Russia Spices and Seasonings Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Russia Spices and Seasonings Market Overview:

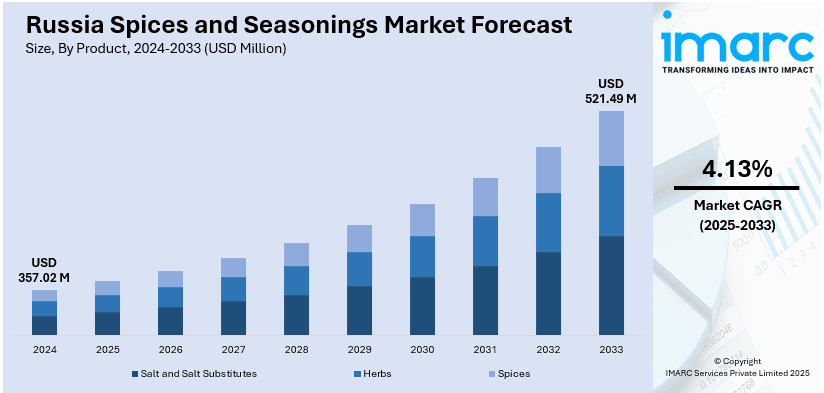

The Russia spices and seasonings market size was valued at USD 357.02 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 521.49 Million by 2033, exhibiting a CAGR of 4.13% from 2025-2033. The market is driven by the growing consumer demand for diverse cuisines, expanding processed food production, increasing natural ingredient preference, improved retail distribution, and rising government support for spice cultivation and imports in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 357.02 Million |

| Market Forecast in 2033 | USD 521.49 Million |

| Market Growth Rate 2025-2033 | 4.13% |

The Russia spices and seasonings market demand is driven by the growing consumer preference for authentic and diverse culinary experiences. As international cuisines gain popularity, consumers are increasingly using a variety of spices such as turmeric, cumin, and paprika to replicate global flavors at home, aiding the market growth. For instance, in 2024, the Russian government approved a strategy for organic agriculture, establishing a separate sector using natural fertilizers, developing national standards, and introducing support measures to promote organic production. Moreover, the rising influence of food bloggers, cooking shows, and social media has fueled interest in experimenting with spices, which is providing an impetus to the market. Additionally, the growing popularity of plant-based diets and functional foods is encouraging consumers to incorporate spices known for their health benefits, such as ginger and garlic, into their daily meals, thus impelling the market growth.

Concurrently, the expansion of the processed and convenience food industry is another significant driver of the Russia spices and seasonings market growth. In line with this, the increasing number of working professionals and urban households is driving the demand for ready-to-eat (RTE) and frozen meals, which require a variety of seasonings to enhance taste and shelf life, strengthening the market share. According to reports, there has been a rising trend among Russians toward rational consumption and greater environmental awareness, over the past 18 months. This shift is driving demand for organic, sustainably sourced, and minimally processed food products, including spices and seasonings. In line with this, food manufacturers are focusing on clean-label products with natural ingredients, boosting demand for organic and minimally processed spices and contributing to the market expansion. Furthermore, government initiatives supporting domestic spice production and the expansion of retail distribution networks, including e-commerce, are thereby propelling the market forward.

Russia Spices and Seasonings Market Trends:

Increasing Demand for Organic and Clean-Label Spices

The growing preference for organic and clean-label spices is influencing the Russia spices and seasonings market trends. Consumers in the region prefer spices that contain no preservatives together with synthetic colors or genetically modified organisms (GMOs) due to their rising food safety and artificial additive concerns. For instance, consumers earning RUB 100,000 or more per month are the primary purchasers of natural foods, driving demand for premium organic spices that align with their preference for healthier, high-quality ingredients. Moreover, manufacturers are focusing on creating sustainably sourced minimal processed spices that maintain their natural flavors and essential nutrients. This shift is supported by the expanding availability of certified organic spices, that are available in both supermarkets and online platforms as consumers want to understand ingredient sourcing and production methods that match the global clean-label movement.

Growth of Online Spice Retailing and E-Commerce Channels

The growth of online spice retailing and e-commerce platforms is enhancing the Russia spices and seasonings market outlook. This shift is leading to an improved accessibility of diverse seasoning products for consumers. For example, in 2023, 23% of the 20,115 professionals attending WorldFood Moscow, totaling 4,707 visitors, showed interest in the Organic and Healthy Food section, reflecting the rising demand for natural and clean-label seasonings. Specialty spice brands along with online grocery retailers use digital channels to provide their products to the urban and rural regions in Russia. Besides this, people are increasingly buying exotic spice blends through subscription boxes, direct-to-consumer (D2C) spices, and bulk spices. These channels allow customers to receive better educational information about spice origins, applications, and health benefits enabling them to purchase premium and specialty seasonings.

Increasing Popularity of Ethnic and Fusion Cuisine

The increasing popularity of multicultural flavors is strengthening the Russia spices and seasonings market share. The growing interest in Asian, Middle Eastern, and Latin American cuisine has boosted the sales of coriander, cardamom, and chili powder in the market. In confluence with this, the food service operators and restaurants are introducing international menu items, allowing consumers to experience new seasonings. For instance, younger generations are driving this shift, with 71% of Gen Z and 68% of Millennials planning to dine out more frequently in 2025, further fueling demand for diverse and globally inspired flavors. The food industry also highlights fusion cuisine as a dominant trend since it unites Russian traditional flavors with spices from around the world. This emerging culinary trend investigates new spices and encourages manufacturers to develop creative combinations of traditional and exotic seasonings.

Russia Spices and Seasonings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia spices and seasonings market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Salt and Salt Substitutes

- Herbs

- Thyme

- Basil

- Oregano

- Parsley

- Others

- Spices

- Pepper

- Cardamom

- Cinnamon

- Clove

- Nutmeg

- Others

Salt and low-sodium alternatives are driving the Russia spices and seasonings market demand, due to the rising concerns of hypertension in the region. The widespread integration of mineral salts and potassium chloride alternatives draws consumers who need safer alternatives for both household and food processing use, transforming the Russia spices and seasonings market forecast.

The rising food preferences towards fresh and dried herbs have elevated the market demand for thyme, basil, oregano, and parsley. The increasing consumption of these herbs in home kitchens, restaurants, and processed food production is contributing to the market expansion, as people are learning about their health benefits.

The use of pepper, cardamom, cinnamon, clove, and nutmeg spices is growing because they appear in traditional Russian cuisine and international culinary traditions. Consumers are opting for natural flavor enhancers and functional properties alongside spice-infused beverages, which is significantly impelling the market growth.

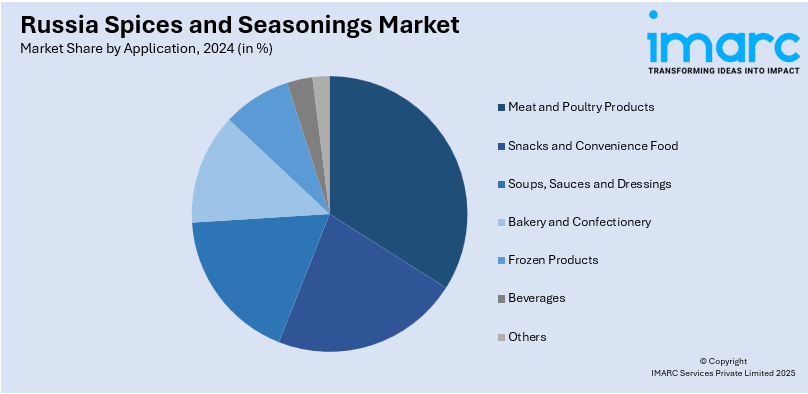

Analysis by Application:

- Meat and Poultry Products

- Snacks and Convenience Food

- Soups, Sauces and Dressings

- Bakery and Confectionery

- Frozen Products

- Beverages

- Others

The meat and poultry products are driving the market growth as spices and seasonings enhance flavor, tenderness, and preservation. The growing demand for marinated meats, processed deli products, and ready-to-cook options is driving the use of spices like pepper, garlic, and paprika in this segment, which is contributing to the market expansion.

The rising market for instant meals, flavored snacks, and RTE products is driving the increasing demand for seasonings in the region. The food industry in the region obtains its taste enhancement and shelf life extension by using spices along with herbs such as paprika, cumin, and onion powder for snack development, thus aiding the market growth.

The increasing preference for homemade and processed soups, sauces, and salad dressings is fueling the market demand for natural seasonings. Herbs like oregano and basil, along with spices such as black pepper and nutmeg, are used to add depth and complexity to these products, boosting the market demand.

Spices such as cinnamon together with cardamom and nutmeg play a fundamental role in Russian bakeries and confectionery production. The market is witnessing a rising demand, driven by consumers, as they choose food items containing natural spices and flavors that enhance both taste and health benefits.

The growing consumption of frozen meals, including ready-to-cook meat, seafood, and vegetable-based dishes, is driving the use of seasonings for flavor enhancement in the region. The spices and herbs improve taste retention in frozen food, ensuring consistency and quality in long-term storage and distribution, fostering the market growth.

The surging consumer demand for tea with spices, functional beverages, and flavored alcoholic drinks is fueling the increased market usage of cinnamon, clove, and nutmeg. The utilization of traditional and exotic spices in the beverage market is driven by consumers who seek beverages that enhance immunity while providing aromatic taste experiences, thereby supporting the market demand.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

In the Central District, Moscow is the economic center that leads to elevated spice usage because of its metropolitan growth, multiple dietary preferences, and growing restaurant businesses. Supermarkets along with e-commerce platforms make numerous spice varieties available to customers, resulting in an increased market demand for premium and organic seasonings.

The Volga District demonstrates a growing market demand for spices in meat and bakery products as well as processed foods. This segment is growing due to the increased urbanization, rising consumer demand for functional ingredients, and improved local spice manufacturing and distribution networks in regional areas.

The Urals District experiences increased spice consumption because of its growing processed food industry and convenience meal market. The rising retail infrastructure alongside increasing consumer interest in preparing global home-cooked meals is driving the market demand for regular and uncommon seasoning products.

In Northwestern District areas, people consume the most premium and imported spices, which is boosting the market demand. The rising tourism sector and the worldwide food culture along with consumer preference for environmentally friendly and chemical-free seasonings is fulfilled by the specialty retailers and internet sales platforms in the region, driving the market forward.

The extreme climate conditions in the Siberian District encourage local consumers to buy warming spices including cinnamon, clove, and nutmeg. The expanding frozen and processed food sectors, along with government initiatives to improve food supply chains, are enhancing market penetration, particularly in urban centers such as Novosibirsk and Krasnoyarsk.

Competitive Landscape:

The Russian spices and seasonings market is highly competitive, with both local and global players emphasizing innovation, and quality, and expanding their distribution networks. Companies are introducing organic, clean-label, and blended spice offerings to cater to evolving consumer preferences. Moreover, supermarkets, hypermarkets, and e-commerce platforms play a crucial role in market penetration, increasing competition. Additionally, manufacturers are investing in sustainable sourcing, advanced packaging, and localized flavors to differentiate their products. Furthermore, strategic partnerships, acquisitions, and targeted marketing efforts further strengthen market positioning, while government initiatives supporting domestic spice production are intensifying competition between imported and locally produced seasonings.

The report provides a comprehensive analysis of the competitive landscape in the Russia spices and seasonings market with detailed profiles of all major companies, including:

- ECO RESOURCE

- Aidigo

- SpiceExpert

- Yash Industries Group

- Verdey Company

- Vremya Company

Latest News and Developments:

- In January 2025, Nord Ingredients announced the launch of ND Prime Vitaroma, a new line of flavoring solutions designed to enhance various food products. This development aims to provide manufacturers with innovative options to improve taste profiles, thereby meeting evolving consumer preferences.

- In October 2024, it was reported that India’s tea, coffee, and spice exports to Russia had surged 1.5 times in August, boosting market supply. This growth strengthened Russia’s spices and seasonings industry, meeting rising consumer demand and supporting food manufacturers.

- In May 2024, The Food Safety and Standards Authority of India (FSSAI) launched thorough inspections of all spice mix manufacturers. This regulatory action boosted confidence in Indian spice exports, increasing demand in Russia’s market while ensuring safer, higher-quality seasonings for consumers.

- In February 2024, Aidigo showcased its latest products and collections at the 31st international exhibition, ProdExpo, in Moscow. The company highlighted its recent rebranding and introduced new product lines to industry professionals and potential partners.

- In January 2024, Miratorg, a leading Russian meat producer, expanded its product range to include spice mixes made from natural ingredients. The company's research and development department crafted unique recipes to enhance the flavor of their semi-finished meat products and ready-to-eat (RTE) meals.

Russia Spices and Seasonings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Meat and Poultry Products, Snacks and Convenience Food, Soups, Sauces and Dressings, Bakery and Confectionery, Frozen Products, Beverages, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Companies Covered | ECO RESOURCE, Aidigo, SpiceExpert, Yash Industries Group, Verdey Company, Vremya Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia spices and seasonings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia spices and seasonings market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia spices and seasonings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The spices and seasonings market in Russia was valued at USD 357.02 Million in 2024.

The Russia spices and seasonings market is growing due to the increasing consumer demand for diverse and international cuisines, the expansion of processed and convenience foods, surging health awareness promoting natural spices, the growth of e-commerce, the rising adoption of clean-label trends, and increasing government support for domestic spice production.

The spices and seasonings market is projected to exhibit a CAGR of 4.13% during 2025-2033, reaching a value of USD 521.49 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)