Russia Pet Food Market Size, Share, Trends and Forecast by Pet Type, Pricing Type, Product Type, Ingredient Type, Distribution Channel, and Region, 2025-2033

Russia Pet Food Market Size and Share:

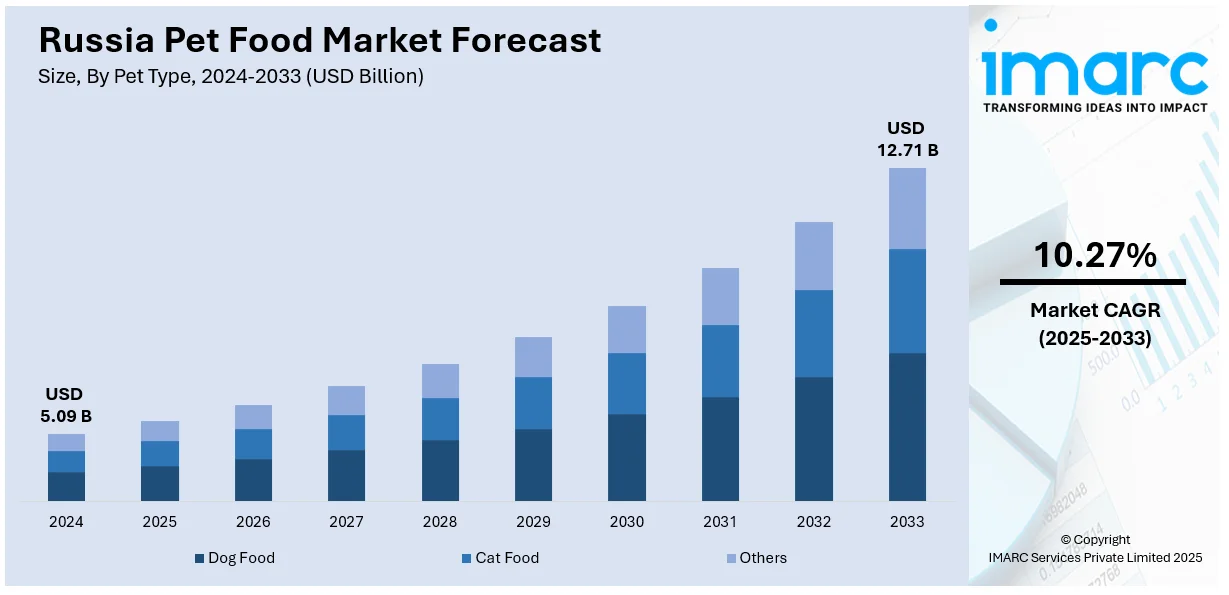

The Russia pet food market size was valued at USD 5.09 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.71 Billion by 2033, exhibiting a CAGR of 10.27% from 2025-2033. Rising pet adoption, premiumization of pet food, and increasing health awareness are key factors propelling the market growth. Besides this, Russia pet food market share is driven by the escalating demand for higher-quality, specialized food on account of the focus on nutrition and pet well-being. E-commerce growth also enhances product accessibility, further fueling the market growth across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.09 Billion |

| Market Forecast in 2033 | USD 12.71 Billion |

| Market Growth Rate 2025-2033 | 10.27% |

Pet parents are progressively focusing on the health and wellness of their animals, choosing superior food options. As pet parents grow increasingly aware of the advantages of high-quality pet food, the need for such products increases. High-quality pet food frequently includes superior ingredients like organic, grain-free, or protein-dense choices. These items address the rising trend of pet humanization, in which pets are considered family members. The growing emphasis on pet nutrition and wellness has resulted in greater expenditures on specialized diets. Customers are ready to spend extra on high-quality products that provide particular health advantages like joint support or better digestion. Furthermore, the high disposable income enables pet parents to spend on premium food choices. High-quality pet food items are frequently promoted with assertions of enhanced health, extended life, and superior flavor, attracting pet parents. The accessibility of high-end brands via supermarkets, specialty shops, and online platforms additionally enhance market expansion.

Rising health awareness about the pet’s health is significantly driving the Russia pet food market demand. Pet parents are increasingly focused on the dietary requirements and health of their pets. This change in attitude is resulting in an increasing inclination towards healthier, natural, and organic pet food options. Pet parents are dedicated to offering balanced nutrition that promotes their pets' overall well-being. Health-minded pet parents are specifically looking for food that supports longevity and helps prevent illnesses. Items with functional components like probiotics, vitamins, and minerals are becoming increasingly popular. Moreover, veterinarians are taking on an important role by suggesting tailored diets for pets with particular health requirements. Social media and internet communities are generating awareness about the significance of proper nutrition for pets.

Russia Pet Food Market Trends:

Expansion of online retail platforms

The growth of e-commerce platforms is influencing the pet food industry in Russia. According to market reports, e-commerce in Russia saw a 28% increase in 2023, totaling 6.4 trillion Rubles. Pet parents are more frequently choosing the ease of buying pet food through online shopping sites. E-commerce gives them the opportunity to explore a wider selection of pet food brands and products. These platforms typically offer comprehensive product details, customer reviews, and comparison tools, impacting buying choices. The increasing use of online shopping is especially common among younger, technology-oriented people residing in urban regions. Moreover, e-commerce provides subscription models that guarantee hassle-free, regular deliveries of pet food. This benefit appeals to hectic pet parents who favor home delivery instead of shopping in stores. Digital platforms also assist in breaking down geographical obstacles, allowing people in distant regions to access a range of products. Discounts, promotions, and exclusive deals enhance the allure of online shopping, making it more attractive. Furthermore, as internet access and mobile shopping grow, the presence of online pet food sellers continues to widen throughout Russia. The presence of both high-end and budget-friendly pet food choices online meets different preferences and financial situations.

Increasing aging demographics

Russia's demographic aging is gradually driving the market of pet food forward. Elders are adopting more pets because of companionship and more spare time. According to UNESCAP, the number of old people aged over 60 years by 2050 will amount to 32.6 percent of the entire population in Russia. Pets also emotionally support them in case elderly people live alone. With a growing elderly population, they tend to invest more in high-grade pet food so that their pets remain healthy. The awareness among seniors about the nutrition of their pets is building demand for niche and health-related pet food. Many elderly pet parents are also becoming more educated about the specific dietary requirements of their pets, seeking quality food. Older pet parents are more likely to use online platforms to conveniently order pet food, which fits their lifestyle. The trend toward smaller pets, such as cats and small dog breeds, also fits the preference of older pet parents. Health-specific pet food products including joint support or digestive health, are also growing in popularity in this age group. Since older adults spend most of their time indoors, they regard pets as part of the family, thus they are more inclined to provide adequate nutrition.

Rising pet adoption

Another factor promoting the growth of the pet food market in Russia is rising adoption of pets. According to market reports, 57% of families in Russia keep pets; among these cats are kept in 43% of households, whereas dogs are kept in 22% of households. Many Russians keep more than one type of pet and 16% reported having more than one type; for instance, 28% of cat-keeping households also have dogs. Increasing urbanization, along with lifestyles, is influencing more people to keep pets as companions for their households. As pets are becoming an integral part of the family, their nutritional requirement is being seriously considered. Nowadays, pet parents are becoming highly conscious about pet food, such as high quality and nutritious feeding. The latest trend of humanization of pets is encouraging many to opt for premium food types for their domesticated animals. In this age, adoption in pets extends much beyond cats and dogs, targeting smaller-sized creatures like rabbits, and more broadly, driving higher demand for diversity in the offered food. In addition, supermarkets, specialty stores, and online platforms have been expanding pet food offerings as demand increases.

Russia Pet Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia pet food market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on pet type, pricing type, product type, ingredient type, and distribution channel.

Analysis by Pet Type:

- Dog Food

- Cat Food

- Others

The dominance of dog food in the market is driven by the high number of dog adoption in Russia. Dogs are the most common pets in Russian households, leading to an increased demand for dog-specific nutrition. Additionally, as dogs are often treated as family members, pet parents seek premium, nutritionally balanced, and functional food options to improve their pets' health. The growing trend of pet humanization also drives the demand for specialized dog food products, such as those for specific breeds, sizes, or health conditions.

The cat food segment is also experiencing growth due to an increasing number of cat parents in Russia. Cats are often more independent than dogs, which appeals to individuals with busier lifestyles, further driving demand for cat food. The market for cat food is expanding with the demand for specialized diets including high-protein, grain-free, and sensitive stomach formulas. In particular, as pet parents become more health-conscious, they are seeking food that promote longevity and address specific dietary needs.

Analysis by Pricing Type:

- Mass Products

- Premium Products

Mass products in the pet food market are driven by price sensitivity and high demand for affordable options. Many pet parents, especially in larger, lower-income segments, prioritize budget-friendly food that still meets basic nutritional needs. The mass product segment caters to this demand with affordable, mass-produced pet food in larger quantities. These products often focus on cost-effective ingredients while meeting standard health requirements for pets. Additionally, the availability of mass pet food in various retail channels including supermarkets and discount stores, ensures broad market access.

Premium products are gaining popularity as pet parents increasingly prioritize quality, nutrition, and overall well-being of their pets. This segment caters to pet parents who view their pets as family members and are willing to pay more for high-quality, specialized food products. Premium pet food often includes natural, organic, and grain-free ingredients, and is formulated to meet specific dietary needs like joint health or weight management. The rising trend of pet humanization is catalyzing demand for premium products, which are often marketed as healthier or more ethically sourced. Premium products also appeal to pet parents looking for food tailored to their pets’ breed, size, or life stage.

Analysis by Product Type:

- Dry Pet Food

- Wet and Canned Pet Food

- Snacks and Treats

Dry pet food is the most popular product type in the market because it is convenient, has a long shelf life, and is cost-effective. It is easy to store and serves as a quick, no-mess feeding option for pet parents. Dry food also benefits pets' dental health, as it helps reduce tartar buildup with its crunchy texture. Dry pet food is also in plentiful supply and can be purchased in bulk. Therefore, if one has many pets, then this is an inexpensive way of feeding them. Practicality being the watchword, dry food remains the pet food market leader.

Wet and canned pet food demand is on the rise, as it contains high moisture levels. This helps hydration in pets who may not drink enough water. These products are often considered more palatable and appetizing for pets, appealing to fussy eaters. Wet food comes in different formulations including specialized ones for health conditions, such as urinary tract or digestive issues, which catalyze demand among health-conscious pet parents. Canned food also usually has a higher protein content, which appeals to pet parents who want their pets to have diets rich in protein.

Snacks and treats are becoming an essential part of the pet food market, driven by the growing trend of pet humanization. The pet parent increasingly seeks healthy, functional treats for rewarding their pets while addressing specific needs such as joint health, dental care, or weight management. The wide variety of treats available, from chews to training rewards, appeals to people looking to enhance their pets' lifestyle. With a focus on premium ingredients, treats are often marketed as natural, organic, or free from artificial additives, making them attractive to health-conscious pet parents.

Analysis by Ingredient Type:

- Animal Derived

- Plant Derived

Animal-derived ingredients dominate the pet food market due to their high protein content and nutritional value, which are essential for the growth and maintenance of pets, especially carnivorous species like dogs and cats. Meat, poultry, fish, and other animal-based proteins are rich in amino acids and essential fatty acids that contribute to healthy coat, muscle development, and overall pet health. Pet parents are increasingly seeking protein-rich food for their pets, particularly those with active or working dogs. Animal-based ingredients are also preferred by many pet parents who view their pets’ dietary needs as similar to those of humans, opting for food that reflect natural carnivorous diets. The growing trend of humanization of pets further drives the demand for high-quality animal-derived products in premium pet food products.

Plant-derived ingredients are gaining traction in the pet food market due to rising interest in plant-based diets and sustainable, ethical sourcing. With increasing concerns over animal welfare and the environmental impact of animal farming, some pet parents are opting for plant-based or partially plant-based food for their pets. Plant-derived ingredients, such as peas, sweet potatoes, and lentils, provide essential nutrients like fiber, vitamins, and antioxidants, which contribute to overall pet health, digestive function, and immunity. The popularity of grain-free diets is also contributing to the rise in plant-based ingredients, as many plant options provide healthy alternatives to grains like corn or wheat.

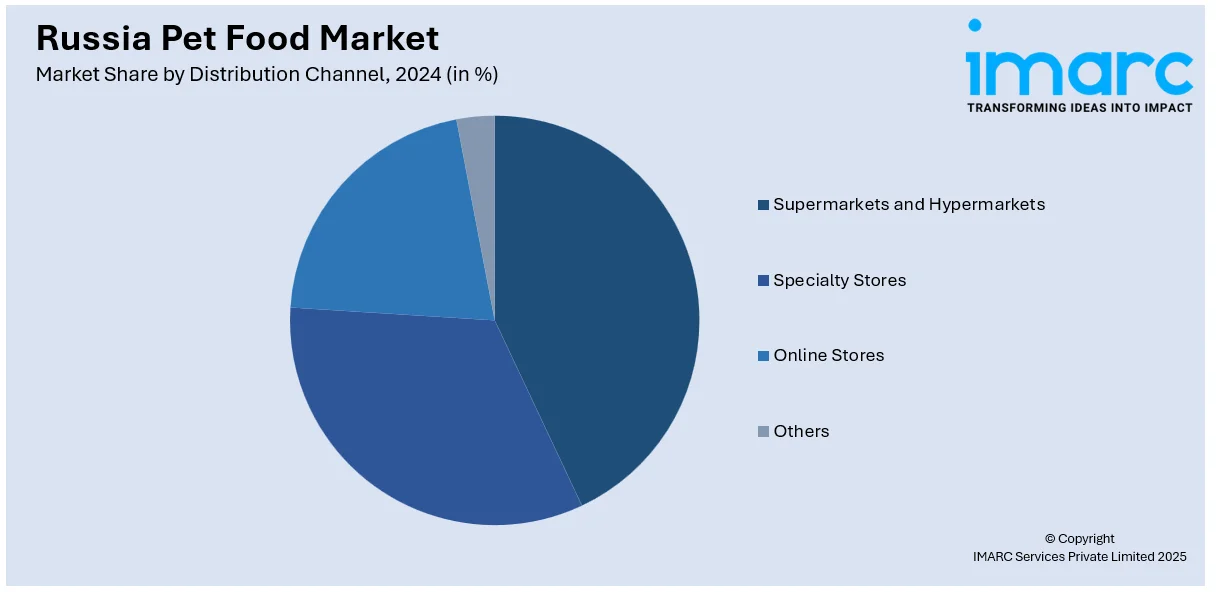

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Supermarkets and hypermarkets remain dominant in the pet food market due to their widespread accessibility and the convenience they offer. These retail outlets are frequented by a broad range of customers, making them a go-to destination for pet parents to purchase pet food during their regular grocery shopping trips. Additionally, the large shelf space allocated for pet food products allows people to choose from a wide variety of brands and formulations, catering to different pet types and dietary preferences. The competitive pricing and availability of mass-market products also make these stores attractive for budget-conscious pet parents.

Specialty stores are becoming an increasingly popular channel for pet food due to their focus on high-quality, premium products. These stores cater to pet parents who are willing to invest in specific, tailored nutrition for their pets, such as organic, natural, or breed-specific food. Specialty stores often offer expert advice and personalized recommendations, which appeal to pet parents who are more discerning about the food they purchase for their pets. Additionally, these stores may carry exclusive or hard-to-find pet food brands that are not available in mass retail outlets, which helps attract niche markets.

Online stores are rapidly gaining market share in the pet food segment due to the convenience they offer, especially in terms of home delivery and subscription services. E-commerce platforms enable pet parents to access a wide range of pet food brands, easily compare prices, and read reviews without leaving their homes. The growth of online shopping for pet products is being fueled by busy lifestyles, with many pet parents preferring the convenience of having their pet food delivered directly to their door. Online stores also cater to a wider geographic reach, making it easier for customers in remote areas to access diverse pet food options.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is the largest and most economically developed region of Russia, accounting for a significant portion of the pet food market. With major cities like Moscow and its surrounding areas, this region has a large, affluent customer base that increasingly views pets as family members, catalyzing demand for higher-quality pet food. The urban population in this district has access to a variety of pet food products through supermarkets, specialty stores, and online platforms. Additionally, the Central District’s higher disposable income allows for greater spending on specialized and higher-quality pet food products.

The Volga District has a diverse population and a mix of urban and rural areas, which results in varied demand for pet food products. The major cities in this region, such as Kazan and Nizhny Novgorod, contribute to the rising trend of pet adoption and the preference for higher-quality pet food. However, in rural areas, mass-market pet food products are more popular due to lower average incomes. As a result, both budget-friendly and premium pet food options are important in this region, with an emphasis on accessibility and affordability.

The Urals District is an industrial hub with a growing middle class, contributing to increased pet adoption and an expanding pet food market. While the region has significant urban centers like Yekaterinburg, where pet food demand is similar to the Central District, rural areas still rely more on mass-market options due to budget constraints. The region is witnessing a shift towards premium pet food products, driven by rising disposable incomes and the increasing humanization of pets. Moreover, as the region continues to industrialize and urbanize, the demand for a variety of pet food types, including dry, wet, and functional food, is expected to rise.

The Northwestern District, home to cities such as St. Petersburg, features a large urban populace and closeness to key European markets, shaping customer choices for high-quality, premium pet food. The pet food industry in this area is notably fueled by pet parents ready to spend on specialized diets for their animals, mirroring Western consumption habits. As a significant cultural and economic hub, St. Petersburg has experienced an increase in demand for both international and domestic premium pet food brands. Moreover, the increasing e-commerce infrastructure in the region enhances access to various pet food products, aiding in the market's growth.

The Siberian District's vast geography and harsh climate give a unique challenge and potential for the pet food industry. Pet adoption is increasing in larger places such as Novosibirsk, which is driving up demand for pet food. However, in more rural places, access to specialist pet diets is limited, and mass-market alternatives are more common. Because of the district's colder environment, there is a greater emphasis on goods that benefit pets' health throughout the winter months, such as food that enhances immunity or encourages coat health.

Competitive Landscape:

Top brands are improving their product selections with high-quality pet food choices. These businesses emphasize providing top-notch nutrition adjusted to different pet requirements, including age and health needs. Furthermore, global brands are increasing their market presence by taking advantage of the rising trend of pet adoption in Russia. Local producers are also making headway by providing affordable options that appeal to budget-conscious individuals. These players concentrate on creating food that aligns with local tastes while guaranteeing availability. With the increasing demand for organic and natural pet food, companies are investing in environmentally friendly and sustainable product lines. Additionally, major companies are enhancing their market presence by utilizing e-commerce platforms for wider distribution. The trend of online shopping has allowed pet food brands to connect with a larger customer base, enhancing convenience. Partnerships with veterinarians and pet health specialists further foster confidence in their products. In reaction to the increasing trend of treating pets as family members, businesses are introducing functional food that enhance health and wellness.

The report provides a comprehensive analysis of the competitive landscape in the Russia pet food market with detailed profiles of all major companies, including:

- Mars

- Nestlé

- ПЕТКОРМ

- TiTBiT

- FORSAGE

Latest News and Developments:

- January 2025: Balchug Capital acquired "Raduga" LLC, a leading Russian pet food manufacturer. Founded in 2017, Raduga specializes in premium dry pet food for cats and dogs. In 2024, the company produced over 25,000 tons of pet food, generating more than 2.3 billion Rubles in revenue. Its advanced facility in the Chelyabinsk region has a production capacity of 50,000 tons, with expansion plans to reach 80,000 tons. This acquisition aligns with Balchug Capital’s strategy of investing in high-quality assets within the real economy sector.

- October 2024: Researchers from the Izhevsk State Medical Academy in Russia developed the world's first anti-aging pet food. This innovative formula contains geroprotective compounds like epigallocatechin gallate, silymarin, curcumin, resveratrol, and naringenin, which may influence molecular markers and signaling pathways linked to aging and longevity. Preliminary tests on laboratory rodents and domestic cats suggest potential benefits, including improved blood parameters for liver and kidney function. The team plans to refine the formula further and expand globally, with international sales expected in late 2025.

- June 2024: Russia announced mandatory labeling for pet food and veterinary drugs to combat counterfeits, which make up 25% of sales in some segments. Dry pet food labeling starts in October 2024, and wet food in March 2025. Unlabeled products will be banned, with proposed criminal penalties for counterfeit imports, impacting industry costs.

- April 2024: Center for the Development of Advanced Technologies (CRPT), which operates Russia's 'Chestny ZNAK' system, successfully labeled the first batch of dog beer as part of an ongoing pet food labeling experiment. The trial took place at the Apicenna production facility near Moscow, where a labeling method was applied to alcohol-free dog beer made with hops and yeast, with the code placed on the bottle cap.

Russia Pet Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog Food, Cat Food, Others |

| Pricing Types Covered | Mass Products, Premium Products |

| Product Types Covered | Dry Pet Food, Wet and Canned Pet Food, Snacks and Treats |

| Ingredient Types Covered | Animal Derived, Plant Derived |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Companies Covered | Mars, Nestlé, ПЕТКОРМ, TiTBiT, FORSAGE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Russia pet food market outlook, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia pet food market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia pet food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet food market in the Russia was valued at USD 5.09 Billion in 2024.

The Russia pet food market growth is driven by rising pet adoption, particularly in urban areas. Premiumization is also a significant trend, with pet parents seeking higher-quality, specialized food for their pets. Additionally, health awareness is growing, with people prioritizing nutritious, functional pet food to support pet well-being.

The Russia pet food market is projected to exhibit a CAGR of 10.27% during 2025-2033, reaching a value of USD 12.71 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)