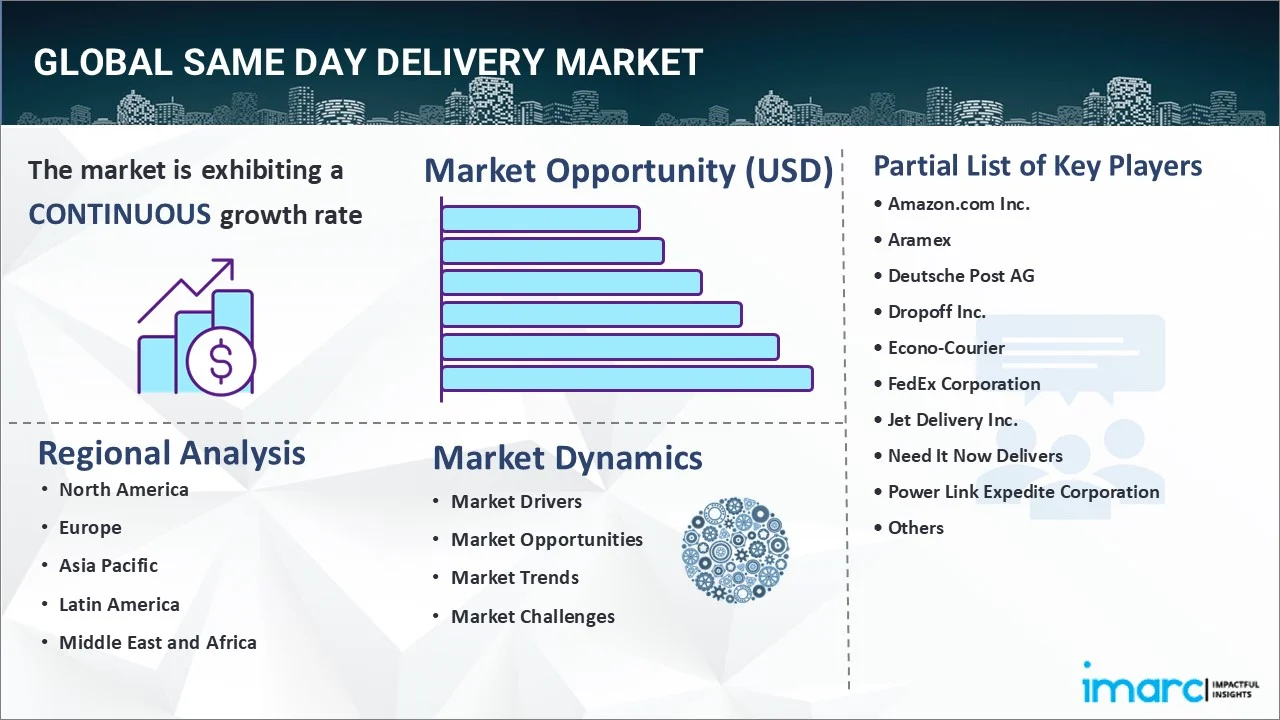

Same Day Delivery Market Report by Service (International Service, Domestic Service), Mode of Transportation (Airways, Roadways, Railways, Intermodal), Application (Retail, E-Commerce, Healthcare, Manufacturing, Documents and Letters, and Others), End User (Business to Business (B2B), Business to Customer (B2C), Customer to Customer (C2C)), and Region 2025-2033

Same Day Delivery Market Overview:

The global same day delivery market size reached USD 8.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.9 Billion by 2033, exhibiting a growth rate (CAGR) of 14.4% during 2025-2033. The market is experiencing robust growth driven by increasing user expectations, rising demand for enhanced convenience among individuals, rapid e-commerce growth and expansion, significant technological advancements in logistics and delivery, rapid urbanization and population density.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.3 Billion |

|

Market Forecast in 2033

|

USD 27.9 Billion |

| Market Growth Rate 2025-2033 | 14.4% |

Same Day Delivery Market Analysis:

- Major Market Drivers: One of the major market drivers include crowdsourced delivery models. In addition, innovations in delivery technologies contribute to the market growth.

- Key Market Trends: The increasing user expectations, rising demand for enhanced convenience, and the thriving e-commerce sector are some main trends in the market.

- Geographical Trends: As per the report, Asia Pacific exhibits a clear dominance, accounting for the biggest market share due to the rise in digital payments.

- Competitive Landscape: Various market players in the industry are Amazon.com Inc., Aramex, Deutsche Post AG, Dropoff Inc., Econo-Courier, FedEx Corporation, Jet Delivery Inc., Need It Now Delivers, Power Link Expedite Corporation, United Parcel Service Inc., USA Couriers Inc., XPO Logistics Inc., among many others.

- Challenges and Opportunities: High operational costs are a key market challenge. Nonetheless, customizable delivery services represent major same day delivery market recent opportunities.

Same Day Delivery Market Trends:

Rising Consumer Expectations and Demand for Convenience

On 26 March 2024, Amazon launched same-day prescription delivery in New York and Los Angeles for enhanced user satisfaction. The company plans to expand the offering to more than a dozen cities by the end of the year. To speed up deliveries, the company is using new and smaller facilities that are stocked with the most common prescription medications for acute conditions. The industry is expanding due to rising user expectations and the need for improved shopping ease. People are looking for delivery choices that are quick and easy, and same day delivery is becoming more common. The increasing number of e-commerce platforms that provide sophisticated delivery alternatives to individuals with busy lifestyles is strengthening the market growth. The ease of same day delivery is something that individuals are ready to pay more for, leading retailers to prioritize and invest in fulfilling these expectations to remain competitive in the market. As a result, retailers and e-commerce businesses are realizing how important it is to improve the user shopping experience to foster enhanced loyalty, thereby propelling the same day delivery market growth. They are investing in effective logistical infrastructure, streamlining operations using technology, and optimizing their supply chain procedures to meet these higher demands.

Rapid E-Commerce Growth and Expansion

On 14 July 2024, FedEx Corp. announced fdx, the first data-driven e-commerce platform that connects the entire customer journey, making it easier for companies to grow demand, increase conversion, optimize fulfillment, and streamline returns. FedEx is the only logistics company to connect the entire client journey by offering end-to-end e-commerce solutions for businesses of all sizes, all in one platform. The thriving e-commerce sector is a major factor driving same day delivery demand. As more individuals shift toward online shopping, retailers are under pressure to provide fast and reliable delivery options to remain competitive. The convenience of shopping online, coupled with the ability to receive purchases on the same day, accelerated the adoption of e-commerce platforms.

Technological Advancements in Logistics and Delivery

Faster, more dependable, and efficient same day delivery services are made possible by innovations in the logistics and delivery sectors. Delivery service companies can reduce delivery times and streamline operations with the use of automated warehouses, real time tracking systems, and route optimization algorithms. With the ability to track orders in real time and receive precise delivery updates, these developments help to improve visibility and transparency throughout the delivery process, thereby offering a positive same day delivery market outlook. On 15 November 2023, Dronamics announced a Letter of Intent (LOI) agreement for cargo drone flights leveraging Dronamics’ technology and Aramex’s fleet management capabilities. Dronamics, renowned for engineering and operating remotely piloted cargo aircraft, will supply its innovative drone technology to Aramex to enable same day, middle-mile, and long-range deliveries. This partnership, facilitated by the Strategic Development Fund (SDF) as a strategic investor in Dronamics, will see Aramex, known for setting the standard in express logistics and transportation, offer the innovative cargo drone solution developed and operated by Dronamics, at a larger scale.

Segmentation of the Market:

IMARC Group provides an analysis of the key same day delivery market trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service, mode of transportation, application, and end user.

Breakup by Service:

- International Service

- Domestic Service

Domestic service accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the service. This includes international service and domestic service. According to the report, domestic service represented the largest segment.

Delivery of parcels and items on the day of purchase inside the same nation or region is referred to as domestic service. The increasing need for quick and easy delivery choices among individuals and organizations is driving this market niche. To accommodate individuals who need their items delivered quickly, retailers, e-commerce sites, and logistics companies are providing same day domestic delivery services. These services are particularly popular for time-sensitive items such as groceries, pharmaceuticals, and consumer electronics.

Breakup by Mode of Transportation:

- Airways

- Roadways

- Railways

- Intermodal

Roadways hold the largest share of the same day delivery industry

A detailed breakup and analysis of the market based on the mode of transportation have also been provided in the report. This includes airways, roadways, railways, and intermodal. According to the report, roadways accounted for the largest market share.

For same day delivery, roadways continue to be the most popular option, especially for local and regional items. Road networks are traversed by delivery vans, lorries, and courier cars as they move products from distribution facilities to their final locations. This mode enables effective last-mile delivery to residential and commercial addresses by providing flexibility in scheduling and routes. Furthermore, e-commerce sites, retail establishments, supermarket chains, and courier services are using same day delivery via highways. Because of this, businesses in this industry frequently spend money on software for route optimization and fleet management in order to increase productivity and adhere to strict delivery deadlines.

Breakup by Application:

- Retail

- E-Commerce

- Healthcare

- Manufacturing

- Documents and Letters

- Others

Retail represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes retail, e-commerce, healthcare, manufacturing, documents and letters, and others. According to the report, retail represented the largest segment.

The retail sector accounts for the largest market share, driven by the need to provide convenient and timely delivery options to meet user expectations. Retailers across various segments including clothing, electronics, and household goods, are increasingly offering same day delivery services to attract a wider range of individuals and remain competitive in the market. Same day delivery enables retailers to reduce time-to-market for new products, improve inventory management, and enhance user satisfaction.

Breakup by End User:

- Business to Business (B2B)

- Business to Customer (B2C)

- Customer to Customer (C2C)

Business to customer (B2C) exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes business to business (B2B), business to customer (B2C), and customer to customer (C2C). According to the report, business to customer (B2C) accounted for the largest market share.

The business to customer (B2C) e-commerce market was valued at US$ 6.4 Trillion in 2023, as claimed by Global Data. The B2C segment of same day delivery serves organizations that provide goods and services directly to individuals. This segment includes online retailers, grocery stores, restaurants, and other businesses that offer delivery services to individual consumers. Same day delivery is becoming increasingly popular in the B2C sector as consumers are seeking convenience and instant satisfaction in their shopping experiences. Retailers and e-commerce platforms are leveraging same day delivery to offer competitive advantages, attract consumers, and increase sales.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest same day delivery market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for same day delivery.

The thriving e-commerce industry due to rapid urbanization is impelling the market growth. Countries such as China, India, and Japan have a large population base, which is catalyzing the demand for fast and convenient delivery options. Key players are investing in logistics infrastructure and technology to capitalize on this growing market opportunity. Additionally, the rise of digital payment systems and mobile shopping platforms further contributes to the market growth in the region. On 17 February 2024, FedEx received ‘Best Partner Award for 2023’ by Samsung Electronics Logitech for its excellence in delivering innovative logistics solutions and ethical practices. The award underscores the commitment of FedEx as a trusted logistics provider connecting Samsung to the world. The company continues to transform its network and operations to make supply chains smarter for everyone and meet the evolving needs of its individuals in South Korea.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the same day delivery industry include Amazon.com Inc., Aramex, Deutsche Post AG, Dropoff Inc., Econo-Courier, FedEx Corporation, Jet Delivery Inc., Need It Now Delivers, Power Link Expedite Corporation, United Parcel Service Inc., USA Couriers Inc., and XPO Logistics Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are focusing on technological innovation, expanding their delivery networks, and enhancing user experience. Companies are investing in advanced delivery technologies such as drones and autonomous vehicle delivery to further reduce delivery times and improve efficiency. Traditional logistics giants are ramping up their delivery offerings by leveraging their extensive network infrastructure to increase same day delivery market revenue. Moreover, e-commerce platforms and delivery startups are partnering with retailers and leveraging data analytics to optimize delivery routes and provide personalized delivery experiences, ultimately aiming to capture a larger share of the rapidly growing same-day delivery market. On 23 December 2023, Amazon announced that it had delivered 1 billion packages from same day sites in the U.S. These same day delivery facilities are designed for speed, allowing the company to fulfill, sort, and deliver all from one site, while making the process of delivering packages even faster.

Same Day Delivery Market Recent Developments:

- 1 May 2023: FedEx Express, a subsidiary of FedEx Corp, one of the world’s largest express transportation companies, expanded same day delivery service on inbound shipment service to better serve users outside of Seoul and the Greater Seoul area. People can now enjoy same day delivery on flight arrivals for non-dutiable shipments from Asia and Europe.

- 22 April 2024: Amazon announced that for the first time drones would be deployed from facilities next to its same day delivery site in Tolleson. These smaller sites are hybrid and part fulfillment center, part delivery station. They allow the company to fulfill, sort, and deliver products all from one site. The same day delivery sites are situated close to the large metro areas.

- 17 November 2023: Aramex, a leading global provider of comprehensive logistics and transportation solutions, unveiled a new and advanced courier operation facility in Muscat, the Sultanate of Oman, as part of its efforts to further streamline the entire shipping process, ranging from package arrival to their final delivery. The new facility is serving as a central hub for Aramex’s operations, facilitating faster delivery times and more efficient logistics management.

Same Day Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | International Services, Domestic Services |

| Mode of Transportations Covered | Airways, Roadways, Railways, Intermodal |

| Applications Covered | Retail, E-Commerce, Healthcare, Manufacturing, Documents and Letters. Others |

| End Users Covered | Business to Business (B2B), Business to Customer (B2C), Customer to Customer (C2C) |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Aramex, Deutsche Post AG, Dropoff Inc., Econo-Courier, FedEx Corporation, Jet Delivery Inc., Need It Now Delivers, Power Link Expedite Corporation, United Parcel Service Inc., USA Couriers Inc., XPO Logistics Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, same day delivery market forecast, and dynamics from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key same day delivery companies.

Key Questions Answered in This Report

The same day delivery market was valued at USD 8.3 Billion in 2024.

IMARC estimates the same day delivery market to exhibit a CAGR of 14.4% during 2025-2033.

The growing e-commerce demand for faster delivery services, advancements in logistics and supply chain technologies, increasing consumer preference for convenience and speed, expansion of same-day delivery networks by retailers, and competitive pressures driving improvements in delivery speed and efficiency are the primary factors driving the same day delivery market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the same day delivery market include Amazon.com Inc., Aramex, Deutsche Post AG, Dropoff Inc., Econo-Courier, FedEx Corporation, Jet Delivery Inc., Need It Now Delivers, Power Link Expedite Corporation, United Parcel Service Inc., USA Couriers Inc., and XPO Logistics Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)