Satellite Antenna Market Size, Share, Trends, and Forecast by Frequency Band, Technology, Antenna Type, Platform, and Region, 2026-2034

Satellite Antenna Market Size and Share:

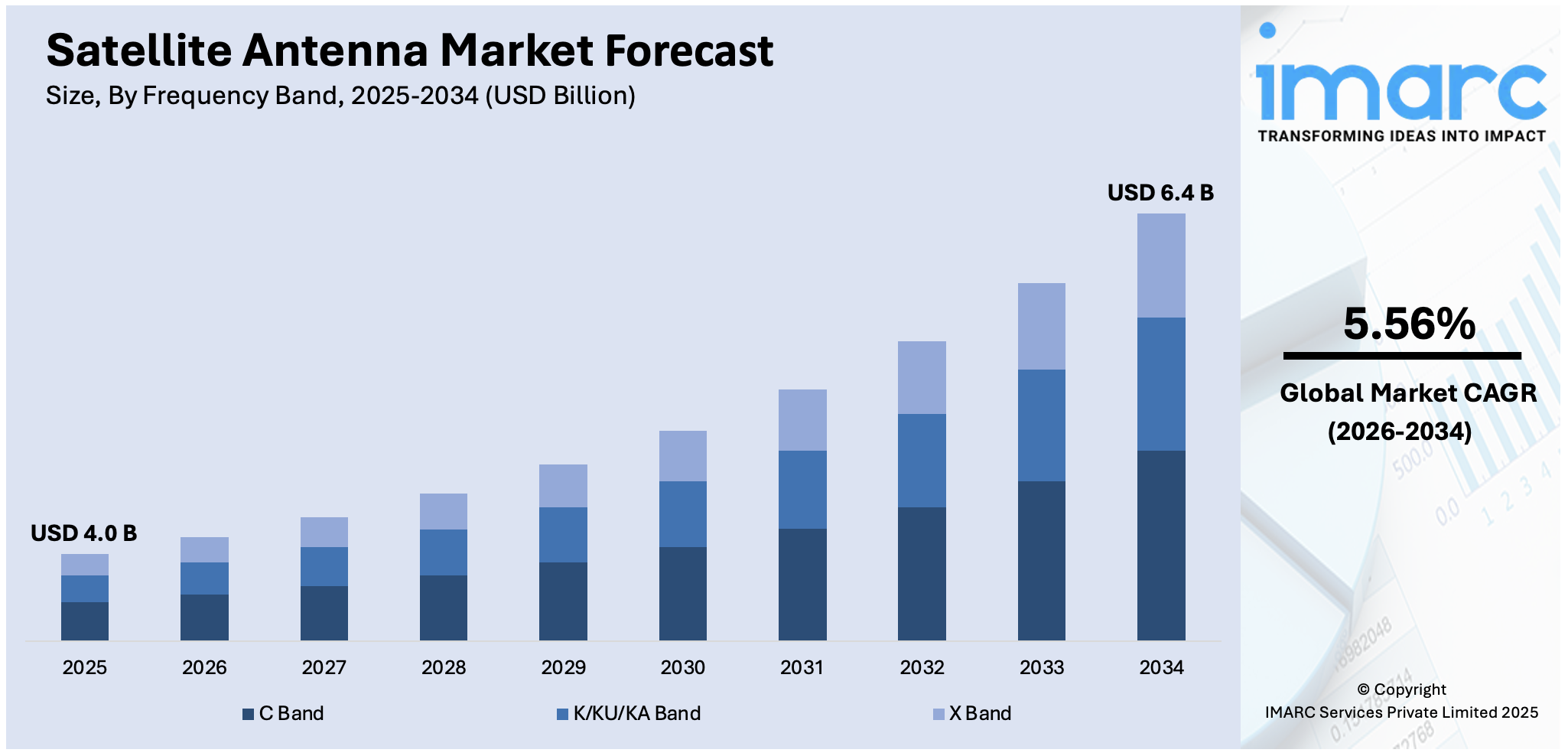

The global satellite antenna market size was valued at USD 4.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2034, exhibiting a CAGR of 5.56% during 2026-2034. North America currently dominates the market, holding a significant market share of over 39.9% in 2025. The growing demand for satellite-based communication systems, increasing space exploration missions and satellite launches, the widespread adoption of electronically steered phased array antennas, and expanding use of satellites in military and defense applications, are some of the factors escalating the market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.0 Billion |

|

Market Forecast in 2034

|

USD 6.4 Billion |

| Market Growth Rate (2026-2034) | 5.56% |

The satellite antenna market is driven by the rising demand for high-speed connectivity, increasing satellite deployments for communications, navigation and Earth observation and growing adoption in defense and aerospace applications. For instance, in January 2025, Hisdesat announced the launch of the SpainSat Next Generation I satellite aboard a SpaceX Falcon 9 rocket. This satellite is equipped with advanced antenna technology designed for secure communications. Supported by the European Space Agency (ESA) the SpainSat Next Generation I will enhance data transmission and allow for real-time coverage adjustments ensuring reliable communication services for governments and emergency teams across Europe and beyond. Expanding broadband services, 5G integration and advancements in phased-array and electronically steered antennas further accelerate satellite antenna market growth. The surge in low Earth orbit (LEO) satellite constellations, government investments in space programs and increasing commercial satellite launches enhance antenna demand. Emerging IoT and maritime applications contribute to the market's growth.

To get more information on this market Request Sample

The demand for high-speed broadband, the growing military and defense applications and increased investment in space exploration drive the United States satellite antenna market. Low Earth orbit (LEO) constellations with backing from companies like SpaceX and Amazon's Kuiper fuel antenna demand. Integration of 5G networks, IoT and autonomous systems accelerate adoption. Government initiatives such as NASA and DoD satellite programs and increasing demand for advanced phased-array and electronically steered antennas are driving the market expansion. For instance, in September 2024, the U.S. Space Force announce its plans to enhance its aging Satellite Control Network by developing a “commercial antenna marketplace.” The program intends for modernization efforts and leveraging commercial capabilities to address increasing demands.

Satellite Antenna Market Trends:

Rising Demand from Telecommunications and Space Industries

The market is primarily driven by the increasing adoption of advanced technologies in telecommunications and space industries. According to the Index of Objects Launched into Outer Space from the United Nations Office for Outer Space Affairs, there are currently 8,261 satellites orbiting Earth. This represents an increase of 11.84% since April 2021. Such growth emphasizes the increasing proliferation of satellite launches, especially of small satellites, that have become highly indispensable in responding to the escalating demand for satellite communication systems. The rise in space exploration missions and the proliferation of small satellites are contributing substantially to the demand for satellite communication systems. Rising investments from both government and private sectors are further supporting this trend. Additionally, the growing need for satellite-aided warfare systems, used for navigation, surveillance, and communication, is propelling satellite antenna market demand. These developments highlight the reliance of both industries on innovative satellite systems and communication technologies, enabling enhanced operational efficiency and creating a favorable satellite antenna market forecast.

Increasing Adoption of Phased Array and Smart Antennas

As per the satellite antenna market analysis, the widespread adoption of electronically steered phased antennas (ESPA) is significantly propelling industry growth, particularly due to the increasing need for communication on the move (COTM) solutions for commercial vehicles, trains, and boats. These antennas enable continuous connectivity in mobile environments, making them essential for modern transportation. The European Investment Bank (EIB) has reported that the European Union currently operates 33 satellites. Additionally, over the next 10 to 15 years, more than 30 launches are scheduled, positioning the EU as the largest institutional client for launch services in Europe. The introduction of phased array antennas, known for their high efficiency, low-drag design, and bird strike compliance, is also enhancing performance, further expanding their presence satellite antenna market share. Additionally, smart antennas, which minimize signal fading and improve power control for more reliable wireless communication, are contributing to the growing demand for advanced antenna systems in various sectors.

Advancements in Satellite Applications and Technology

The expanding use of satellites for remote sensing, earth observation, space research, weather forecasting, and climate monitoring, all of which are significantly influencing market growth, is one of the major satellite antenna market trends. These applications enable vital data collection for various industries, improving environmental monitoring and scientific research. The World Economic Forum projects that the space economy will reach USD 1.8 trillion by 2035. In 2023, it stood at USD 630 billion and is growing at an average annual rate of 9%. The increasing demand for wireless and mobile communications is also boosting satellite deployment as connectivity becomes essential worldwide. Additionally, the adoption of reusable rocket technology and cost-efficient off-the-shelf CubeSats is lowering launch costs and making satellite deployment more accessible. Ongoing research and development (R&D) efforts in satellite miniaturization are also allowing for more affordable, efficient, and frequent satellite launches, thus fostering long-term satellite antenna market growth.

Satellite Antenna Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global satellite antenna market report, along with forecasts at the global, regional and country level from 2026-2034. Our report has categorized the market based on frequency band, technology, antenna type, and platform.

Analysis by Frequency Band:

- C Band

- K/KU/KA Band

- X Band

C-band is the leads the satellite antenna market because of its balance of wide coverage, high reliability and resistance to rain fade making it ideal for broadcasting telecommunications and military applications. Its frequency range of 4-8 GHz enables stable connectivity for satellite TV, maritime communications and air traffic control. The growing demand for HTS and 5G backhaul further boosts adoption. Despite spectrum reallocation for 5G in some regions C-band remains dominant in key markets due to its efficiency in long-distance signal transmission.

Analysis by Technology:

- SOTM

- SOTP

Satellite-on-the-Move leads the market with its critical applications in defense, maritime and commercial mobility, allowing for the seamless communication of military vehicles, aircraft and ships including real-time data transfer in harsh and remote environments. The increase in demand for high-speed broadband in transportation-including connected aircraft and autonomous vehicles-is driving its adoption. Technological advancement in ESA and phased-array systems enhances the reliability and performance of SOTM thus establishing its dominance in the satellite antenna market.

Analysis by Antenna Type:

- Flat Panel Antenna

- Parabolic Reflector Antenna

- Horn Antenna

Parabolic reflector antennas dominate the satellite antenna market because of high gain, directional precision and efficiency in signal transmission and reception over long distances. It has been extensively used in broadcasting, telecommunications and deep-space communication for its superiority in signal strength and interference level. Their market dominance is supported by growing demands for high-bandwidth applications, satellite internet and Earth observation. The latest improvements in adaptive optics and tracking mechanisms enhance their performance and hence they maintain leadership in commercial, military and scientific satellite communications.

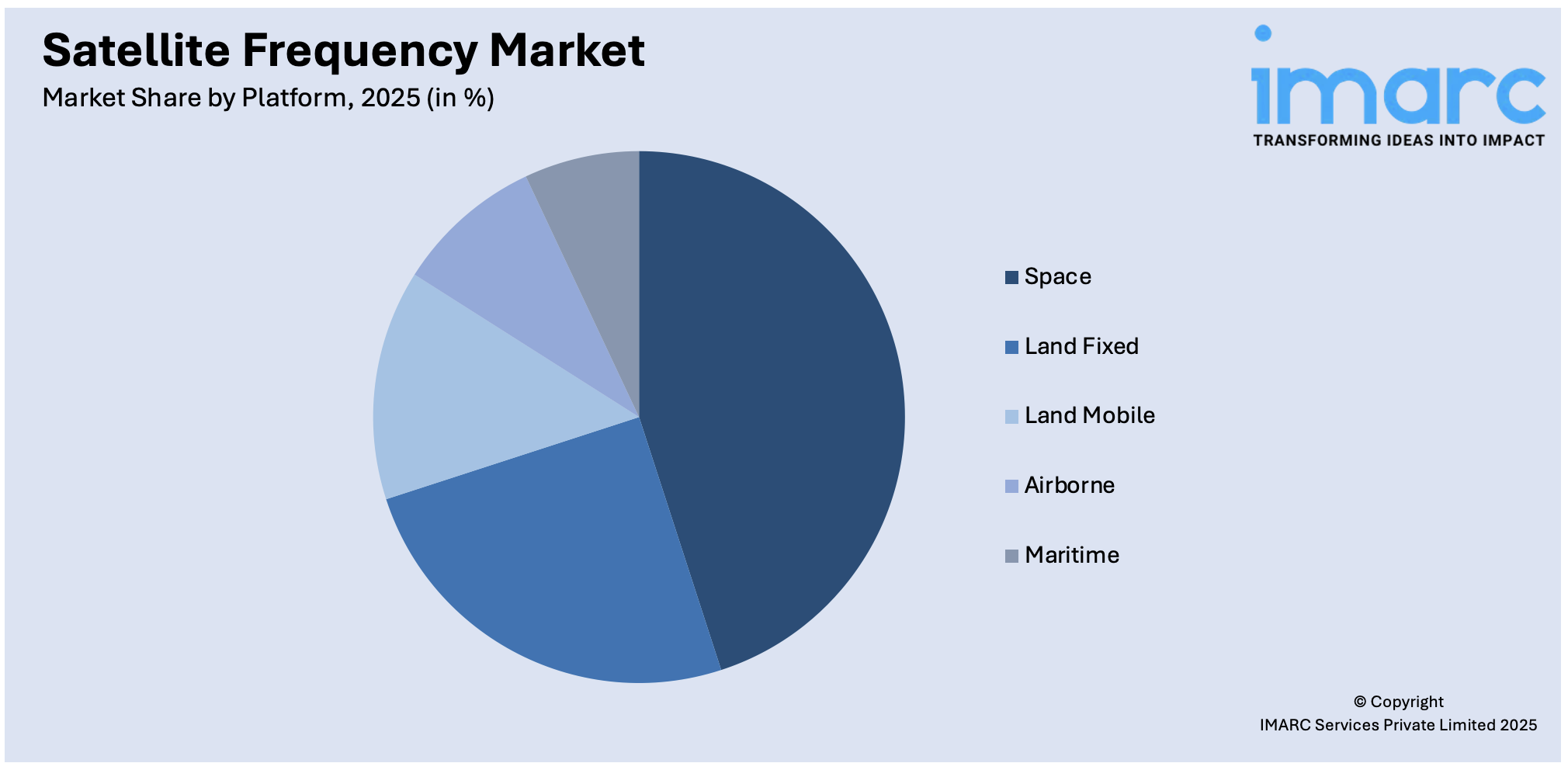

Analysis by Platform:

Access the comprehensive market breakdown Request Sample

- Land Fixed

- Land Mobile

- Airborne

- Maritime

- Space

Space leads the market with around 38.2% of market share in 2025. The space segment is leading the satellite antenna market due to increased satellite deployments for communications, Earth observation, defense and scientific missions. Increasing investments in low Earth orbit (LEO) constellations, geostationary (GEO) satellites and inter-satellite communication drive demand for high-performance antennas. Advanced technologies such as phased-array, electronically steered and deployable reflector antennas enhance efficiency. The initiatives of government and private sectors such as SpaceX, OneWeb and national space agencies add more strength to the dominance of space-based antennas in global connectivity and data transmission applications.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest satellite antenna market share of over 39.9%. North America accounts for the largest market share of the satellite antenna market because of high government and private sector investment in space technology, defense communications and satellite broadband. Innovations from the presence of SpaceX, Lockheed Martin and Northrop Grumman add a competitive edge to the market. Increasing LEO constellations, 5G backhaul integration and military-grade satellite communication systems' increasing demand make the market more robust. Agencies like NASA and the U.S. Department of Defense also contributes significantly through satellite-based intelligence, surveillance and secure communication initiatives.

Key Regional Takeaways:

United States Satellite Antenna Market Analysis

The rapid growth of orbital infrastructure is a significant driver for the United States satellite antenna market. As of January 2022, the Union of Concerned Scientists reported that there are 4,852 active artificial satellites orbiting the Earth, with the United States responsible for operating 2,944 of them. This dominance underscores the country's pivotal role in advancing satellite technology to support critical applications such as global defense, communications, navigation, and scientific research.

Increasing the use of satellites for military purposes, such as secure communication and surveillance, fuels demand for high-performance satellite antennas. Moreover, growth in commercial satellite services, such as broadband internet and remote sensing, is also increasing the market growth. New technologies such as phased array antennas and flat-panel designs are becoming popular to improve connectivity, enhance signal strength, and reduce size and weight. With strong government funding for space through initiatives and private sector investments in satellite constellations, these factors spur the advancement of the United States satellite antenna market.

Europe Satellite Antenna Market Analysis

Government investments in space exploration and innovation are significant growth drivers for the Europe satellite antenna market. During the European Space Agency (ESA) Council of Ministers meeting in November, an impressive financial commitment of €1.84 billion (approximately $1.91 billion) was revealed to support important space initiatives. This investment includes backing for the UK-developed Rosalind Franklin Mars Rover which is slated for a launch to Mars in 2028 as indicated by gov.uk.

Such investments reflect Europe's commitment to enhancing its space capabilities, driving demand for satellite antennas to support scientific and commercial missions. Deep space exploration, earth observation, and satellite-based communication create a compelling need for developing high-end antenna technologies. With private sector initiatives gaining momentum in addition to collaborative ESA projects, the adoption of next-generation satellite antennas is speeding up. These developments focus on increasing connectivity, improving data transfer, and answering the needs of new industries such as defense, telecommunications, and climate monitoring, to name a few, making Europe a forerunner in the satellite industry.

Asia Pacific Satellite Antenna Market Analysis

The Asia-Pacific satellite antenna market is growing rapidly, and this can be traced to regional investments in advanced space and defense technologies. Industry sources claim that China aims to become a space superpower by 2045, and this ambition has begun to fuel its construction of satellite infrastructure, including advanced satellite antennas for both military and commercial purposes. In 2022, Japan's government authorized defense expenditures totaling JPY 5.4 trillion (approximately USD 47.2 billion), highlighting the country's commitment to bolstering satellite communication capabilities for national security. This includes investments in satellite networks aimed at supporting military operations and ensuring secure communications.

South Korea has also committed KRW 266.4 Billion (USD 220 Million) for stealth drones and military assets, which is another example of the region investing in space-based technology, as per reports. The growth of defence, telecommunications, and satellite internet will drive a higher need for high-performance satellite antennas, and investments in space exploration and defense create further technological needs, meaning sophisticated solutions for antennas throughout the Asia-Pacific region are increasing as well.

Latin America Satellite Antenna Market Analysis

Investment in space programs is rising across Latin America. Brazil leads the way, dedicating USD 47 million annually to its space initiatives, followed closely by Argentina with USD 45 million and Mexico at USD 8.34 million, as reported by Air University. These financial investments reflect a growing interest in space exploration, satellite communication, and technological advancement in the region.

Advanced satellite antennas are in high demand due to the investments of countries in satellite infrastructure for national security, telecommunications, and scientific research. Brazil, as the largest investor in space within the region, is focusing on satellite communication systems to support its growing defense and commercial sectors. Argentina and Mexico are also enhancing their satellite capabilities and promoting the development of reliable and high-performance antenna technologies. Latin America's satellite antenna market will witness growth due to the increase in funds allocated for space exploration, climate monitoring, and connectivity services. There is still going to be an increasing need for advanced solutions for both governmental and private activities.

Middle East and Africa Satellite Antenna Market Analysis

The Middle East and Africa satellite antenna market is likely to witness significant growth as the region focuses on strategic investments in space sector advancement. For example, the UAE Space Agency has established a National Space Fund amounting to AED 3 billion (USD 0.82 billion) to promote innovation in space engineering, science, and research applications. The purpose of this fund is to assist the international and Emirati companies that cooperate with each other in space technologies, thereby boosting the demand for satellite communication systems and advanced antenna solutions.

Countries across the Middle East and Africa, developing their space programs, with applications in satellite communications for defense, telecommunications, and scientific exploration, increase the need for high-performance satellite antennas. The development of cutting-edge antenna technologies is influenced by the fact that the UAE is at the forefront of space initiatives, investing heavily in breakthrough programs. Other countries in the region are emulating the same model, considering that space infrastructure will play a crucial role in national security, economic growth, and global competitiveness. These trends will continue to drive demand for satellite antennas in the Middle East and Africa.

Competitive Landscape:

The report provides a comprehensive analysis of the competitive landscape in the satellite antenna market with detailed profiles of all major companies, including:

- C-COM Satellite Systems Inc

- Cobham Satcom

- General Dynamics Mission Systems, Inc.

- Gilat Satellite Networks

- Honeywell International Inc.

- Hughes Network Systems, LLC

- Kymeta Corporation

- L3Harris Technologies, Inc.

- Norsat International Inc.

- Viasat Inc.

Latest News and Developments:

- September 2024: SWISSto12, an innovator in next-generation payload technology for radio frequencies, has awarded a contract to MDA Space, a space technology company based in Ontario, for antenna systems. Under this agreement, MDA Space will provide antenna systems for three HummingSat satellites set to operate in geostationary orbit (GEO), which will be launched as part of SWISSto12's Inmarsat-8 program.

- July 2024: Cobham SATCOM introduced its latest flagship product, the Sea Tel TVRO antenna, aimed at improving connectivity for maritime vessels. This advanced antenna features state-of-the-art technology designed to significantly enhance communication capabilities for ships operating at sea. This development marks a major advance in maritime satellite communication systems.

- February 2023: BeetleSat, a global leader in satellite communication technology and formerly known as NSLComm, announced the successful deployment of their innovative lightweight and expandable antenna into space. This in-orbit launch represents a key milestone for the company, confirming the practical applications of its unique technology.

Satellite Antenna Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Frequency Bands Covered | C Band, K/KU/KA Band, X Band |

| Technologies Covered | SOTM, SOTP |

| Antenna Types Covered | Flat Panel Antenna, Parabolic Reflector Antenna, Horn Antenna |

| Platforms Covered | Land Fixed, Land Mobile, Airborne, Maritime, Space |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | C-COM Satellite Systems Inc, Cobham Satcom, General Dynamics Mission Systems, Inc., Gilat Satellite Networks, Honeywell International Inc., Hughes Network Systems, LLC, Kymeta Corporation, L3Harris Technologies, Inc., Norsat International Inc., Viasat Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the satellite antenna market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global satellite antenna market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the satellite antenna industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The satellite antenna market size reached USD 4.0 Billion in 2025.

IMARC estimates the satellite antenna market to reach USD 6.4 Billion by 2034, exhibiting a CAGR of 5.56% during 2026-2034.

Growth is fueled by rising demand for high-speed broadband, expanding LEO and GEO satellite constellations, increasing military and defense applications, adoption of electronically steered phased-array antennas, and advancements in telecommunications and space exploration.

North America dominates the market, accounting for over 39.9% in 2025, driven by strong space investments, military communication demand, and private sector innovations from companies like SpaceX, Lockheed Martin, and Northrop Grumman. In addition to this, extensive research and development (R&D) activities and significant technological advancements are creating a positive satellite antenna market outlook.

Some of the major players in the satellite antenna market include C-COM Satellite Systems Inc, Cobham Satcom, General Dynamics Mission Systems, Inc., Gilat Satellite Networks, Honeywell International Inc., Hughes Network Systems, LLC, Kymeta Corporation, L3Harris Technologies, Inc., Norsat International Inc., Viasat Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)