Russia Over the Top (OTT) Market Report by Component (Solution, Services), Platform Type (Smartphones, Smart TV's, Laptops Desktops and Tablets, Gaming Consoles, Set-Top Boxes), Deployment Type (Cloud, On-Premises), Content Type (Video Streaming, Game Streaming, Live Streaming, and Others), Revenue Model (Subscription Video on Demand (SVOD), Advertising-Based Video on Demand (AVOD), Transactional Video on Demand (TVOD), and Others), Vertical (Media and Entertainment, Education and Training, Health and Fitness, IT and Telecom, E-Commerce, BFSI, Government, and Others), and Region 2025-2033

Russia Over the Top (OTT) Market Overview:

The Russia over the top (OTT) market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% during 2025-2033. The growing availability of high-speed internet and use of smartphone to stream videos, increasing importance of culturally tailored content, and rising penetration of smart televisions (TVs) and connected devices are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.3 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 7.1% |

Russia Over the Top (OTT) Market Trends:

Increasing Internet Penetration and Smartphone Adoption

With the increasing availability of high-speed internet, watching streaming content on mobile devices is becoming easier, enabling viewers to enjoy entertainment while on the move. The accessibility of smartphones is allowing a broader audience to access over the top (OTT) platforms easily, resulting in more users and higher viewers of content. This pattern is also reinforced by improvements in internet infrastructure and government initiatives to promote digital accessibility. The growing popularity of watching content on mobile devices, especially among younger users who favor mobile-centric viewing over traditional television (TV), is positively influencing the market in Russia. Furthermore, manufacturers are releasing devices with larger screens, higher resolutions, and improved processing power, which is enhancing the experience of streaming content on smartphones. In 2023, Russia unveiled the R-PHONE, a domestically produced smartphone featuring a 6.7" AMOLED display and powered by the new Rosa Mobile operating system. The OS included essential services like an app store and cloud service.

Rise of Localized Content Offerings

The growing need for culturally appropriate material is encouraging OTT platforms to provide more content tailored for local viewers. This refers to not only Russian-language movies and television programs, but also material that reflects specific local cultural traits and interests. These options are expanding the attractiveness of OTT services, attracting viewers who were hesitant to move away from traditional broadcasters. Collaborations between OTT platforms and local production companies are also resulting in the development of unique content, setting these platforms apart from traditional television. The success of localized content is leading to higher user engagement and a growing subscriber base, assisting to establish OTT services as a key player in the entertainment industry. This trend underscores the importance of culturally tailored content. TelecomDaily reported that the investment in original content reached R54 billion (€575 million) in the first quarter and is projected to surpass R207 billion by 2023.

Growing Popularity of Smart TV

More households are investing in smart TVs, streaming sticks, gaming consoles, and set-top boxes, which are making it easier for people to access OTT platforms. These devices enable users to stream high-definition content on large screens, making OTT services particularly appealing for families and groups who enjoy watching together. The inclusion of voice assistants and artificial intelligence (AI)-driven content recommendations enhances user convenience by providing personalized viewing experiences. Additionally, collaborations between device manufacturers and OTT platforms, such as pre-installed apps and bundled subscription offers, are encouraging the adoption of these services. The increasing penetration of smart TVs and connected devices is broadening the reach of OTT platforms, leading to greater user engagement and a growing subscriber base in Russia. TAdviser reported that as of July 8, 2024, the production of BBK, Hyundai, and Telefunken brand TVs in Russia saw a 30-70% increase in 2023.

Russia Over the Top (OTT) Market News:

- May 2024: Okko, a subscription OTT platform, and Match TV obtained the authorization to air the Euro 2024 competition in Russia, marking the inaugural occurrence of the event being accessible on both traditional TV and online streaming services in the nation.

- June 2023: Rostelecom and National Media Group (NMG) completed an agreement to combine their video platforms, more.tv and Wink, into a joint venture operating as Wink. Rostelecom has a 70% share, with NMG possessing 30%, in an effort to enhance their presence in the Russian online movie market.

Russia Over the Top (OTT) Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, platform type, deployment type, content type, revenue model, and vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Platform Type Insights:

- Smartphones

- Smart TV's

- Laptops Desktops and Tablets

- Gaming Consoles

- Set-Top Boxes

A detailed breakup and analysis of the market based on the platform type have also been provided in the report. This includes smartphones, smart TV’s, laptops desktops and tablets, gaming consoles, and set-top boxes.

Deployment Type Insights:

- Cloud

- On-Premises

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud and on-premises.

Content Type Insights:

- Video Streaming

- Game Streaming

- Live Streaming

- Others

A detailed breakup and analysis of the market based on the content type have also been provided in the report. This includes video streaming, game streaming, live streaming, and others.

Revenue Model Insights:

- Subscription Video on Demand (SVOD)

- Advertising-Based Video on Demand (AVOD)

- Transactional Video on Demand (TVOD)

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription video on demand (SVOD), advertising-based video on demand (AVOD), transactional video on demand (TVOD), and others.

Vertical Insights:

- Media and Entertainment

- Education and Training

- Health and Fitness

- IT and Telecom

- E-Commerce

- BFSI

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes media and entertainment, education and training, health and fitness, IT and telecom, e-commerce, BFSI, government, and others.

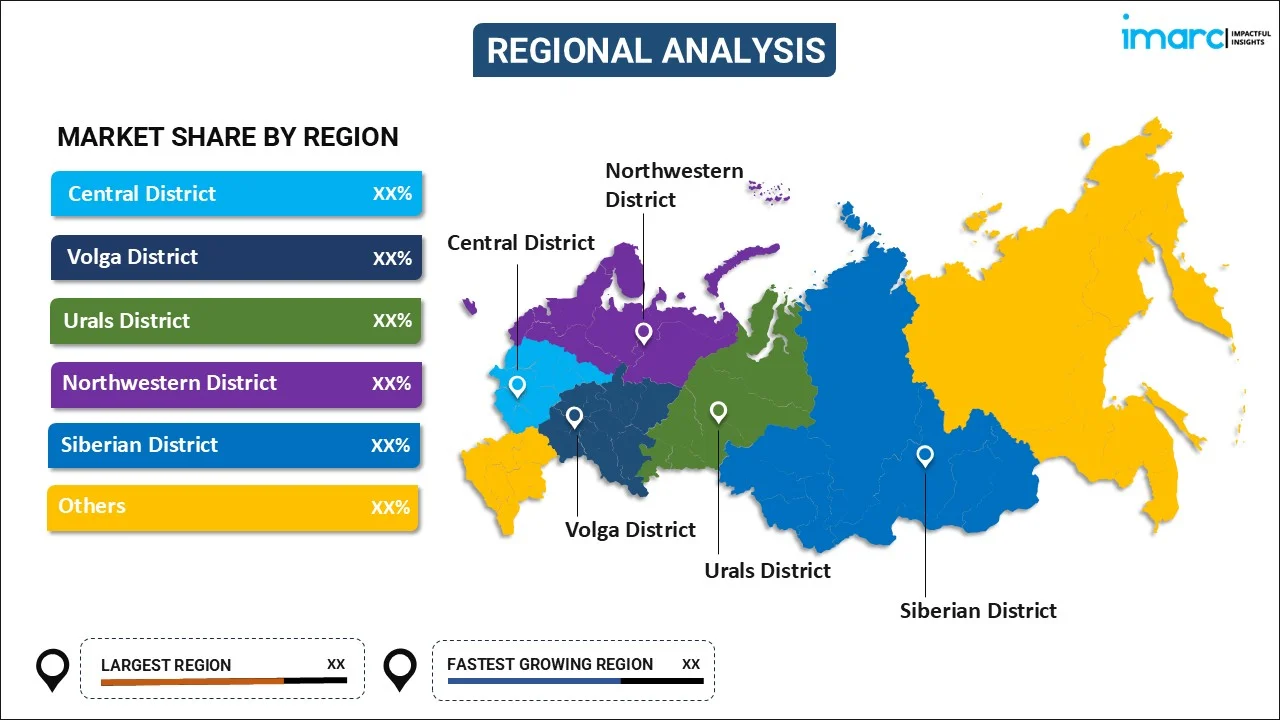

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Over the Top (OTT) Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Platform Types Covered | Smartphones, Smart TV's, Laptops Desktops and Tablets, Gaming Consoles, Set-Top Boxes |

| Deployment Types Covered | Cloud, On-Premises |

| Content Types Covered | Video Streaming, Game Streaming, Live Streaming, Others |

| Revenue Models Covered | Subscription Video on Demand (SVOD), Advertising-Based Video on Demand (AVOD), Transactional Video on Demand (TVOD), Others |

| Verticals Covered | Media and Entertainment, Education and Training, Health and Fitness, IT and Telecom, E-Commerce, BFSI, Government, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia over the top (OTT) market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia over the top (OTT) market on the basis of component?

- What is the breakup of the Russia over the top (OTT) market on the basis of platform type?

- What is the breakup of the Russia over the top (OTT) market on the basis of deployment type?

- What is the breakup of the Russia over the top (OTT) market on the basis of content type?

- What is the breakup of the Russia over the top (OTT) market on the basis of revenue model?

- What is the breakup of the Russia over the top (OTT) market on the basis of vertical?

- What are the various stages in the value chain of the Russia over the top (OTT) market?

- What are the key driving factors and challenges in the Russia over the top (OTT)?

- What is the structure of the Russia over the top (OTT) market and who are the key players?

- What is the degree of competition in the Russia over the top (OTT) market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia over the top (OTT) market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia over the top (OTT) market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia over the top (OTT) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)