Russia Secondhand Luxury Goods Market Size, Share, Trends, and Forecast by Product Type, Demography, Distribution Channel, and Region, 2025-2033

Russia Secondhand Luxury Goods Market Size and Share:

The Russia secondhand luxury goods market size reached USD 2.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.30 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The increasing consumer demand for affordable luxury, rising economic uncertainties prompting budget-conscious spending, growing awareness of sustainability, and the rise of online platforms that facilitate the resale of luxury items are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.10 Billion |

| Market Forecast in 2033 | USD 3.30 Billion |

| Market Growth Rate (2025-2033) | 4.70% |

Russia Secondhand Luxury Goods Market Trends:

Rising Economic Uncertainties

Economic factors are a significant driver, as the fluctuating economic conditions in Russia have led consumers to seek more cost-effective ways to access luxury items. The allure of purchasing used luxury goods lies in their affordability; consumers can acquire high-quality, prestigious brands at a fraction of the original retail price. This trend has gained momentum as more Russians look for ways to maintain their lifestyle and access luxury goods without the hefty price tag associated with new items. According to industry reports, Russia continues to be subjected to an unheard-of volume of economic penalties due to its ongoing socio-political circumstances. Its central bank has frozen almost €260 billion (£222 billion) in assets, and it has been shut out of major international financial services. Russia is spending unprecedented amounts on the public sector, with the total military spending is predicted to exceed 10% of GDP (the UK spends 2.3% of GDP on defense) for the year 2023.

Growing Digital Platforms and Online Marketplaces

The growth of online platforms is also playing a crucial role in driving the market growth. These platforms make it easier for consumers to buy and sell luxury goods, offering a wide selection and greater convenience. The digitalization of the market has expanded its reach, enabling more people to participate in the resale economy and driving the overall growth of the secondhand luxury goods market in Russia. For instance, according to industry reports, Farfetch a multi-brand etailer, is still stocking many of the same brands indirectly and by collaborating with a larger range of independent boutiques to upload their inventory to Farfetch in exchange for "complete anonymity," Farfetch is attempting to gain access to luxury brands like Givenchy, Loewe, and The Row. This makes Farfetch look like Russia, which, is no longer directly supplied by brands, is still seemingly able to get all the luxury goods it wants. Affluent Russians are still bringing high-end Western products into Russia, such as electronics, automobiles, and other luxury goods. In 2023, there has been minimal revenue loss and very minor asset impairment write-downs on the luxury goods sector. In terms of mega fashion brands, the only Dior, Chanel, and Louis Vuitton that Farfetch stocks are pre-owned.

Russia Secondhand Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, demography, and distribution channel.

Product Type Insights:

.webp)

- Handbags

- Jewelry & Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes handbags, jewelry & watches, clothing, small leather goods, footwear, accessories, and others.

Demography Insights:

- Women

- Men

- Unisex

A detailed breakup and analysis of the market based on the demography have also been provided in the report. This includes women, men, and unisex.

Distribution Channel Insights:

- Offline

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online.

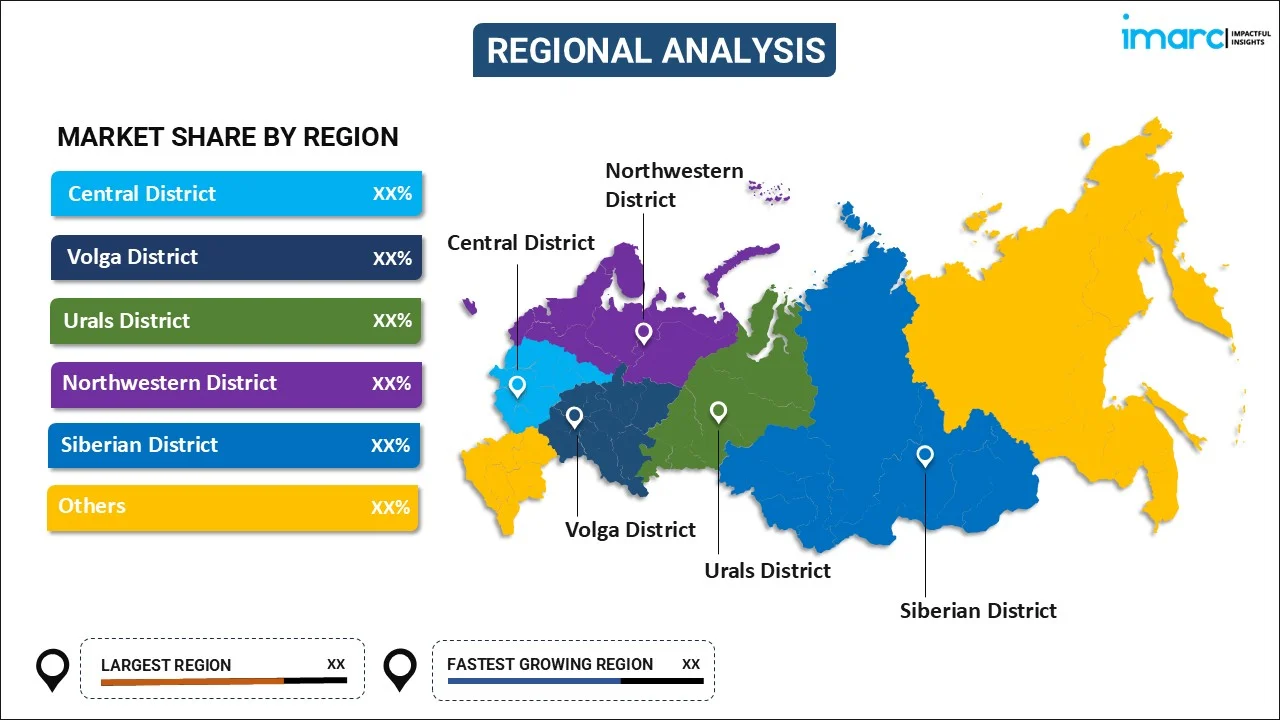

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central district, Volga district, Urals district, Northwestern district, Siberian district, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Secondhand Luxury Goods Market News:

- In March 2024, Moscow Fashion Week (MEW) highlighted Russia's fashion evolution, blending heritage with modernity while prioritizing recycling, sustainability, and individual expression. The event also highlighted the significance of upcycled fashion, which is steadily gaining momentum in the country.

Russia Secondhand Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handbags, Jewelry & Watches, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographies Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia secondhand luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia secondhand luxury goods market on the basis of product type?

- What is the breakup of the Russia secondhand luxury goods market on the basis of demography?

- What is the breakup of the Russia secondhand luxury goods market on the basis of distribution channel?

- What is the breakup of the Russia secondhand luxury goods market on the basis of region?

- What are the various stages in the value chain of the Russia secondhand luxury goods market?

- What are the key driving factors and challenges in the Russia secondhand luxury goods?

- What is the structure of the Russia secondhand luxury goods market and who are the key players?

- What is the degree of competition in the Russia secondhand luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia secondhand luxury goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia secondhand luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia secondhand luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)