients into compact, uniform particles that deliver multiple operational and nutritional advantages across livestock feeding programs. This form significantly reduces selective feeding behaviors that can compromise nutritional intake when animals preferentially consume certain components while leaving others unconsumed. The compression involved in pellet production enhances ingredient digestibility by partially breaking down complex carbohydrates and proteins, improving nutrient absorption and utilization efficiency. Storage and handling logistics favor pellets due to their reduced bulk density and resistance to segregation during transportation, factors particularly relevant in Saudi Arabia's challenging climate conditions. Feed conversion ratios typically improve when livestock consume pelleted rations, translating into enhanced growth performance and reduced production costs for farmers.

The economic implications extend beyond farm-level efficiency gains to encompass broader supply chain benefits including extended shelf life and reduced spoilage rates during distribution. Manufacturing infrastructure across the Kingdom has evolved to support large-scale pellet production, with major processors investing in advanced pelleting equipment capable of maintaining consistent quality specifications. Temperature and moisture control during the pelleting process enables manufacturers to preserve nutritional integrity while achieving the physical characteristics that optimize animal performance. Quality parameters including pellet durability and fines percentage are closely monitored to ensure products withstand repeated handling without excessive breakdown. The segment's dominance reflects both producer preferences for manufacturing efficiency and farmer recognition of pelleted feed's superior performance characteristics across diverse livestock operations.

Animal Type Insights:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Turkeys

- Others

- Aquaculture

- Carps

- Crustaceans

- Mackeral

- Milkfish

- Mollusks

- Salmon

- Others

- Others

Poultry leads with a share of 44.24% of the total Saudi Arabia animal feed market in 2025.

The poultry sector occupies a central position in Saudi Arabia's protein production landscape, driven by cultural dietary preferences, religious considerations, and favorable economic characteristics that position chicken as the primary affordable protein source for the population. Government policies explicitly prioritize poultry self-sufficiency as a food security objective, translating into sustained support for domestic production expansion through financial incentives and infrastructure development programs. Chicken meat consumption patterns demonstrate consistent growth trajectory, with per capita intake rising steadily as urbanization and income levels advance across the Kingdom. In 2025, Tanmiah Food Company launched two new facilities in the central region of Saudi Arabia: a poultry processing plant in Al Majmaa and a feed mill in Dahna. These additions complement Tanmiah's existing network of hatcheries, feed mills and processing plants.

Integration within the poultry value chain has created sophisticated feed demand patterns, with large-scale producers operating dedicated feed mills that supply their vertically integrated operations. Nutritional requirements vary significantly across broiler production stages, necessitating specialized starter, grower, and finisher formulations that optimize growth rates while maintaining bird health and meat quality characteristics. Feed represents the dominant cost component in poultry production economics, incentivizing continuous innovation in formulation strategies that maximize feed conversion efficiency. The sector benefits from well-established production protocols and genetic improvements that enable rapid growth cycles, characteristics that have contributed to poultry's competitive positioning relative to alternative protein sources in the domestic market.

Ingredient Insights:

- Cereals

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acids

- Feed Enzymes

- Feed Acidifiers

- Others

- Others

Cereals exhibit a clear dominance with a 45.45% share of the total Saudi Arabia animal feed market in 2025.

Cereal grains constitute the foundational energy source in compound feed formulations across all livestock categories, providing carbohydrates that fuel metabolic processes essential for growth and production. Corn dominates cereal utilization due to its favorable nutritional profile combining high energy density with palatability characteristics that enhance voluntary feed intake across species. The Kingdom's dependence on imported cereals reflects climatic constraints that limit domestic grain production, with corn imports projected to increase. Barley serves as a complementary cereal particularly valued in ruminant feeding programs, where its nutritional attributes align well with digestive physiology requirements. Government import subsidy programs for feed grains help moderate cost pressures that might otherwise constrain livestock sector competitiveness.

Strategic sourcing arrangements with major grain-producing regions ensure supply continuity despite global market volatility that periodically affects commodity prices and availability. Feed manufacturers maintain sophisticated procurement operations that leverage futures markets and diversified supplier relationships to optimize ingredient costs while managing quality specifications. Processing technologies including grinding and conditioning are employed to enhance cereal digestibility and incorporation into finished feed products. Nutritional composition varies among cereal types, enabling formulation flexibility as manufacturers adjust recipes in response to relative price movements and availability conditions. The segment's dominance reflects cereals' irreplaceable role as the primary energy substrate supporting livestock production systems throughout the Kingdom.

Region Insights:

To get detailed regional analysis of this market, Request Sample

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Northern and central region leads with a share of 40% of the total Saudi Arabia animal feed market in 2025.

This region encompasses the capital Riyadh and surrounding areas that concentrate both major feed manufacturing operations and significant livestock production activities, creating synergies that support market leadership. Infrastructure advantages including well-developed transportation networks facilitate ingredient logistics and finished product distribution to farms dispersed throughout the territory. The presence of major feed processors with production capacities measured in millions of metric tons annually establishes the region as the industry's manufacturing epicenter. Proximity to government institutions enables responsive interaction between industry participants and regulatory authorities, facilitating policy implementation and standards compliance. Agricultural Development Fund resources are strategically deployed to support infrastructure enhancements and production expansion concentrated in this economically vital region.

Livestock operations benefit from established service provider networks encompassing veterinary support, equipment suppliers, and technical expertise that collectively contribute to sector sophistication. The region's economic dynamism attracts investment capital and human resources that drive innovation in feeding practices and farm management systems. Feed demand patterns reflect diversified livestock activities including poultry, dairy, and ruminant operations that collectively generate substantial consumption volumes across product categories. Distribution efficiency advantages stemming from centralized manufacturing locations reduce logistics costs while ensuring product freshness through shortened supply chains. The regional concentration of industry capabilities creates competitive dynamics that incentivize continuous improvement in product quality and service delivery standards.

Market Dynamics:

Growth Drivers:

Why is the Saudi Arabia Animal Feed Market Growing?

Rising Meat and Dairy Consumption Fueling Feed Demand

Demographic expansion combined with increasing affluence is fundamentally altering protein consumption patterns across Saudi society, with meat and dairy products assuming progressively larger shares of household food expenditures. Urbanization trends concentrate population in cities where modern retail channels provide convenient access to fresh and processed animal products, stimulating consumption beyond traditional levels. Poultry meat consumption has risen from 23.7 kilograms per capita in 2022 to 24.3 kilograms in 2024, reflecting poultry's positioning as an affordable, accessible protein source aligned with cultural dietary preferences. Beef and veal consumption reached 4.2 kilograms per capita in 2024, demonstrating growing appetite for premium protein products as household incomes advance. Local dairy production has exceeded domestic demand, reaching 109 percent of consumption requirements, while egg production stands at 116 percent, showcasing the sector's successful expansion trajectory.

Government Support and Agricultural Investments Driving Sector Modernization

Authorities have positioned agricultural development as a strategic priority within broader economic diversification efforts, translating into comprehensive policy frameworks that channel substantial financial resources toward livestock sector enhancement. The Agricultural Development Fund serves as the principal mechanism for providing accessible financing to producers pursuing capacity expansion, technology adoption, and operational improvements. In 2025, the Ministry of Environment, Water and Agriculture (MEWA) has finalized 29 agreements in the poultry sector, with overall investments reaching SAR 5 billion. The initiative seeks to enhance national supply chains and promote the growth and advancement of the poultry sector by incorporating advanced technologies and innovations throughout production, manufacturing, and marketing. Regulatory reforms are reducing bureaucratic impediments while maintaining quality and safety standards that protect consumer interests and enable market access for compliant producers. Import subsidy programs covering livestock feed ingredients help moderate input costs that might otherwise constrain profitability margins across the livestock value chain.

Poultry Sector Expansion Toward Self-Sufficiency Targets

Government ambitions to achieve poultry self-sufficiency by 2025 have catalyzed unprecedented investment in domestic production infrastructure and capabilities across the value chain. Major integrated producers are executing expansion strategies that will substantially increase processing capacity over the forecast horizon, with some companies targeting production volume increases exceeding 80 percent relative to current levels. Vertical integration enables large operators to capture margins across multiple value chain stages while ensuring supply chain coordination that optimizes efficiency and quality control. Genetic improvements continue enhancing bird performance characteristics including growth rates and feed conversion efficiency, translating into productivity gains that strengthen economic competitiveness. Modern production facilities incorporate climate control systems and automated feeding equipment that enable year-round operations maintaining consistent output volumes. IMARC Group predicts that the Saudi Arabia poultry market is projected to attain USD 26.6 Billion by 2033.

Market Restraints:

What Challenges the Saudi Arabia Animal Feed Market is Facing?

High Costs of Raw Materials and Import Dependency

The Kingdom's reliance on imported feed ingredients exposes producers to global commodity price volatility that periodically creates significant cost pressures affecting profitability margins throughout the livestock value chain. Corn prices are increasing, reflecting supply chain disruptions and agricultural market dynamics in exporting regions. Import tariffs on key feed ingredients add incremental costs that compound the challenges facing local feed manufacturers attempting to maintain competitive pricing structures. A major percentage of feed ingredients are imported, creating vulnerability to international market conditions beyond domestic industry control or influence. Exchange rate fluctuations between the Saudi riyal and currencies of major agricultural exporters introduce additional financial risks that complicate procurement planning and pricing strategies.

Volatility in Feed Ingredient Availability

Global supply chain disruptions periodically constrain ingredient availability, creating temporary shortages that force manufacturers to reformulate products or accept premium pricing to maintain production schedules. Geopolitical tensions in agricultural exporting regions can restrict supply flows, introducing uncertainty that complicates production planning and inventory management. Domestic agricultural limitations including scarce arable land and water resources preclude significant local feed ingredient production, necessitating continued import dependence. Climate events in major grain-producing regions create harvest variability that affects global commodity markets, with supply disruptions cascading through international trade channels to impact Saudi Arabia's feed ingredient procurement. Transportation logistics including shipping capacity constraints and port congestion episodes contribute to supply chain unpredictability that affects ingredient flow continuity.

Geopolitical Tensions and Supply Chain Disruptions

Regional conflicts including those affecting Red Sea shipping routes have demonstrated the vulnerability of international trade corridors essential for ingredient imports. Political instability in neighboring territories periodically disrupts logistics networks, introducing delays and additional costs associated with alternative routing arrangements. Trade policy changes in exporting nations can alter market access conditions, requiring Saudi importers to develop new supplier relationships and navigate unfamiliar regulatory frameworks. Sanctions regimes affecting certain regions constrain sourcing flexibility, potentially forcing procurement from higher-cost alternative suppliers. The complex international environment requires feed manufacturers to maintain sophisticated risk management capabilities encompassing geopolitical analysis, alternative sourcing strategies, and financial hedging mechanisms that add operational complexity and overhead costs.

Competitive Landscape:

The Saudi Arabia animal feed market features a concentrated competitive structure dominated by several large-scale integrated producers possessing extensive manufacturing capabilities and established distribution networks spanning the Kingdom. Major domestic companies leverage vertical integration strategies that provide advantages in supply chain coordination and cost management while enabling responsive adjustments to market conditions. International corporations maintain significant market presence through direct operations, joint ventures, and technology licensing arrangements that facilitate knowledge transfer and capability development. Competition centers on product quality, nutritional performance, technical service capabilities, and pricing competitiveness, with leading firms investing heavily in research and development to maintain technological advantages. Strategic partnerships between feed manufacturers and livestock producers create long-term relationships that stabilize demand patterns while enabling collaborative innovation in feeding programs tailored to specific operational requirements across poultry, dairy, and ruminant segments.

Recent Developments:

-

In November 2025, Thailand has made a historic breakthrough by exporting its inaugural shipment of pelletized cassava to Saudi Arabia, representing a significant achievement for the nation's agricultural exports. A shipment of 20,000 tons of Hard Pellets has arrived at the Dammam port in Saudi Arabia, after a business delegation's trip to the area in May 2025. This action signifies Thailand's entry into the Middle Eastern animal feed sector, creating a fresh opportunity for cassava exports.

-

In April 2025, The international technology company ANDRITZ has secured a contract from Alwadi Poultry Farms Company, located in Riyadh, Saudi Arabia, to provide a comprehensive, high-capacity feed mill for manufacturing poultry and ruminant feed. The new feed facility will be situated in Riyadh Province and is expected to commence operations in the first half of 2026. Built for an overall capacity of 90 tons per hour (TPH), the facility will feature two production lines for poultry feed (60 TPH) and one line for ruminant feed (30 TPH).

Saudi Arabia Animal Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Pellets, Crumbles, Mash, Others |

| Animal Types Covered |

|

| Ingredients Covered |

|

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Saudi Arabia animal feed market size was valued at USD 6.86 Billion in 2025.

The Saudi Arabia animal feed market is expected to grow at a compound annual growth rate of 5.11% from 2026-2034 to reach USD 10.80 Billion by 2034.

Pellets held the largest market share of 53.12%, driven by superior feed efficiency, reduced wastage, enhanced palatability, and improved handling characteristics. The pelleting process delivers operational advantages including reduced selective feeding behaviors, improved nutrient digestibility, and extended shelf life. Manufacturing infrastructure investments have enabled large-scale pellet production maintaining consistent quality specifications that optimize animal performance across diverse livestock operations.

Key factors driving the Saudi Arabia animal feed market include rising meat and dairy consumption fueled by population growth and increasing affluence, with poultry consumption increasing rapidly. Government support through the Agricultural Development Fund with investments totaling billions in livestock sector development, combined with poultry sector expansion targeting self-sufficiency by 2025, are accelerating market growth.

Major challenges include high costs of imported raw materials with corn prices increasing, alongside over a major percent import dependency for feed ingredients. Volatility in ingredient availability due to global supply chain disruptions and geopolitical tensions affecting trade routes create operational uncertainties that complicate procurement planning and increase production costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)