Russia Tyre Market Size, Share, Trends and Forecast by Design, End-Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033

Russia Tyre Market Size and Share:

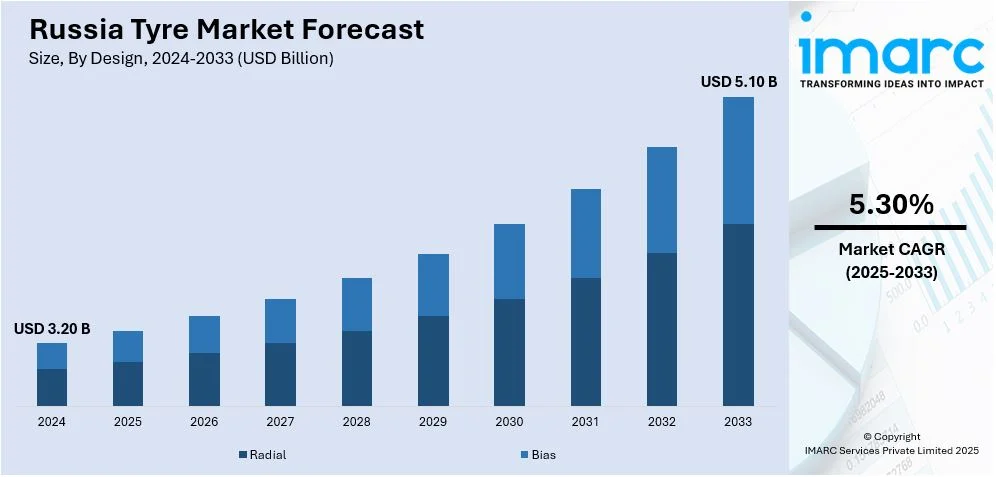

The Russia tyre market size was valued at USD 3.20 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.10 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. Growing automotive production, increasing vehicle ownership, high demand for winter tyres due to extreme weather, expanding logistics and transportation sectors, rising industrial and mining activities, government safety regulations, strong domestic manufacturing, stable raw material supply, technological advancements, and expanding retail and distribution networks are driving Russia’s tyre market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.20 Billion |

| Market Forecast in 2033 | USD 5.10 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

The Russia tyre market share is expanding significantly due to the rising automotive sector, with rising vehicle production and sales fostering demand for both OEM and replacement tyres. For instance, according to Autostat, Russia sold 1.571 million new passenger cars in 2024, a 48.4% year-over-year gain. With 436,155 vehicles sold, leading Russian carmaker Avtovaz recorded a 34.4% increase in sales, gaining 28% of the market. However, as rising inflation, loan rates, and scrappage penalties drove up prices, December sales growth slowed to 3.3%, with 123,431 automobiles sold. Moreover, increasing disposable incomes and urbanization have led to greater vehicle ownership, which is further supporting tyre sales. Additionally, growth in e-commerce and last-mile delivery services has propelled the demand for commercial vehicle tyres. Apart from this, the development of smart and fuel-efficient tyres has also gained traction as manufacturers focus on innovation. Also, stricter environmental regulations are encouraging the adoption of eco-friendly and retreaded tyres, thus influencing purchasing patterns.

Furthermore, the increasing focus on road infrastructure development and highway expansion has accelerated demand for durable and high-performance tyres in the country. On December 22, 2024, President Vladimir Putin attended the inauguration of a number of transportation infrastructure projects throughout Russia via videoconference. These projects include bypasses surrounding Malye Vyazyomy hamlet, the cities of Nizhnekamsk and Naberezhnye Chelny, five towns in the Republic of Bashkortostan, the Vitebsk crossroads in St. Petersburg, and a high-speed access road to the Crimean Bridge. The President underlined that the nation's continuous efforts to improve its transportation infrastructure include these advances. Moreover, seasonal demand fluctuations, particularly for winter tyres due to Russia’s harsh climate, play a crucial role in market dynamics. Also, rising foreign investments in domestic tyre manufacturing have strengthened local production capacity and the shift towards electric vehicles is also reshaping tyre demand, with a need for specialized low-rolling resistance tyres. Besides, government policies supporting the domestic automotive industry and tariffs on imports are further shaping the competitive landscape.

Russia Tyre Market Trends:

Rising Demand for Winter and All-Season Tyres

Russia’s extreme climate conditions, characterized by harsh winters and icy roads, have driven strong demand for winter tyres. For instance, as per an article published on April 2024, with winter temperatures in places like Siberia falling below -30°C, Russia is known as the world's coldest nation. Russia's reputation for being extremely cold is cemented by the frequent temperatures below -30°C in cities like Norilsk. Because winter tires offer superior traction and handling on ice roads, they are crucial for safe transportation in these severe circumstances. Due to the harsh weather, winter tires must be widely used in order to guarantee vehicle safety during the long and cold winters. Stringent government regulations mandating the use of winter tyres during specific months have further fueled market growth. Consumers are increasingly opting for all-season tyres as a cost-effective alternative, reducing the need for seasonal tyre changes. Advancements in tyre technology, such as enhanced tread patterns and improved rubber compounds, are making winter and all-season tyres more efficient. This trend is also influenced by increasing awareness of road safety and a growing preference for high-performance, durable tyre solutions.

Growth in Domestic Tyre Manufacturing

Russia tyre market forecast is expanding due to a rise in domestic tyre manufacturing, driven by government support, import substitution policies, and foreign investments in local production facilities. Notably, on February 27, 2024, Russian Ministry of Industry and Trade declared that the nation's tire industry has completely adjusted to the difficulties brought on by the sanctions. With domestic companies supplying all of the demand for synthetic rubbers and natural rubbers being imported from allies, the industry has secured all necessary feedstock components. Additionally, the government noted that Russia has 18 tire manufacturing facilities and that the market volume was roughly 76 million tires in 2023. Leading global tyre brands have established production plants in the country to cater to growing demand while reducing dependency on imports. The localization of tyre production has helped in cost reduction and improved supply chain efficiency. Additionally, the presence of domestic brands is intensifying competition, leading to better pricing strategies and product innovations. Rising geopolitical tensions and trade restrictions have further strengthened the focus on self-sufficiency in the tyre sector.

Increasing Popularity of Retreaded and Eco-Friendly Tyres

Sustainability concerns and cost-effectiveness are driving the demand for retreaded and eco-friendly tyres in Russia. For instance, with plans to treble its capacity in five years, Ecostar Factory opened a second facility in Vladivostok in January 2025 with the goal of recycling over 10,000 tonnes of end-of-life tires yearly. The project was given a total investment of USD 500,000, which was funded by a mix of 70% bank loans and 30% cash. The Federal Government Fund for SMEs and the Primorye Government Guarantee Fund offered a 7% subsidized interest rate. The high costs of new tyres have led commercial fleet operators and logistics companies to opt for retreading, extending tyre life and reducing expenses. Government regulations promoting environmental sustainability have encouraged tyre manufacturers to develop products with lower rolling resistance and improved fuel efficiency. Advances in green tyre technology, such as the use of silica-based compounds and sustainable raw materials, are gaining traction. Consumer awareness regarding the environmental impact of tyre disposal is also influencing purchasing decisions toward eco-friendly options.

Russia Tyre Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia tyre market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on design, end-use, vehicle type, distribution channel, and season.

Analysis by Design:

- Radial

- Bias

The radial tyre offers superior durability, fuel efficiency, and better traction on both dry and icy roads. Radial tyres, with their flexible sidewalls and steel belts, provide improved road grip, essential for Russia’s harsh winters and diverse terrains. They are widely used in passenger vehicles, commercial trucks, and agricultural equipment, enhancing ride comfort and longevity. Additionally, growing demand for winter and all-season radial tyres is driving investments in domestic production, reducing reliance on imports amid ongoing trade restrictions.

The bias tyre segment remains relevant in Russia’s tyre market, particularly in off-road, agricultural, and heavy-duty industrial applications. Bias tyres, constructed with multiple rubber plies at cross angles, offer higher load-carrying capacity and resistance to punctures, making them suitable for construction and mining vehicles operating in rugged terrains. Although they have lower fuel efficiency and shorter tread life compared to radial tyres, their affordability and durability in extreme conditions sustain demand. Russian manufacturers continue producing bias tyres to meet specific industry needs, particularly in remote and high-stress environments.

Analysis by End-Use:

- OEM

- Replacement

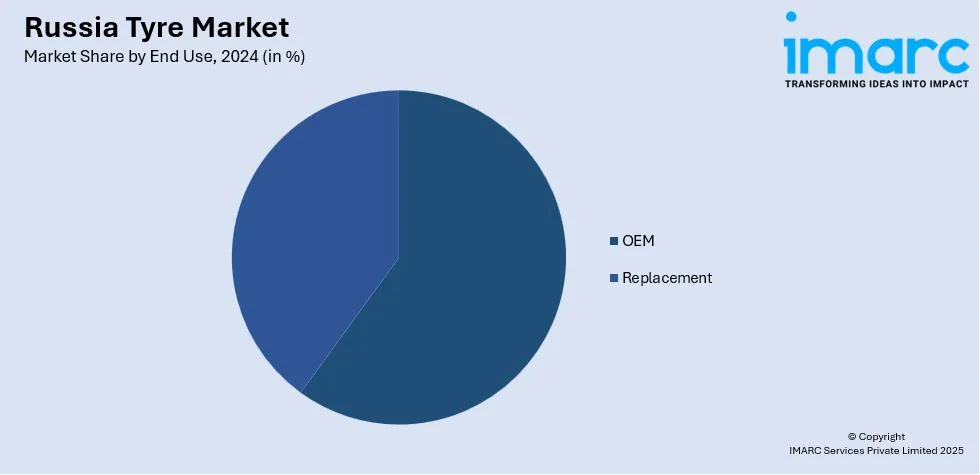

The OEM segment in Russia’s tyre market plays a critical role as domestic vehicle production recovers and expands. Major automakers, including Avtovaz and GAZ, rely on locally produced tyres for new vehicle assembly, ensuring compliance with regulatory standards and performance requirements. With foreign brands reducing operations in Russia, domestic tyre manufacturers are strengthening supply chains to meet OEM demand. Additionally, government incentives for local automotive production and rising demand for electric and hybrid vehicles are driving the growth of OEM tyre sales in the country.

The replacement tyre market dominates Russia’s tyre industry due to the country's vast road network, extreme weather conditions, and high vehicle ownership. Harsh winters necessitate frequent tyre changes, increasing demand for winter and all-season tyres. With rising imports of Chinese and domestic tyre brands replacing Western manufacturers, consumers have shifted preferences towards cost-effective and durable options. The market is further supported by e-commerce growth, making tyre availability and pricing more competitive. Increasing investments in tyre recycling also contribute to sustainability in the replacement sector.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

Passenger cars are one of the largest segments in Russia’s tyre market, driven by a growing vehicle fleet, increased car ownership, and seasonal tyre changes due to extreme winter conditions. The demand for winter tyres is particularly high, given the country's harsh climate, with studded and non-studded variants widely used. Urbanization and rising disposable incomes further contribute to the segment’s growth. Additionally, the influx of Chinese and domestic car brands is supporting new tyre demand, while aftermarket sales remain strong due to frequent replacements required by rough road conditions.

Light Commercial Vehicles (LCVs) play a significant role in Russia’s tyre market due to their extensive use in logistics, trade, and small-scale transportation. The e-commerce boom has increased demand for delivery vans, which require durable and high-mileage tyres. Additionally, winter tyres are mandatory during specific months, ensuring consistent replacement cycles. Many LCVs operate in challenging terrains, necessitating reinforced tyres with enhanced tread patterns for grip and longevity. The rising number of last-mile delivery services further boosts LCV tyre consumption, particularly in urban and semi-urban areas.

Medium and Heavy Commercial Vehicles (MHCVs) are crucial for freight and construction sectors, making them a key driver of Russia’s tyre market. Long-haul trucks require tyres with superior durability and fuel efficiency, while winter conditions necessitate specialized winter tyres for traction and safety. Government investments in infrastructure projects and increased trade with Asian markets are expanding the MHCV fleet, supporting sustained tyre demand. Retreading solutions are also growing in popularity, reducing operational costs for fleet operators and increasing the lifecycle of truck tyres in Russia’s demanding road conditions.

Analysis by Distribution Channel:

- Offline

- Online

The offline tyre market in Russia remains strong due to strong consumer preference for physical inspection before purchase, especially for winter and all-season tyres. Retail stores, dealerships, and service centers provide expert guidance, installation services, and immediate product availability, making them the preferred choice for commercial fleets and individual buyers. Additionally, offline channels support bulk purchases for logistics and industrial sectors, ensuring efficient supply chain management. Regional distributors and wholesalers play a key role in catering to remote areas where online accessibility and logistics remain limited.

The online tyre market in Russia is expanding rapidly, driven by increasing internet penetration and e-commerce adoption. Consumers benefit from a wider selection, competitive pricing, and doorstep delivery, particularly in urban areas. E-commerce platforms, such as Avito and Ozon, offer winter and performance tyres with detailed reviews and comparison tools, enhancing purchasing decisions. Online sales also cater to the demand for imported brands, which are often unavailable in local stores. The growing digital marketplace ensures convenience and accessibility, accelerating the shift toward online tyre purchasing.

Analysis by Season:

- All Season Tires

- Winter Tires

- Summer Tires

All-season tires play a crucial role in Russia’s tire market as they offer a balanced performance for varying road conditions. Given the country’s vast geography, regions with milder winters, such as the southern parts, benefit from all-season tires that eliminate the need for seasonal tire changes. These tires provide adequate traction in both dry and wet conditions, making them a practical choice for drivers who do not frequently encounter extreme winter weather. However, in harsher climates, their performance is limited compared to specialized winter tires.

Winter tires are essential in Russia due to its long and severe winters, where temperatures drop below -30°C in many regions. Studded and non-studded winter tires improve grip on icy and snow-covered roads, significantly enhancing safety and reducing braking distances. Government regulations mandate their use in many areas to prevent accidents during the cold months. The high demand for winter tires drives significant sales in the market, with brands like Nokian and Triangle leading in consumer preference, particularly in northern and central Russia.

Summer tires are widely used in Russia’s warmer months, particularly in cities with hot summers and well-maintained roads. These tires offer superior grip and stability on dry and wet roads, improving fuel efficiency and handling. Their specialized rubber compounds prevent overheating, making them ideal for regions like the Black Sea coast and southern Siberia. As Russian drivers often switch between summer and winter tires due to extreme seasonal temperature shifts, demand remains strong, supporting a robust seasonal tire market driven by both local and imported brands.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is a key region in Russia’s tyre market, driven by high vehicle density, major manufacturing hubs, and strong logistics infrastructure. Moscow and surrounding regions serve as distribution centers for domestic and imported tyres, catering to passenger and commercial vehicles. The presence of large tyre manufacturers and retail networks strengthens market accessibility, while demand for premium and winter tyres remains high due to extreme seasonal variations. Additionally, government regulations on road safety and emission standards influence tyre demand, particularly in urban areas with stringent compliance requirements.

The Volga District holds significant importance in Russia’s tyre industry due to its strong automotive and industrial base. Home to major vehicle manufacturers in cities like Nizhny Novgorod and Tolyatti, the region drives tyre demand for both original equipment (OE) and replacement segments. The presence of tyre manufacturing plants, coupled with access to petrochemical feedstock, supports local production. With well-established road networks and logistics corridors, the Volga District plays a critical role in tyre distribution across Russia, particularly for heavy-duty and commercial vehicle applications.

The Urals District is an essential region for Russia’s tyre market due to its strategic location bridging European and Asian markets. Its strong metallurgical and industrial base supports high demand for heavy-duty and off-road tyres, particularly in mining and construction sectors. The harsh climatic conditions in this region necessitate widespread use of winter tyres for both passenger and commercial vehicles. Additionally, the Urals' proximity to oil refineries ensures a stable supply of raw materials for tyre production, making it a key region for both manufacturing and consumption.

The Northwestern District is a crucial hub for Russia’s tyre industry, primarily due to its strong trade links with Europe and advanced transportation networks. St. Petersburg, a major automotive and logistics center, houses key manufacturing facilities and serves as a gateway for tyre imports and exports. Winter tyre demand is particularly high in this region due to harsh winters and strict road safety regulations. Additionally, the district's well-developed retail sector ensures easy market penetration for domestic and foreign tyre brands, strengthening its role in Russia’s overall tyre market.

The Siberian District plays a vital role in Russia’s tyre market, driven by its harsh climate, growing logistics sector, and strong demand for durable tyres. The extreme cold temperatures necessitate high-performance winter tyres, making Siberia a critical region for specialised tyre sales. Increasing industrial activity, particularly in mining and transportation, boosts demand for heavy-duty tyres. Additionally, improving road infrastructure and rising vehicle ownership contribute to the expansion of tyre distribution networks, while local manufacturing efforts aim to reduce dependency on imports and enhance regional supply chain resilience.

Competitive Landscape:

The Russia tyre market is highly competitive, with a mix of domestic and international manufacturers vying for market share. Local producers benefit from government support, import restrictions, and cost advantages, while global brands leverage advanced technology and strong distribution networks. Price competitiveness is a key factor, with manufacturers focusing on affordability alongside performance. The market is also characterized by increasing investments in R&D to develop durable, winter-resistant, and fuel-efficient tyres. The rise of e-commerce has intensified competition, allowing consumers to compare prices and access a wider range of products. Additionally, the growing demand for specialized tyres, including all-season and retreaded variants, is pushing companies to diversify their offerings.

The report provides a comprehensive analysis of the competitive landscape in the Russia tyre market with detailed profiles of all major companies.

Latest News and Developments:

- On November 22, 2024, the Cordiant Group announced that activities at the former Bridgestone tire plant in Ulyanovsk, Russia, which has since been renamed a Gislaved facility, would resume. The company has started producing a new summer tire model under the Cordiant brand and intends to add high-end models under the Gislaved brand in 2025. The manufacturing of winter tires is expected to start in the first half of 2025, which is noteworthy because of the high demand for these tires in Russia's frigid climate.

- In September 2024, the Russian Far East and Arctic Development Corporation and Vladivostok-based Vlad-Garant joined up to build a tire factory in Primorsky Krai, close to the North Korean and Chinese borders. Ten billion roubles (£84.0 million) will be invested in the project, which is anticipated to generate 134 new employment in the area. By 2027, the facility should be up and running.

- In March 2024, Yokohama Rubber said that its Lipetsk passenger car tire plant in Russia had resumed profitability in 2023 after operations had been suspended in March 2022 because of difficulties obtaining raw materials. August 2022 saw the start of production again, and the plant has since stabilized. The facility manufactures a range of tire models, including winter tires, to satisfy the needs of the Russian market.

- On August 12, 2024, Tatneft declared that its Ikon Tyres facility in Vsevolozhsk is running at more than 50% capacity this year, a notable rise from roughly one-third capacity in 2022–2023. Before the crisis of 2022, the company produced over 16 million tires a year, of which two-thirds were sold to more than 40 nations.

Russia Tyre Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial, Bias |

| End-Uses Covered | OEM, Replacement |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia tyre market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia tyre market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia tyre industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia tyre market was valued at USD 3.20 Billion in 2024.

The market is primarily driven by expanding automotive production, rising vehicle ownership, demand for winter tyres due to harsh climates, growing logistics and transportation sectors, increasing industrial and mining activities, government road safety regulations, strong domestic tyre manufacturing, stable raw material supply, ongoing technological advancements in tyre production, and expanding retail and distribution networks.

The Russia tyre market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 5.10 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)