Russia Warehouse Market Size, Share, Trends and Forecast by Sector, Ownership, Type of Commodities Stored, and Region, 2025-2033

Russia Warehouse Market Size and Share:

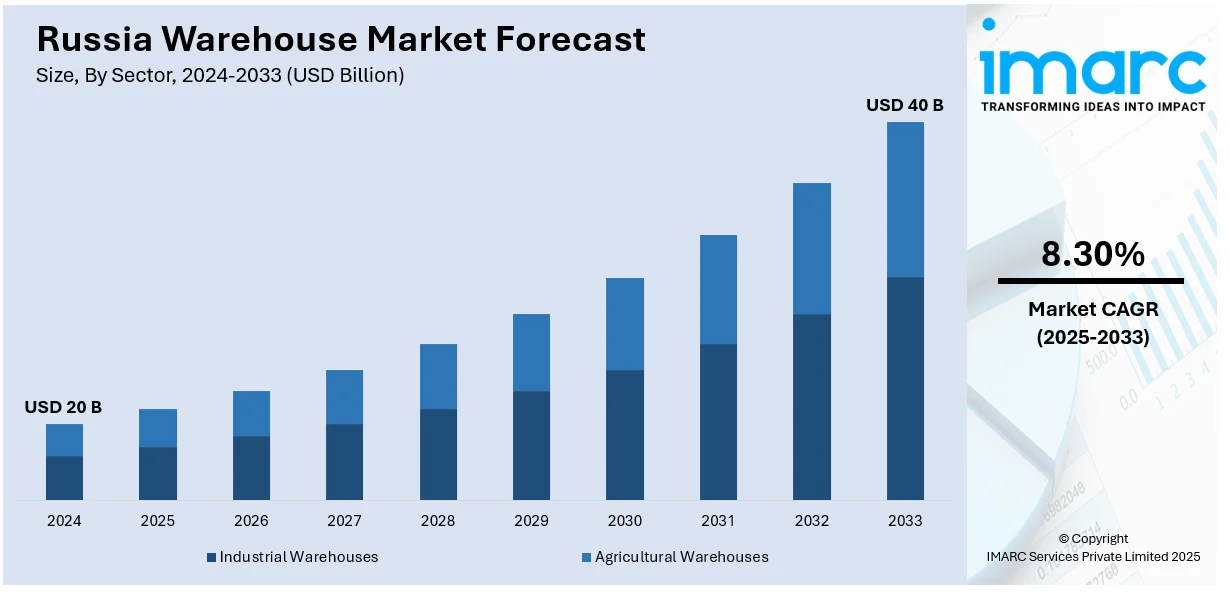

The Russia warehouse market size was valued at USD 20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 40 Billion by 2033, exhibiting a CAGR of 8.30% from 2025-2033. The Russian warehouse market share is expanding, driven by e-commerce expansion for providing online shopping facilities to the masses, infrastructure development for improved storage systems, regional logistics innovations, automation adoption for improving the efficiency of various operations, and rising investments in distribution and last-mile logistics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20 Billion |

| Market Forecast in 2033 | USD 40 Billion |

| Market Growth Rate (2025-2033) | 8.30% |

The warehouse market in Russia has experienced a significant change. A combination of macroeconomic factors, technological advancements, and shifts in consumer behavior have all played a role in this transformation. The expansion of omnichannel retail has also generated a demand for improved, strategically placed distribution centers. Retailers are putting money into logistics infrastructure to guarantee that products are delivered more quickly and distributed more effectively across long distances. Dark stores, micro-fulfillment centers, and last-mile distribution hubs emerge as the key components of the warehouse framework. To meet these evolving needs, developers are increasingly depending on advanced technologies such as automation, artificial intelligence (AI), and robotics to enhance the efficiency and effectiveness of the process, thereby propelling the Russia warehouse market growth.

Sustainability is a very significant aspect in the Russian warehouse market, as the demand for energy-efficient buildings and eco-friendly logistics practices increases. Companies have been adopting green building standards to cut down on the costs of operation and reduce their impact on the environment. The employment of energy-efficient lighting systems, renewable energy sources, and sustainable construction materials is increasingly becoming popular among developers and tenants. Other changes in the regulatory aspect have also led to environmental compliance that requires the use of sustainable warehouse solutions. Russian regulations have, for instance tightened their rules regarding carbon emissions and waste management thus making companies invest in greener logistics strategies.

Russia Warehouse Market Trends:

Growth of E-Commerce and Omnichannel Retail

Expansion in e-commerce, especially in Russia, has become one of the major demand generators for warehouses. Online retail sites have witnessed several innovations and need more fulfillment centers, sorting hubs, and last-mile delivery infrastructures. Online shoppers are demanding faster shipping, easy returns, and all of this is being driven by making investments in warehouses strategically located in a manner to ensure distribution without any issues. Additional traction has come in the way of omnichannel retailing, where physical brick-and-mortar retailers are integrating online sales channels. Several organizations are arranging regional warehouses to reduce shipment lead times and maximize supply chain functions to ensure smooth order fulfilment, thereby offering a favorable Russia warehouse market outlook. Furthermore, the IMARC Group has indicated that the Russia e-commerce market size is projected to reach USD 283.4 Billion by 2032. Therefore, there will be a greater need for warehouses to store inventories.

Infrastructure Development and Government Initiatives

Large-scale infrastructure projects initiated by the Russian government for the improvement of the country's logistics and transportation network have impacted the warehouse market directly. Improvements in highway, railroad, and port infrastructure have increased the connectivity between industrial centers and consumer markets, hence making warehouse locations more strategically viable. Modernizing key trade corridors has positioned Russia as a very important logistics hub for Eurasian trade. Besides, in 2024, Moscow is included in the national program aimed at creating the first high-speed rail in Russia. Construction of the Moscow-Saint Petersburg high-speed rail is being carried on in the city. This is a major step towards improving logistics operations.

Rising Demand for Class A Warehousing and Automation

The shift towards high-quality Class A warehouses is another critical factor contributing the Russia warehouse market growth. More businesses are shifting away from old warehouse storage into modern structures with advanced systems, higher ceilings, improved security systems, and energy efficiency. Class A warehouses are in huge demand among e-commerce companies, third-party logistics (3PL) suppliers, and manufacturers looking to optimize their operations to have more reliable supply chains. Automation is also defining the future needs for warehouses. The warehouse management systems (WMS), automated storage and retrieval systems (ASRS), and robots are deployed at warehouses in increasing numbers for achieving greater efficiency, as they avoid dependence on man. Increasing implementation of Internet of Things devices with real-time analytics enhances tracking inventory and providing increased visibility of operational performance. During 2024, a top Russian food retailer, X5 Group developed and tested a Nexus WMS as an internal application to its users. The in-house software allowed automation of its business process with the support of warehouse operations. The software is utilized in overseeing warehouse activities from the point when products hit a distribution center right up to forwarding along the logistics chain.

Russia Warehouse Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia warehouse market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sector, ownership, and type of commodities stored.

Analysis by Sector:

- Industrial Warehouses

- Agricultural Warehouses

Industrial warehouses are critical in supporting various manufacturing and retail businesses of Russia through the storage and distribution of raw materials, finished goods, and components. Such facilities are located conveniently proximate to industrial zones, highways, and logistics corridors to enable efficient transportation and supply chain management. Demand for modern industrial warehouses has been growing with increased domestic manufacturing, reshoring initiatives, and an expanding e-commerce market.

Agricultural warehouses serve as essential storage facilities for Russia’s vast agribusiness sector, ensuring the proper handling, preservation, and distribution of grains, vegetables, dairy products, and other perishable goods. Given Russia’s role as one of the world’s leading grain exporters, the demand for grain storage silos and temperature-controlled agricultural warehouses remains strong. These facilities are typically located in key agricultural regions, close to production sites, ports, and railway networks to streamline export operations. The increasing emphasis on food security and supply chain resilience has led to investments in modern storage solutions with climate-controlled environments, pest management systems, and automated inventory tracking.

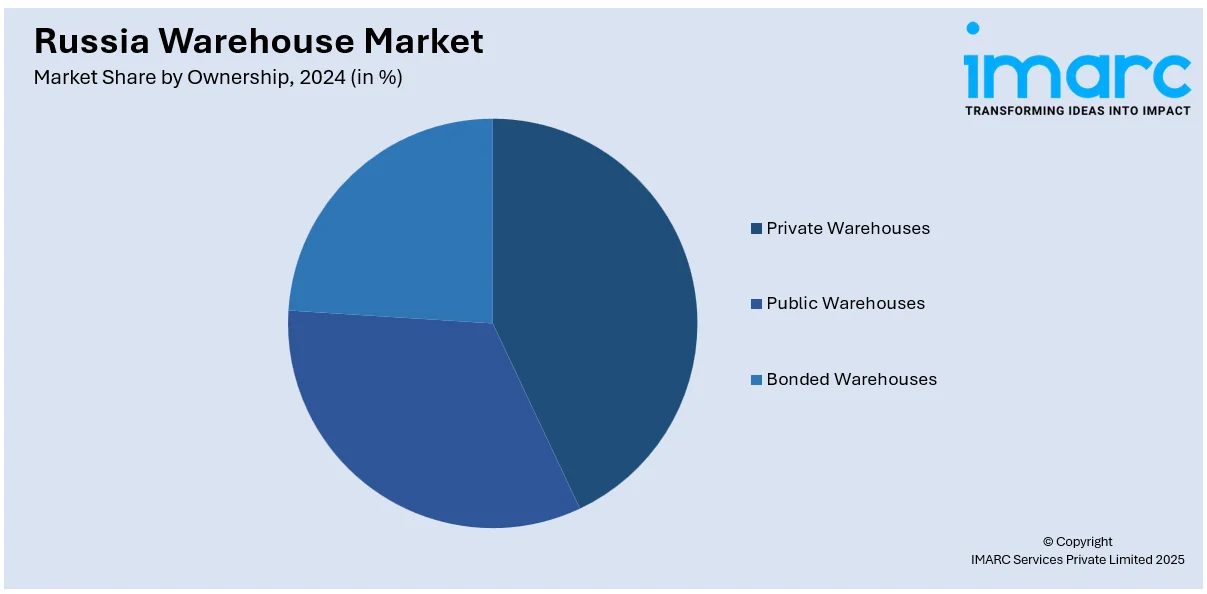

Analysis by Ownership:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

Private warehouses are owned and operated by businesses to store their goods exclusively, providing greater control over inventory management, security, and logistics operations. These warehouses are commonly used by large manufacturers, retailers, and e-commerce companies that require dedicated storage space to ensure seamless supply chain operations. In Russia, private warehouses are often located near major industrial hubs, logistics corridors, and urban centers to facilitate efficient distribution.

Public warehouses are third-party storage facilities available for use by multiple businesses on a rental or lease basis. These warehouses are managed by logistics service providers and offer flexible storage solutions for companies that do not require permanent warehouse ownership. In Russia, public warehouses are particularly beneficial for small and medium-sized enterprises (SMEs), seasonal businesses, and importers who need temporary storage for their goods. These facilities provide cost-effective solutions by eliminating the need for businesses to invest in their own storage infrastructure.

Bonded warehouses play a crucial role in Russia’s import-export trade by allowing businesses to store goods without immediately paying customs duties and taxes. These facilities are typically located near ports, airports, and international trade zones, providing a secure environment for imported goods awaiting clearance or re-export. Bonded warehouses help businesses manage cash flow efficiently by deferring tax payments until the goods are officially released into the market.

Analysis by Type of Commodities Stored:

- General Warehouses

- Specialty Warehouses

- Refrigerated Warehouses

General warehouses are versatile storage facilities designed to accommodate a wide range of non-perishable goods, including consumer products, industrial supplies, and retail merchandise. These warehouses are widely used by manufacturers, wholesalers, and e-commerce businesses that require efficient inventory management and distribution networks. In Russia, general warehouses are typically located near major transportation hubs, allowing seamless connectivity for domestic and international trade.

Specialty warehouses are designed to store specific types of goods that require unique handling, storage conditions, or regulatory compliance. These include hazardous materials, pharmaceuticals, chemicals, electronics, and high-value products such as luxury goods and automotive parts.

Refrigerated warehouses, also known as cold storage facilities, are essential for preserving perishable goods such as food, beverages, pharmaceuticals, and biotechnology products. These warehouses are equipped with temperature-controlled systems to maintain optimal storage conditions, preventing spoilage and ensuring product quality. In Russia, refrigerated warehousing is crucial due to the country’s large agricultural sector and increasing demand for fresh and frozen food products.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, particularly Moscow and its surrounding regions, serves as the largest and most developed logistics hub in Russia. Due to its strategic location, well-established infrastructure, and proximity to major consumer markets, this region dominates the country's warehouse market. The high concentration of industrial activities, retail centers, and e-commerce fulfillment operations has driven significant demand for modern logistics facilities.

The Volga District is a key industrial and agricultural center, contributing significantly to Russia’s manufacturing and food production sectors. Major cities such as Kazan, Samara, and Nizhny Novgorod serve as critical logistics hubs, supporting the storage and distribution of automotive components, machinery, and agricultural goods. The region’s well-developed transportation infrastructure, including access to the Volga River and extensive rail networks, makes it an attractive location for warehousing and logistics operations.

The Urals District is a major industrial powerhouse, known for its mining, metallurgy, and heavy manufacturing industries. Cities such as Yekaterinburg, Chelyabinsk, and Perm play a crucial role in Russia’s supply chain network, serving as important centers for the storage and transportation of industrial goods, machinery, and raw materials.

The Northwestern District, anchored by St. Petersburg, serves as Russia’s primary gateway for international trade with Europe. The region is home to one of the largest seaports in the country, making it a critical hub for import and export activities. The strong presence of multinational corporations, coupled with well-developed transportation links, has led to significant demand for modern warehouse infrastructure.

The Siberian District, characterized by its vast geography and extreme climate conditions, plays a crucial role in Russia’s logistics network, particularly for the transportation of natural resources, agricultural products, and consumer goods. Major cities such as Novosibirsk, Krasnoyarsk, and Irkutsk serve as key distribution centers, linking western and eastern Russia.

Competitive Landscape:

Major logistics companies and real estate developers are significantly increasing investments in warehouse infrastructure to meet the rising demand for high-quality storage facilities. In Moscow, St. Petersburg, and other key logistics hubs, developers are constructing Class A warehouses equipped with advanced storage systems, high ceilings, and state-of-the-art security measures. This shift is being driven by retailers, manufacturers, and third-party logistics (3PL) providers seeking to optimize inventory management and streamline distribution processes. To enhance operational efficiency, key market players are increasingly integrating advanced technologies into warehouse management. The adoption of automation, robotics, and artificial intelligence (AI)-driven analytics is transforming warehouse operations, improving inventory accuracy, and reducing labor costs. Recognizing the need to improve delivery efficiency, key market players are expanding their warehouse networks to regional markets. Traditionally, Moscow and St. Petersburg have been the dominant logistics hubs, but increasing demand from businesses operating in smaller cities and remote areas has led to the development of regional warehousing facilities.

The report provides a comprehensive analysis of the competitive landscape in the Russia warehouse market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: The Chinese car exporter Biulu (Chongqing Biulu Automotive Technology Co., Ltd) has established a consignment warehouse in Belarus to hold Chinese, European, and other vehicles for future shipments to Russia and CIS nations.

- September 2024: Wildberries introduced a new business division for warehouse automation, named WB Automation, according to the marketplace. The firm will offer solutions utilizing both Wildberries' proprietary technologies and partner products tailored for the Russian market.

Russia Warehouse Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Industrial Warehouses, Agricultural Warehouses |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| Types of Commodities Stored Covered | General Warehouses, Speciality Warehouses, Refrigerated Warehouses |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia warehouse market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia warehouse market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia warehouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia warehouse market was valued at USD 20 Billion in 2024.

The market is driven by e-commerce expansion, infrastructure development, rising demand for Class A warehouses, and increasing automation adoption. Government-led logistics initiatives, investments in regional distribution centers, and sustainability trends are also boosting growth. Additionally, omnichannel retail and last-mile delivery networks are fueling demand for modern warehouse facilities.

The Russia warehouse market is projected to exhibit a CAGR of 8.30% from 2025-2033, reaching a value of USD 40 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)