Russia Tequila Market Report by Product Type (Blanco, Joven, Reposado, Anejo, and Others), Purity (100% Tequila, 60% Tequila), Price Range (Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila), Distribution Channel (Off-Trade, On-Trade), and Region 2025-2033

Russia Tequila Market Overview:

The Russia tequila market size reached USD 128.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 184.5 Million by 2033, exhibiting a growth rate (CAGR) of 3.65% during 2025-2033. The market is propelled by a significant shift toward premium and ultra-premium alcoholic beverages, proliferation of bars, pubs, and restaurants, popularity of Mexican cuisine and festivals, and legislative and regulatory environment.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 128.9 Million |

| Market Forecast in 2033 | USD 184.5 Million |

| Market Growth Rate (2025-2033) | 3.65% |

Russia Tequila Market Trends:

Increasing Tequila Production

The Russian market has seen a significant shift toward premium and ultra-premium alcoholic beverages, driven by an increasing preference for quality over quantity. This trend is largely influenced by rising disposable incomes and the aspiration for a more sophisticated lifestyle among consumers. As per the Russian Federation, the average household net-adjusted disposable income per capita is USD 19 546 a year. This tendency is bolstered by the growing number of working professionals who prioritize quality and brand reputation. About 70% of people aged 15 to 64 in the Russian Federation have a paid job. Tequila, once considered a niche product, is now gaining popularity as a premium spirit. High-end tequila brands are positioning themselves as luxury products, appealing to affluent consumers and connoisseurs who seek unique and high-quality drinking experiences. This growing appreciation for premium spirits is driving the demand for tequila in Russia, encouraging more imports and distribution of high-end tequila brands.

Increasing number of Bars and Pubs

The proliferation of bars, pubs, and restaurants in urban areas has significantly boosted the visibility and consumption of tequila. On-trade channels, including upscale bars and nightclubs, are key platforms for tequila sales, often promoting the spirit through specialized cocktails and tasting events. The social aspect of consuming tequila in these settings, coupled with the rising popularity of tequila-based cocktails, is enhancing the spirit’s appeal among younger consumers and driving market growth. These venues create an environment where tequila is showcased and celebrated, encouraging trial and adoption among patrons.

Rising Influence of Social Media Marketing

Global cultural trends, including the popularity of Mexican cuisine and festivals, are influencing Russian consumers. Marketing campaigns and promotions by leading tequila brands, emphasizing authenticity and heritage, are resonating well with consumers. Social media and digital marketing have also played a crucial role in educating consumers about tequila, its origins, and its unique qualities, thereby increasing its acceptance and consumption. Influencers and celebrities endorsing tequila brands add to this trend, making it a trendy choice among the younger. According to the European Audiovisual Observatory, as of January 2021, Russian officials estimated that there were 99 million social media users in Russia, which makes, 67.8 % of the total population.

Regulatory Environment

Russia's legislative and regulatory environment influences the tequila market through import laws, tariffs, and trade policies. Favorable policies, such as lower import charges and easier licensing requirements, help tequila brands enter the Russian market. In contrast, strict rules or high tariffs impede market growth. Changes in the regulatory framework controlling alcohol sales and distribution affect the cost structure and availability of tequila, hence influencing its market potential and competitiveness in Russia's spirits business.

Russia Tequila Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, purity, price range, and distribution channel.

Product Type Insights:

- Blanco

- Joven

- Reposado

- Anejo

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes blanco, joven, reposado, anejo, and others.

Purity Insights:

- 100% Tequila

- 60% Tequila

A detailed breakup and analysis of the market based on the purity have also been provided in the report. This includes 100% tequila and 60% tequila.

Price Range Insights:

- Premium Tequila

- Value Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

The report has provided a detailed breakup and analysis of the market based on the price range. This includes premium tequila, value tequila, premium and super-premium tequila, and ultra-premium tequila.

Distribution Channel Insights:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes off-trade (supermarkets and hypermarkets, discount stores, online stores, and others) and on-trade (restaurants and bars, liquor stores, and others).

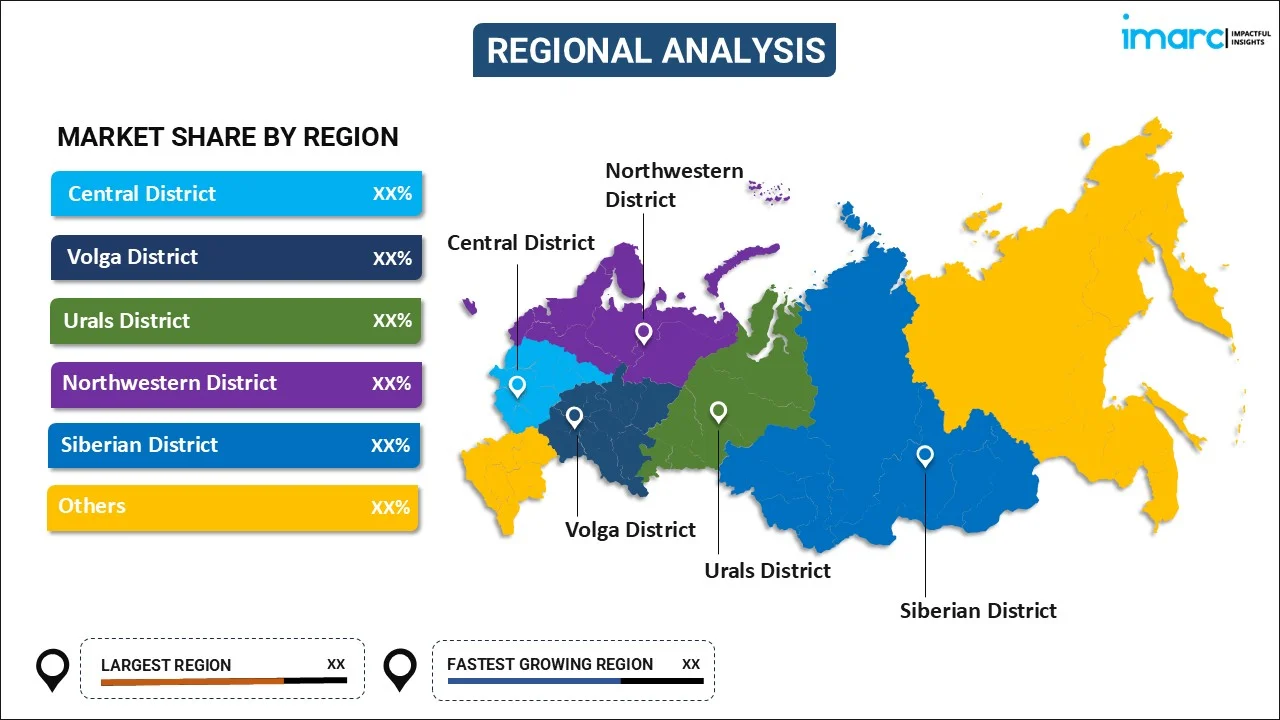

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Tequila Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Blanco, Joven, Reposado, Anejo, Others |

| Purities Covered | 100% Tequila, 60% Tequila |

| Price Ranges Covered | Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila |

| Distribution Channels Covered |

|

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia tequila market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia tequila market on the basis of product type?

- What is the breakup of the Russia tequila market on the basis of purity?

- What is the breakup of the Russia tequila market on the basis of price range?

- What is the breakup of the Russia tequila market on the basis of distribution channel?

- What are the various stages in the value chain of the Russia tequila market?

- What are the key driving factors and challenges in the Russia tequila?

- What is the structure of the Russia tequila market and who are the key players?

- What is the degree of competition in the Russia tequila market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia tequila market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia tequila market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia tequila industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)