Russia Private Equity Market Size, Share, Trends and Forecast by Fund Type, Sector, and Region, 2025-2033

Russia Private Equity Market Size and Share:

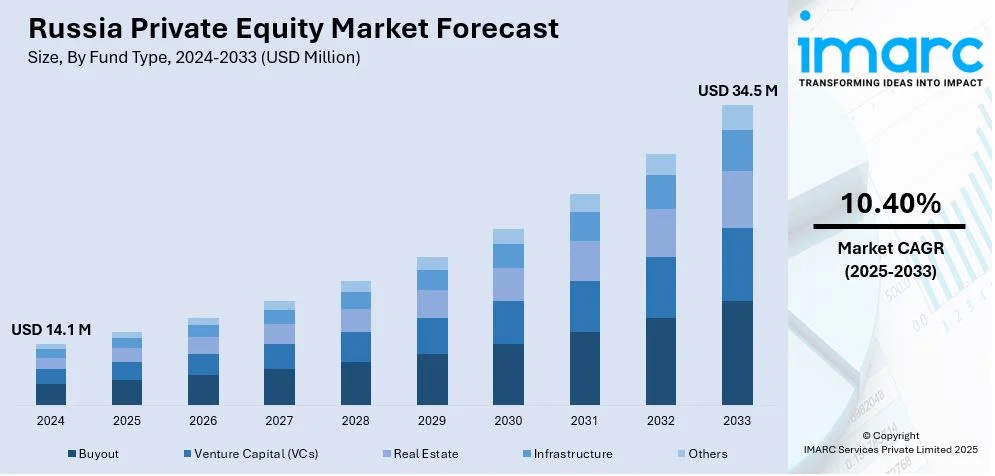

The Russia private equity market size was valued at USD 14.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 34.5 Million by 2033, exhibiting a CAGR of 10.40% from 2025-2033. The market is driven by abundant natural resources, industrial diversification, increasing foreign investments, and expanding infrastructure, emerging sectors such as technology, fintech, and e-commerce, regulatory reforms and a growing consumer market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.1 Million |

| Market Forecast in 2033 | USD 34.5 Million |

| Market Growth Rate (2025-2033) | 10.40% |

The Russia private equity market share is increasing due to the accelerating government intervention and support for strategic industries amid ongoing economic sanctions and geopolitical tensions. Additionally, sovereign wealth funds and state-backed institutions play a crucial role in financing key sectors such as energy, defense, agriculture, and technology, which in turn is fostering the market. For instance, Russian Finance Minister Anton Siluanov declared on November 21, 2024, that the National Wealth Fund (NWF) would be restocked by roughly USD 14.4 to USD 15.5 Billion in 2024. Additional revenue from the oil and gas industry is responsible for this replenishment, and it will be deposited into the fund in 2025 in accordance with current protocols. The NWF is predicted by the Finance Ministry to reach USD 122 Billion, or 5.6% of GDP, by the end of 2024 and to increase to USD142 Billion, or 6% of GDP, in 2025. Moreover, policies aimed at import substitution and economic self-sufficiency encourage private equity investments in domestic businesses, reducing reliance on foreign capital and supply chains, are propelling the Russia private equity market growth further. Apart from this, regulatory frameworks have been adjusted to facilitate domestic fundraising, and tax incentives further attract investors. Additionally, state-linked investment funds act as co-investors, ensuring financial stability and promoting long-term growth in targeted industries.

Russia private equity forecast is witnessing significant uptick due to the growing demand for alternative financing solutions, as traditional banking channels remain constrained due to international restrictions. Notably, on May 1, 2024, Russia declared on that the System for Transfer of Financial Messages (SPFS), created as a substitute for SWIFT, now handles almost all domestic financial operations. In January 2024, the Central Bank of Russia announced that SPFS has been linked to 557 financial institutions in 20 countries. This project is a component of Russia's larger plan to attain digital sovereignty and lessen reliance on financial systems controlled by the West. Apart from this, private equity firms are increasingly offering mezzanine financing, direct lending, and distressed asset acquisitions to support local businesses facing liquidity challenges. Besides, high-net-worth individuals and institutional investors are diversifying their portfolios by engaging in private equity to hedge against currency volatility and inflation. Also, the digital economy and tech-driven enterprises also present lucrative opportunities, with an increase in funding for AI, fintech, and cybersecurity startups, which in turn is further expanding the Russia private equity market outlook. The expansion of secondary market transactions further drives deal activity, as investors seek to acquire undervalued assets and restructure portfolios in response to shifting economic conditions.

Russia Private Equity Market Trends:

Increased Focus on Domestic Investments

The Russia private equity market trend is shifting towards domestic investments as geopolitical tensions and economic sanctions limit foreign capital inflows. For instance, on February 16, 2025, President Vladimir Putin presided at a meeting on investment support for Russian domestic industry in Chelyabinsk, with a focus on successful import substitution across important industries and steady growth. In order to increase output in key industries, he emphasized specific assistance methods such as industrial mortgages, soft loans, and subsidies. Deputy Prime Minister Denis Manturov gave an update on the development of industries like as chemical, automotive, and metallurgical production, emphasizing the need for consistent government assistance to guarantee long-term industrial growth and technical sovereignty. Private equity firms are increasingly investing in sectors such as technology, agriculture, and infrastructure to support self-sufficiency and reduce reliance on imports. Government-backed initiatives and sovereign wealth funds are playing a crucial role in funding strategic industries. This trend reflects a broader effort to strengthen the national economy by prioritizing internal growth and reducing foreign exposure.

Growth in Secondary Market Transactions

As international investors reduce direct involvement in Russia, secondary market transactions are becoming a key trend in private equity. For instance, on January 30, 2025, the Russian central bank stated that strong loan growth and high interest rates helped domestic banks to a record yearly profit of USD 40.7 Billion in 2024. Nevertheless, high borrowing costs caused lending growth to slow, and mortgage issuance fell by almost 40% to USD 4.9 Billion. Many firms are looking to divest or restructure their portfolios, creating opportunities for local investors to acquire assets at discounted valuations. Russian private equity firms are focusing on acquiring stakes in distressed businesses, particularly in manufacturing and retail. The increased activity in secondary deals is reshaping the investment landscape, offering new entry points for domestic investors.

Expansion of Private Debt and Alternative Financing

With traditional financing becoming more restricted due to sanctions, private equity firms in Russia are increasingly turning to private debt and alternative financing mechanisms. Mezzanine financing, direct lending, and venture debt are emerging as key funding sources for businesses seeking capital. Private equity investors are also forming joint ventures with state-backed institutions to mitigate risks and ensure financial stability. This trend is supporting business expansion in critical sectors while reducing dependency on traditional banking systems.

Russia Private Equity Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia private equity market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on fund type and sector.

Analysis by Fund Type:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyouts play a significant role in the Russian private equity market as they allow investors to acquire controlling stakes in established companies, enabling them to restructure operations, enhance profitability, and drive growth. These transactions often involve companies that are undervalued or facing operational inefficiencies, presenting opportunities for strategic improvements and long-term value creation. Buyouts are attractive to investors due to their potential for high returns through active management, operational optimization, and cost reductions. Additionally, they offer a stable exit strategy through a sale or public listing, contributing to the maturity of the private equity market.

Venture Capital (VC) investments are crucial in the Russian private equity market, particularly in the tech, innovation, and start-up ecosystems. These investments provide essential funding to early-stage companies with high growth potential, allowing them to scale rapidly and disrupt existing industries. VCs bring more than just capital; they also offer strategic guidance, mentorship, and networking opportunities to enhance the companies' chances of success. By fostering innovation and entrepreneurship, venture capital supports the broader economy while providing significant returns on investment as successful startups mature and expand.

Real estate is an important driver of the Russian private equity market due to the country's expanding urbanization and infrastructure development. Private equity firms often invest in commercial, residential, and mixed-use properties to capitalize on the growing demand for real estate driven by both domestic and international buyers. Investments in real estate offer a reliable avenue for generating long-term returns through property appreciation, rental income, and urban development projects. Moreover, with real estate being a tangible asset, it acts as a hedge against inflation, making it an attractive investment class for private equity firms.

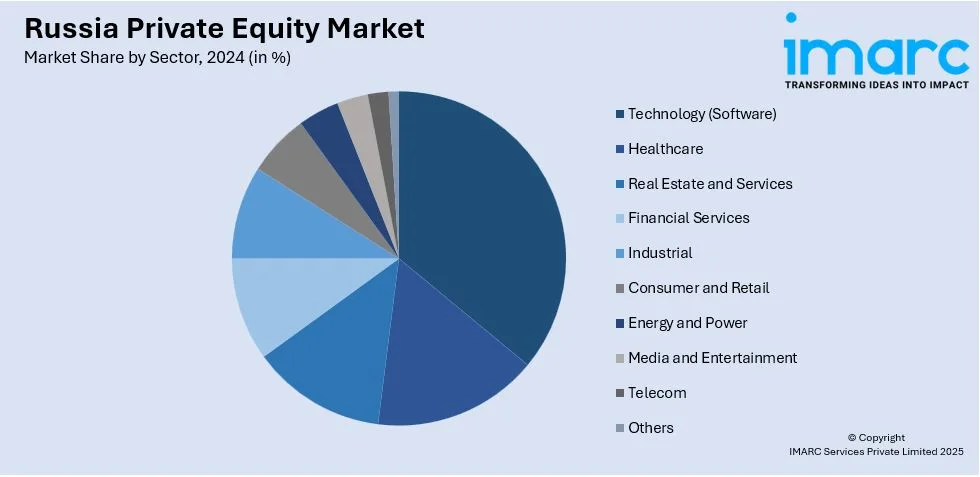

Analysis by Sector:

- Technology (Software)

- Healthcare

- Real Estate and Services

- Financial Services

- Industrial

- Consumer and Retail

- Energy and Power

- Media and Entertainment

- Telecom

- Others

Technology (software) plays a critical role in the Russian private equity market by attracting investments in digital transformation and innovation. The growth of the tech sector, particularly in software development, data analytics, AI, and cybersecurity, has become a primary driver for venture capital funding. As businesses across various sectors digitize, there is an increasing demand for technological solutions to optimize operations and improve efficiency. Investors are keen on backing software companies with strong growth potential, scalability, and the ability to disrupt existing industries, contributing to Russia’s broader tech ecosystem and digital economy.

The healthcare sector has become a significant area of investment in the Russian private equity market due to the country’s aging population and increasing demand for quality medical services. Private equity funds are focusing on healthcare infrastructure, medical technology, pharmaceuticals, and digital health solutions to address gaps in the sector. As the Russian government invests in healthcare reforms, private equity firms see opportunities to support the development of advanced medical facilities, telemedicine, and healthcare products. This growing sector promises long-term returns due to the rising focus on healthcare accessibility and innovation in Russia.

Real estate and services in Russia are key drivers of private equity investments, as the sector offers attractive returns due to its growth potential and increasing urbanization. The expansion of residential, commercial, and industrial real estate is supported by both local and international investors looking for high-yield opportunities. Private equity firms are investing in property development, management services, and infrastructure projects, capitalizing on the demand for modern, well-equipped buildings. With the Russian economy diversifying, real estate offers stable returns, with both residential and commercial properties becoming critical assets in the country’s economic transformation.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District plays a pivotal role in Russia’s private equity market due to its position as the country’s political, economic, and financial hub. Moscow, the capital city, is home to numerous investment firms, multinational corporations, and startups, making it a prime area for private equity activity. With access to a skilled workforce, a concentration of large businesses, and significant infrastructure development, the district attracts both domestic and international investors seeking opportunities in sectors like technology, finance, and real estate. The region’s economic strength and market potential offer a stable environment for private equity investments.

The Volga District holds significant importance in Russia’s private equity market due to its diverse economic landscape and growing industrial base. The region is a major player in manufacturing, energy, and agriculture, which creates numerous opportunities for private equity investments in these sectors. The Volga District also has a well-developed infrastructure, with expanding logistics, transportation, and industrial parks, which further attracts capital. The district’s strategic location along major rivers and close proximity to key European markets makes it an attractive area for investments aiming for both local and international growth.

The Urals District is crucial to Russia’s private equity market due to its resource-rich economy and its role as a key industrial and manufacturing hub. The region is a leading center for heavy industry, including metallurgy, mining, and energy, sectors that are often targeted by private equity firms seeking high-return investments. With ongoing modernization of its industrial base and a strong emphasis on technological innovation, the Urals District presents significant growth opportunities. The strategic location of the region, connecting European Russia to Siberia, also makes it an essential part of the private equity landscape.

The Northwestern District is important to Russia’s private equity market as it encompasses key regions like St. Petersburg, one of Russia’s most developed cities in terms of infrastructure and commerce. The region benefits from a high concentration of industries such as shipbuilding, logistics, and IT, which are attractive sectors for private equity firms. With its strong export-oriented economy and proximity to European markets, the Northwestern District presents opportunities for cross-border investments and strategic partnerships. Its dynamic economy, skilled workforce, and favorable investment environment make it an appealing location for private equity funding.

The Siberian District, with its vast natural resources and emerging industrial sectors, is an essential area for private equity investment in Russia. The region is rich in oil, gas, and minerals, attracting private equity firms focused on energy and resource extraction. Siberia is also seeing increasing industrial development, particularly in sectors like agriculture, forestry, and manufacturing, providing a broad range of investment opportunities. Despite its remote location, the district’s growing infrastructure and potential for long-term economic growth make it a valuable region for private equity players looking to capitalize on Russia’s resource-based economy.

Competitive Landscape:

The competitive landscape of the Russia Private Equity market is characterized by a mix of domestic and international investors, with varying degrees of market entry strategies. Domestic private equity firms tend to focus on sectors closely tied to Russia's economic strengths, such as energy, natural resources, and heavy industry. International investors, particularly those from Europe, the US, and Asia, often seek opportunities in emerging sectors such as technology, infrastructure, and consumer goods. Competition is intensified by the relatively high-risk environment, with regulatory changes, geopolitical issues, and market volatility influencing investment decisions. Additionally, private equity firms face pressure to balance long-term growth potential with the need for returns amidst Russia’s evolving economic climate.

The report provides a comprehensive analysis of the competitive landscape in the Russia private equity market with detailed profiles of all major companies.

Russia Private Equity Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Sectors Covered | Technology (Software), Healthcare, Real Estate and Services, Financial Services, Industrial, Consumer and Retail, Energy and Power, Media and Entertainment, Telecom, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia private equity market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia private equity market was valued at USD 14.1 Million in 2024.

The drivers of the Russia private equity market include the country’s abundant natural resources, growing industrial diversification, increasing foreign investment, expanding infrastructure, a rising consumer market, regulatory reforms, emerging technology sectors, and the development of new industries such as fintech and e-commerce.

The market is projected to exhibit a CAGR of 10.40% during 2025-2033, reaching a value of USD 34.5 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)