Russia Online Food Delivery Market Report by Platform Type (Mobile Applications, Website), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Method (Online Payment, Cash on Delivery), and Region 2025-2033

Russia Online Food Delivery Market Overview:

The Russia online food delivery market size reached USD 8.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.95% during 2025-2033. The market is propelled by the increasing urbanization and digitalization, expanding delivery platforms and restaurant partnerships, rising consumer preferences for convenience and variety, integration of advanced technologies, and emergence of subscription models and membership programs.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.7 Billion |

| Market Forecast in 2033 | USD 14.7 Billion |

| Market Growth Rate 2025-2033 | 5.95% |

Russia Online Food Delivery Market Trends:

Increasing Urbanization and Digitalization

The Russia online food delivery market is significantly driven by the increasing urbanization and digitalization across the country. With a growing number of individuals moving to urban areas, the demand for convenient food delivery services has increased. Urban residents, particularly in metropolitan cities such as Moscow and St. Petersburg, have increasingly busy lifestyles and limited time to cook, making online food delivery an appealing option. Digitalization has further accelerated this trend, with widespread internet penetration and smartphone usage facilitating the adoption of food delivery apps. According to DATA REPORTAL, in the year 2024, there were 130.4 million internet users in the Russian Federation, with internet penetration at 90.4%. The convenience of ordering food through mobile apps and websites has led to a significant rise in the frequency and volume of online food orders. These digital advancements have enabled food delivery companies to efficiently reach and serve a broader consumer base, thus driving the growth of the market.

Rising Consumer Preference for Convenience and Variety

The rising consumer preference for convenience and variety is a major factor propelling the online food delivery market in Russia. Modern consumers, particularly the younger demographic, prioritize convenience in their daily lives. According to Observer Research Foundation (ORF), about 45% of the population of Russia, lies in the age group of 25-45 years of age. The ability to order food from the comfort of their homes or offices, without the hassle of cooking or dining out, has made online food delivery extremely popular. This convenience is further enhanced by the variety of cuisine options available through delivery platforms, catering to diverse tastes and dietary preferences. Additionally, the availability of various discounts, loyalty programs, and promotional offers on food delivery apps makes the service more attractive to consumers. These incentives, coupled with the ease of placing orders and timely delivery, have significantly boosted the demand for online food delivery services. The growing trend of seeking variety in daily meals, without compromising on convenience, continues to drive the market forward, reflecting a shift in consumer behavior toward more digital and on-demand solutions.

Integration of Advanced Technologies

The integration of advanced technologies into the food delivery ecosystem is a significant factor driving the Russia online food delivery market. Innovations such as artificial intelligence (AI), machine learning, and big data analytics are being increasingly utilized by food delivery companies to enhance their operations, improve consumer experience, and streamline logistics. These technologies help in personalizing recommendations, predicting consumer preferences, optimizing delivery routes, and ensuring timely and efficient service. Big data analytics plays a crucial role in understanding market trends and consumer behavior. By analyzing data from multiple sources, food delivery companies can identify emerging trends, understand consumer preferences, and tailor their offerings accordingly. This data-driven approach allows companies to provide more personalized services, attract a larger consumer base, and increase their market share. Moreover, the adoption of contactless delivery methods, which gained prominence during the pandemic, has continued to be popular due to its convenience and safety. The use of GPS tracking systems enables consumers to track their orders in real-time, adding transparency and reliability to the delivery process.

Russia Online Food Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on platform type, business model, and payment method.

Platform Type Insights:

- Mobile Applications

- Website

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes mobile applications and website.

Business Model Insights:

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes order focused food delivery system, logistics based food delivery system, and full-service food delivery system.

Payment Method Insights:

- Online Payment

- Cash on Delivery

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes online payment and cash on delivery.

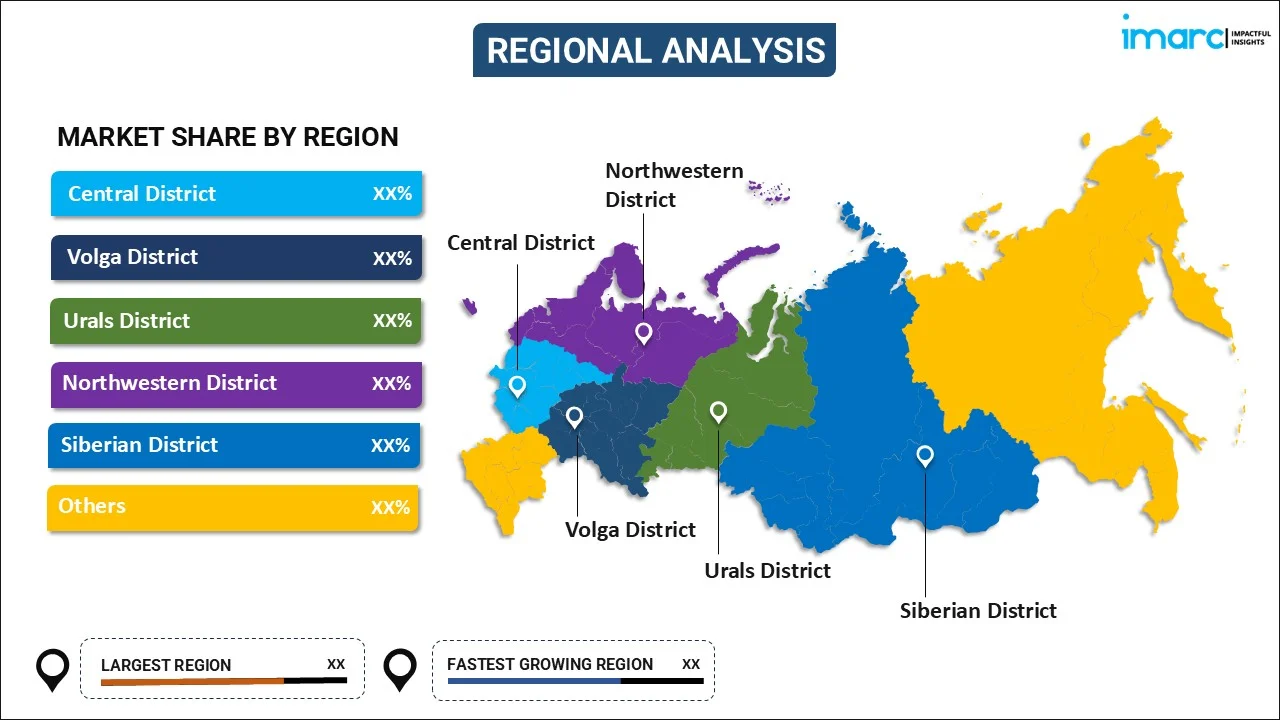

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Online Food Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Website |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System |

| Payment Methods Covered | Online Payment, Cash on Delivery |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia online food delivery market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Russia online food delivery market?

- What is the breakup of the Russia online food delivery market on the basis of platform type?

- What is the breakup of the Russia online food delivery market on the basis of business model?

- What is the breakup of the Russia online food delivery market on the basis of payment method?

- What are the various stages in the value chain of the Russia online food delivery market?

- What are the key driving factors and challenges in the Russia online food delivery?

- What is the structure of the Russia online food delivery market and who are the key players?

- What is the degree of competition in the Russia online food delivery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia online food delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia online food delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia online food delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)