Russia Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Russia Oil and Gas Market Size and Share:

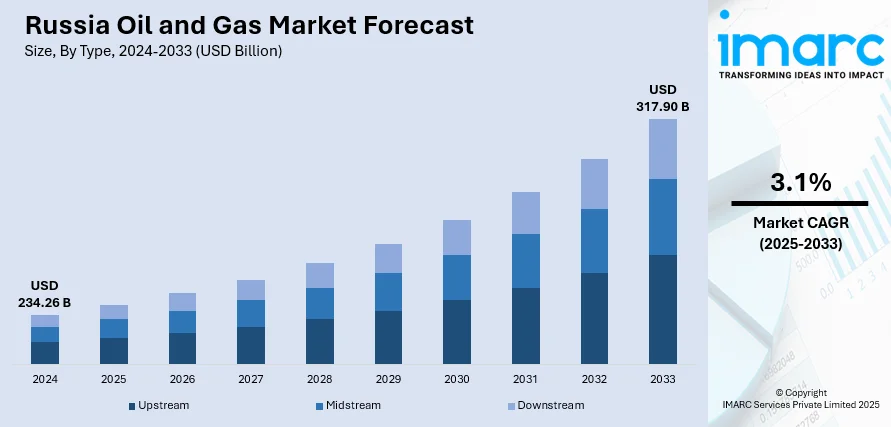

The Russia oil and gas market size was valued at USD 234.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 317.90 Billion by 2033, exhibiting a CAGR of 3.1% during 2025-2033. The market is driven by Russia’s strategic focus on domestic energy resilience, with emphasis on Arctic exploration and unconventional resource development. Advancements in extraction automation, alongside expanded refining and petrochemical capabilities, are improving operational output and efficiency. Rising demand from non-European markets and increased investments in localized equipment manufacturing are further augmenting the Russia oil and gas market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 234.26 Billion |

| Market Forecast in 2033 | USD 317.90 Billion |

| Market Growth Rate (2025-2033) | 3.1% |

The market in Russia is primarily driven by the rising need to enhance energy security and economic resilience through domestic resource optimization. In line with this, the increasing prioritization of energy self-sufficiency and long-term supply assurance is also providing an impetus to the market. Moreover, the continuous development of Arctic exploration projects and unconventional reserves is also acting as a significant growth-inducing factor for the market. Russia’s oil and gas sector is under pressure to stay cost competitive as global demand shifts and competition tightens. Digital solutions, like advanced modeling, logistics optimization, and automated design, are expected to cut capital costs by 10–15%, trim operating expenses by 5–10% and speed up large project commissioning by up to 40%, helping Russian producers hold their ground on the global supply curve. In addition to this, the growing integration of automation and robotics to streamline complex extraction processes is resulting in improved operational performance and cost-efficiency, leading to Russia oil and gas market growth.

To get more information on this market, Request Sample

Besides this, the expanding role of national energy champions in securing international joint ventures is creating lucrative opportunities in the market. Russia is redirecting its crude oil exports, sending about 30 Million Tons yearly to Asia through the ESPO pipeline, with China as its main buyer as sanctions cut access to Japan and South Korea. Through the Power of Siberia pipeline, Russia supplies gas to China, starting at 5 BCM in 2019, set to hit 38 BCM by 2025, and aiming for 100 BCM in the future. Another factor impacting the Russia oil and gas market outlook positively is the consistent focus on localizing equipment production and reducing import dependency. The market is further driven by the implementation of targeted subsidies and fiscal policies supporting upstream and downstream operations. Apart from this, extensive investments in refining and petrochemical capacity upgrades are propelling the market. Some of the other factors contributing to the market include rising demand from emerging export destinations, ongoing exploration of offshore fields in the Far East and Caspian regions, and the strategic emphasis on long-term hydrocarbon monetization.

Russia Oil and Gas Market Trends:

Substantial Shift towards Modernizing Infrastructure

The market is undergoing a significant shift towards modernizing infrastructure and technology. As such, in June 2025, Russia allocated RUB 860 Million (USD 11 Million) to develop industrial and techno parks, including oil and gas projects, with major funding for Tatarstan, Bashkortostan, and Moscow. This trend is characterized by increasing investments in advanced drilling techniques, digital oilfield technologies, and enhanced oil recovery (EOR) methods. This shift is driven by the need to improve extraction efficiency, reduce operational costs, and minimize environmental impact, positioning modernization as a key driver in the market landscape. The modernization drive is also essential for ensuring sustainable and profitable operations, particularly in mature and challenging oil fields. Furthermore, the rapid integration of digital technologies is enabling real-time monitoring and data-driven decision-making, thereby optimizing production processes.

Growing Diversification of Export Routes

The increased diversification of export routes and partnerships is a prominent trend in the market, which is primarily driven by the strategic effort to mitigate geopolitical risks. The expansion of pipeline networks, such as the Power of Siberia pipeline to China, as well as the development of new routes to Asia, including India and other emerging markets, are creating lucrative opportunities in the market. Accordingly, between January and April 2025, Gazprom extended gas infrastructure to 55 Russian localities across seven federal districts. This expansion included 96 inter-settlement and intra-settlement gas pipelines, enabling 6,700 households and 40 boiler houses to access natural gas. In addition to this, forging strategic alliances and long-term supply agreements with these nations is reducing Russia's dependency on European markets. The trend is further supported by leveraging its vast energy resources and strategic geographic position to strengthen its role as a key global energy supplier while securing economic stability and growth.

Increasing Emphasis on Natural Gas Development

The growing emphasis on natural gas development is a significant trend in the Russia oil and gas market. As such, Russia’s natural gas production rose 7.6% in 2024 to 685 BCM, driven by domestic demand, exports, and new fields. Infrastructure expanded, with gas access reaching 74.7% and major projects nearing completion. One of the key Russia oil and gas market trends include Russia capitalizing on its vast natural gas reserves by significantly supporting production and expanding liquefied natural gas (LNG) capacities, facilitating new opportunities as international demand for cleaner energy alternatives rises. This can be attributed to the global shift towards cleaner energy sources. This strategic move aligns with global energy transition trends and the need to reduce carbon emissions. The emphasis on natural gas development is further bolstered by government policies promoting energy diversification and environmental sustainability, ensuring long-term economic benefits for Russia.

Russia Oil and Gas Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia oil and gas market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Upstream

- Midstream

- Downstream

The upstream segment plays a critical role in shaping the Russia oil and gas market by focusing on exploration, drilling, and extraction activities. With Russia holding some of the world’s largest hydrocarbon reserves, upstream investments are vital for ensuring long-term production sustainability. New explorations in Arctic regions and untapped basins are enabling the discovery of unconventional reserves. Enhanced oil recovery (EOR) techniques and digital seismic technologies are improving efficiency and reducing environmental impact. The upstream segment is crucial for maintaining supply security, supporting export growth, and attracting foreign investment, thus reinforcing the country’s position as a key energy producer.

The midstream segment, encompassing transportation and storage, is pivotal to the structural efficiency of the Russia oil and gas value chain. Expanding pipeline infrastructure, such as cross-border projects and internal networks, facilitates uninterrupted distribution across vast geographies and international markets. Russia’s ability to diversify export routes—especially toward Asia, is largely dependent on midstream capabilities. Strategic storage facilities ensure supply flexibility during seasonal demand shifts and geopolitical uncertainties. Investment in technologically advanced monitoring and maintenance systems enhances pipeline safety and performance. This segment not only enables market accessibility but also strengthens trade relations and ensures logistical resilience across domestic and global operations.

The downstream segment adds value through refining, processing, and petrochemical production, making it essential for domestic consumption and export diversification. Modernization of existing refineries and establishment of integrated petrochemical complexes are increasing Russia’s capability to produce high-value end products. These include fuels, lubricants, plastics, and chemicals that serve both industrial and consumer needs. Downstream operations also support local employment and regional development while contributing to energy self-reliance. Moreover, refining excess crude into value-added exports helps mitigate raw commodity dependency. Through innovation and capacity expansion, the downstream segment drives profitability, broadens the product base, and enhances Russia’s global market competitiveness.

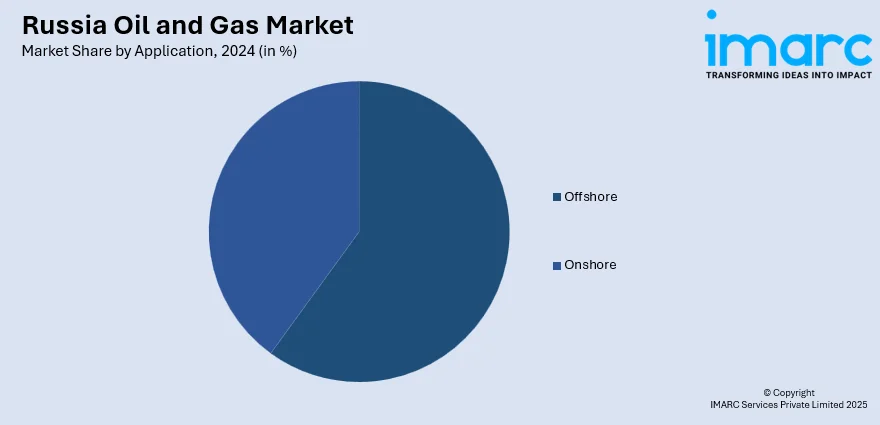

Analysis by Application:

- Offshore

- Onshore

According to the Russia oil and gas market forecast, the offshore segment is gaining prominence in the Russia oil and gas industry due to growing interest in Arctic and Far Eastern waters. These regions hold vast untapped hydrocarbon reserves that require specialized infrastructure and technology for extraction. Offshore drilling enhances the strategic diversification of resource bases, reducing reliance on traditional onshore fields. Collaborations with foreign technology partners are advancing offshore capabilities in extreme weather conditions. Despite higher operational complexity, offshore projects are increasingly prioritized to sustain production volumes and meet export commitments. This segment is instrumental in expanding resource accessibility and ensuring long-term energy supply diversification.

The onshore segment remains the backbone of Russia’s oil and gas output, with established fields across regions such as Western Siberia and the Volga-Urals basin. Onshore operations benefit from mature infrastructure, skilled labor, and cost-effective logistics, enabling stable production and efficient processing. Continuous enhancements in drilling technologies and reservoir management are helping to optimize yield from aging fields. Onshore sites also support easier integration with pipeline networks, facilitating smoother domestic and international distribution. Their strategic importance lies in balancing production risk, managing operational costs, and ensuring consistent energy availability for industrial and consumer sectors alike.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District contributes to the oil and gas market primarily through downstream refining and petrochemical activities. Its proximity to administrative centers and economic hubs supports regulatory oversight, infrastructure financing, and skilled workforce availability. Major industrial clusters in this region are integral to processing and distributing oil and gas products across domestic markets. Additionally, the Central District functions as a logistical bridge between production zones and consumption centers. Investments in refining capacity and storage facilities here enhance supply chain fluidity and market responsiveness. Its infrastructural and administrative role makes the region vital for managing and optimizing Russia’s energy output.

The Volga District holds strategic value due to its significant oil reserves and concentration of onshore extraction operations. The region is home to some of Russia’s oldest and most productive fields, with infrastructure tailored for mature field recovery. Key refineries and pipeline connections in the Volga District facilitate efficient resource transport and processing. Continuous field development programs, supported by state-backed oil companies, contribute to steady production rates. Moreover, the region’s integration with both domestic and export networks enhances its influence on national energy policy. Its consistent contribution to output and regional economic growth reinforces its importance in the sector.

The Urals District serves as a vital link between oil-rich zones and processing centers, with a mix of upstream and midstream infrastructure. This region is characterized by advanced pipeline connectivity and significant logistics assets that support the movement of hydrocarbons across Eurasia. Industrial activity in the Urals District supports both resource extraction and equipment manufacturing, making it a hub for energy-related services. Ongoing modernization efforts are aimed at improving pipeline efficiency and safety standards. Its role in transit and operational support strengthens its position as a key facilitator in the national oil and gas supply chain.

The Northwestern District plays a strategic role in export logistics, particularly through its proximity to Baltic Sea ports and European markets. The region houses critical midstream infrastructure, including export terminals and storage facilities, that handle significant volumes of oil and gas shipments. It also supports petrochemical processing and maritime transport operations, contributing to downstream value addition. As European energy demand shifts, this district is pivotal for re-routing and balancing exports. Investments in cold-weather and maritime handling technology further enhance its capacity. The Northwestern District’s geographical and infrastructural positioning enables it to act as a global energy gateway for Russia.

Siberia is the powerhouse of Russia’s oil and gas production, with vast onshore reserves and a growing number of exploratory projects in remote and Arctic territories. The region hosts some of the most prolific oil fields, supported by extensive upstream operations. Advanced technologies for operating in permafrost and harsh environments are critical here. The Siberian District is also integral to Russia’s energy export strategy, with pipeline links to both European and Asian markets. State-backed exploration and production initiatives, coupled with rising foreign interest, reinforce the region’s centrality to future resource development. Its output underpins Russia’s global energy stature.

Competitive Landscape:

Key players in the Russia oil and gas market are prioritizing strategic investments in technology modernization, infrastructure development, and regional exploration to enhance operational efficiency and resource utilization. They are increasingly adopting advanced drilling techniques, including horizontal and multistage fracturing, to optimize production from mature fields. Companies are also collaborating with domestic and international partners to develop Arctic and offshore reserves, supported by investments in specialized equipment and logistics. In addition, digital transformation initiatives, such as real-time monitoring, predictive maintenance, and AI-driven analytics, are being implemented to streamline operations and reduce costs. Leading firms are further expanding refining and petrochemical capacities to diversify product offerings, while strengthening global partnerships to secure alternative export routes and long-term supply agreements.

The report provides a comprehensive analysis of the competitive landscape in the Russia oil and gas market with detailed profiles of all major companies.

Latest News and Developments:

- June 2025: Russian and Chinese officials discussed expanding LNG and pipeline gas cooperation, including oil and coal projects. While China remains Russia’s top energy buyer post-Ukraine war, it has not committed to the Power of Siberia 2 pipeline, amid ongoing price negotiations and uncertain prospects for a near-term agreement.

- June 2025: The EU announced its 18th sanctions package targeting Russia’s oil, gas, tankers, and banking sector, aiming to cut revenues and enforce stricter price caps. The measures include banning Nord Stream transactions, expanding tanker blacklists, and proposing tougher financial restrictions to pressure Russia for peace negotiations.

- May 2025: Russia and Vietnam agreed to advance oil and gas cooperation, including LNG and crude refining projects. New deals grant PetroVietnam and Zarubezhneft stakes in joint ventures, while talks continue developing Vietnam’s Dung Quat refinery. Both nations aim to enhance energy security and bilateral strategic ties.

- December 2024: President Putin announced Rosneft's USD 20 Billion investment in India, highlighting plans for manufacturing expansion. Strengthened by rising oil imports, Russia became India’s top supplier. Bilateral trade nearly doubled to USD 65 Billion in 2023, with both nations targeting USD 100 Billion by 2030.

- November 2024: Russia planned to merge its top oil companies, Rosneft, Gazprom Neft, and Lukoil, into a single mega producer. This merger aims to strengthen Russia’s control over global energy markets and increase pricing power with key customers like India and China, despite existing U.S. sanctions.

- October 2024: Russia inaugurated the GTD-110M, its first domestically produced high-capacity gas turbine, augmenting Udarnaya power plant capacity and advancing energy independence. Developed by Rostec and Power Machines, this marks a strategic step amid sanctions, though challenges remain in scaling production and competing globally.

Russia Oil and Gas Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Offshore, Onshore |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia oil and gas market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia oil and gas market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The market in Russia was valued at USD 234.26 Billion in 2024.

The Russia oil and gas market is projected to exhibit a CAGR of 3.1% during 2025-2033, reaching a value of USD 317.90 Billion by 2033.

The market is driven by Russia’s focus on energy resilience, Arctic exploration, unconventional reserves, automation in extraction, expanded refining capacity, redirected exports to Asia, localized equipment production, supportive fiscal policies, and investments in new pipelines and offshore projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)