Safety Sensors Market Size, Share, Trends and Forecast by Type, Sensor Type, End User, and Region, 2025-2033

Safety Sensors Market Size and Share:

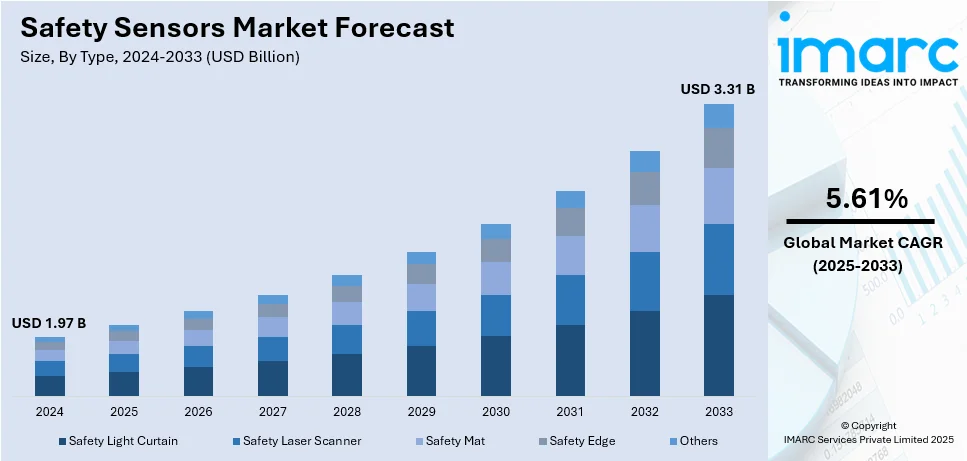

The global safety sensors market size was valued at USD 1.97 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.31 Billion by 2033, exhibiting a CAGR of 5.61% from 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 35.6% in 2024 driven by the increasing industrial automation to enhance operational safety, stringent workplace safety regulations across industries, and rising demand for advanced safety solutions in automotive and manufacturing sectors. The adoption of IoT-enabled safety sensors and growing awareness about reducing workplace hazards further propelling the safety sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.97 Billion |

|

Market Forecast in 2033

|

USD 3.31 Billion |

| Market Growth Rate (2025-2033) | 5.61% |

The growing adoption of industrial automation systems is a major driver for the safety sensors market. As manufacturing and industrial operations become more automated, ensuring worker safety and equipment protection is paramount. Safety sensors, such as light curtains, pressure sensors, and proximity detectors, play a crucial role in preventing workplace accidents by monitoring equipment and human activity in real-time. Moreover, stringent safety regulations imposed by governments and international organizations mandate the use of advanced safety technologies in workplaces. Compliance with these standards drives industries to integrate safety sensors, ensuring operational efficiency while minimizing risks to employees and assets.

The U.S. safety sensors market is significantly driven by advanced industrial automation, stringent workplace safety regulations, and rising demand from the automotive and manufacturing sectors. In Fiscal Year 2023, the Occupational Safety and Health Administration (OSHA) conducted 34,221 inspections, with 54% of these being unprogrammed inspections due to employee complaints, injuries, fatalities, and referrals. This highlights the growing emphasis on workplace safety, encouraging industries to adopt safety sensors like light curtains and proximity detectors to meet OSHA standards. Additionally, the automotive sector fuels growth through the widespread integration of advanced safety systems such as collision avoidance and driver-assistance technologies. The nation's focus on IoT and smart technologies further accelerates the adoption of IoT-enabled safety sensors, while investments in robotics and autonomous vehicles boost the demand for innovative safety solutions, strengthening the U.S. position as a key player in the global market.

Safety Sensors Market Trends:

Integration of IoT and Smart Safety Solutions

The integration of the Internet of Things (IoT) into safety sensors is transforming the market by enabling real-time monitoring and predictive maintenance. IoT-connected safety sensors provide data analytics, allowing industries to identify potential safety risks and optimize operational efficiency. Smart sensors equipped with wireless connectivity and cloud integration are becoming increasingly popular, especially in industrial automation, healthcare, and building safety. These innovations enable remote monitoring and control, reducing downtime and enhancing workplace safety. As industries prioritize digital transformation, the demand for IoT-enabled safety solutions continues to grow, further shaping the safety sensors market outlook.

Rising Demand in Automotive Safety Systems

The automotive sector is witnessing a surge in demand for advanced safety sensors driven by the proliferation of autonomous vehicles and Advanced Driver-Assistance Systems (ADAS). Safety sensors, such as LiDAR, radar, and cameras, play a critical role in collision avoidance, lane departure warning, and pedestrian detection systems. Regulatory requirements mandating safety technologies in vehicles and growing consumer preference for safety features have further accelerated this trend. Electric vehicles (EVs) and connected cars also rely heavily on sensor integration, enhancing the overall driving experience and road safety. This trend underscores the pivotal role of safety sensors in shaping the future of mobility.

Growth in Industrial Automation and Robotics

Another prominent safety sensors market trends is the rapid adoption of automation and robotics in manufacturing, logistics, and warehousing is driving the demand for safety sensors. Robots and automated machinery rely on sensors like proximity detectors, light curtains, and pressure sensors to ensure safe interaction with human workers and prevent accidents. Industries are increasingly integrating collaborative robots (cobots) designed to work alongside humans, further necessitating advanced safety systems. Additionally, safety sensors help in compliance with stringent workplace safety regulations, boosting their adoption. As automation technologies continue to evolve, the use of sophisticated safety sensors is expected to expand, catering to diverse industrial applications and improving operational safety.

Safety Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global safety sensors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, sensor type, and end user.

Analysis by Type:

- Safety Light Curtain

- Safety Laser Scanner

- Safety Mat

- Safety Edge

- Others

Safety light curtains drive market growth due to their critical role in safeguarding personnel and machinery in industrial settings. These devices are widely adopted in manufacturing, automotive, and packaging industries to ensure compliance with stringent safety regulations while maintaining operational efficiency. Increasing automation across industries has amplified the need for reliable safety solutions, with light curtains offering non-intrusive protection by creating an invisible safety barrier. The demand is further fueled by their versatility, as they can be easily integrated into robotic systems and automated production lines. Advancements in technology, such as IoT-enabled safety light curtains with remote monitoring capabilities, enhance their functionality. Additionally, the global focus on workplace safety and reduced downtime drives the growth of safety light curtain adoption.

Analysis by Sensor Type:

- Accelerometers

- Biosensors

- Image Sensors

- Motion Detectors

- Others

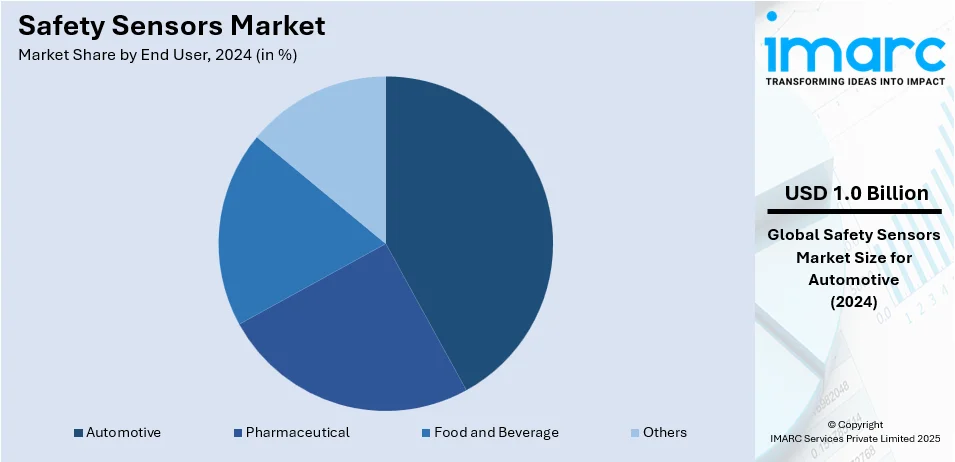

The automotive sector exhibits clear dominance with a significant market share of 42.2% in the safety sensors market due to increasing demand for advanced safety systems and the global shift toward electric and autonomous vehicles. Safety sensors such as LiDAR, radar, ultrasonic sensors, and cameras are integral to advanced driver-assistance systems (ADAS), enabling features like collision avoidance, lane departure warnings, and pedestrian detection. Regulatory mandates in regions like North America and Europe, requiring vehicles to include advanced safety technologies, further fuel adoption. Additionally, consumer demand for enhanced vehicle safety and comfort drives innovation in sensor technology. The rapid electrification of vehicles and the development of connected car ecosystems amplify the need for sophisticated safety sensors, bolstering the safety sensors market growth.

Analysis by End User:

- Pharmaceutical

- Food and Beverage

- Automotive

- Others

Based on the safety sensors market forecast, the pharmaceutical industry, safety sensors are crucial for ensuring compliance with stringent safety and hygiene standards. They help monitor equipment, control environmental conditions, and prevent contamination during production. Sensors are essential in automating processes, ensuring accurate monitoring of sensitive processes, and improving overall operational safety in pharmaceutical facilities.

Additionally, in the food and beverage sector, safety sensors are used to monitor production lines, prevent contamination, and maintain hygiene standards. They ensure the safety of food products by detecting foreign objects, controlling temperature, and regulating machine functions. Compliance with food safety regulations like FDA guidelines drives the demand for these sensors.

Besides this, the automotive sector relies heavily on safety sensors, especially in advanced driver-assistance systems (ADAS) and autonomous vehicles. Sensors such as radar, LiDAR, and cameras help in collision avoidance, lane detection, and obstacle detection. These sensors are critical in improving vehicle safety, reducing accidents, and meeting regulatory safety standards.

Furthermore, the other industries such as manufacturing, construction, and robotics also rely on safety sensors for monitoring equipment, ensuring worker safety, and preventing accidents. These sensors help detect hazardous conditions, control machine operations, and enable safe interaction between workers and automated systems. They are essential in maintaining safety standards across diverse sectors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific holds a significant safety sensors market share of 35.6% due to rapid industrialization, significant investments in automation, and the expansion of manufacturing hubs in countries like China, Japan, and India. The region's robust automotive industry, particularly in China and Japan, drives the adoption of safety sensors in advanced driver-assistance systems (ADAS) and electric vehicles. Additionally, the growing focus on workplace safety and increasing regulatory mandates in industries such as electronics, pharmaceuticals, and construction further boost demand. The rising adoption of IoT-enabled safety solutions and the proliferation of robotics in manufacturing also contribute to market dominance. Competitive pricing and innovations by regional manufacturers strengthen Asia-Pacific’s position as a global leader in the safety sensors market.

Key Regional Takeaways:

North America Market Analysis

The North American safety sensors market is driven by advanced industrial automation, stringent safety regulations, and growing adoption of smart technologies across industries. The region's well-established automotive sector is a significant contributor, with increasing integration of safety sensors in advanced driver-assistance systems (ADAS) and autonomous vehicles. Industrial applications, particularly in manufacturing, logistics, and energy, rely heavily on safety sensors like proximity detectors, light curtains, and pressure sensors to ensure workplace safety and regulatory compliance. The rise of IoT-enabled smart safety systems and robotics adoption further fuels market growth. Key players in the region focus on innovation and strategic partnerships to address evolving safety needs, making North America a prominent market for safety sensor technologies.

United States Safety Sensors Market Analysis

The safety sensors market in the United States is driven by strong industrial safety regulations and advanced manufacturing practices. The Occupational Safety and Health Administration (OSHA) mandates strict safety standards across industries, pushing manufacturers to adopt technologies that enhance workplace safety. These regulations, combined with the growing automation of production processes, is creating significant demand for safety sensors, including light curtains, proximity sensors, and safety mats. Other factors include an increasing adoption rate of Industry 4.0 technologies. Integrating robotics and IoT-enabled systems in factories brings along the demand for more solid safety solutions against hazardous interactions of workers with the machines. There is a higher demand for advanced safety sensors with intelligent features, which can collect and provide real-time data and diagnosis. In addition to this, investment in areas like automotive and aerospace further supports market growth. These are high accuracy industries with respect to safety levels and hence a requirement for manufacturing and testing areas of safety sensors. In addition, companies want safety more so in order not to incur judicial and reputational damages, making it a higher market growth driving technology. Besides this, safety sensor demand by pharmaceutical industries that ensure high accuracy and compliance will propel the industry's growth. They ensure safe operations and maintain product quality. The increasing production and sales of pharmaceutical products in the country is bolstering the market growth. The U.S. pharmaceutical industry was approximately valued at about USD 574.37 Billion in 2023. Such a strong figure places the U.S. among the top nations in the pharmaceutical world, making up around 45% of global pharmaceutical sales, as per reports.

Asia Pacific Safety Sensors Market Analysis

The Asia Pacific safety sensors market is experiencing rapid growth due to the region's industrial expansion and urbanization. Countries like China, India, and Japan are heavily investing in manufacturing and infrastructure development, creating significant opportunities for safety sensor deployment. In line with this, governing agencies in the region are implementing policies for promoting workplace safety and initiatives to modernize production facilities. Major growth factors are automation and the integration of robots in manufacturing, which is becoming more prominent in China and South Korea, where the need for safety sensors in guarding worker safety in hi-tech environments cannot be neglected. The emergence of the automotive sector as a major car-producing hub in Asia Pacific also pushes the need for advanced safety systems to meet international standards in this industry. Indian passenger vehicle sales for November 2024 reportedly increased 4.4% y/y to 300,459 units. Besides, safety sensors are being implemented in the SMEs of the region to enhance the safety and productivity of operations. Subsidies and incentives by the governing agencies encourage the firms to upgrade the equipment, and hence, growth in the market is witnessed. Regional players are also focusing on developing cost-effective sensors tailored to local industries, further aiding the safety sensors market demand.

Europe Safety Sensors Market Analysis

Europe's safety sensors market is based on strong work health and workplace safety norms set by regulatory conditions. According to reports, from 2022-2023, as much as 561,000 people suffered from work-related injuries without any severe repercussions in Great Britain. All this is part of the stringent instructions set by the European Union's guidelines through the Machinery Directive 2006/42/EC, General Product Safety Directive, to name a few. Much of the advanced industrial base of this region, from Germany and the UK to France, is based on automation. Their production lines require reliable safety sensors as it becomes increasingly dependent on added robotics and AI-driven systems. Smart factories, that form the backbone of Europe's industrial strategy, use sensors in a way that ensures safety while maintaining production levels. Besides this, the increasing focus on sustainability goals is bolstering the market growth. Europe is transitioning toward sustainable manufacturing, with companies investing in energy-efficient safety solutions. Sensors equipped with low-power technologies and recyclable materials align with these objectives, making them popular across industries. Furthermore, the automotive and aerospace sectors, two critical industries in Europe, are major contributors to the market. Safety sensors are vital for maintaining compliance with international safety standards during manufacturing and testing. Moreover, collaborative robots (cobots) in European factories require advanced sensor systems to ensure human safety, further driving demand.

Latin America Safety Sensors Market Analysis

Latin American safety sensors market is developing in line with the industrialization pace and urbanization. According to the CIA, the total urban population of Mexico was 81.6% of total population in 2023. The manufacturing industries in Brazil and Mexico are developing by investing into those sectors and ensuring that proper technologies for the sake of better operations and security measures for employees are adopted. There is the introduction of multinational companies that have brought in international safety standards and are pushing the local manufacturers to adopt modern safety practices. The mining and oil and gas industries are very essential to the regional economy. Since these are very risky sectors, they demand the implementation of good safety measures. As the region continues to modernize, the focus on worker safety and compliance with global standards is expected to fuel the growth of the safety sensors market.

Middle East and Africa Safety Sensors Market Analysis

The growing industrialization and investments in sectors like oil and gas, construction, and manufacturing is offering a favorable market outlook. These industries operate in high-risk environments, making safety technologies essential to prevent accidents and enhance operational safety. The thriving construction sector in the region is catalytzing the demand for safety sensors. Construction sites make use of safety sensors to manage the risk of heavy machinery and unsafe conditions. Construction projects are a significant source of demand in GCC countries. Since large-scale infrastructure development is ongoing, these GCC countries deploy safety sensors at their job sites to mitigate the risk. According to reports, the Middle East and North Africa (MENA) region has remained remarkably resilient and has awarded USD 101 Billion worth of projects in the first half of 2023. The UAE and Saudi Arabia, in particular, are driving industrial modernization in the region, thereby opening up possibilities for more advanced safety solutions.

Competitive Landscape:

The competitive landscape is dominated by global players and regional companies emerging in the safety sensors market. Notable industry leaders include Rockwell Automation, Siemens, Honeywell International, and SICK AG, which gain leadership over the market by innovating and diversifying portfolios of sensors for industrial automation, automotive and building applications for safety. These players concentrate more on technology frontiers like integration of IoT, AI-powered sensors, to be at par and maintain competitiveness. Moreover, there are strategies for mergers and acquisitions to enlarge market shares, expand geographically, and bring new technologies. Regional players are intensifying competition with cost-effective solutions. The market remains dynamic, driven by innovation, regulatory compliance, and the growing adoption of smart safety technologies globally.

The report provides a comprehensive analysis of the competitive landscape in the safety sensors market with detailed profiles of all major companies, including:

- ABB Ltd

- Autonics Corporation

- Balluff GmbH

- Banner Engineering Corporation

- Contrinex AG

- Keyence Corporation

- Leuze electronic GmbH + Co. KG

- Omron Corporation

- Panasonic Corporation

- Pilz GmbH & Co. KG

- Rockwell Automation Inc.

- Schneider Electric SE.

Latest News and Developments:

- October 2024: Researchers from the Centre for Nano and Soft Matter Sciences (CeNS) developed a prototype of a road safety sensor that can be implanted at high-risk curves where accidents are frequent. A new polymer nanocomposite was developed for prototype purposes with properties of pressure sensing and energy harvesting.

- June 2024: Baker Hughes launched three gas, flow, and moisture measurement sensor technologies designed to deliver safety performance, productivity, oil and gas applications, hydrogen applications, and drive productivity in across energy and industrial sectors. From the demand side, Baker Hughes' three Panametrics innovations were built and designed to supply long-term stability in challenging conditions, providing three new solutions delivering advanced levels of accuracy, reliability, and durability.

- May 2024: Sonair announced its breakthroughs in sensor technology that help in enhancing the safety of industrial automation. Moreover, the company declared that its first evaluation kit will be rolled out this summer, which marks a giant step in the robotic and machine autonomy world. Sonair 3D ultrasonic sensor enables the AMRs to measure distance and direction to any object within its 180x180 field of view up to five meters away.

- December 2023: Life Solutions by Panasonic The company has recently announced a revolutionary 6-in-1, 6DoF (Degrees of Freedom) inertial sensor from the India Industrial Devices Division that measures acceleration and angular rate over three axes: X, Y, and Z. Such sensor data are required for optimizing a vehicle's stability and safety. It delivers power and reliability for mission-critical applications and meets the entire spectrum of ISO26262 Functional Safety Standards that range up to ASIL-D for Automotive Safety Integrity Level.

Safety Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Safety Light Curtain, Safety Laser Scanner, Safety Mat, Safety Edge, Others |

| Sensor Types Covered | Accelerometers, Biosensors, Image Sensors, Motion Detectors, Others |

| End Users Covered | Pharmaceutical, Food and Beverage, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Autonics Corporation, Balluff GmbH, Banner Engineering Corporation, Contrinex AG, Keyence Corporation, Leuze electronic GmbH + Co. KG, Omron Corporation, Panasonic Corporation, Pilz GmbH & Co. KG, Rockwell Automation Inc. and Schneider Electric SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the safety sensors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global safety sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the safety sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The safety sensors market was valued at USD 1.97 Billion in 2024.

The safety sensors market was valued at USD 3.31 Billion in 2033, projected to exhibit a CAGR of 5.61% during 2025-2033.

Key factors driving the safety sensors market include increasing industrial automation, strict workplace safety regulations, and the growing demand for advanced automotive safety systems. Additionally, the rise of IoT and smart technologies, along with the adoption of robotics and autonomous vehicles, further accelerates the need for innovative safety sensor solutions.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the safety sensors market include ABB Ltd, Autonics Corporation, Balluff GmbH, Banner Engineering Corporation, Contrinex AG, Keyence Corporation, Leuze electronic GmbH + Co. KG, Omron Corporation, Panasonic Corporation, Pilz GmbH & Co. KG, Rockwell Automation Inc. and Schneider Electric SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)