Russia Semiconductor Market Report by Component (Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, and Others), Material Used (Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, and Others), End User (Automotive, Industrial, Data Centre, Telecommunication, Consumer Electronics, Aerospace and Defense, Healthcare, and Others), and Region 2025-2033

Russia Semiconductor Market Overview:

The Russia semiconductor market size reached USD 8.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.9 Billion by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is driven by geopolitical isolation pushing for self-reliance, increased domestic production investments, and technological advancements. The drive for indigenous chip development and alternative sourcing from non-Western countries also plays a significant role in driving the Russia semiconductor industry growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 17.9 Billion |

| Market Growth Rate 2025-2033 | 8.70% |

Russia Semiconductor Market Trends:

Geopolitical Isolation and Sanctions

Russia semiconductor industry is heavily influenced by geopolitical isolation and global sanctions. These penalties, especially from the US and EU, have limited Russia's capacity to acquire advanced chips and associated technologies from top global vendors such as TSMC and Intel. In reaction, Russia has stepped up initiatives to build its own semiconductor sector to lessen dependence on foreign technologies. For example, in July 2024, Russia declared that it aims to recreate Western microchips from the early 2000s by 2028, emphasizing 65-nm technology. This project, spearheaded by the Mikron company located in Zelenograd, seeks to address the technological challenges created by Western sanctions following the annexation of Crimea. At present, Mikron manufactures chips utilizing 180-90-nm technologies for particular uses. In spite of the trade restrictions and sanctions, Russia is currently striving to rejuvenate its chip manufacturing abilities. This pursuit of independence is vital for preserving technological autonomy and lessening the effects of global trade limitations. The necessity to evade these sanctions has expedited local investments and advancements in Russia's semiconductor industry.

Rising Investments in Domestic Production

To mitigate the effects of sanctions and guarantee a steady supply of essential components, Russia has invested heavily in local semiconductor manufacturing. The Russian government has dedicated significant resources to enhance local chip production capabilities, with the goal of creating a more self-sufficient and robust technology industry. This encompasses funding research and development for native chip designs and production technologies. For example, as stated in industry reports, Russia is establishing ambitious objectives to advance its semiconductor sector, with plans to manufacture 28nm chips by 2027 and 14nm chips by 2030. With substantial investments intended, approximately $38.43 billion is set to be designated by 2030 to improve local chip manufacturing, infrastructure, and workforce. Immediate goals involve increasing output with 90nm technology by the conclusion of 2023, whereas long-range aims concentrate on reaching 28nm production by 2030. Russia aims to improve its ability to manufacture semiconductors and lessen reliance on outside suppliers by establishing local production facilities and encouraging technological developments domestically. The Russia semiconductor market forecast indicates continued growth, driven by these substantial investments and government initiatives.

Rapid Technological Advancements and Innovation

Technological advancements and innovation are central to driving the growth of Russia's semiconductor market. In the face of international restrictions, Russia is investing in the development of new semiconductor technologies and manufacturing processes. The push to innovate includes creating new chip designs, improving fabrication techniques, and developing advanced materials to meet the needs of various applications, from consumer electronics to industrial automation. Additionally, collaborations with non-Western countries and leveraging existing expertise within Russia are contributing to these technological advancements. This focus on innovation aims to overcome limitations imposed by sanctions and position Russia as a competitive player in the global semiconductor industry, despite the challenges it faces. For instance, in May 2024, according to industry reports Russia has completed its first lithography machine designed for 350nm chip production, currently undergoing testing. While 350nm chips are considered outdated by modern standards, they remain useful in sectors such as automotive, energy, and telecommunications. This development marks a significant step for Russia towards self-sufficiency in chip production. Looking ahead, Russia plans to develop lithography machines supporting 130nm processes by 2026, 65nm by 2027, and 14nm by 2030.

Russia Semiconductor Market News:

- October 2024: Russia announced plans to invest over 360 billion yen (approximately 240 billion rubles) in domestic semiconductor production by 2030. The goal is to produce 65nm semiconductors and increase local production of equipment and materials for electronics manufacturing to 70%.

- February 2024: Mikron Group, one of the leading Russian semiconductor companies, announced the acquisition of DM2, an Italian company specializing in rotary transfer CNC machines. This move is part of Mikron's strategy to expand its Machining division and enhance its market presence in applications related to fittings and valves. The acquisition will also ensure DM2's business continuity, providing a succession plan for its founder, Gianfranco Duina. Mikron aims to leverage DM2's expertise and product portfolio to complement its own offerings and strengthen its position in precision and productivity-critical applications.

- June 2024: Rostec, a state-owned Russian technology company, launched the MP21, a single-board computer designed to compete with the Raspberry Pi. The MP21 is powered by the domestically developed Elbrus 2S3 processor, which is designed by the Moscow Center of SPARC Technologies (MCST) and manufactured using TSMC's 16nm process. The dual-core Elbrus 2S3 processor has a clock speed of 2GHz and delivers 196 Gflops of computational performance. Targeted at industrial automation, aerospace, and security systems, the MP21 aims to enhance Russia's technological capabilities.

Russia Semiconductor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, material used, and end user.

Component Insights:

![]()

- Memory Devices

- Logic Devices

- Analog IC

- MPU

- Discrete Power Devices

- MCU

- Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes memory devices, logic devices, analog IC, MPU, discrete power devices, MCU, sensors, and others.

Material Used Insights:

- Silicon Carbide

- Gallium Manganese Arsenide

- Copper Indium Gallium Selenide

- Molybdenum Disulfide

- Others

A detailed breakup and analysis of the market based on the material used have also been provided in the report. This includes silicon carbide, gallium manganese arsenide, copper indium gallium selenide, molybdenum disulfide, and others.

End User Insights:

- Automotive

- Industrial

- Data Centre

- Telecommunication

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes automotive, industrial, data centre, telecommunication, consumer electronics, aerospace and defense, healthcare, and others.

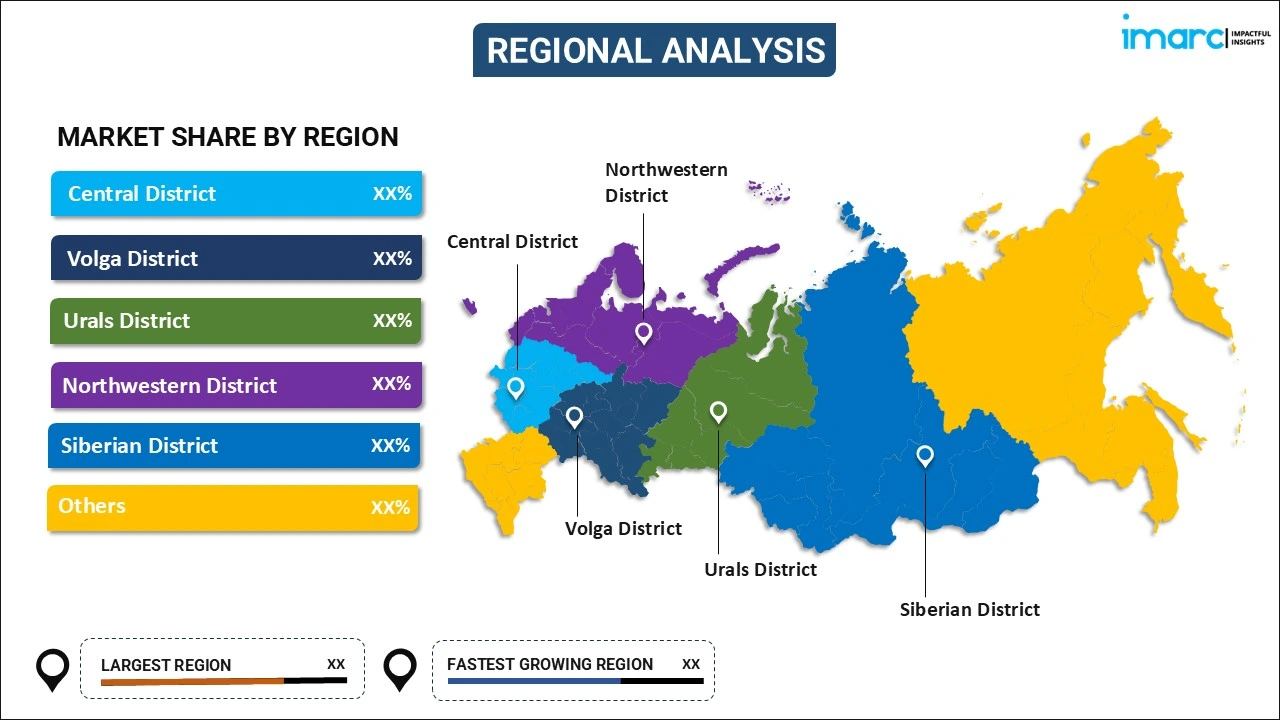

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Semiconductor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Memory Devices, Logic Devices, Analog IC, MPU, Discrete Power Devices, MCU, Sensors, Others |

| Material Used Covered | Silicon Carbide, Gallium Manganese Arsenide, Copper Indium Gallium Selenide, Molybdenum Disulfide, Others |

| End Users Covered | Automotive, Industrial, Data Centre, Telecommunication, Consumer Electronics, Aerospace and Defense, Healthcare, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia semiconductor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia semiconductor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia semiconductor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia semiconductor market was valued at USD 8.5 Billion in 2024.

IMARC estimates the Russia semiconductor market to exhibit a CAGR of 8.70% during 2025-2033, reaching a value of USD 17.9 Billion by 2033.

Key factors driving the Russia semiconductor market include the growing demand for electronics, advancements in automation, and increased adoption of IoT technologies. Government initiatives to support the domestic production of semiconductors, along with rising investments in research and development, are further fueling market growth. Additionally, the shift toward electric vehicles and renewable energy drives demand for semiconductor components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)