Russia Three-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Passenger Vehicle, Fuel Type, and Region, 2025-2033

Russia Three-Wheeler Market Size and Share:

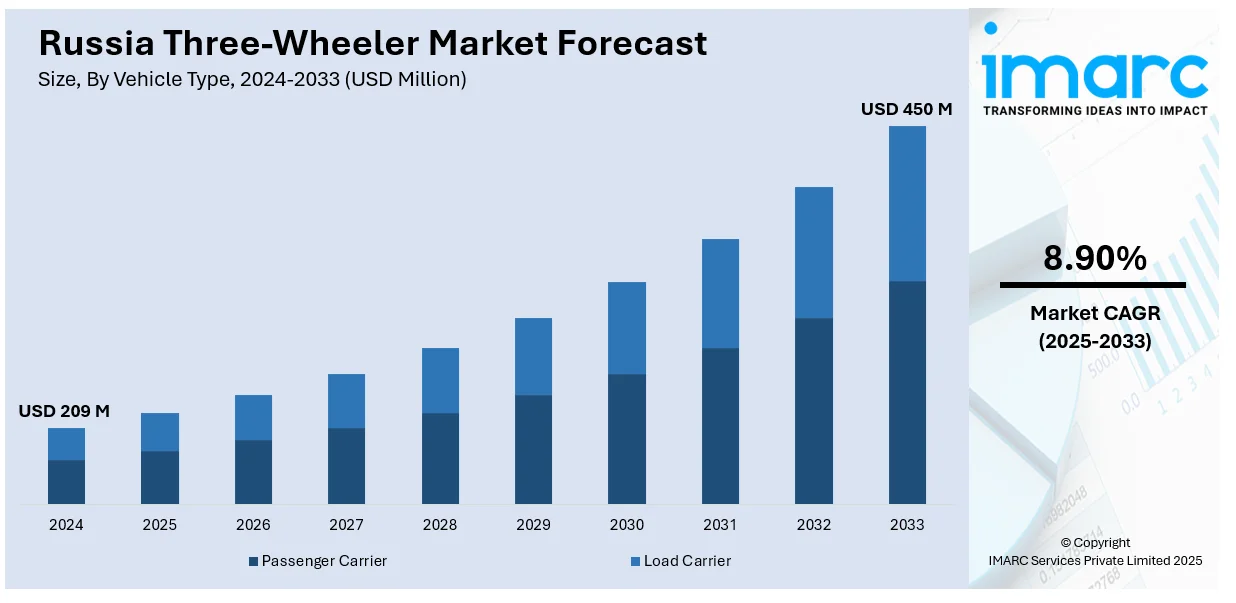

The Russia three-wheeler market size was valued at USD 209 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 450 Million by 2033, exhibiting a CAGR of 8.90% from 2025-2033. The market is driven by the greater adoption of eco-friendly vehicles, increasing utilization in agriculture and rural logistics, and rising integration into public transport and ride-hailing services, fueled by policy support, cost efficiency, technological improvements, and urban mobility challenges.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 209 Million |

| Market Forecast in 2033 | USD 450 Million |

| Market Growth Rate (2025-2033) | 8.90% |

The market In Russia is expanding due to increasing demand for cost-effective last-mile transportation, particularly in urban and semi-urban areas. In line with this, growing fuel efficiency concerns are driving businesses and individuals toward three-wheelers over traditional four-wheeled vehicles. Furthermore, favorable government initiatives supporting small-scale businesses and micro-enterprises is expanding the Russia three-wheeler market share. For example, on December 11, 2024, the government addressed national projects for 2025, including a 7.6% premium rate reduction for SMEs, 14 Billion roubles for rural mortgages and infrastructure, and 18 billion roubles for soft auto-loans and leasing, totaling 45 Billion roubles in 2024. Discounts of 25% for vehicles and 35% for electric cars were announced. The expansion in cold storage and perishable goods transport demand, along with flexible financing and leasing, enhance affordability and drive adoption across industries.

In addition to this, the increasing demand for electric and alternative fuel-powered vehicles, driven by environmental concerns and emission regulations is impelling the market. Similarly, rising urban congestion augmenting the need for compact, maneuverable transport, particularly for commercial deliveries is propelling the Russia three-wheeler market growth. E-commerce and hyperlocal delivery services are also accelerating last-mile connectivity demand. For instance, on February 12, 2024, the Association of E-Commerce Companies reported 28% growth in Russia’s e-commerce market, reaching 6.4 Trillion rubles, with online sales comprising 13.8% of total retail. Furthermore, continual advancements in durability, load capacity, and design fosters market penetration. Besides this, supportive government efforts to improve road infrastructure and increase three-wheeler transport zones, along with rising localization of manufacturing and growing ride-sharing adoption, are driving market expansion, making three-wheelers a cost-effective mobility solution.

Russia Three-Wheeler Market Trends:

Rising Demand for Electric and Alternative Fuel Three-Wheelers

The Russia three-wheeler market trends indicate a shift toward electric and alternative fuel-powered models as concerns over fuel efficiency, emissions reduction, and sustainability grow. Government incentives for green mobility, including subsidies for electric vehicles and tax reductions on alternative fuel transport, are accelerating adoption. Urban congestion and rising fuel costs are prompting businesses and individuals to choose battery-powered and CNG-based three-wheelers for cost-effective last-mile transport. Advances in battery technology, such as improved lithium-ion efficiency and extended range, are making electric three-wheelers more commercially viable. Additionally, fleet operators in logistics and e-commerce are increasingly integrating electric three-wheelers, supporting Russia’s goal of decarbonizing urban transport.

Expansion of Usage in Rural and Agricultural Sectors

The Russia three-wheeler market demand is growing in rural and agricultural areas, driven by the need for affordable and adaptable transport solutions. Farmers and small-scale agribusinesses are utilizing three-wheelers for cargo transport, including agricultural produce, livestock feed, and farming equipment. The development of heavy-duty three-wheeler models with enhanced load capacity and rugged designs is enabling their use on off-road and unpaved routes. Furthermore, government-supported rural development programs promoting mechanization and small-scale transport solutions are facilitating market expansion. The availability of customized three-wheeler attachments for harvest collection, irrigation, and fertilizer distribution is increasing adoption, while manufacturers continue to enhance torque, fuel efficiency, and durability to cater to Russia’s agricultural sector.

Growth in Ride-Sharing and Public Transport Services

The Russia three-wheeler market outlook highlights the growing role of three-wheelers in ride-sharing and public transport services, particularly in small cities and suburban areas where cost-effective mobility solutions are crucial. The expansion of app-based ride-hailing services has led to the integration of three-wheeler taxis, providing affordable short-distance transport. Their low operating costs and maneuverability render them a viable alternative to traditional taxis, especially in congested urban zones. Additionally, public transport initiatives, such as feeder services linking commuters to bus and metro stations, are increasing. Municipal authorities are implementing regulations and incentives to integrate electric and fuel-efficient three-wheelers into urban transport planning, enhancing mobility accessibility and traffic flow.

Russia Three-Wheeler Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia three-wheeler market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on vehicle type, passenger vehicle, and fuel type.

Analysis by Vehicle Type:

- Passenger Carrier

- Load Carrier

The passenger carrier segment in the market is expanding due to increasing demand for affordable and efficient urban mobility solutions. Small cities and suburban areas, where public transport options are limited, are witnessing higher adoption of three-wheeler taxis for short-distance commutes. Ride-hailing platforms are integrating three-wheeler passenger services, offering cost-effective and fuel-efficient alternatives to traditional taxis. Additionally, electric three-wheeler passenger carriers are gaining traction as environmental regulations tighten and fuel prices rise. Municipal authorities are also exploring three-wheeler-based feeder transport solutions to connect commuters with larger public transit networks, improving accessibility while reducing traffic congestion.

The load carrier segment is experiencing strong growth as businesses prioritize cost-efficient, compact cargo transport solutions for urban logistics. Three-wheeler load carriers are widely used for last-mile delivery services, particularly in e-commerce, retail, and agriculture. The rise of quick-commerce and hyperlocal delivery is further fueling demand for compact, maneuverable cargo vehicles. Additionally, rural enterprises and small-scale manufacturers are increasingly adopting three-wheeler load carriers for farm produce transportation and local goods distribution. Advancements in vehicle durability, payload capacity, and alternative fuel options are enhancing their appeal, making them a preferred choice for small businesses and logistics operators.

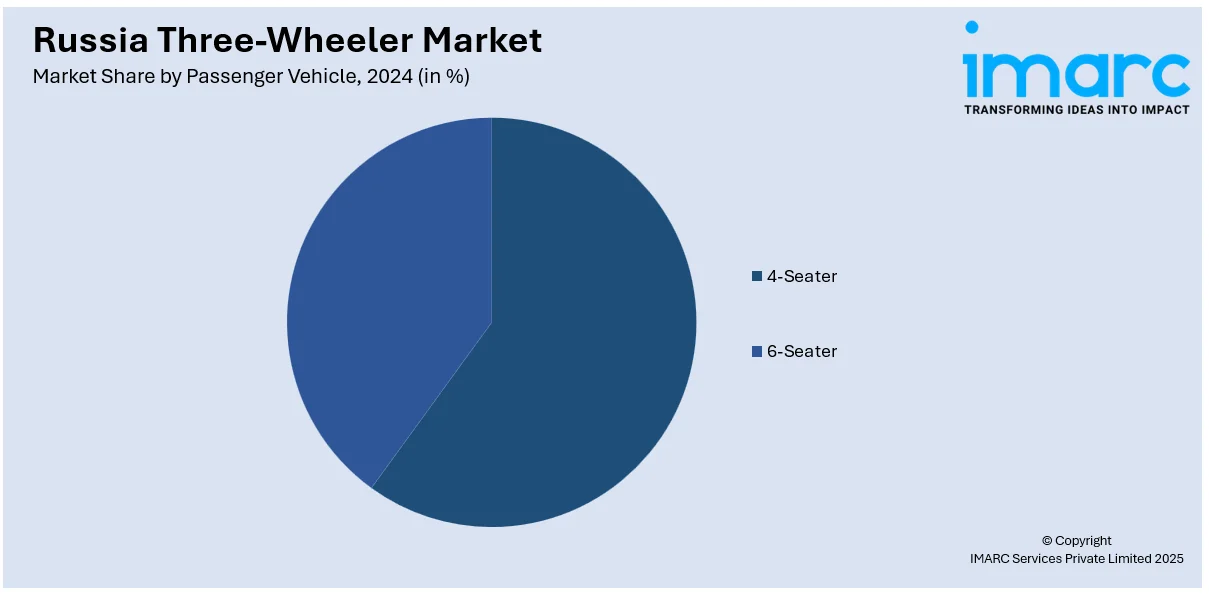

Analysis by Passenger Vehicle:

- 4-Seater

- 6-Seater

The 4-seater three-wheeler segment in the Russia three-wheeler market is gaining popularity as an affordable and fuel-efficient alternative to conventional taxis and small passenger vehicles. These vehicles are increasingly used for urban and suburban transport, catering to commuters in small towns, industrial areas, and local transit hubs. The rise of app-based ride-sharing platforms has further driven demand for compact, maneuverable passenger carriers that offer low operational costs. Additionally, the introduction of electric 4-seater three-wheelers is improving environmental sustainability, as businesses and transport operators seek eco-friendly solutions to align with government regulations on emissions reduction and urban congestion management.

The 6-seater three-wheeler segment is expanding as a cost-effective shared transport solution, particularly in semi-urban and rural regions where larger public transport options are unavailable. These vehicles are increasingly used in feeder services, transporting passengers to bus and train stations, and providing affordable transit in low-density areas. Their higher seating capacity makes them ideal for group travel, school transport, and local commuting, reducing per-passenger costs compared to conventional taxis. Additionally, manufacturers are focusing on enhanced durability, fuel efficiency, and alternative fuel options, making 6-seater three-wheelers a reliable and economical transport mode for emerging markets.

Analysis by Fuel Type:

- Petrol/CNG

- Diesel

- Electric

Petrol and CNG-powered three-wheelers remain widely used in the Russia market due to their affordability and widespread fuel availability. Petrol variants are preferred for short-distance urban commutes, while CNG models are gaining traction as businesses and fleet operators seek cost-effective, low-emission alternatives. The Russian government’s initiatives to expand CNG fueling infrastructure and provide subsidies for gas-powered vehicles are driving adoption. Additionally, the rising cost of petrol is encouraging small businesses and transport operators to switch to CNG three-wheelers, which offer lower operating expenses. Manufacturers are developing dual-fuel models to provide users with flexibility and improved fuel efficiency.

Diesel three-wheelers are primarily used in rural areas and heavy-load applications, where their higher torque and fuel efficiency make them suitable for longer routes and cargo transport. These vehicles are commonly utilized in agriculture, small-scale manufacturing, and last-mile logistics, as they offer greater load capacity compared to petrol and CNG variants. However, strict emission norms and concerns about air pollution are leading to declining sales of diesel three-wheelers in urban areas. Manufacturers are focusing on engine upgrades and hybrid models to comply with environmental standards, ensuring that diesel three-wheelers remain viable in select commercial applications.

Electric three-wheelers are witnessing strong growth in the Russia three-wheeler market as government policies promote green mobility through incentives, tax exemptions, and infrastructure development. Businesses and fleet operators are increasingly adopting electric models for last-mile delivery and passenger transport, benefiting from low operating costs, zero emissions, and improved battery efficiency. Advancements in lithium-ion battery technology, including faster charging times and extended range, are making electric three-wheelers more viable for commercial use. Additionally, the expansion of EV charging stations and investments in battery swapping technology are supporting market expansion, positioning electric three-wheelers as a key component of Russia’s sustainable transportation goals.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is a key region in the Russia three-wheeler market, driven by urban demand for cost-efficient passenger and cargo transport. Major cities like Moscow and Tula are experiencing growing adoption of electric and CNG three-wheelers due to government-backed emission reduction initiatives. Ride-sharing services and last-mile delivery providers are integrating three-wheelers for urban mobility and e-commerce logistics, benefiting from traffic congestion solutions and low operating costs. Additionally, infrastructure investments in alternative fuel stations and battery swapping stations are facilitating the transition to green three-wheeler transport. The market’s growth is also fueled by expanding food delivery and local goods distribution services.

The Volga District is emerging as a high-growth region for three-wheeler adoption, particularly in agriculture and small-scale manufacturing. Cities like Kazan, Samara, and Nizhny Novgorod are witnessing rising demand for load carriers to support rural logistics, farm produce transport, and industrial cargo movement. The district’s expanding e-commerce sector is further driving adoption, as businesses seek compact and fuel-efficient delivery vehicles. Additionally, government incentives for CNG and electric three-wheelers are gaining momentum, especially as Volga cities develop green transport policies. The affordable pricing and high maneuverability of three-wheelers render them an attractive alternative to larger commercial vehicles.

The Urals District is seeing a steady rise in three-wheeler utilization, particularly for rugged terrain and heavy-duty transport applications. Given the region’s harsh winters and industrial zones, businesses prefer diesel and CNG three-wheelers for reliable cargo movement in mining, construction, and forestry sectors. Cities like Yekaterinburg, Chelyabinsk, and Perm are adopting three-wheelers for intra-city goods transport, benefiting from low-cost and fuel-efficient solutions. The presence of manufacturing hubs and logistics centers is also driving demand for customized load carriers. Additionally, government investments in infrastructure and alternative fuel networks are gradually augmenting interest in electric three-wheelers for urban and semi-urban mobility applications.

Competitive Landscape:

The Russia three-wheeler market features a competitive landscape with the presence of domestic and international manufacturers catering to diverse commercial and passenger mobility needs. Key players are focusing on technological advancements, fuel efficiency, and affordability to strengthen market positioning. Local manufacturers emphasize cost-effective petrol and CNG models, while global brands introduce electric and hybrid three-wheelers to align with sustainability trends. Strategic partnerships between automotive firms and financial institutions are driving sales through leasing options and financing schemes. Additionally, companies are investing in after-sales services, localized assembly plants, and distribution networks to enhance accessibility. Intense price competition, government regulations, and rising demand for urban logistics solutions are further shaping the market dynamics and growth strategies.

The report provides a comprehensive analysis of the competitive landscape in the Russia three-wheeler market with detailed profiles of all major companies.

Russia Three-Wheeler Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Carrier, Load Carrier |

| Passenger Vehicles Covered | 4-Seater, 6-Seater |

| Fuel Types Covered | Petrol/CNG, Diesel, Electric |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia three-wheeler market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia three-wheeler market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia three-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia three-wheeler market was valued at USD 209 Million in 2024.

The Russian market is expanding due to rising demand for cost-effective last-mile transport, government incentives for electric and CNG vehicles, growing e-commerce and hyperlocal deliveries, and increased adoption in agriculture and rural logistics. Additionally, ride-sharing expansion, fuel efficiency concerns, and infrastructure development are fueling market growth.

The Russia three-wheeler market is projected to reach a value of USD 450 Million by 2033, growing at a CAGR of 8.90% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)