Salmon Market Size, Share, Trends and Forecast by Type, Species, End Product Type, Distribution Chanel and Region, 2025-2033

Salmon Market Size and Share:

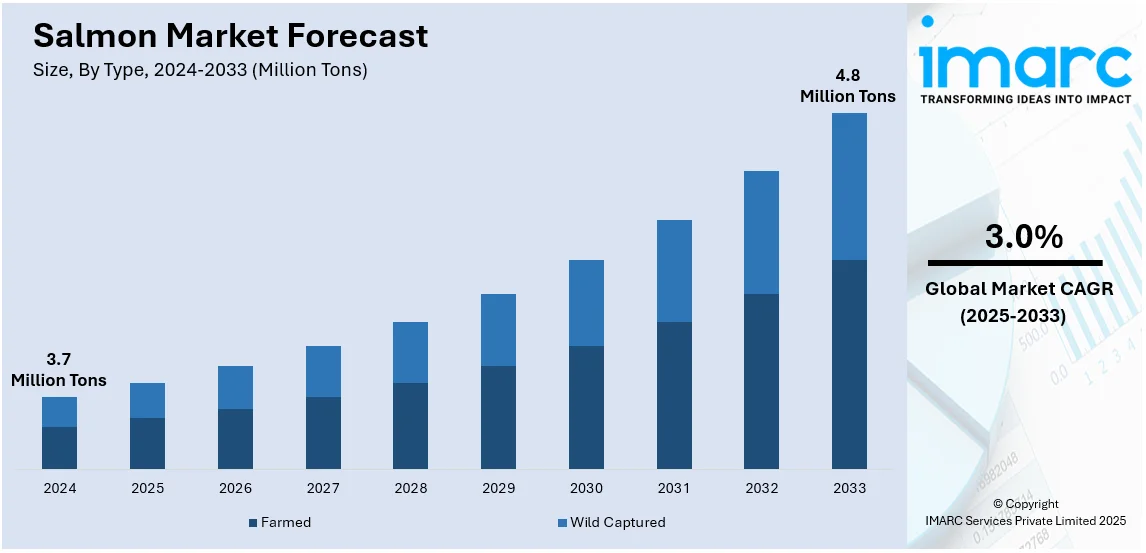

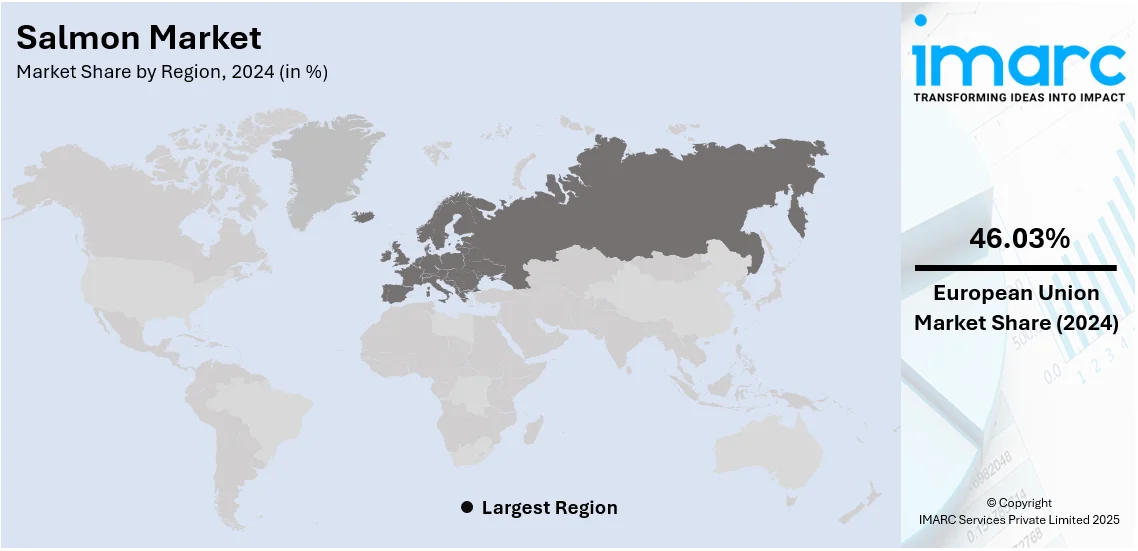

The global salmon market size was valued at 3.7 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 4.8 Million Tons by 2033, exhibiting a CAGR of 3.0% during 2025-2033. European Union currently dominates the market (based on consumption), holding a significant market share of over 46.3% in 2024. The rising seafood consumption worldwide, increasing consumer disposable incomes in emerging economies, favorable government policies, and escalating demand for value-added salmon products are some of the major factors propelling the salmon market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

3.7 Million Tons |

|

Market Forecast in 2033

|

4.8 Million Tons |

| Market Growth Rate 2025-2033 | 3.0% |

The market is expanding due to increasing investments in aquaculture technology, enhancing disease resistance, growth rates, and overall yield. Additionally, continual advancements in sustainable feed formulations are improving efficiency and reducing environmental impact. Furthermore, the implementation of government initiatives supporting sustainable fisheries and responsible farming practices is also shaping market expansion. For instance, in India, the Pradhan Mantri Matsya Sampada Yojana (PMMSY) aims to elevate the country's aquatic potential and bring about a revolutionary blue revolution. The plan calls for a spectacular 7 million MT increase in fish production and a USD 12 Billion spike in exports by FY 2025. Such policies are fostering investments in modern aquaculture techniques, improving disease management, and promoting responsible salmon farming. Besides this, digitalization in seafood supply chains, including blockchain-based traceability and automated quality control, is improving logistics efficiency and consumer trust, which is an emerging salmon market trend.

The market in the United States is witnessing significant growth, driven by the increasing domestic aquaculture production, reducing reliance on imports, and ensuring a stable supply. In line with this, consumer preferences for antibiotic-free, non-GMO, and organic seafood options are pushing producers toward sustainable farming practices. Also, retail and food service sectors are expanding their salmon-based offerings, including ready-to-eat meals and sushi-grade fillets, catering to convenience-oriented consumers. According to industry reports, 16.4% of total sales in the Q4 of 2024 came from e-commerce. The shift highlights the growing influence of online platforms. These further influences seafood distribution, which enhances accessibility, price transparency, and direct engagement between suppliers and consumers. Apart from this, government efforts to regulate overfishing and support sustainable seafood certifications are further shaping market dynamics.

Salmon Market Trends

Rise in Awareness About Health Benefits of Salmon

One of the most significant factors driving the salmon market growth is the growing awareness about the health benefits of consuming salmon. For example, approximately 36% of Americans have adopted some diet in 2023 to adopt healthy eating habits. Being rich in essential nutrients such as Omega-3 fatty acids, protein, and other vitamins, salmon is gaining popularity extensively for its cardiovascular benefits, brain function, and general well-being. Public health campaigns and word-of-mouth support from healthcare professionals are going further to promote this awareness, influencing individuals to make healthier food choices. This is creating a greater demand for salmon as consumers become more concerned about the nutritional aspect of their diets. The health trend is especially prevalent amongst middle-aged and older groups, who are more likely to be concerned about the cardiovascular benefits.

Advancements in Aquaculture Technologies

Ongoing technological developments in aquaculture are positively impacting the salmon market outlook. Developments in aquaculture technologies are facilitating more efficient and sustainable production methods, thus driving supply. Technological developments such as recirculating aquaculture systems (RAS) and improved fish feed are resulting in improved yields and improved quality of fish. On November 27, 2024, Multigen Akva, a technology firm in Norway, introduced a modular recirculating aquaculture system (RAS) designed for closed sea farming. This system utilizes ultrafiltration to eliminate viruses and bacteria from incoming water, allowing for scalable operations in sheltered coastal regions with depths between 7 and 45 meters. Emphasizing sustainability, the company employs a zero-emissions strategy by collecting organic waste and purifying wastewater before environmental discharge. These technology advancements are also mitigating the environmental issues surrounding aquaculture, including water pollution and the misuse of antibiotics. Consequently, the industry is becoming more environmentally friendly, and this improves production capacity and attracts eco-friendly consumers, thus propelling the salmon market demand further.

Global Expansion of Seafood Retail Chains and Restaurants

The growing number of seafood-specialized retail chains and restaurants is another key growth-inducing factor for the market. For example, per capita consumption of fish grew 81.43%, from 4.9 kg to 8.89 kg, at a 4.05% rate every year over the past 15 years. Such venues usually have a variety of salmon dishes to suit different tastes and cuisines. As they expand, these chains implement localized menus to address local tastes and thus increase the base of consumers for salmon. Further, their expansion into new markets, particularly in emerging economies, is leading to increased consumer exposure to salmon. Several of these chains also provide take-out and delivery options, further increasing consumer convenience and increasing their outreach. The increasing trend of online ordering and food delivery applications provides convenient access to consumers to consume salmon-based meals, which is also driving the consumption of salmon. This enhanced exposure increases availability and awareness, ultimately raising the global demand for the salmon market.

Salmon Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global salmon market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, species, end product type, and distribution channel.

Analysis by Type:

- Farmed

- Wild Captured

Farmed leads the market with around 75.51% of market share in 2024. Farmed salmon are raised in the controlled environment of aquaculture, where a more stable and consistent supply is possible. In contrast to wild-caught salmon, which is influenced by seasonal variations and environmental factors, farmed salmon may be produced all year round. This consistency is particularly crucial for retailers and restaurants that need a constant supply to fulfill consumer demands. Additionally, technological innovations in aquaculture contribute to higher yields and improved fish quality. Methods such as recirculating aquaculture systems (RAS) and maximized fish feed increase the efficiency of salmon production, rendering it a more cost-effective solution compared to depending entirely on wild salmon. Also, farmed salmon can be easily tracked for health and quality, which assures that the final product is compliant with high food safety standards. Moreover, manufacturing methods can be modified to produce salmon with specific desired qualities, like as a higher Omega-3 fatty acid content, to meet evolving market demands. These factors altogether make farmed salmon a safe, high-quality, and more sustainable choice for consumers globally, thereby driving the segment growth.

Analysis by Species:

- Atlantic

- Pink

- Chum/Dog

- Coho

- Sockeye

- Others

Atlantic leads the market with around 63.7% of market share in 2024. Atlantic salmon possesses a flavor profile that is versatile and well-liked across a wide group of consumers. Its tender texture and mild flavor make it highly suitable for usage in a range of culinary practices, from grilling and smoking to sushi and sashimi consumption. Its versatility increases its popularity across diverse markets and cuisines of various cultures. Besides, Atlantic salmon have a high degree of aquaculture adaptation. It easily adjusts to agricultural settings with productive and sustainable practices. The great availability of Atlantic salmon has been facilitated by its easier breeding and cultivation in controlled environments, in contrast to several other salmon species. The high supply is in accordance with the increasing demand across the world, further making it a top choice for both consumers and producers. In addition, Atlantic salmon is positioned as a high-quality but reasonably priced choice through strong marketing. The fish is widely available in supermarkets, seafood shops, and dining establishments, where it is usually marked as a high-quality option. Therefore, Atlantic salmon is now seen as a high-value product, which increases demand for it and helps this market grow.

Analysis by End Product Type:

- Frozen

- Fresh

- Canned

- Others

Frozen leads the market with around 58.3% of market share in 2024. Frozen salmon addresses consumer requirements and transportation practicalities. Freezing maintains the nutritional content, texture, and taste of the salmon to the best of its potential, providing consumers with a product that is virtually equal in quality to fresh forms. This allows individuals to access the health benefits of salmon despite location or nearness to water fishing. Additionally, frozen salmon offers the utmost convenience. It provides consumers with the convenience of keeping the product for longer durations without fear of quick spoilage, thereby minimizing food wastage. Frozen salmon is especially beneficial to consumers and food service establishments that need a longer shelf life for planning purposes as well as inventory management. At the supply chain level, frozen salmon is more convenient and cheaper to transport and distribute. As opposed to fresh salmon, which requires advanced cold-chain logistics and swift transit to ensure quality, frozen salmon is less susceptible to transport variabilities and is less perishable. This enables producers to address a wider market, including areas far away from coastal zones where salmon is usually caught, hence driving the segment growth.

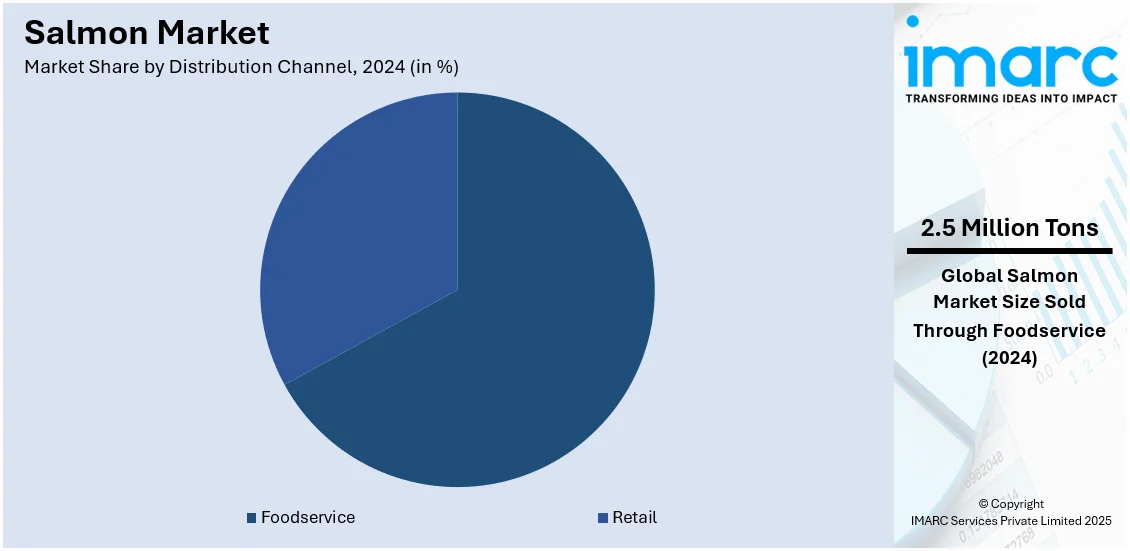

Analysis by Distribution Channel:

- Foodservice

- Retail

Food service leads the market with around 66.6% of market share in 2024, driven by the versatility and flavor of salmon, which render it a standard fixture in all forms of dining restaurants, from fast-casual restaurants to fine dining restaurants. Also, salmon's adaptability in preparation, from grilling and baking to raw uses such as sushi, contributes to its increasing popularity. In addition, the growing popularity of dining out or purchasing pre-prepared meals provides an easy solution for customers who lack the time or ability to prepare salmon in the comfort of their homes. The convenience aspect then propels demand within the food service market as customers are able to partake in various types of salmon meals without having to go through the process of preparation. The food service sector is also subject to economies of scale, with opportunities for bulk procurement and preparation. This results in cost reductions that can increase the profitability or lower the price of salmon goods for these companies, enhancing their ability to market and sell salmon products effectively. Additionally, the advent of food delivery services has further increased the presence of food service operators, such that salmon meals are now made available to those who prefer to eat at home. The convenience of ordering using apps and websites also promotes this trend, and the food services industry is positioned at the front as the largest channel for distributing salmon.

Regional Analysis:

Based on Production

- Farmed

- Norway

- Chile

- Scotland

- Canada

- Faroe Islands

- Others

- Wild Captured

- United States

- Russia

- Japan

- Canada

- Others

Norway holds the biggest share in the market for farmed salmon with around 46% in 2024 due to the region’s extensive coastline, featuring deep fjords and cold, clean waters, which provides an optimal natural environment for salmon farming. These conditions have catalyzed the development of advanced aquaculture technologies and practices, further promoting the growth of the farmed salmon industry in the region. Moreover, Norway benefits from strong governmental support and well-established regulations, facilitating a sustainable and efficient production framework. These factors have helped Norway build a robust infrastructure for salmon farming, making it the largest market for farmed salmon based on production.

The United States is the largest market for wild-caught salmon with around 45.1% of market share in 2024., primarily because of its access to the rich fishing grounds of the North Pacific, especially off the coast of Alaska. The region is also home to significant populations of various salmon species, particularly sockeye, coho, and king salmon. Stringent regulations and conservation efforts have made wild-captured fishing in the United States a relatively sustainable practice, bolstering its reputation and consumer appeal for wild-caught products. Furthermore, the region has a strong preference for wild-caught salmon, often viewed as a more natural and flavorful option compared to farmed variants. This consumer perception, combined with abundant natural resources, positions the United States at the forefront of wild-captured salmon production.

Based on Consumption

- European Union

- Russia

- United States

- Brazil

- Japan

- China

- Others

In 2024, European Union accounts for the largest market share (based on consumption) of over 46.3%, due to strong cultural affinity for seafood, including salmon, in many European countries. Whether it is smoked salmon in the United Kingdom, gravlax in Scandinavia, or salmon pasta dishes in Italy, the fish holds a central place in various European cuisines. This widespread culinary inclusion propels the demand for salmon across the EU. Moreover, the European Union benefits from proximity to major salmon-producing countries like Norway and Scotland, ensuring a stable and abundant supply. The well-established trade routes and favorable trade agreements within the EU make it easier and more cost-effective to distribute salmon across member countries. Besides this, the high standard of living and elevated consumer disposable incomes in several EU countries enable consumers to afford premium protein sources like salmon. This financial capacity, coupled with a heightened awareness of the health benefits of Omega-3 fatty acids found in salmon, drives consumer choice toward this nutritious fish. Also, the EU has stringent food safety and quality regulations, and sustainably farmed and wild-caught salmon often meet these high standards. This ensures consumer trust and further boosts demand for salmon products, thus fostering market growth.

Key Regional Takeaways:

European Union Salmon Market Analysis

European Union experiences increasing salmon adoption due to the growing food and beverages business, leading to greater seafood integration into diets. According to reports, in 2020, there were 291,000 enterprises in the EU processing food and beverages. Expanding restaurant chains, catering services, and fine-dining establishments elevate salmon’s presence in menus. Growing consumer preference for nutritious, protein-rich diets drives demand for premium seafood. Retail outlets stock diverse salmon variants, including smoked, frozen, and fresh options, catering to varied preferences. Culinary innovation introduces salmon into gourmet recipes, appealing to evolving palates. Food delivery services and meal kit providers feature salmon-based dishes, aligning with convenience-driven consumption. Expanding food festivals and seafood promotions enhance market visibility, encouraging trial purchases. Cold chain advancements maintain product integrity, ensuring widespread availability. Increasing investments in seafood processing facilities streamline production, enhancing supply chain efficiency. Expanding retail partnerships boost salmon distribution, promoting accessibility. Nutritional awareness campaigns highlight salmon’s benefits, fostering sustained demand.

Russia Salmon Market Analysis

Russia is witnessing a surge in seafood consumption, driven by increasing domestic aquaculture production and rising consumer preference for nutrient-rich diets. For instance, the average Russian consumed 22.5 kg of fish annually, a 2% rise compared to 2022. Expanding cold storage infrastructure and improved supply chain logistics are enhancing seafood accessibility across major cities. Government initiatives supporting fishery development and sustainable harvesting practices are strengthening the industry. The popularity of locally sourced salmon and whitefish is rising, fuelled by health-conscious trends and demand for premium seafood options. Retail expansion and growing seafood imports are diversifying product availability, while processed seafood varieties are gaining traction. This evolving landscape positions Russia’s seafood market for continued growth and diversification.

United States Salmon Market Analysis

The United States holds a substantial share of the North America salmon market with 81.20% in 2024. United States experiences rising salmon demand due to the growing online ecommerce sector, which enhances accessibility for consumers. For instance, in 2024, in comparison to the same quarter last year, US eCommerce sales have increased by 7.2% and 2.8% over the preceding quarter. Digital platforms streamline salmon distribution, allowing fresh and frozen options to reach a wider audience. Restaurants and meal kit providers increasingly incorporate salmon into menus, responding to shifting consumer preferences. Competitive pricing on ecommerce platforms makes salmon more affordable, encouraging frequent purchases. Improved cold chain logistics maintain freshness, ensuring quality assurance. Consumers favor convenient shopping experiences, accelerating demand. Online reviews and digital marketing shape purchasing decisions, fostering brand loyalty. Expanding digital grocery networks support bulk sales, benefiting both retailers and customers. Influencer promotions amplify awareness of nutritional benefits, strengthening consumer engagement. Advanced payment solutions facilitate seamless transactions, promoting repeat orders. Virtual cooking tutorials featuring salmon dishes boost home-cooked seafood trends.

Brazil Salmon Market Analysis

Brazil experiences rising demand for salmon, driven by growing disposable income, shifting dietary habits, and expanding middle-class consumption. Brazil Households Disposable Income data was reported at approximately USD 127,664 Million in Dec 2024. This indicates a rise in comparison to the prior figure of approximately USD 121,298 Million for Nov 2024. Health awareness fuels interest in protein-rich seafood, while urbanization enhances accessibility through modern retail. Cold chain advancements support wider distribution, ensuring freshness across markets. Culinary diversification introduces salmon into various cuisines, increasing local acceptance. Rising aquaculture investments enhance supply, stabilizing prices for consumers. Sustainability initiatives encourage eco-friendly practices, appealing to environmentally conscious buyers. Premiumization trends drive preference for high-quality variants, influencing purchasing behaviour. Evolving foodservice industries incorporate salmon into diverse menus, reinforcing its presence in mainstream consumption patterns.

Japan Salmon Market Analysis

Japan's frozen food demand is rising as growing tourism fuels the need for convenient meal options. For instance, as of May 2024, Japan is welcoming more than 3 Million foreign tourists monthly, around 8% above the pre-pandemic level. The influx of international visitors increases demand for ready-to-eat frozen meals, seafood, and snacks catering to diverse tastes. Expanding foodservice sectors, including hotels and restaurants, rely on frozen products for efficiency and consistency. The rising preference for high-quality frozen seafood, such as salmon and shrimp, supports market growth. Convenience stores and supermarkets expand their frozen offerings to meet consumer preferences. As inbound tourism strengthens, the frozen food industry benefits from evolving culinary trends, ensuring a steady rise in demand across multiple consumer segments.

Competitive Landscape:

The market is highly competitive, with the presence of established aquaculture companies, fisheries, and vertically integrated producers competing on efficiency and sustainability. Firms spend on cutting-edge aquaculture methods, such as recirculating aquaculture systems (RAS) and offshore farming, to maximize yield and reduce environmental footprint. Sustainability labels and traceability programs are important to market positioning since consumers and regulators require responsible sourcing. Additionally, continual technological innovation in feed formulation, genetics, and disease control enhances production quality and efficiency, leading to increased competition. Participants in the market increase global distribution systems through strategic alliances and online stores to serve multiple consumer groups. Processed and added-value products of salmon, including value-added smoked and ready-to-eat products, also enhance differentiation. Price volatility, supply chain disruption, and climate change-related issues affect competitiveness, leading industry stakeholders to embrace resilient business models and invest in alternative protein sources to ensure market stability.

The report provides a comprehensive analysis of the competitive landscape in the salmon market with detailed profiles of all major companies, including:

- AquaChile S.A. (Agrosuper S.A.)

- Atlantic Sapphire

- Australis Seafoods

- Bakkafrost P/F

- BluGlacier, LLC

- Camanchaca S.A.

- Cermaq Group AS (Mitsubishi Corporation)

- Grieg Seafood ASA

- Lerøy Seafood Group ASA

- Mowi ASA

- SalMar ASA

- Tassal Group Limited (Cooke Aquaculture Inc.)

Latest News and Developments:

- February 2025: Salmon Evolution, in partnership with Lofotprodukt, launched Norway's first smoked salmon from a land-based facility. Marketed under the premium Lofoten brand, it will be available in Meny and select Spar stores. The salmon, produced at Indre Harøy, reaches Norwegian retail next week. This marks a milestone for sustainable seafood innovation.

- February 2025: Dutch group Pan Ocean Aquaculture (POA) plans to develop a salmon-producing vessel to grow and transport salmon across oceans in a fully-enclosed aquaculture system.

- July 2024: Captain Fresh acquired Koral, a Polish company specializing in branded salmon products, to expand its reach in the global salmon market. This move strengthens Captain Fresh’s position in the USD 33.5 Billion salmon industry, enhancing its supply chain capabilities. By integrating Koral’s distribution network, the company aims to meet rising global demand for high-quality salmon.

- March 2024: In Chile, eleven salmon farmers, along with industry bodies and government agencies, have joined forces to enhance vaccine availability for salmon farming. This collaboration, involving the Salmon Council and Chilean authorities, aims to reduce antibiotic usage and combat bacterial diseases in salmon production. By improving disease prevention methods, the initiative supports sustainable salmon farming practices in Chile.

Salmon Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Farmed, Wild Captured |

| Species Covered | Atlantic, Pink, Chum/Dog, Coho, Sockeye, Others |

| End Product Types Covered | Frozen, Fresh, Canned, Others |

| Distribution Channels Covered | Foodservice, Retail |

| Regions Covered (Based on Production) |

|

| Regions Covered (Based on Consumption) | European Union, Russia, the United States, Brazil, Japan, China, Others |

| Companies Covered | AquaChile S.A. (Agrosuper S.A.), Atlantic Sapphire, Australis Seafoods, Bakkafrost P/F, BluGlacier, LLC, Camanchaca S.A., Cermaq Group AS (Mitsubishi Corporation), Grieg Seafood ASA, Lerøy Seafood Group ASA, Mowi ASA, SalMar ASA, Tassal Group Limited (Cooke Aquaculture Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the salmon market from 2019-2033.

- The salmon market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the salmon industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The salmon market was valued at 3.7 Million Tons in 2024.

The salmon market is projected to exhibit a CAGR of 3.0% during 2025-2033, reaching a value of 4.8 Million Tons by 2033.

The market is driven by the rising consumer demand for protein-rich diets, increasing health awareness, and expanding aquaculture production. Growing preference for sustainable seafood, technological advancements in fish farming, and supportive government policies further propel market growth. Expanding distribution channels, including e-commerce, also contribute to higher consumption.

European Union currently dominates the salmon market (based on consumption), accounting for a share of 46.3% in 2024. The dominance is fueled by high per capita seafood consumption, strong aquaculture infrastructure, and government initiatives supporting sustainable fisheries. Increasing demand for premium and organic salmon, coupled with well-established supply chains and cold storage facilities, strengthens the region’s position in the market.

Some of the major players in the salmon market include AquaChile S.A. (Agrosuper S.A.), Atlantic Sapphire, Australis Seafoods, Bakkafrost P/F, BluGlacier, LLC, Camanchaca S.A., Cermaq Group AS (Mitsubishi Corporation), Grieg Seafood ASA, Lerøy Seafood Group ASA, Mowi ASA, SalMar ASA, and Tassal Group Limited (Cooke Aquaculture Inc.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)