Salicylic Acid Market Report by Application (Pharmaceuticals, Personal Care, Food & Preservatives, and Others), and Region 2025-2033

Salicylic Acid Market Overview:

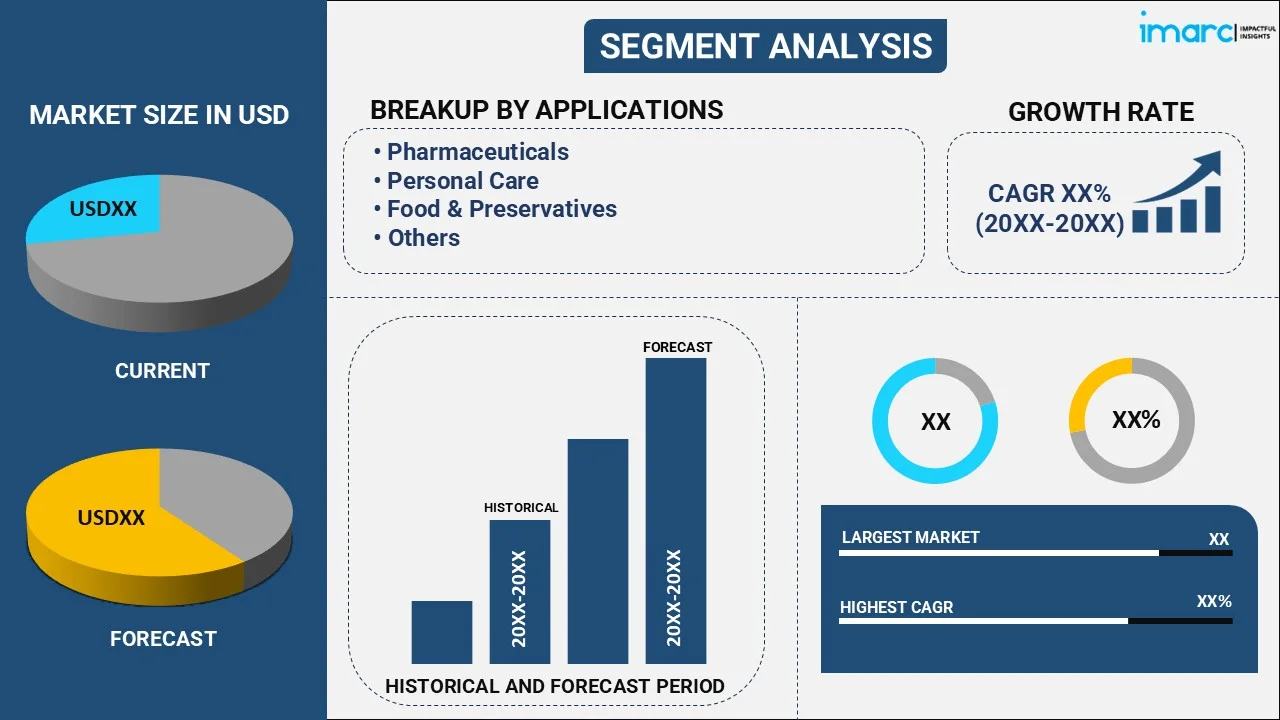

The global salicylic acid market size reached USD 472.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 762.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The market is experiencing steady growth driven by increasing product employment in the cosmetics sector, particularly in anti-acne products, rising consumption of food products among the masses worldwide, and the escalating demand for plant growth regulators.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 472.9 Million |

|

Market Forecast in 2033

|

USD 762.2 Million |

| Market Growth Rate 2025-2033 | 5.4% |

Salicylic Acid Market Analysis:

- Major Salicylic Acid Market Drivers: The market is witnessing moderate growth due to the increasing focus on organic farming practices, coupled with the rising need for various chemicals.

- Key Market Trends: The market is showcasing rapid growth on account of the thriving cosmetics sector and the increasing need for plant growth regulators.

- Geographical Trends: Asia Pacific leads the market share, driven by the rising focus on maintaining personal hygiene among people, along with inflating income levels of individuals in the region.

- Competitive Landscape: Some of the major market players in the salicylic acid industry include Alfa Aesar (Thermo Fisher Scientific), Alta Laboratories Limited, JM Loveridge Limited, Novacap, Inc., Sigma-Aldrich Chemicals Private Limited, and Siddharth Carbochem Products Limited, among many others.

- Challenges and Opportunities: While the market faces challenges, such as regulatory compliance, it also encounters opportunities on account of the increasing demand for natural ingredients.

Salicylic Acid Market Trends:

Thriving Cosmetics Sector

The rising demand for salicylic acid due to the thriving personal care and cosmetics industry is propelling the market growth. For instance, according to Statista, the global cosmetic sector is projected to generate revenues around US$ 129 Billion by 2028. There are many uses of salicylic acid in various skincare products, particularly in anti-acne products, on account of its exfoliating and keratolytic properties. It assists in reducing blemishes and providing youthful skin. Moreover, various cosmetic brands are incorporating salicylic acid in their products to attract a wider consumer base worldwide. As per PR Newswire, La Roche-Posay launched ‘Effaclar Salicylic Acid Acne Treatment Serum’ that is specifically formulated with triple acid complex, a blend of 1.5% salicylic acid with glycolic acid and lipo-hydroxy acid. The product clears acne blemishes while helping to prevent new breakouts. It is paraben free and benefits in reducing pores, fine lines, and post-acne marks.

Rising consumption of food products

The increasing demand for salicylic acid in the food and beverage (F&B) sector as a food preservative is supporting the market growth. It is widely employed in several food items and beverages to extend the shelf life of products and inhibit the growth of certain microorganisms. In addition, the growing cultivation of food items on account of the rising population is offering a positive market outlook. For instance, according to the Press Information Bureau, India’s foodgrains production touched a record 315.7 million tons in 2021-22. Besides this, the Government of India introduced agriculture infrastructure fund (AIF) under Aatmanirbhar Bharat Package during July 2020. The Scheme is operational from 2020-21 to 2032-33 reported by Press Information Bureau on 1 August 2023. This scheme will be implemented for the creation of post-harvest management infrastructure and community farm assets.

Increasing need for plant growth regulators

The rising employment of salicylic acid as plant growth regulators (PGRs) is impelling the market growth. Salicylic acid regulates plant growth and development by triggering many physiological and metabolic processes. It is a vital component of plant defense mechanisms against environmental stimuli. It helps plants cope with various abiotic stresses, such as drought, salinity, extreme temperatures, and heavy metal toxicity. It can effectively modulate a myriad of metabolic processes, including strengthening of oxidative defense system, by directly or indirectly limiting the buildup of reactive nitrogen and oxygen radicals in stressed plants. In addition, it assists in root growth and development and enhances root elongation. Furthermore, the escalating demand for salicylic acid on account of the increasing plantation is bolstering the market growth. Apart from this, the market size of the United States plant and flower sector reached US$ 18.5 Billion in 2022, which was US$ 17.17 Billion in 2021, as claimed by Statista.

Salicylic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on application.

Breakup by Application:

- Pharmaceuticals

- Personal Care

- Food & Preservatives

- Others

Pharmaceuticals account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes pharmaceuticals, personal care, food and preservatives, and others. According to the report, pharmaceuticals represented the largest segment.

In the pharmaceutical sector, salicylic acid is widely used to produce aspirin, one of the most common analgesics and blood-thinning agents. Another analgesic formed from salicylic acid is methyl salicylate, also known as the oil of wintergreen. Both analgesics are preferred solutions to treat headaches and other body aches. Apart from this, salicylic acid is utilized in the treatment of wart infections. It dehydrates the skin cells affected by warts when applied to it and thereby slowly leads to its shedding off from the body. It also activates the immune reaction of the body toward the viral wart infection by introducing a mild inflammatory reaction. In addition, salicylic acid can treat various ringworm infections and the wet form of tinea pedis infection, such as the athlete’s foot. It also cures a very rare genetic skin disorder, named Ichthyosis, in which skin becomes dry, scaly, and thick. It has keratolytic properties that make it a main ingredient in many over the counter (OTC) and prescription acne treatments. Furthermore, key players in the pharmaceutical sector are utilizing salicylic acid in various OTC medications. Consumer Healthcare Products Association reports that OTC sales were US$ 42,096 Million in 2022 and are projected to reach US$ 43,361 Million in 2023 in the United States. Besides this, as per Statista, the global OTC pharmaceuticals market is anticipated to generate a revenue of US$ 202.40 Billion in 2024.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

Asia Pacific leads the market, accounting for the largest salicylic acid market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Asia Pacific represents the largest regional market for salicylic acid.

The rising employment of salicylic acid on account of the thriving personal care sector in shampoos, creams, lotions, and moisturizers is bolstering the salicylic acid market growth. People are increasingly focusing on maintaining personal hygiene, thereby spending on premium quality personal care products. In line with this, the growing demand for salicylic acid due to the burgeoning pharmaceutical industry in the region is offering a positive salicylic acid market outlook. For example, Invest India reports that the pharmaceutical sector is projected to reach US$ 65 Billion by 2024 and US$ 130 Billion in 2030. India is a major exporter of Pharmaceuticals, with over 200 and more countries served by Indian pharma exports. Furthermore, the increasing need for salicylic acid-based products among individuals suffering from several skin diseases is contributing to the growth of the market in the Asia Pacific region.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the salicylic acid industry include Alfa Aesar (Thermo Fisher Scientific), Alta Laboratories Limited, JM Loveridge Limited, Novacap, Inc., Sigma-Aldrich Chemicals Private Limited, and Siddharth Carbochem Products Limited.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players in the market are introducing various cosmetic and skincare products containing salicylic acid to cure various diseases and skin issues. For instance, Peace out skincare, the top acne brand at Sephora, cult-favorite, and leader in innovative skincare treatments announced their newest launch, Peace Out Acne Day Dot on 5 December 2022. The product ‘acne day dot’ is an ultra-sheer version that is designed for virtually invisible daytime wear. It contains all the acne-fighting and healing ingredients, such as hydrocolloid polymer technology, salicylic acid, aloe vera leaf extract, and retinyl acetate. Furthermore, companies are opening huge manufacturing hubs that reduce salicylic acid market price in terms of production. Besides this, various companies are getting approvals for experiments related to salicylic acid in their products. These approvals assist in creating enhanced salicylic acid market demand across the globe. For example, according to Medical Dialogues, Synokem pharmaceutical got approval from the Subject Expert Panel (SEC) functional under the Central Drug Standard Control Organisation (CDSCO) on 22 January 2023 to conduct the proposed Phase III clinical trial of the fixed-dose combination, salicylic acid IP plus Luliconazole IP (3%+1%) cream. As a result, these initiatives are benefit in increasing salicylic acid market revenue.

Salicylic Acid Market Recent Development:

- August 2022: Bubble launched its first over the counter (OTC) acne treatment called ‘Super Clear.’ It is an acne serum that is created to aid individuals with sensitive skin. It eliminates acne-causing oils or substances from pores, which prevents breakouts before they begin. It contains a combination of 2% salicylic acid and willow bark extract to help clear pores and tackle breakouts without causing any damage to the skin. The product is widely available on the website of the brand.

- 21 April 2023: NovaBay Pharmaceuticals, Inc., a company developing and commercializing high-quality eyecare, skincare, and wound care products introduced the new DERMAdoctor comfort + Joy psoriasis therapeutic moisturizing cream with 3% salicylic acid as an on-air guest on the quality value convenience (QVC) network. The product will help in restoring essential moisture of the skin for a soft, supple, comfortable, and joy-filled appearance.

- 12 December 2022: OUAI introduced an anti-dandruff shampoo, the brand’s first product offering containing a Food and Drug Administration (FDA) approved ingredient, 2% salicylic acid. The product benefits in reducing flaking, itching, and irritation associated with dandruff that leaves hair feeling clean and soft. It provides relief from dandruff symptoms and minimizes dandruff-causing bacteria by creating a diversion to break down the bacteria and soothe the scalp.

Salicylic Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Pharmaceuticals, Personal Care, Food and Preservatives, Others |

| Regions Covered | Europe, North America, Asia Pacific, Latin America, Middle East and Africa |

| Companies Covered | Alfa Aesar (Thermo Fisher Scientific), Alta Laboratories Limited, JM Loveridge Limited, Novacap, Inc., Sigma-Aldrich Chemicals Private Limited, Siddharth Carbochem Products Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How big is the salicylic acid market so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global salicylic acid market?

- What is the impact of each driver, restraint, and opportunity on the global salicylic acid market?

- What are the key regional markets?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the salicylic acid market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global salicylic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the salicylic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global salicylic acid market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the salicylic acid industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)