Russia Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

Russia Watch Market Size and Share:

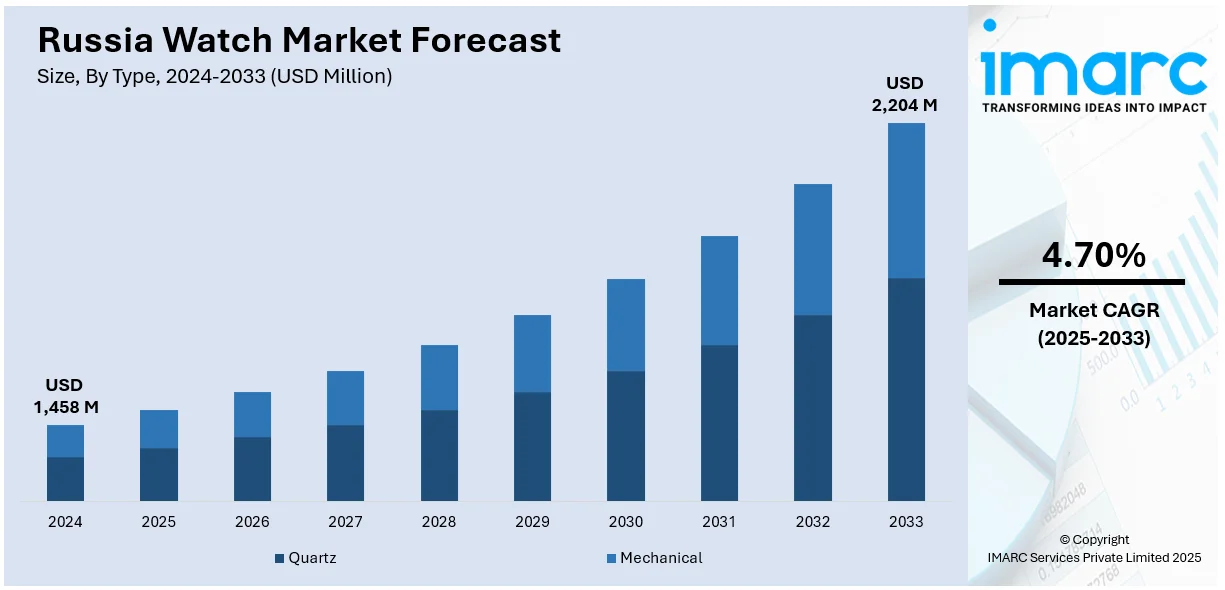

The Russia watch market size was valued at USD 1,458 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 2,204 Million by 2033, exhibiting a CAGR of 4.70% from 2025-2033. The growing interest in luxury goods, expanding e-commerce, and increasing gifting culture are propelling the market growth. Moreover, Russia watch market share is driven by the escalating demand for premium timepieces as status symbols, while online platforms enhance accessibility and convenience. Watches remains a premium choice for gifting, which further strengthens the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,458 Million |

| Market Forecast in 2033 | USD 2,204 Million |

| Market Growth Rate (2025-2033) | 4.70% |

Affluent buyers view luxury watches as a status symbol and long-term investments. High-net-worth individuals prefer exclusive, limited-edition timepieces from prestigious global brands. Luxury watch brands are expanding their presence in Russia through flagship stores and premium retail partnerships. Celebrity endorsements and influencer marketing enhance brand appeal, thereby catalyzing the demand for high-end watches. Buyers associate luxury watches with craftsmanship, heritage, and exclusivity, increasing interest in premium timepieces. Economic stability and high disposable income is encouraging buyers to invest in luxury watches. Russian collectors seek rare and vintage watches, driving the demand for premium brands. The secondary luxury watch market is growing, increasing brand desirability and resale value. Personalized services and VIP shopping experiences attract elite buyers to high-end watch boutiques. Digital platforms allow wealthy buyers to explore and purchase luxury watches conveniently. Limited production runs and collaborations with designers make luxury watches more desirable.

The Russia watch market demand is influenced by an increase in gifting culture. Watches are a sort after gift for birthdays, anniversaries, and corporate milestones, influencing overall sales. Shoppers prefer luxury and mid-range watches as prestigious and meaningful gift options. Holiday seasons and special occasions drive higher demand for premium timepieces across all price segments. Personalization options, such as engraving, make watches more appealing as thoughtful and customized gifts. Corporate gifting trends encourage businesses to purchase branded watches for employees and partners. Luxury brands promote watches as timeless and elegant gifts for high-profile occasions. E-commerce platforms offer gifting services including premium packaging and delivery, increasing online watch purchases. Social media marketing highlights watches as ideal presents, influencing buying decisions. Younger buyers choose stylish and fashion-forward watches as gifts for friends and loved ones. Limited-edition watches create exclusivity, making them desirable for collectors and high-end gifting. Retailers introduce festive discounts and special promotions to attract gift buyers during peak seasons.

Russia Watch Market Trends:

Expanding e-commerce and online sales

Expanding e-commerce and online sales are significantly driving the watch market in Russia. Digital platforms provide customers with easy access to a wide range of watch brands and models. As per a market report, e-commerce in Russia grew by 28% in 2023, reaching 6.4 trillion Rubles. Online retailers offer competitive pricing, discounts, and promotions, attracting budget-conscious and aspirational buyers. Secure payment gateways and flexible return policies enhance customer trust in purchasing watches through e-commerce. Social media marketing, influencer collaborations, and digital advertising increase brand visibility and online sales conversions. E-commerce platforms enable international brands to penetrate the Russian market without requiring extensive physical retail presence. Shoppers enjoy the convenience of browsing, comparing, and purchasing watches from the comfort of their homes. Artificial intelligence (AI)-powered recommendations and virtual try-on features improve the online shopping experience and customer engagement. Online-exclusive watch collections and limited-time offers create urgency, encouraging faster purchasing decisions among buyers. The rise of direct-to-consumer (D2C) models helps brands build stronger relationships and loyalty with online shoppers. Logistics advancements ensure faster and more efficient deliveries, further improving buyers’ confidence in e-commerce platforms.

Growing outbound tourism and duty-free shopping

Outbound tourism and duty-free shopping are significantly propelling the market’s growth and sales of watches in Russia. Industry reports states that Russians took over 29 million trips abroad in 2024, including 11.5 million for tourism, marking a 25% increase from 2023. Russian travelers purchase luxury and mid-range watches abroad, taking advantage of tax-free shopping opportunities. Duty-free stores in international airports and travel hubs offer premium watch brands at competitive prices. Many luxury brands cater to Russian tourists by providing exclusive models and Russian-language customer support. High-net-worth individuals prefer buying limited-edition timepieces while traveling to major shopping destinations worldwide. Shopping tourism remains a strong trend, with watches being a popular purchase among outbound travelers. Currency fluctuations sometimes make foreign purchases more attractive, driving demand for international watch brands abroad. Russian tourists visiting Europe, Dubai, and Asia frequently invest in high-end watches during their trips. Duty-free retail experiences provide convenient access to prestigious brands, increasing watch sales among traveling customers. Luxury retailers target Russian tourists through personalized services, discounts, and VIP shopping experiences in global markets. Growing international travel from Russia fuels greater interest in foreign watch brands and exclusive timepieces.

Increasing number of locally produced watches

Russian watch brands attract buyers with unique designs and craftsmanship. National pride encourages customers to choose domestic watches over expensive imported alternatives. Locally manufactured watches offer affordability, making them accessible to a broader range of customers. Russian brands emphasize quality mechanical movements, appealing to watch enthusiasts and collectors nationwide. Government support for domestic manufacturing strengthens production capabilities and enhance market competitiveness. Reduced dependence on imports helps stabilize prices and ensures a steady supply of watches in Russia. Local brands leverage historical significance and heritage to differentiate themselves from international competitors. Collaborations with designers and celebrities enhance brand image and increase buyer interest. Innovation in watchmaking technology improves product quality, attracting younger and tech-savvy buyers. Limited-edition Russian watches create exclusivity, driving the demand among collectors and enthusiasts. The growing trend of military and adventure watches improves local brand recognition. Expanding production capacity enables brands to meet rising demand and compete in international markets, which helps in strengthening the market growth.

Russia Watch Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia watch market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, price range, distribution channel, and end user.

Analysis by Type:

- Quartz

- Mechanical

Quartz watches dominate the market due to their affordability, precision, and low maintenance. They use a battery-powered quartz crystal, ensuring accurate timekeeping with minimal deviation. These watches appeal to mass who prioritize reliability and convenience. Many fashion and sports watch brands prefer quartz technology due to its cost-effectiveness. Advancements in battery life and digital integration further enhance their appeal.

Mechanical watches including automatic and manual-winding types, cater to luxury buyers and collectors. Their intricate craftsmanship, historical significance, and superior aesthetics drive demand, especially for premium and heritage brands. Watch enthusiasts appreciate the artistry and engineering behind their complex movements. Despite being more expensive and requiring regular servicing, mechanical watches symbolize status, tradition, and exclusivity. Limited-edition releases and collaborations with renowned designers enhance their desirability.

Analysis by Price Range:

- Low-Range

- Mid-Range

- Luxury

Low-range watches cater to budget-conscious buyers looking for affordability and functionality. These watches are often mass-produced, featuring quartz movements and simple designs. They appeal to students, entry-level professionals, and those needing a reliable everyday timepiece. Fast fashion brands and local manufacturers dominate this segment by offering trendy designs at competitive prices.

Mid-range watches attract buyers seeking a balance between quality, brand reputation, and affordability. These watches often feature better materials, enhanced durability, and reputable quartz or automatic movements. Buyers in this segment look for stylish designs, advanced features like water resistance, and moderate brand prestige. Many fashion and sports brands dominate this category, offering value-for-money products. Retailers and online platforms contribute to sales growth by highlighting brand heritage and durability.

Luxury watches symbolize status, craftsmanship, and exclusivity, appealing to affluent customers and collectors. They feature high-quality materials, intricate mechanical movements, and prestigious brand heritage. Limited editions and customization options enhance exclusivity, driving higher demand among enthusiasts. Luxury brands invest in flagship stores, personalized services, and collaborations to strengthen market positioning. Despite premium pricing, the segment remains resilient due to brand loyalty and investment value.

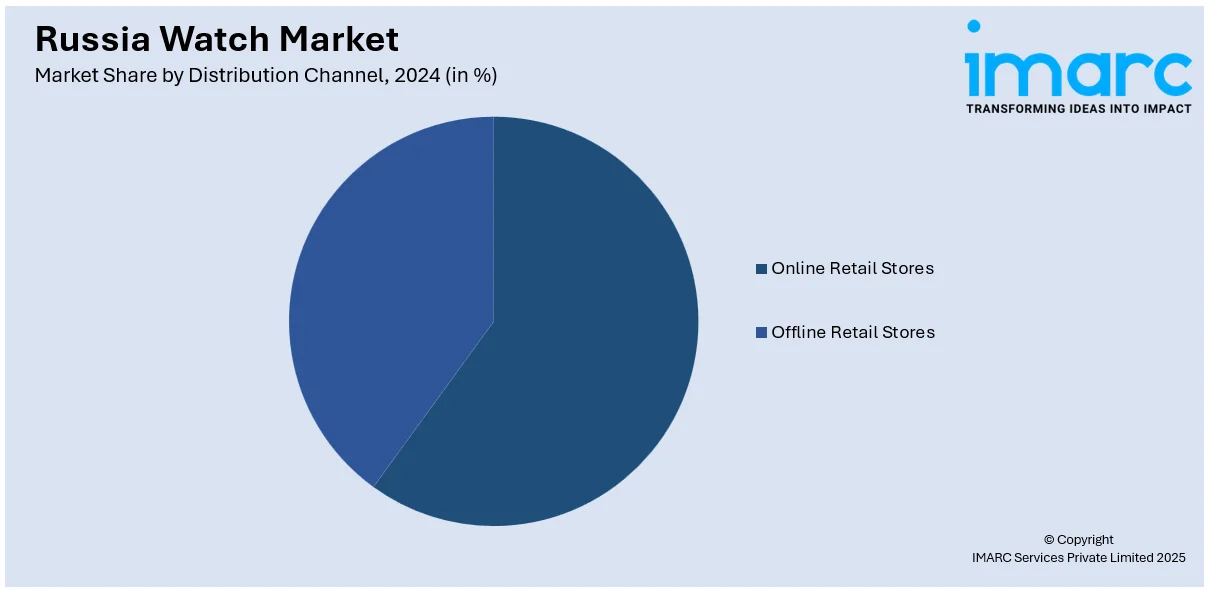

Analysis by Distribution Channel:

- Online Retail Stores

- Offline Retail Stores

Online retail stores are gaining traction due to their convenience, vast product selection, and competitive pricing. E-commerce platforms allow customers to browse various brands, compare prices, and read reviews before purchasing. Many brands offer exclusive online discounts, attracting price-sensitive buyers. Digital marketing, influencer endorsements, and social media campaigns further influences online sales. Secure payment options and easy return policies enhance customer confidence in purchasing watches online.

Offline retail stores remain essential for buyers who prefer a hands-on experience before purchasing a watch. Physical stores offer personalized customer service, expert guidance, and after-sales support, ensuring trust and satisfaction. Luxury brands rely heavily on flagship stores and authorized dealers to provide an exclusive shopping experience. High-end showrooms create an immersive brand experience that enhances desirability and strengthens customer loyalty. Department stores and multi-brand retailers contribute to market growth by offering a diverse selection under one roof.

Analysis by End User:

- Men

- Women

- Unisex

The men’s watch segment dominates the market due to higher demand for both luxury and functional timepieces. Many men consider watches an essential fashion accessory, symbolizing status, professionalism, and personal style. Mechanical and luxury watches are particularly in fashion among male buyers, with many preferring intricate craftsmanship and brand heritage. Sports and smartwatches also drive sales, catering to fitness-conscious and tech-savvy buyers. Premium brands focus on masculine designs, larger dials, and advanced features like chronographs.

The women’s watch segment is expanding as more brands introduce elegant and fashion-forward designs. Women often prefer watches with smaller dials, aesthetic appeal, and jewelry-inspired elements. Luxury brands incorporate diamonds, gold, and intricate detailing for catering to high-end buyers. Fashion brands dominate the mid-range segment by offering trendy, affordable options. The rise of smartwatches tailored for women, featuring health tracking and customizable designs, is further fueling the market growth.

Unisex watches are gaining traction as gender-neutral fashion trends rise. Many buyers prefer minimalist and versatile designs suitable for all genders. Brands are increasingly launching neutral-colored, medium-sized watches that appeal to a broader audience. Smartwatches and casual fashion brands drive this segment, emphasizing practicality and modern aesthetics. Unisex designs offer flexibility, making them ideal for gifting and shared usage.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, including Moscow, is the largest market due to high urbanization, affluent customers, and a strong retail network. Luxury watch brands are thriving in Moscow’s upscale shopping districts, where wealthy buyers seek premium timepieces. The region's economic activity and business culture drive the demand for high-end and mid-range watches. International brands establish flagship stores here to target elite customers. E-commerce penetration is also high, influencing online watch sales.

The Volga District has a diverse customer base, with demand for both affordable and premium watches. Industrial and business growth in cities like Kazan and Samara increases disposable income, expanding mid-range watch sales. The presence of shopping malls and multi-brand stores helps expand retail distribution. Local watch manufacturers cater to budget-conscious buyers, while international brands target aspirational customers. Digital platforms are becoming a key sales channel in this region.

The Urals District, with cities like Yekaterinburg, has a strong market for durable and high-quality watches. The region’s economic significance, driven by mining and heavy industries, creates a stable customer base with disposable income. Luxury and mid-range watches appeal to business professionals and collectors. Offline retail stores play a significant role, offering premium shopping experiences.

The Northwestern District including Saint Petersburg, has a growing luxury watch market due to its cultural and economic significance. High tourism inflow increases demand for premium brands through duty-free and retail stores. The region’s affluent population drives interest in high-end and limited-edition watches. Fashion-conscious individuals prefer stylish and statement timepieces, benefiting both luxury and mid-range segments. The presence of luxury boutiques expands offline sales.

The Siberian District has a demand for durable and practical watches, given its extreme climatic conditions. Buyers prefer robust, water-resistant, and temperature-resistant models suited for outdoor activities. The market leans toward affordable and mid-range watches, with some demand for premium brands among affluent buyers. Retail presence is growing, but online shopping plays a crucial role in reaching remote areas. Military-style and adventure watches are in trend, which is a key factor propelling the growth of the market in the region.

Competitive Landscape:

Luxury brands are strengthening their presence with exclusive stores and collections. Russian watchmakers attract buyers with heritage craftsmanship and affordable mechanical timepieces. Online and offline retailers enhance accessibility, offering diverse product ranges for budget-conscious and luxury customers alike. Digital marketing, celebrity endorsements, and influencer collaborations increase brand awareness and influence watch sales significantly. Personalized customer experiences, after-sales services, and premium showrooms improve customer loyalty and market competitiveness. Key players focus on limited-edition releases and mechanical innovations to attract watch collectors and enthusiasts. International partnerships with Russian brands encourage technological advancements and strengthen the domestic watch manufacturing industry. E-commerce platforms facilitate direct-to-consumer (D2C) sales, allowing brands to expand reach without extensive physical retail presence. Adapting to fluctuating exchange rates, brands adjust pricing strategies to maintain affordability and demand. Smartwatches and hybrid models are gaining traction as key players introduce advanced technology and health-tracking features.

The report provides a comprehensive analysis of the competitive landscape in the Russia watch market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Russian brand Космос unveiled two limited-edition series, at Moscow Watch Expo 2024. The Marsohod II features a multifunctional automatic movement with Cyrillic script indicators, highly valued by customers. The Sputnik series showcases an automatic movement visible through a dial aperture. Both models have transparent casebacks with individual numbering in xx/50 format, secured with screws, and offer enhanced water resistance of 10 atmospheres.

- August 2024: Independent Russian watchmaker Konstantin Chaykin introduced the "ThinKing," a mechanical wristwatch with an ultra-thin 1.65-millimeter profile and a weight of just 13.3 grams (excluding the strap). This innovation sets a new benchmark, competing with luxury brands like Bulgari, Piaget, and Richard Mille.

- March 2023: Sturmanskie introduced a Heritage model in the Gagarin collection for Cosmonautics Day, inspired by the original 1949 watch. It features vintage dial markings, index shapes, and a "Sturmanskie 1st Kirov MWF" inscription. A portrait of Yuri Gagarin appears on the dial and back.

Russia Watch Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Russia watch market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia watch market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The watch market in the Russia was valued at USD 1,458 Million in 2024.

The Russia watch market growth is driven by rising interest in luxury goods, which increases the demand for premium timepieces as status symbols and investments. Expanding e-commerce enhances accessibility, offering convenience, discounts, and wider brand choices. Increasing gifting culture influences watch sales, with buyers preferring them for special occasions. Duty-free shopping and outbound tourism encourage purchases of high-end watches abroad, further strengthens the market growth.

The Russia watch market is projected to exhibit a CAGR of 4.70% during 2025-2033, reaching a value of USD 2,204 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)