Safes and Vaults Market Size, Share, Trends and Forecast by Type, Function Type, Application, End User, and Region, 2025-2033

Safes and Vaults Market Size and Trends:

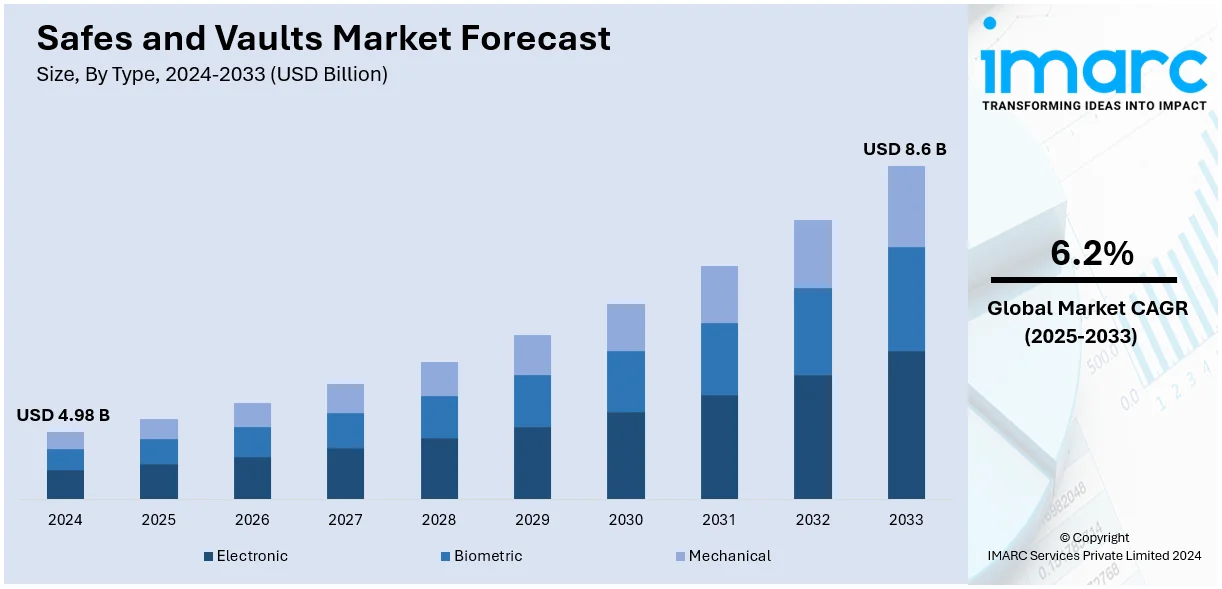

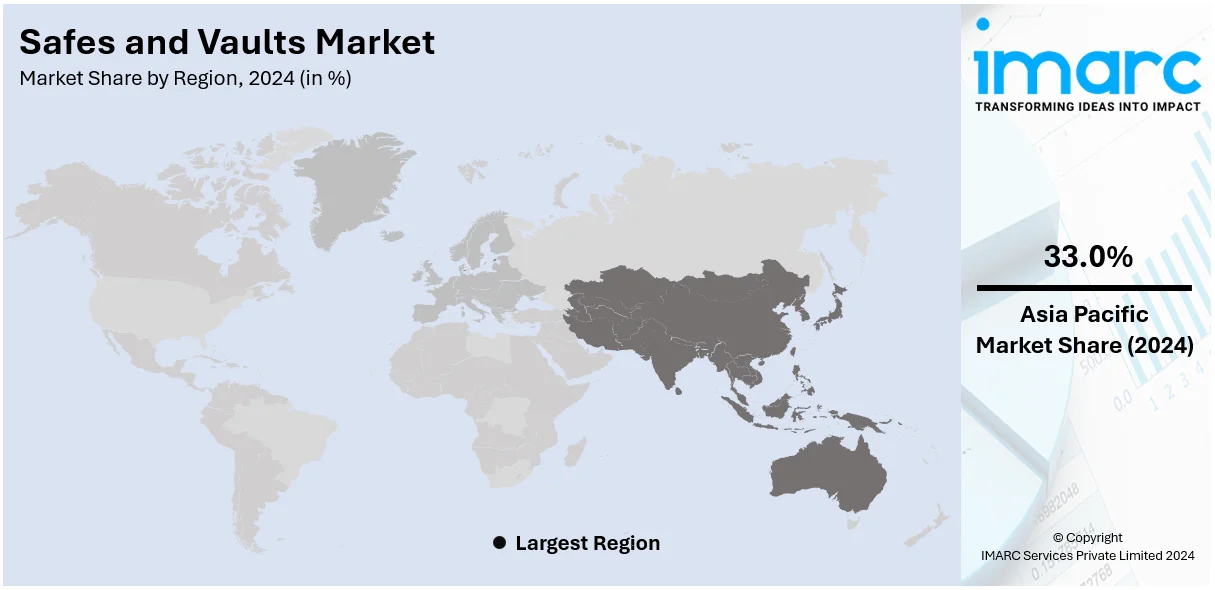

The global safes and vaults market size was valued at USD 4.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.6 Billion by 2033, exhibiting a CAGR of 6.2% from 2025-2033. Asia Pacific dominates the market in 2024. The expansion of global wealth and the accumulation of valuable assets, the increasing digitalization of information and services, and the growing demand for cyber-secure storage options are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.98 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Market Growth Rate (2025-2033) | 6.2% |

The global safes and vaults market is witnessing significant growth due to rising security concerns, driven by increasing burglary and cyber-theft cases. Advanced biometric and digital locking systems are enhancing demand, while sectors like banking, financial services, and insurance (BFSI) continue to expand their need for high-security storage. On September 21, 2024, Steelage, a leading provider of physical security solutions, announced the introduction of advanced safes equipped with live finger detection and duress alarm features, including India’s first fire-resistant cabinets and modular vaults, BIS-certified products, and IoT-enabled technology for remote monitoring and alerts. With a vast service network and advanced manufacturing facilities, Steelage is driving industry standards. In addition to this, rising disposable incomes and urbanization are encouraging residential investments in secure storage, further accelerating market growth.

The United States is a key regional market and is growing due to strict regulations for secure storage in sectors like banking, pharmaceuticals, and firearms. Increasing focus on disaster resilience, such as fire and floodproofing, drives innovation. Expanding e-commerce and retail operations amplify demand for secure cash and inventory management. Notably, on February 19, 2024, Convergint introduced DEA-compliant vault systems and cages tailored for healthcare facilities, integrating engineering, manufacturing, and installation to meet DEA standards for Schedule I-V materials. Continual advancements in modular vault technology and integration with building management systems enhance adoption. Rising affluence and demand for premium, customized security solutions, combined with government efforts to enforce safety standards, further strengthen market growth across various sectors.

Safes and Vaults Market Trends:

Increasing Emphasis on Security and Asset Protection

With the pervasive threats of theft, burglary, and unauthorized access, individuals and businesses are prioritizing the safeguarding of valuable assets, sensitive documents, and priceless possessions. 847,522 burglaries in the United States were reported to the FBI in 2022. That is an estimated 269.8 causes for every 100,000 individuals, as per the data by Criminal Justice Information Services Division. This heightened concern stems from the ever-changing landscape of security breaches, both physical and digital, prompting an increase in demand for state-of-the-art safes and vaults. From residential homes to commercial enterprises, the need to deter theft, unauthorized intrusion, and even natural disasters has increased, highlighting the indispensability of this market. Financial institutions, jewelry stores, and data centers are prime targets for theft, accentuating the necessity for advanced security solutions. Consequently, the adoption of cutting-edge safes and vaults gained traction, integrating features, including biometric authentication, multiple-layered encryption, fire-resistant materials, and real-time monitoring systems.

Continual Technological Advancements and Innovation

Traditional mechanical locks have given way to cutting-edge electronic and biometric locking systems, ushering in unparalleled security and ease of access. Biometric identification methods such as fingerprint recognition, retina scanning, and facial authentication have revolutionized security measures by minimizing unauthorized access risk. Additionally, the integration of Internet of Things (IoT) technology redefined safes and vaults by enabling remote monitoring, instant alerts, and precise access control. This connectivity revolutionizes inventory management, enhances audit trails, and refines overall security protocols. According to an industry report, from 2024 to 2029, the IOT market is expected to expand at an annual growth rate of 10.49%. As consumers increasingly seek sophisticated solutions seamlessly integrating with their digitally driven lifestyles, manufacturers are compelled to invest in extensive research and development, ensuring they remain at the forefront of innovation.

Expanding Hospitality and Tourism Sector

Hotels, resorts, cruise ships, and other hospitality establishments are keenly aware of their guest’s security concerns, particularly when it comes to protecting valuables during their stay. Industry statistics state that the hotel sector grew at a compound annual growth rate (CAGR) of 7.0%, from USD 4,390.59 Billion in 2022 to USD 4,699.57 Billion in 2023. Travelers seek seamless, worry-free experiences during their stays, and ensuring the protection of their valuables is a crucial aspect of this experience. By incorporating safes and vaults within guest rooms, hospitality establishments provide a secure space for guests to store items, such as jewelry, passports, electronic devices, and important documents. Moreover, the integration of modern technology into safes and vaults aligns with the hospitality industry's pursuit of innovation. Many modern safes feature electronic locks with customizable codes, RFID card access, or even biometric authentication. These advanced security features enhance ease of use and contribute to a more sophisticated and convenient guest experience.

Safes and Vaults Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global safes and vaults market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, function type, application, and end user.

Analysis by Type:

- Electronic

- Biometric

- Mechanical

Mechanical leads the market share in 2024. Mechanical safes have garnered enduring popularity due to their time-tested reliability, robustness, and straightforward functionality. These safes employ traditional lock and key mechanisms, offering a tangible sense of security through their tangible, tactile interactions. They do not rely on electricity or digital components, ensuring consistent operation even in the absence of power or technical malfunctions. This reliability has made them a staple choice across a wide range of settings, from residential homes to commercial establishments. Moreover, mechanical safes often come with multiple combination options, allowing users to set personalized codes that are easily memorized yet difficult to guess. This feature enhances security by minimizing the risk of unauthorized duplication or access to the safe's contents.

Analysis by Function Type:

- Cash Management Safes

- Depository Safes

- Gun Safes and Vaults

- Vaults and Vault Doors

- Media Safes

- Others

Cash management safes dominate the market share in 2024. Cash remains an integral aspect of everyday transactions, and businesses are continually seeking efficient ways to handle, secure, and monitor their cash flow. Cash management safes offer a comprehensive solution by integrating advanced features that streamline the handling and storage of currency. Cash management safes excel in optimizing this process through features such as bill validation, counterfeit detection, and automated cash counting. These safes not only enhance accuracy and efficiency but also contribute to minimizing the risks associated with human error and theft. The integration of smart technologies further elevates the appeal of cash management safes. IoT-enabled safes allow for real-time monitoring of cash levels, enabling businesses to render informed decisions regarding replenishment and cash flow management.

Analysis by Application:

- Residential

- Commercial

Commercial represents the largest segment in market. Commercial establishments often deal with substantial cash flows, valuable inventory, and confidential customer information. From retail stores managing daily cash transactions to hospitality establishments safeguarding guest belongings, the need for reliable and robust safes and vaults is paramount. Financial institutions, a significant subset of the commercial segment, require specialized safes and vaults to securely store cash, important documents, and customer valuables. Additionally, with the rise of digital data and the growing threat of cybercrime, businesses in various sectors are increasingly seeking secure storage solutions for digital media, sensitive records, and intellectual property. This expanded scope of assets requiring safeguarding further fuels the demand for advanced commercial safes and vaults equipped with the latest security technologies, including biometric access, fire resistance, and real-time monitoring capabilities.

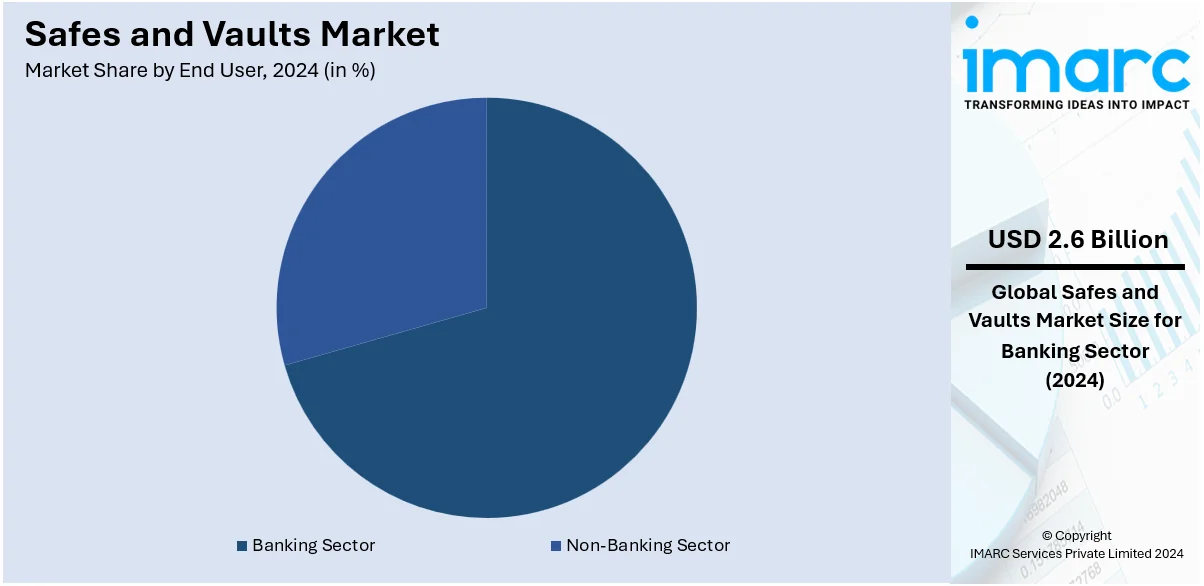

Analysis by End User:

- Banking Sector

- Non-Banking Sector

Banking sector holds the leading market share in 2024. The banking sector's reliance on safes and vaults extends beyond basic security considerations. Stringent regulations and compliance standards mandate the secure storage of cash reserves, customer valuables, and sensitive documents. These regulatory imperatives have led to the development of specialized safes and vaults that meet the unique demands of banking environments. Such solutions often feature multiple layers of security, including advanced access controls, biometric authentication, and intricate locking mechanisms, all designed to safeguard against a wide array of threats. In addition to physical security, technological advancements have transformed banking operations, with digitalization playing a pivotal role. Many modern safes and vaults used by banks integrate cutting-edge technologies, such as IoT connectivity for remote monitoring, electronic audit trails, and real-time alerts.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the report, Asia Pacific accounted for the largest market share. Asia Pacific manufacturing capabilities have facilitated the production of a wide spectrum of safes and vaults, catering to both local demand and global supply chains. The presence of numerous skilled labor forces, advanced manufacturing technologies, and strategic trade networks has positioned Asia Pacific as a hub for the production and distribution of high-quality security solutions. Furthermore, the increasing adoption of advanced technologies, such as biometric access control, electronic monitoring, and IoT integration, has driven innovation within the market. These technologies resonate well with the global tech-savvy population and forward-looking businesses, propelling the growth of the safes and vaults market. Moreover, the cultural significance of safeguarding valuables and documents has also contributed to the strong demand for safes and vaults across Asia Pacific.

Key Regional Takeaways:

United States Safes and Vaults Market Analysis

Demand from the banking, retail, and residential sectors for high security safes and vaults in the United States propels the US market for safes and vaults. With over 4,100 commercial banks and thousands of credit unions across the country, the US strong financial infrastructure constantly builds up demand for high-grade safes and vaults that secure the assets, as per industry report. On top of that, an increase in retail theft investments has fueled security systems as well. According to the FBI, 1.4 million homes were burglarized in 2019 and property losses from burglaries amount to USD 3 Billion. Residential adoption is also rising given the growing burglary concerns; more than 1 million households experience burglary annually, according to the U.S. Department of Justice. Technological innovations such as time-lock vaults and biometric safes are expanding product offerings to meet consumer demand for high-tech solutions. Since over 40% of all guns are owned in the United States, the jewelry and guns industries both play a major role in the market's expansion and demand for safe storage solutions. Government rules that require safe currency storage, like those pertaining to guns, and the legalization of cannabis in a number of states are further factors driving this sector.

Europe Safes and Vaults Market Analysis

Strict laws and enhanced security needs of the banking and residential sectors have been driving the safes and vaults market in Europe. The demand for safes in financial institutions increased due to the cash-handling compliance criteria of the European Central Bank. Residential installations of safes have picked up due to increased break-ins in homes in nations like the UK. According to statistics, 181,617 home burglaries occurred in England and Wales during the period of 2023–2024. To secure inventories in the high-end consumer goods industry, vault systems are applied. As per the reports, a growth of 24.6% was seen by the European market in consuming luxury goods in 2023, which regained its ranking as one of the globe's most resilient luxury markets. There has been an important recovery from this shrinkage in 2023. Luxury spending in Europe averages USD 130 per person. The EU's green programs have also increased demand for safes that are fireproof and environmentally friendly. Investment in high-security vaults is also fueled by growing risks of cyber theft and physical security breaches in government buildings and data centers.

Asia Pacific Safes and Vaults Market Analysis

The Asia-Pacific safes and vaults market is expanding rapidly due to growing banking industry, economic expansion, and rising urbanization. Increasing disposable incomes and growing home security concerns are driving over 50% of regional demand in China and India combined as per an industry report. According to Aurm, a company that provides accessible and secure lockers, six crore wealthy Indians will need safe deposit storage lockers in Indian cities by 2030. However, there are now just 60 lakh (6 million) bank vaults available nationwide. The difference between the demand for lockers and the supply of lockers would therefore be approximately 5.4 crore, as found out by the analysis that was commissioned following interviews with multiple banking executives and data collected from numerous Reserve Bank of India (RBI) papers. Technological improvements are most advanced in South Korea and Japan, where smart safes and biometrics are in high demand. Key growth drivers also include the growing usage of safes for secured storage in SMEs and consumption of luxury products, also in China.

Latin America Safes and Vaults Market Analysis

The demand for safes and vaults in Latin America can be primarily linked to elevated crime rates and economic instability. Brazil and Mexico are with a combined market share greater than 60% its biggest markets. Residential safes are in good demand due to the high rate of burglary in the area. In 2024, residential burglaries went up by 15.18% in Rio de Janeiro, which is the capital city of Brazil, according to statistics from the Public Security Institute (ISP). The South Zone in the city registered 220 house invasions between January and August this year, while during the same period in 2023, there were only 191 house invasions. Several South Zone areas in the city reported that the cases had almost doubled this year. Constant investment in vault systems is aided by the fact that banking systems have seen tremendous growth in countries like Argentina and Colombia. The industry is growing as more small businesses use safes to secure their cash and merchandise.

Middle East and Africa Safes and Vaults Market Analysis

Increased infrastructure spending and security concerns are driving the market in the Middle East and Africa. Demand is highest in the United Arab Emirates and Saudi Arabia, with major contributions from the luxury and finance industries. Since the gold imports at Dubai amount to a substantial USD 23.9 Billion a year, as per an industry news, the value items like gold and diamond require secure storage solutions. Multiple new branches in Africa are opening during 2021-2023, which is making an increase in the banking industry for vault systems. The presence of political unpredictability coupled with high crime rates within several African countries is leading to an increase in usage of home and business safes.

Competitive Landscape:

Several major companies are investing in research and development (R&D) to integrate advanced security technologies into their products. Biometric authentication, such as fingerprint recognition and facial identification, is becoming more common, reducing the risk of unauthorized entry as well as enhancing access control. Additionally, companies are incorporating electronic monitoring, remote access control, and real-time alerts using IoT technology to provide enhanced security features. Moreover, with the increasing emphasis on digitization, companies are incorporating digital features into their safes and vaults. This includes electronic audit trails, enabling businesses to monitor and track access to the safe, which is crucial for compliance and accountability. Integration with existing digital systems and software is also a growing trend. As environmental consciousness rises, companies are developing safes and vaults using sustainable materials and manufacturing processes. This includes energy-efficient components, recyclable materials, and reduced carbon footprints, aligning with the global focus on eco-friendly practices.

The report provides a comprehensive analysis of the competitive landscape in the safes and vaults market with detailed profiles of all major companies, including:

- Alpha Safe & Vault, Inc.

- American Security

- Assa Abloy AB

- BJARSTAL sarl

- Brown Safe Manufacturing, Inc.

- Cannon Safe, Inc.

- Caradonna

- Diebold Nixdorf, Incorporated

- Godrej Enterprises

- Gunnebo Safe Storage AB

- Kaso Oy

- Kumahira Co., Ltd.

- Liberty Safe

Latest News and Developments:

- May 2024: Godrej Architectural Fittings and Systems unveiled a cutting-edge line of smart locks that combine cutting-edge technology with contemporary style. These smart locks meet the growing need for safe, electronic locking systems for residences and workplaces. With features like RFID cards, PIN codes, biometric authentication, and mobile app connectivity, the new line offers strong security and user ease.

- April 2024: As the largest facility for safe storage products in India, Gunnebo India increased the capacity of its Halol manufacturing plant in Gujarat by 50%. Meeting the rising need for premium security solutions, such as safes, vaults, and other storage items, both domestically and abroad is the goal of the expansion. Additionally, this move is consistent with Gunnebo's strategic objective on expanding its involvement in the "Make in India" campaign as well as enhancing its manufacturing skills.

- July 2023: Diebold Nixdorf partnered with Red Link to transition the entire ATM network to the DN Series. These compact ATMs feature advanced cash processing technology and robust multi-layered security. The upgrade enables Red Link and over 40 partner banks to enhance customer experience with features like fingerprint and facial recognition while improving operational efficiency through remote optimization and process automation.

- May 2023: Godrej Locks introduced a cutting-edge line of digital locks to meet the rising demand for smart home security systems, broadening its product line. RFID cards, smartphone connectivity, PIN-based unlocking, and biometric access are some of the new features in the portfolio.

- December 2021: American Security Products Co. launched new keyless courier app, SUREACCESS™ to armored car and retail industries. The app provides secure access to depository safes, eliminating the need for a physical courier key.

Safes and Vaults Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electronic, Biometric, Mechanical |

| Function Types Covered | Cash Management Safes, Depository Safes, Gun Safes and Vaults, Vaults and Vault Doors, Media Safes, Others |

| Applications Covered | Residential, Commercial |

| End Users Covered | Banking Sector, Non-Banking Sector |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpha Safe & Vault, Inc., American Security, Assa Abloy AB, BJARSTAL sarl, Brown Safe Manufacturing, Inc., Cannon Safe, Inc., Caradonna, Diebold Nixdorf, Incorporated, Godrej Enterprises, Gunnebo Safe Storage AB, Kaso Oy, Kumahira Co., Ltd., Liberty Safe, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the safes and vaults market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global safes and vaults market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the safes and vaults industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Safes and vaults refer to secure storage solutions designed to protect valuable items, documents, and sensitive information from theft, fire, and unauthorized access. Commonly used in homes, businesses, and financial institutions, they provide varying levels of security through advanced locking mechanisms and durable materials to ensure reliable protection.

The safes and vaults market was valued at USD 4.98 Billion in 2024.

IMARC estimates the global safes and vaults market to exhibit a CAGR of 6.2% during 2025-2033.

The global market is primarily driven by heightened security concerns, ongoing innovations in biometric and IoT-enabled systems, the rapid expansion of e-commerce operations, the growing BFSI and hospitality sectors, rising disposable incomes, and increased investments in advanced security solutions across various industries worldwide.

In 2024, mechanical represented the largest segment by type, driven by its reliability, robustness, and power-independent functionality.

Cash management safes lead the market by function type attributed to their efficiency in handling, storing, and monitoring cash securely.

Commercial is the leading segment by application, driven by high cash flows, inventory security needs, and growing digital data storage requirements.

In 2024, the banking sector represented the largest segment by end user, propelled by stringent regulations and the need for secure cash and document storage.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global safes and vaults market include Alpha Safe & Vault, Inc., American Security, Assa Abloy AB, BJARSTAL sarl, Brown Safe Manufacturing, Inc., Cannon Safe, Inc., Caradonna, Diebold Nixdorf, Incorporated, Godrej Enterprises, Gunnebo Safe Storage AB, Kaso Oy, Kumahira Co., Ltd., and Liberty Safe, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)