Russia Washing Machine Market Size, Share, Trends and Forecast by Product, Technology, Capacity, Application, End Use, and Region, 2025-2033

Russia Washing Machine Market Size and Share:

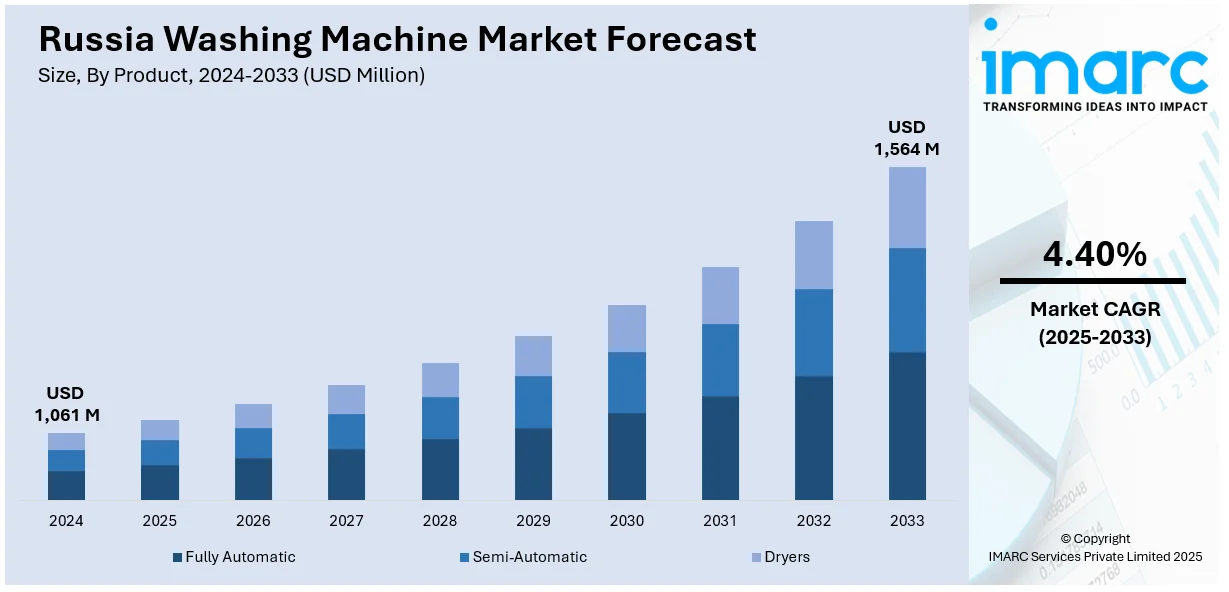

The Russia washing machine market size was valued at USD 1,061 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,564 Million by 2033, exhibiting a CAGR of 4.40% from 2025-2033. The Russia washing machine market share is propelled by rising urbanization and increasing household appliance adoption, growing disposable income and improving living standards, expansion of e-commerce and retail distribution channels, increasing demand for energy-efficient and smart washing machines, and government initiatives supporting local manufacturing and import substitution.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,061 Million |

| Market Forecast in 2033 | USD 1,564 Million |

| Market Growth Rate (2025-2033) | 4.40% |

The Russia washing machine market growth is being driven mainly by increasing urbanization and the changing lifestyles of consumers. According to industry reports, in 2025, 75.0% of the population in Russia lives in urban areas. Rising migration to urban centers is creating a growing demand for modern, energy-efficient home appliances. In cities, consumers are seeking advanced features such as smart connectivity and energy-saving functions for their busy, convenience-oriented lifestyles. With increasing disposable incomes among middle-class families, consumers are spending much more on advanced washing machines. From premium models that provide quick cycles to smart controls, the overall Russia washing machine market demand has been growing due to this trend.

Besides this, according to the Russia washing machine market forecast, other important market drivers are the expansion of real estate and construction industries, as more washing machines are in demand in newly constructed homes, apartments, and commercial buildings. Another factor that drives the industrial-grade washing machine market is the hospitality industry, with the increasing demand from hotels and resorts. According to the IMARC Group, the Russia hospitality market is expected to grow at a CAGR of 5.20% during 2024-2032. Moreover, consumers in Russia are getting more aware of environmental issues and thus increasing the demand for energy-efficient and eco-friendly washing machines. The concern over water and energy consumption has led both the residential and commercial sectors to prefer models that can reduce resource usage, thereby propelling innovation and market growth.

Russia Washing Machine Market Trends:

Significant technological advancements

Technological innovation is a major growth driver of the Russia washing machine market. Washers are now increasingly sought after, particularly smart products that integrate features such as remote control, connectivity with smartphones, and integration with home automation systems. These enhance convenience for users by enabling them to start, stop, and monitor laundry cycles without physically having to be present in the location of the appliance. The demand for advanced wash programs such as quick wash, delicate care, and allergy-friendly cycles has also fueled technological changes in washing machines. With continuous innovation from manufacturers, consumers are becoming interested in appliances that offer high performance, convenience, and sustainability, creating a positive Russia washing machine market outlook overall.

Growing demand in the commercial sector

Increasing demand from the commercial market is significantly influencing the industry, as per the Russia washing machine market report. As the hospitality sector expands, hotels, resorts, and restaurants are increasing their usage of industrial washing machines to address heavy volumes of laundry. There is also a rise in the demand for durable washing machines in the healthcare industry that can effectively sanitize hospital gowns, medical linens, and other personal items and towels. Furthermore, as Russia’s urbanization increases, more businesses are opening in metropolitan areas, which boosts the demand for washing machines that can cater to the needs of commercial laundry services. This demand from both the hospitality and healthcare sectors encourages manufacturers to provide specialized machines designed for heavy-duty use, contributing significantly to market growth.

Changing consumer preferences toward convenience and efficiency

The Russia washing machine market trends indicate that consumer preferences are shifting toward more convenient and efficient products, propelling industry growth. The busy, modern lifestyles of consumers, particularly within urban areas, make them seek machines that will save time, energy, and water. Consequently, washing machines with quick wash cycles, smart features, and energy-efficient functions have gained a lot of demand. Moreover, many consumers wish to have a big capacity and even higher washing machine speed so that they can successfully manage their cleaning chores. Preferences for appliances producing better results with minimal input mirror the trend of convenience and the efficiency of goods, which fuels the growing market for innovative washing machines.

Russia Washing Machine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia washing machine market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product, technology, capacity, application, and end use.

Analysis by Product:

- Fully Automatic

- Front Load

- Top Load

- Semi-Automatic

- Dryers

The fully automatic washing machines category has dominance in the Russian market due to its convenience and advanced features. The machines, due to their ease of use, with less manual effort required, are a favorite among consumers. Fully automatic machines, with intelligent technology, energy efficiency, and various wash programs, are in demand by a large number of consumers, and therefore, they are very popular.

Semi-automatic washing machines are an affordable choice for price-sensitive consumers in Russia. The machines require manual effort for water filling and draining but offer better control over the washing process. Semi-automatic machines are also very popular in small families or rural regions where the availability of electricity is not stable. They are also an affordable choice as compared to fully automatic machines.

The dryers segment in the Russia washing machine market is on the rise as the demand for quick laundry solutions among consumers increases. Dryers are particularly popular in cities with smaller living spaces, where air drying is less feasible. In countries with cold climates, dryers are a convenient choice to use throughout the year, and the presence of energy-efficient models makes them a desirable choice for households.

Analysis by Technology:

- Smart Connected

- Conventional

Smart connected washing machines are becoming very popular in the Russian market, with increased consumer interest in convenience and efficiency. These machines have remote smartphone access for control and monitoring of cycles and are often integrated into home automation systems. The aspects of energy monitoring, customization of cycles, and troubleshooting via an app make these machines appealing to technology enthusiasts and drive demand in the market for these devices.

Traditional washing machines occupy a considerable share, even though they are not as technologically advanced as smart ones. These are usually more affordable and easier to handle for those consumers who are really concerned with basic functionality rather than with numerous features. The segment is popular among rural dwellers and price-conscious buyers who value reliability and efficiency in laundry equipment.

Analysis by Capacity:

- Below 6 kg

- 6.1 to 8 kg

- Above 8 kg

The capacity of less than 6 kg is preferred in small households, single-person homes, or apartments where space is limited. These models are for individuals with lower laundry loads and for those who consider compact, affordable appliances as their priority. Though they have a smaller capacity, they provide basic functionality and efficiency, which is why they are so popular among budget-conscious buyers in Russia.

The 6.1 to 8 kg capacity segment holds a significant share in the Russia washing machine market. These machines offer a perfect balance between affordability and practicality, which makes them suitable for medium-sized households. They are popular due to their ability to handle moderate laundry loads, energy efficiency, and versatile wash programs, appealing to a broad range of consumers.

Above 8 kg capacity washing machines are designed for large families or bigger households that have higher laundry needs. These products are in increasing demand in Russia because they can take on more massive loads, thus requiring fewer cycles and less energy. They have larger drum sizes and other advanced features to appeal to high-performance and convenience-seeking consumers in urban settings.

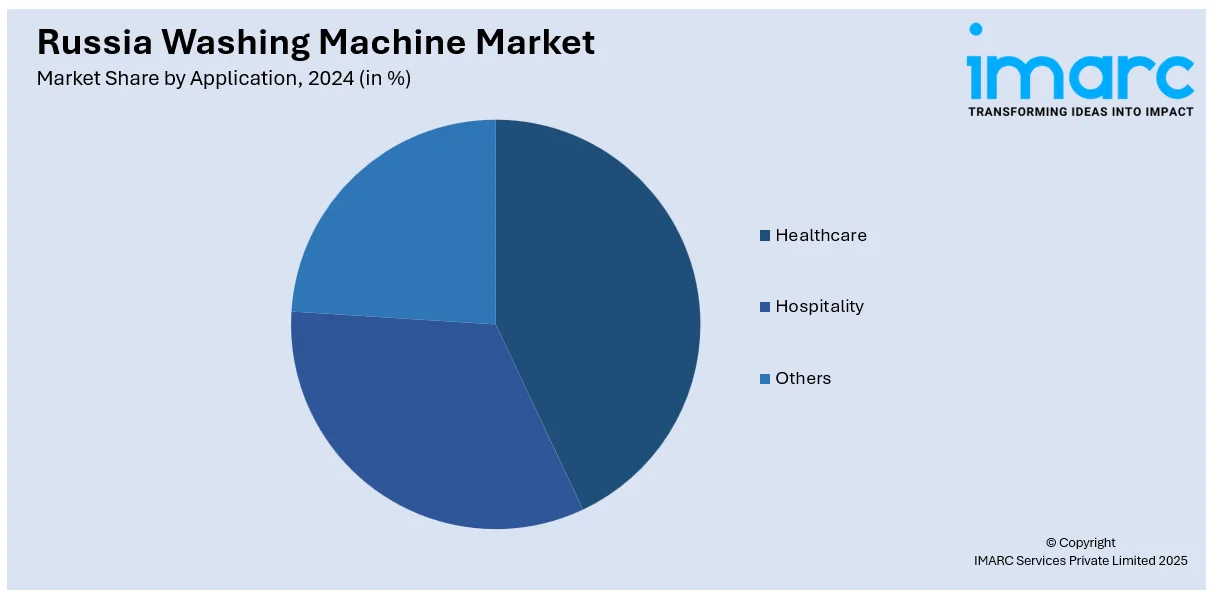

Analysis by Application:

- Healthcare

- Hospitality

- Others

The health sector requires washing machines to ensure hygiene standards. Heavy-duty washing machines in hospitals and clinics are employed for cleaning medical linens, surgical gowns, and patient apparel. The laundry volume to be handled is enormous while ensuring proper cleaning and disinfection with specific standards of health-related regulations. This demand for high-efficiency sterilizing machines drives this segment.

The hospitality sector, including hotels, resorts, and restaurants in Russia, also employs industrial washing machines to wash its high levels of linens, towels, and uniforms. In this sense, the durability and high-capacity laundry operation abilities of industrial washing machines play an important role in maintaining efficiency and ensuring energy efficiency. Increased tourism and expansion of the hospitality sector drive the application of industrial washing machines due to the demand for more dependable laundry solutions.

The others segment encompasses various sectors such as retail, residential, and laundromats, where washing machines are used for routine laundry needs. This broad category also includes specialized applications, such as in fitness centers or spas, where maintaining clean towels and uniforms is essential. The diverse needs across these sectors contribute to the steady growth of this market segment.

Analysis by End Use:

- Commercial

- Residential

The commercial market for washing machines in Russia primarily consists of business users, such as hotels, laundromats, hospitals, and restaurants. These are high-volume applications requiring robustness, efficiency, and short turnaround times. As the need for laundry services increases in urban areas and in the hospitality industry, the commercial market for washing machines in Russia is growing.

The residential segment accounts for a large share in the Russia washing machine market, as most households require appliances for regular laundry needs. Residential washing machines come in a wide variety of capacities and technologies, from basic models to advanced, smart-connected versions. With increasing urbanization and changing lifestyles, the demand for energy-efficient, compact, and feature-rich residential washing machines is steadily rising across Russia.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District leads the Russian market, which contains major urban centers such as Moscow. The higher population density, along with higher disposable income, drives a higher demand for modern, energy-efficient, and smart-connected washing machines. Urbanization and the increasing shift toward convenient appliances further fuel growth in this district.

The Volga District is also witnessing stable demand for washing machines as the region continues to flourish economically. There is a growing preference for affordable yet reliable models of washing machines. Residential and commercial applications are predominant in this region, with a mix of basic and advanced washing machines serving diverse consumers in urban and rural areas.

The washing machine market is displaying an upward trend in the Urals District, with much growth in urban centers such as Yekaterinburg. Consumers are showing significant interest in budget-friendly and mid-range models as the region's industrial and economic activities grow. Consumers are opting for energy-saving and long-lasting washing machines, which is making the Urals region a hotspot in the overall market space.

Competitive Landscape:

The key players in the Russia washing machine market are leading growth by emphasizing innovation and localization. Brands are launching sophisticated features, including energy efficiency, smart technology, and green solutions, to address the growing need for more eco-friendly and convenient appliances. Concurrently, these brands are investing in local production, minimizing dependence on imports, and increasing domestic output. They are also improving customer experiences by expanding product offerings, catering to multiple price points, and ensuring after-sales services. These moves address changing consumer tastes and also enhance their competitive position in the market, driving overall market growth.

The report provides a comprehensive analysis of the competitive landscape in the Russia washing machine market with detailed profiles of all major companies.

Latest News and Developments:

- 21 March 2023: Wildberries, an online retailing platform in Russia, is launching a line of household appliances, including washing machines and refrigerators, under its brand name in the domestic market. The collection will be marketed through the ‘Ruzz’ and ‘Razz’ brands. The appliances will be manufactured in Russia, China, and Belarus.

Russia Washing Machine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Technologies Covered | Smart Connected, Conventional |

| Capacities Covered | Below 6 kg, 6.1 to 8 kg, Above 8 kg |

| Applications Covered | Healthcare, Hospitality, Others |

| End Uses Covered | Commercial, Residential |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia washing machine market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia washing machine market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia washing machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia washing machine market was valued at USD 1,061 Million in 2024.

The rising urbanization and increasing middle-class households, growing demand for energy-efficient and smart appliances, expansion of local manufacturing due to import restrictions, increasing penetration of e-commerce and retail channels, and government policies promoting domestic appliance production are the primary factors driving the growth of the Russia washing machine market.

IMARC estimates the Russia washing machine market to exhibit a CAGR of 4.40% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)