Sanitary Napkin Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Sanitary Napkin Market Size and Share:

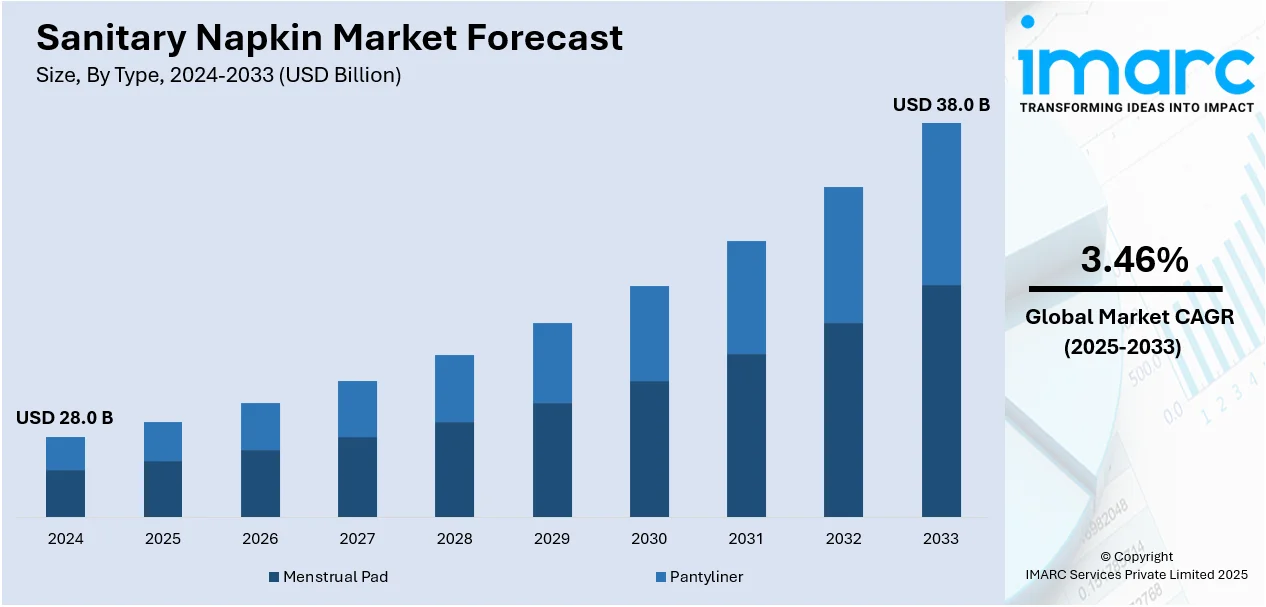

The global sanitary napkin market size reached USD 28.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 38.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.46% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 64.3% in 2024. The increasing awareness about menstrual health and hygiene, expanding female population, inflating disposable income of consumers, ongoing technological advancements in product design, and growing proliferation of various distribution channels are some of the key factors influencing the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.0 Billion |

| Market Forecast in 2033 | USD 38.0 Billion |

| Market Growth Rate 2025-2033 | 3.46% |

The global sanitary napkin market is rapidly expanding due to increasing awareness about menstrual hygiene and the availability of diverse products catering to various needs. Rising disposable income, particularly in developing regions, is enabling more women to access quality menstrual products. Government initiatives and non-governmental efforts to promote menstrual health and provide free or subsidized sanitary napkins are further boosting demand. Additionally, the growth of e-commerce platforms has made sanitary napkins more accessible, even in remote areas. According to the IMARC Group, the global e-commerce market size reached USD 26.8 Trillion in 2024 and is projected to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. Besides this, innovations in materials, such as biodegradable and organic pads, are appealing to eco-conscious consumers, supporting industry growth.

The United States has emerged as a key regional market for sanitary napkins, driven by the increasing awareness about menstrual health and rising adoption of premium, high-quality products. The influence of social media and marketing campaigns is fostering discussions around menstrual hygiene, reducing stigma, and boosting demand. Retailers and e-commerce platforms also offer convenient access to a wide range of products, appealing to diverse consumer preferences. As per a report published by the IMARC Group, the United States e-commerce market is forecasted to reach USD 2,083.97 Billion by 2032, exhibiting a CAGR of 6.80% during 2024-2032. Other than this, supportive policies and initiatives focused on menstrual equity further contribute to industry expansion by improving accessibility for underserved communities.

Sanitary Napkin Market Trends:

Changing societal dynamics

One of the primary factors driving the global sanitary napkin market is the evolving societal dynamics, particularly in terms of women's health and hygiene. The significant shift in societal attitudes toward women's health and well-being, leading to increased awareness about menstrual hygiene due to education, empowerment, and advocacy for women's rights, is propelling market growth. World Bank data indicates that the global labor force participation rate for women exceeds 50%, while it stands at 80% for men. As more women gain access to education and employment opportunities, there is a growing awareness about the importance of menstrual hygiene. This awareness has translated into an increased demand for sanitary napkins as a convenient and effective solution for managing menstrual hygiene. Additionally, cultural taboos surrounding menstruation are gradually breaking down, contributing to a more open discussion about menstrual health and hygiene practices.

Technological advancements in product innovation

The sanitary napkin market is experiencing important technological developments, particularly in product innovation and design. There is continuous investment by manufacturers in research and development (R&D), introducing new and better sanitary napkin products and aiming to solve problems concerning comfort, absorbency, and discretion, which supports growth in the market. In tandem with this is the growing use of high-value materials, including superabsorbent polymers, to increase absorption and reduce leakage even more. In addition, the introduction of thinner and more discreet products has become popular among consumers, providing a higher level of comfort and convenience. It is estimated that a woman who menstruates and does not experience excessive menstrual flow uses up to 10,000 pads throughout her life. It, therefore, becomes imperative to continuously innovate the materials to be used in creating sanitary pads to reduce environmental impact.

Rising focus on sustainability

The rising concerns about sustainability are significantly influencing the growth of the sanitary napkin market, with consumers growing more aware of the implications of their purchases on the environment. The growth-inducing factors are rising demand and preference for the use of non-biodegradable materials and eco-friendly and sustainable menstrual hygiene products. In line with this, there are many manufacturers exploring sustainable alternatives for sanitary napkin production by using organic and biodegradable material, thereby setting a positive industry outlook. Besides this, the growing demand for sanitary napkins that are reusable and can be washed is promoting growth in the market as more consumers seek products that align with their environmental values. According to a research paper by Springer, women generate about 125 kg of menstrual waste while menstruating, using 6–8 sanitary napkins every cycle. This has caused an increase in the usage of biodegradable sanitary napkins.

Regional demographics and economic factors

The demand for sanitary napkins is also being propelled by regional demographics and economic factors. In developing regions with a large population and increasing disposable income, there is a rising demand for affordable and accessible menstrual hygiene products. For instance, in India, affordability has been a major concern in numerous regions. In order to address the problem, the government is offering subsidized sanitary pads nationwide. According to Health Ministry data, the PMBJP's Jan Aushadhi Suvidha Sanitary Napkins program sold over 47.87 crore subsidized pads. As more women in these regions become economically empowered, they are prioritizing their health and well-being, contributing to the growth of the sanitary napkin market. Moreover, favorable government initiatives and awareness campaigns in developing countries are promoting menstrual hygiene education and making sanitary napkins more affordable and accessible, further facilitating industry expansion.

Sanitary Napkin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on type and distribution channel.

Analysis by Type:

- Menstrual Pad

- Pantyliner

Menstrual pad represents the leading market segment, with around 79.8% of market share in 2024. This dominance is largely due to their accessibility to a large population, cost-effectiveness, and convenience. Disposable products are a mass-market favorite, particularly in developing countries where individuals resist using reusable products for personal hygiene. These pads are designed to meet diverse requirements, including different sizes, absorbency levels, and features such as wings to provide comfort and prevent leakage. Aggressive marketing by top brands has increased its visibility and acceptance. Moreover, increasing female workforce and rising awareness about menstrual hygiene also boost demand, making it the preferred product in the sanitary napkin market.

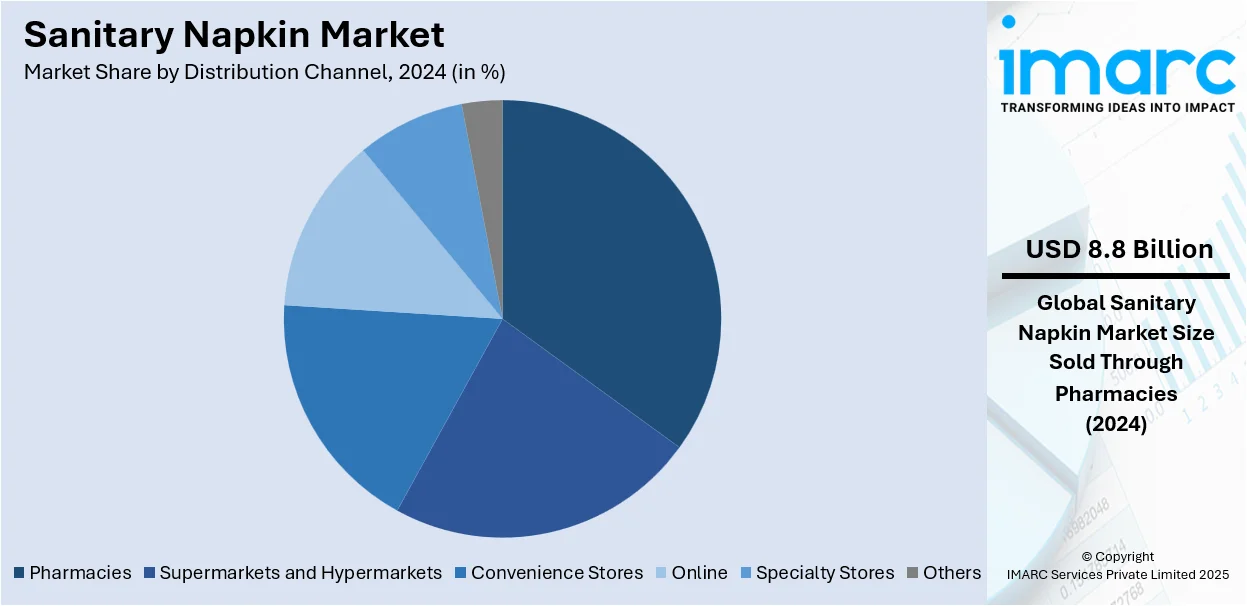

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Specialty Stores

- Others

Pharmacies lead the market with around 31.5% of market share in 2024. The rising demand for sanitary napkins through pharmacies is mainly backed by growing awareness and accessibility of menstrual hygiene products in healthcare settings. Pharmacies are trusted outlets where consumers can get reliable information about different sanitary napkin options, including those addressing specific health needs. In this regard, the convenience of buying menstrual hygiene products along with other health-related items contributes to the growth in demand for sanitary napkins through pharmacies, offering a one-stop solution for the health and wellness needs of women.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 64.3%. In this region, the large and growing population of women, increasing awareness about menstrual hygiene, and rising disposable incomes are positively driving the sanitary napkin market. Along with this, significant cultural shifts, favorable government initiatives, and educational campaigns in numerous Asian countries are breaking down taboos surrounding menstruation and fostering market growth. Moreover, as more women join the workforce and urbanize, the demand for convenient and reliable menstrual hygiene products such as sanitary napkins is rising, facilitating industry expansion.

Key Regional Takeaways:

United States Sanitary Napkin Market Analysis

Factors driving the United States sanitary napkin market are increasing demand for eco-friendly products and more awareness about hygiene during menstruation. Industry data reflects that in 2020, there were 57.43 Million women in the United States who used sanitary pads and napkins. According to the US Department of Health and Human Services, within the age range 35-44, 52% women use sanitary napkins than 47% who reported using tampons. In the age group 25-34, 52% were said to have used sanitary napkins. Another impetus to market growth is increased attention toward health and personal hygiene, with greater awareness about the materials used in menstruation products. Besides this, with rising awareness about the environment, organic cotton or biodegradable material-based sanitary napkins are gaining popularity. The growth through the direct-to-consumer e-commerce platform is also visible here as wide ranges of commodity, high-end, or natural brands are available readily through it. The rise of younger generations also using sanitary napkins and their attraction toward comfort and convenience also drive the demand for creative, absorbent, and skin-friendly solutions.

Europe Sanitary Napkin Market Analysis

The sanitary napkins market in Europe is expanding due to increasing environmental sustainability and hygiene awareness, along with an ongoing trend of health-conscious consumption. Consumers are demanding organic cotton sanitary napkins, as they prefer chemical-free and synthetic-free commodities. Eco-friendly, biodegradable, and organic products are being demanded increasingly in Germany, France, and UK. Improvement in menstrual hygiene through government programs, along with initiatives providing sanitary napkins to the deprived, also boosts the growth of the market. Product innovation is also increasing. This includes reusable sanitary napkins and products with sophisticated absorbency technology. In addition to this, Internet sales have transformed the way sanitary napkins are being purchased, particularly from high-end and organic brands. 75% of internet users in Europe between the ages 16 to 74 years made some form of purchase online in the year 2023 as reported by the European Council of the European Union statistics. Europe also has strict consumer products standards for its items, including sanitary pads.

Asia Pacific Sanitary Napkin Market Analysis

The Asia Pacific sanitary napkin market is growing rapidly due to urbanization, increased disposable incomes, and enhanced awareness about menstrual hygiene. Sanitary pad demand is primarily influenced by the increased middle-class population and improvement in health information accessibility among residents of countries such as China and India. According to the latest government data, the use of sanitary pads in India is slowly growing among the population aged 15-24. For instance, in Bihar, 58.8% of women and girls in this age group used such items, a nearly 90% increase in just four years. Its usage increased from 67.5% in 2015-16 to 85.1% in Andhra Pradesh. Similarly, this trend has been observed in most Indian states. Rural women, with increasing awareness about the health of menstruation, are increasingly using sanitary napkins more frequently. Moreover, due to the availability of easy-to-use and affordable goods such as single-use and biodegradable options, the market has expanded. Besides this, more buyers are prioritizing sustainability in a purchase, propelling the demand for organic and environment-friendly items, particularly in urban areas.

Latin America Sanitary Napkin Market Analysis

Latin America sanitary napkins market continues to be driven forward mainly by improvements in the availability of products, growth of middle-class populations, and increased recognition of menstrual hygiene. The sanitary napkins market also shows strong dominance in Brazil, Mexico, and Argentina, where growing disposable incomes allow most women to purchase sanitary napkins. Other factors driving the demand are social programs that promote access to reasonably priced sanitary products and education on menstrual hygiene. After Colombia abolished the tax on pads in 2018, the movement, Menstruación Digna (Decent Period), in Mexico was finally able to do the same and eliminate the 16% VAT on sanitary products in 2021. The increasing demand for organic and biodegradable sanitary napkins is also opening a new avenue for the industry, as customers are showing more concern for the environment.

Middle East and Africa Sanitary Napkin Market Analysis

Rising awareness about menstruation hygiene and modern, easy-use hygienic products are driving the sanitary napkin market in the Middle East and Africa. Government initiatives with rising awareness about healthy menstrual health in countries such as South Africa and the United Arab Emirates are driving demand. According to UNICEF statistics, 6% of women in Niger used paper, 12% in Burkina Faso only used pants, and 11% in Ethiopia used nothing at all. This indicates that a significant part of the region's countries have no access to sanitary napkins. As a result, there is a lot of room for expansion in this market as many organizations are addressing the problem. The industry is also expanding as consumers need high-end, eco-friendly sanitary napkin solutions, including organic cotton and biodegradable products.

Competitive Landscape:

The global sanitary napkin market features a competitive landscape characterized by the presence of key players striving for market dominance through strategies such as product innovation, strategic partnerships, and geographical expansion. Established multinational companies maintain a significant market share, leveraging their brand recognition and extensive distribution networks. These industry leaders continually invest in research and development (R&D) to introduce advanced technologies and materials, enhancing product performance and meeting evolving consumer preferences. Additionally, the market is witnessing the emergence of smaller, niche players and local manufacturers who focus on specific market segments, offering innovative and sustainable alternatives to cater to diverse consumer needs.

The report provides a comprehensive analysis of the competitive landscape in the sanitary napkin market with detailed profiles of all major companies, including:

- Procter & Gamble

- Kimberly-Clark Corporation

- Hengan International Group Company Limited

- Edgewell Personal Care Company

- Kao Corporation

Latest News and Developments:

- October 2024: Sirona, a leading feminine hygiene brand, has been acquired by the Good Glamm Group for INR 450 crore (USD 52.99 Million). This acquisition supports Good Glamm's plan to expand its line of personal care products and maintain its market-leading position in the direct-to-consumer (D2C) market. The vast digital ecosystem and distribution skills of Good Glamm are anticipated to be advantageous to Sirona, a company renowned for its inventive goods, such as menstrual cups and other sustainable feminine hygiene solutions.

Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Units |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Menstrual Pad, Pantyliner |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online, Specialty Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Procter & Gamble, Kimberly-Clark Corporation, Hengan International Group Company Limited, Edgewell Personal Care Company, Kao Corporation etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sanitary napkin market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sanitary napkin market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sanitary napkin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A sanitary napkin is a disposable absorbent product designed to manage menstrual flow. It consists of layers of soft material with a moisture-proof backing to prevent leaks. Available in various sizes and absorbency levels, it is worn in underwear for comfort and hygiene. Sanitary napkins are widely used globally as a convenient and effective menstrual hygiene solution.

The global sanitary napkin market was valued at USD 28.0 Billion in 2024.

IMARC estimates the global sanitary napkin market to exhibit a CAGR of 3.46% during 2025-2033.

The increasing awareness about menstrual hygiene, growing female workforce participation, product innovations such as biodegradable and organic pads, government initiatives promoting menstrual health, and expanding retail and e-commerce distribution channels are the primary factors driving the global sanitary napkin market.

According to the report, menstrual pad represents the largest segment by type due to its convenience, affordability, and wide availability.

Pharmacies account for the leading market segment by distribution channel due to their accessibility, trusted reputation, and consistent availability of products.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Sanitary Napkin market include Procter & Gamble, Kimberly-Clark Corporation, Hengan International Group Company Limited, Edgewell Personal Care Company, Kao Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)