Russia Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2025-2033

Russia Wine Market Size and Share:

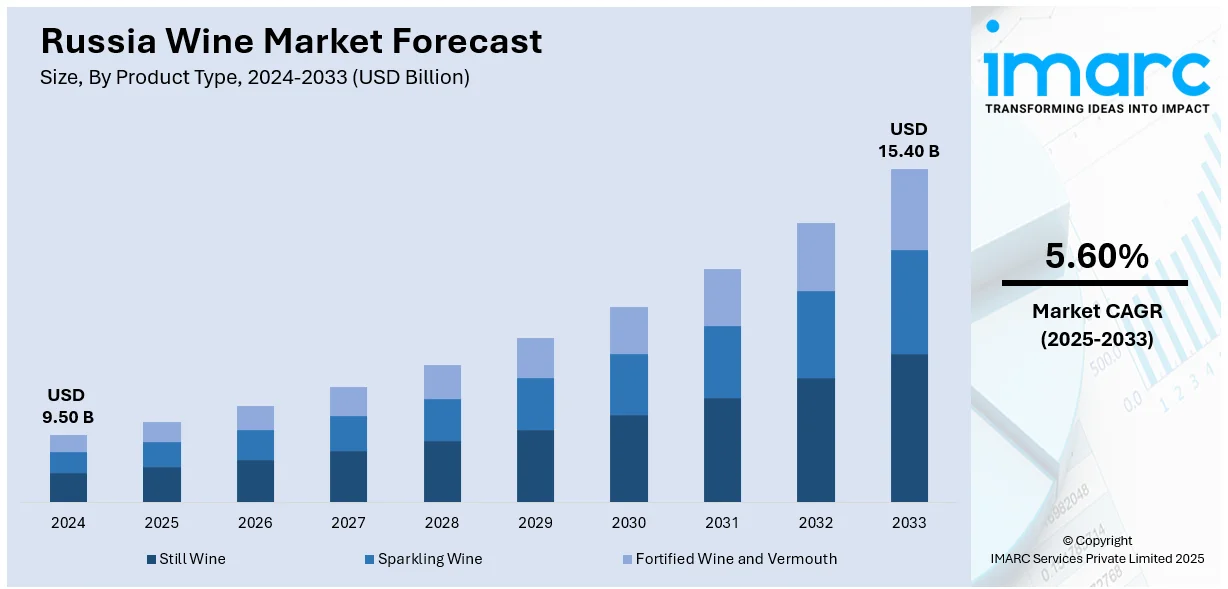

The Russia wine market size was valued at USD 9.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.40 Billion by 2033, exhibiting a CAGR of 5.60% from 2025-2033. The Russia wine market share is expanding, driven by increased domestic production of wines, expansion of retail channels, changing drinking habits of the masses, and introduction of subsidies for vineyard development, tax breaks for winemakers, and rules that favor domestic wines.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.50 Billion |

| Market Forecast in 2033 | USD 15.40 Billion |

| Market Growth Rate (2025-2033) | 5.60% |

The Russian wine market is majorly transformed by a mix of evolving consumer preferences, regulatory changes, and economic factors. Traditionally dominated by imported wines, there is now a clear transform patient toward domestically produced varieties. Government authorities are implementing policies to encourage local viticulture, along with incentives for homegrown producers and increased regulation on imports. These activities are leading to an increase in vineyards and the improvement of winemaking techniques in the country. The promotion of locally produced wine as an authentic product is also contributing to the increased consumer confidence in Russian brands.

Consumer preferences have also played a crucial role in improving the Russia wine market price. There is an increased demand for quality wines, which are meant to satisfy various tastes. More so, younger generations are finding a wider scope of options with an interest in traditional and innovative styles of wine. This trend reflects a broader global trend in which wine consumption becomes more experiential, and consumers seek new flavors, unique blends, and wines that fit their lifestyles. Another important aspect of the growing preference for organic and natural wines is a shift towards health-conscious consumption.

Russia Wine Market Trends:

Government Support and Policy Initiatives

The Russian government is contributing immensely to the development of the wine industry through the implementation of policies that boost local production and curb reliance on imported wines. Successive administrations have put in place various incentives, including grants for the establishment of vineyards, funding of winemakers, and tax breaks on local wines. All these incentives have spurred investment in the industry, increased vineyards, and enhanced the art of making wines. Regulatory frameworks have also been modified to upgrade the quality standards of Russian wines, thus improving their competitiveness within the local as well as global markets. Importation of wines has also been restricted by imposing higher tariffs and stricter labeling regulations by the government, thereby impelling the Russia wine market growth. For instance, import duties on wine were hiked to 20% and new tariffs were places until and including December 31st, 2024, in Russia. These policies have created a favorable environment for domestic brands, allowing them to gain a larger market share.

Changing Consumer Preferences and Lifestyle Trends

Consumer behavior in Russia has changed dramatically, with many preferring wine to other alcoholic beverages. This shift is primarily due to increased exposure to global influences. Younger generations, at least those who live in big cities, have begun to opt for wine as a fashionable and social drink, increasingly away from spirits that were always popular. This demographic shift has opened up new opportunities for winemakers to introduce a diverse range of products that cater to evolving tastes. In addition, health-conscious consumers are looking for wines with lower alcohol content, organic ingredients, and natural production methods. The demand for organic and biodynamic wines is steadily increasing, reflecting a broader trend toward sustainable consumption. According to RIA Novosti, the first quarter of 2024 saw Georgia take the lead in supplying still and fortified wines to Russia. Luding Group experts from one of the major alcohol companies in the Russian Federation established the leader in supply volumes.

Expansion of Wine Tourism and Domestic Production

Russia’s wine regions have gained significant recognition, contributing to the expansion of wine tourism, thereby driving the Russia wine market demand. Regions like Krasnodar Krai and Crimea have emerged as significant wine-producing areas, drawing both local and international visitors. These areas provide vineyard tours, wine tasting activities, and cultural events that enhance local economies while also raising awareness and appreciation for Russian wines. With an increase in visitors to these wine-producing regions, the demand for wines made locally is rising, strengthening the upward trend. In May 2024, the RUSSIA EXPO revealed its intention to hold a foresight session titled “Wine Tourism and Regional Development.” Representatives from leading Russian wineries, specialized groups, government agencies, specialists, and media members assessed new opportunities for improving wine tourism throughout different areas of the country.

Russia Wine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia wine market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, color, and distribution channel.

Analysis by Product Type:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

Still wine occupies a noteworthy portion of the Russian wine market, appealing to a varied consumer demographic with an assortment of red, white, and rosé selections. This section is favored because of its adaptability and suitability for various cuisines, making it a go-to option for both informal and formal events. Russian winemakers have been broadening their collections to feature premium and mid-range still wines, focusing more on locally grown grape varieties.

Sparkling wine has witnessed a rise in popularity in Russia, largely driven by its association with celebrations and special occasions. Champagne and locally produced sparkling varieties, such as those from Crimea and Krasnodar, have gained traction among consumers looking for quality alternatives to imported brands. Russian sparkling wines, particularly semi-sweet and brut varieties, have become household staples for festive gatherings and social events.

Fortified wines and vermouths occupy a niche but important segment in the Russian wine industry, appealing to both traditional and modern consumers. Historically popular due to their longer shelf life and strong flavors, fortified wines continue to be favored by those who enjoy bolder and richer wine experiences, thereby offering a favorable Russia wine market outlook.

Analysis by Color:

- Red Wine

- Rose Wine

- White Wine

Red wine remains the most widely consumed wine category in Russia, favored for its bold flavors, rich aromas, and strong cultural association with traditional dining. Russian consumers appreciate red wine for its versatility, making it a staple at family gatherings, formal dinners, and social events.

Rosé wine is steadily gaining popularity in Russia, particularly among younger consumers and those looking for a refreshing and lighter alternative to traditional red and white wines. The growing preference for rosé can be attributed to its versatility, appealing flavor profile, and suitability for warm-weather consumption.

White wine enjoys a strong presence in the Russian market, appealing to those who prefer lighter, crisp, and aromatic wines. It is particularly popular among consumers seeking refreshing options for summer months or wines that pair well with seafood, poultry, and lighter cuisine. Russian vineyards have been investing in high-quality white grape varieties, resulting in a broader selection of both dry and semi-sweet wines.

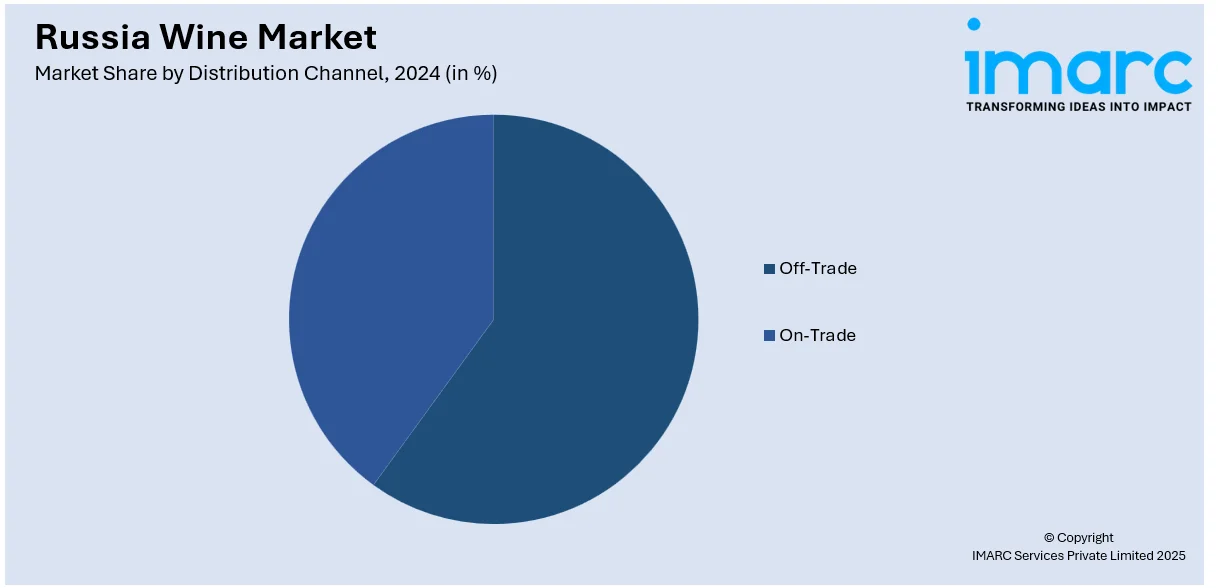

Analysis by Distribution Channel:

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

- On-Trade

The off-trade (supermarkets and hypermarkets, specialty stores, online stores, and others) distribution channel plays a dominant role in the Russian wine market. Consumers prefer purchasing wine from retail outlets due to the convenience, competitive pricing, and wide product selection available. Supermarkets and liquor stores offer a broad range of domestic and imported wines, catering to different budgets and preferences.

The on-trade segment, which includes restaurants, bars, hotels, and cafes, serves as an important channel for premium and high-end wines in Russia. This distribution method thrives in urban centers, where fine dining and social drinking culture are expanding.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, which includes Moscow and surrounding areas, is the largest and most influential market for wine consumption in Russia. Being the economic and cultural hub of the country, this region has a well-developed retail infrastructure and a strong presence of both domestic and imported wine brands.

The Volga District is one of Russia’s key economic regions, with a rapidly developing wine market influenced by increasing disposable income and urbanization. Cities like Kazan and Samara have seen a growing appreciation for wine, particularly among younger consumers and professionals who are shifting away from traditional spirits.

The Urals District, with major cities like Yekaterinburg and Chelyabinsk, represents a growing yet developing wine market. While historically dominated by stronger alcoholic beverages, consumer preferences are gradually shifting toward wine due to changing lifestyle trends and increased exposure to global drinking habits. The retail sector in this region has expanded to include a broader selection of wines, from affordable local brands to premium imports.

The Northwestern District, home to Saint Petersburg, is a significant wine-consuming region characterized by a diverse and sophisticated market. As Russia’s second-largest city and a cultural hotspot, Saint Petersburg has a thriving fine dining scene that supports strong demand for high-quality wines.

The Siberian District, encompassing cities like Novosibirsk and Krasnoyarsk, has a steadily growing wine market despite logistical challenges associated with its remote location. The demand for wine in this region is primarily driven by urban centers where consumers are becoming more interested in exploring different wine varieties.

Competitive Landscape:

One of the most significant steps taken by key players in the Russian wine industry is the expansion of domestic wine production. With government initiatives supporting local winemaking, companies are increasing investments in vineyards. Additionally, many wineries are modernizing their production facilities by adopting advanced winemaking technologies. These upgrades help improve the quality of domestic wines, allowing them to meet international standards. To enhance accessibility and reach a broader audience, key players in the Russian wine industry are strengthening their distribution networks. Supermarkets, hypermarkets, and specialized wine stores remain dominant channels for off-trade sales, and companies are working closely with retailers to optimize shelf space, improve visibility, and offer promotional deals.

The report provides a comprehensive analysis of the competitive landscape in the Russia wine market with detailed profiles of all major companies.

Latest News and Developments:

- November 2024: Russian winemakers proposed the development of a BRICS wine union to promote their products in the foreign markets and improve their operations. As wine markets are shifting this is considered a crucial step to make improvisations.

- November 2024: The Russian Wine Forum was held in Moscow and the event was sponsored by the Roscongress Foundation and the Association of Winegrowers and Winemakers of Russia with the aid of the Russian government.

- September 2024: A wine exhibition was held at the wine pavilion of Moscow’s iconic outdoor VDNKhA All-Russian Exhibition Centre where wineries throughout the country gathered to offer various types of wine for connoisseurs ad enthusiasts.

- August 2024: Russia announced its plan to get sparkling wine from India and Prosecco from Brazil to enrich the availability of wine in the country.

- February 2024: Abrau-Durso, a prominent alcohol company in Russia, presented a unique sparkling wine Cuvée Alexander II, created from special vintages, aged more than ten years old, and a young wine of 2022.

Russia Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered |

|

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia wine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia wine market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia wine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia wine market was valued at USD 9.50 Billion in 2024.

Growth is driven by increased domestic production, government incentives like subsidies and tax breaks for winemakers, changing consumer preferences toward wine, expansion of retail channels, and growing interest in organic and natural wines.

The Russia wine market is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 15.40 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)