Russia LED Lighting Market Size, Share, Trends and Forecast by Product Type, Installation, Application, and Region, 2025-2033

Russia LED Lighting Market Size and Share:

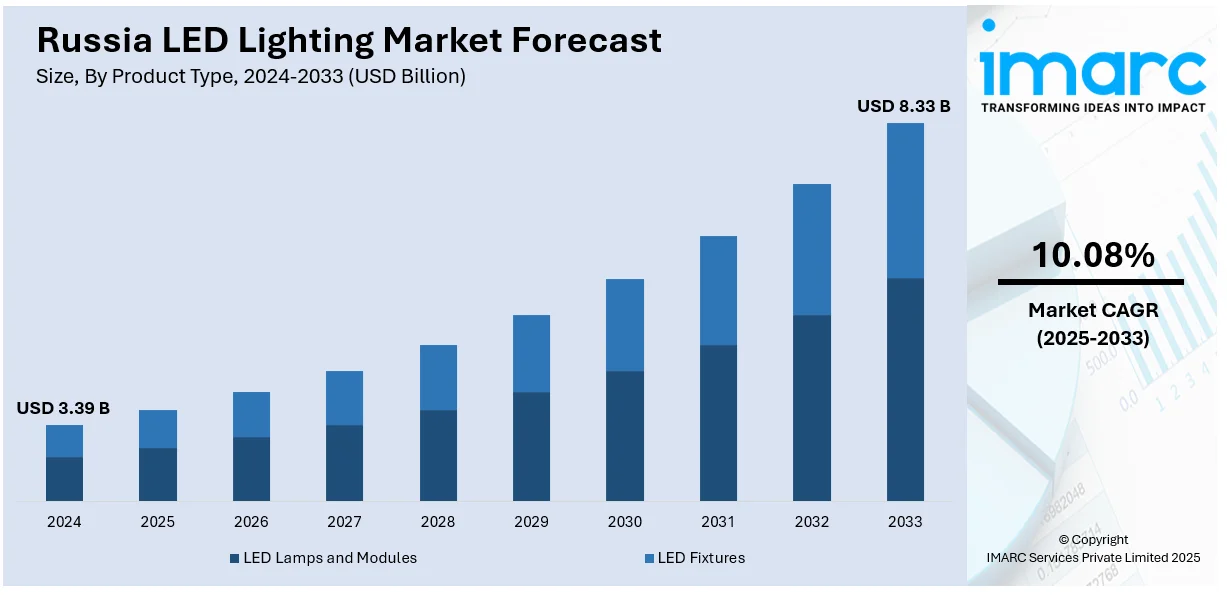

The Russia LED lighting market size was valued at USD 3.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.33 Billion by 2033, exhibiting a CAGR of 10.08% from 2025-2033. The implementation of favorable government initiatives promoting energy efficiency, the introduction of import substitution policies, rapid infrastructure modernization, and the growing demand for smart lighting in urban development and industrial facilities are some of the major factors that are positively impacting the Russia LED lighting market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.39 Billion |

| Market Forecast in 2033 | USD 8.33 Billion |

| Market Growth Rate (2025-2033) | 10.08% |

The market in Russia is primarily driven by the implementation of government initiatives that promote energy efficiency and sustainability. Also, strict regulations on incandescent bulbs and incentives for the adoption of LEDs are propelling the need across residential, commercial, and industrial sectors. According to reports, by 2050, Russia wants to cut greenhouse gas emissions by 80%, and by 2060, achieve net zero emissions. The increased concerns over carbon emissions is compelling industries to shift conventional lighting with LED-based lighting solutions. In addition to these drivers, the increasing price of electricity is encouraging consumers and businesses to shift toward energy-saving solutions and drive Russia LED lighting market demand.

Apart from this, the growing number of infrastructure projects, especially in smart cities and public lighting, are accelerating product adoption. Additionally, the growing demand for smart homes and IoT-based lighting solutions influences Russia LED lighting market price. Moreover, constant technological advancements in LED technology, such as efficiency improvement, long lifetime, and intelligent lighting, continue to drive growth in the market. For instance, on 6 November 2024, VARTON launched IONIK series park luminaires having a correlated color temperature of 2200K to provide safety and comfort under lights in the park and outdoors. GS LED's high-quality Russian LEDs installed in these luminaires give outdoor areas a warm glow and enhancement to the ambiance. Functional forms approach aesthetics, with series like IONIK that ensure durability and energy efficiency for the urban environment.

Russia LED Lighting Market Trends:

Growth of Domestic LED Manufacturing and Localization Efforts

The growing push toward domestic production of electronics is a significant factor facilitating the Russia LED lighting market growth. According to an industry report on September 24, 2024, the country's electronics production is expected to grow by 33% annually, from 2.63 Trillion Rubles in 2023 to over 3.5 Trillion Rubles in 2024. Local manufacturers are expanding their capabilities to reduce dependency on foreign suppliers, especially in response to supply chain disruptions and economic factors. Government support for local production through subsidies, investments in research and development (R&D) activities, and import substitution policies is strengthening the domestic LED industry. Companies are focusing on producing high-quality, cost-effective LED components to compete with global brands. This shift to local production enhances market stability and lower prices and boosts innovation in the Russian LED lighting sector.

Continual Advancements in LED Lighting

Continual developments with key innovations in efficiency, sustainability, and smart technology is a significant Russia LED market lighting trend. Ultra-thin and flexible LED strips enable seamless integration into modern interiors, while higher efficacy chips reduce energy consumption. For example, on July 16, 2024, Feron announced the release of an ultra-thin COB LED strip, measuring only 3mm in width, designed to provide uniform, bright, and efficient lighting. The strip features a minimal cutting interval of 1 cm, allowing for precise customization to fit various applications. Available in multiple color temperatures, this product offers versatility for diverse lighting needs. Smart LEDs with internet of things (IoT) connectivity allow personalized control, adapting to user preferences and optimizing energy use. Human-centric lighting, mimicking natural daylight, enhances well-being and productivity. Advances in micro-LED and COB technology improve brightness and uniformity, which is resulting in higher applications in architectural and automotive lighting. Additionally, eco-friendly materials and improved recyclability align LED development with global sustainability goals, reinforcing its dominance in the lighting industry.

Rising Urbanization and Infrastructure Development

Rapid urbanization in Russia is driving significant demand for LED lighting across residential, commercial, and public infrastructure project. As cities expand, there is a growing need for energy-efficient and sustainable lighting solutions to support modern urban developments. According to UN predictions, by 2050, three-quarters of the Russian population will reside in cities. Russia's rural population would drop from 36.8 Million to 22.1 Million as a result of urbanization. Large-scale construction projects, including smart cities, high-rise buildings, and transportation hubs, are integrating LED technology to improve energy efficiency and reduce operational costs, which is enhancing the Russia LED lighting market outlook. Additionally, municipal authorities are upgrading streetlights and public spaces with LEDs to improve visibility and safety. The increasing focus on eco-friendly urban planning and smart infrastructure is further accelerating the adoption of LED lighting in Russia's expanding cities.

Russia LED Lighting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia LED lighting market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, installation, and application.

Analysis by Product Type:

- LED Lamps and Modules

- LED Fixtures

LED lamps and modules form a big share in the market for Russia LED lighting, as these energy-efficient devices have a longer lifespan and can be used in a wide variety of applications. Energy-saving initiatives by the government, along with the ban on incandescent bulbs in Russia, are driving adoption in the residential, commercial, and industrial sectors. There has been increasing demand for LED retrofitting as businesses and households seek cheaper alternatives to replace traditional lighting systems. Smart lighting applications, which involve connected LED modules for automation and remote control, are gaining popularity, especially in commercial buildings and urban infrastructure projects, thereby helping expand the market.

LED fixtures are in high requirement as urban development and infrastructure modernization require durable and high-performance lighting solutions. These fixtures are used in street lighting, industrial plants, and architectural applications because of their superior luminous efficacy and low maintenance requirements. With growing interest in smart cities and smart lighting solutions, investments in sensor-integrated and IoT-enabled LED fixtures are witnessing further boosts. Government policies on energy-efficient public and commercial building lighting are hastening adoption. Domestic players focus on product differentiation and technology improvements, such as tunable white and human-centric lighting, in response to changes in consumer preferences and regulatory expectations.

Analysis by Installation:

- New Installation

- Replacement

New installations are a major segment of the Russian LED lighting market. Large-scale infrastructure projects, urban redevelopment, and the expansion of smart cities support new installations. Government initiatives for energy efficiency in public and private spaces drive demand for LED lighting in newly constructed residential, commercial, and industrial buildings. The increasing construction of new roads, bridges, and public spaces is creating more avenues for the adoption of LED street lighting and outdoor fixtures. In addition, smart lighting solutions with sensors and automation systems are now an integral part of the design of the modern cityscape. The environmental appeal and regulatory requirements of meeting strict energy efficiency standards are further driving the use of LED technology in new construction projects in Russia.

The replacement segment is a strong driver for the Russian LED lighting market, especially through the desire to replace energy-wasting light sources and consequently reduce electricity costs. Companies, governmental institutions, and households have changed from traditional light sources such as incandescent, halogen, and fluorescent lighting to modern LED solutions. Office, retail, and industrial facility retrofitting projects are driving market growth as companies aim to reduce maintenance costs and adhere to energy-related regulations. Also, the decreasing price of LED products and their longer lifespan make them the preferred replacement choice. The adoption of smart retrofit solutions, such as LED modules with remote control and dimming, is increasingly changing the replacement landscape in Russia market.

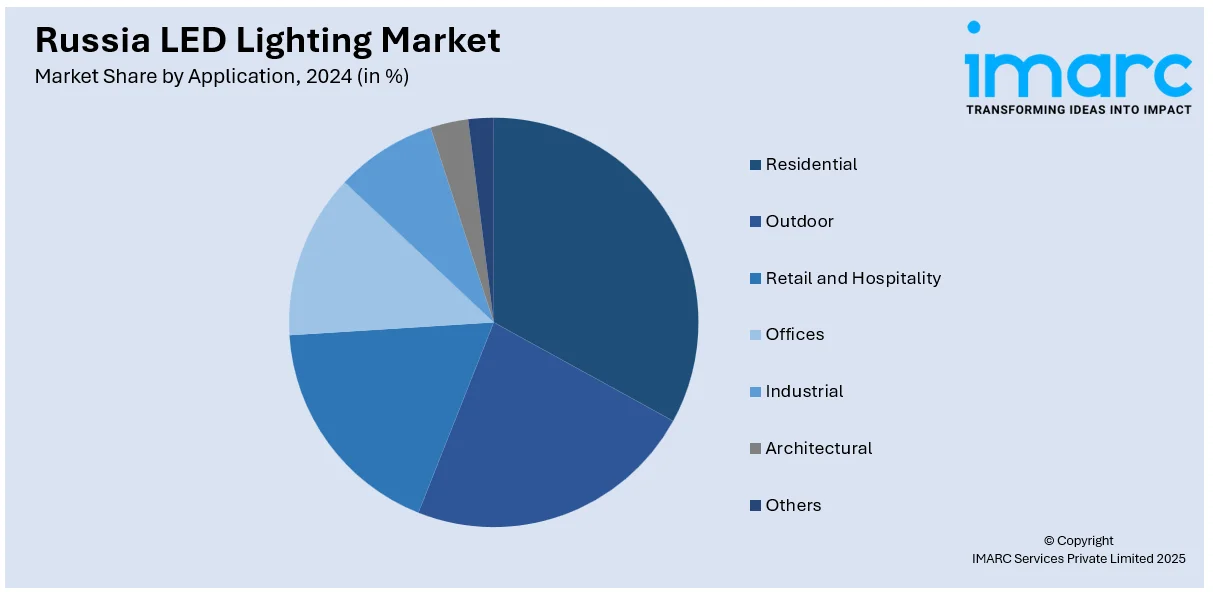

Analysis by Application:

- Residential

- Outdoor

- Retail and Hospitality

- Offices

- Industrial

- Architectural

- Others

Residential is a significant segment in the Russian LED lighting market as consumers are increasingly opting for energy-efficient and long-lasting lighting solutions. Increasing electricity costs, government subsidies, and awareness regarding the benefits of LEDs are propelling adoption in homes and apartment complexes. The availability of smart LED bulbs with dimming, color-tuning, and remote-control features is further enhancing demand. Home automation trends are also influencing the market as connected lighting solutions become increasingly popular. Also, sustainable living and energy-efficient housing projects are pushing the demand for LED lighting in new residential developments.

The outdoor LED segment is highly contributing to the demand in Russia for infrastructure development and smart city projects, modernizing public spaces. Government initiatives regarding street lighting in terms of efficiency and energy-savings motivate the mass implementation of LEDs along roads, in parks, and urban regions. High durability and resistance to all kinds of weather with negligible maintenance costs have made LEDs more favorable for use in outdoor areas. Sports arenas, parking lots, and industrial complexes are also migrating to LED solutions for better visibility and security. The integration of motion sensors and IoT-based adaptive lighting is making it more efficient and reducing operational costs, which supports the market in Russia.

Retail and hospitality sectors in Russia rely on LED lights to create an attractive environment that is energy efficient. Shopping centers, hypermarkets, hotels, and restaurants are turning to LEDs to improve customer comfort while propelling electricity costs down. The versatility of lighting to be used as an ambiance, highlight product presentation, or as aesthetics in a design architecture is fueling demand. Smart LED solutions that adjust brightness automatically and control colors are gaining traction in high-end retail stores and luxury hotels. Also, regulatory requirements on energy efficiency for commercial establishments have forced businesses to replace old lighting with LED. The trend towards experience-driven retail and hospitality design is further creating the need for creative and decorative LED lighting solutions.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Central Region comprises Moscow, is the largest and most developed regional LED lighting market in Russia. High urbanization, government policies encouraging energy efficiency, and modern infrastructure investments increase the demand for LED solutions. Smart city developments in Moscow and other cities are fast-tracking intelligent street lighting and building automation systems. The commercial sector, including offices, retail spaces, and hospitality, is one of the significant contributors to growth, mainly due to the increasing demand for high-performance and aesthetic lighting solutions. New residential construction and retrofitting projects are also driving the adoption of LEDs in homes.

The market in the Volga district is driven by industrial growth, urban development, and government-driven infrastructure projects. The regions of Nizhny Novgorod, Kazan, and Samara are widely using streetlights and streetlamps across bridges and other public spaces. The robust industrial base, in particular the automobile and petrochemical sectors, is pushing for industrial-grade LED lighting solutions in the region. Energy efficiency rules are compelling businesses to shift towards LED solutions and lower operation costs. Also, the focus on sustainability with a lesser carbon footprint leads municipalities and businesses towards retrofitting in LED, thus becoming a leading region in terms of contribution towards the country's LED market.

The Urals District is one of the main Russian industrial centers; it has large markets for LED lighting, mainly in heavy industry, mining, and energy areas. The cities of Yekaterinburg, Chelyabinsk, and Perm invest highly in industrial facilities and LED street lighting, which are gaining popularity for enhancing energy efficiency. Mining and metallurgical plants use high-lumen, long-life LED fixtures due to extreme conditions, thereby raising demand for industrial-grade LED solutions. Incentives offered by the government on energy-saving technologies are persuading businesses to adopt LEDs while increasing interest in smart lighting solutions for warehouses and logistics centers, further driving the expansion of the market in the region.

The Northwestern District, particularly Saint Petersburg, is one of the leaders in LED lighting adoption due to its strong commercial sector and sustainable urban development focus. Heritage sites and architectural landmarks in the city drive demand for decorative and efficient LED lighting solutions. Street lighting upgrades, smart city projects, and expansion of commercial buildings are major growth drivers. The hospitality and retail industries are investing significantly in LED technology to improve aesthetic appeal and decrease energy costs. The proximity of the district to European markets facilitates the adoption of advanced LED technologies. Moreover, the government's push for smart lighting systems in public spaces is fueling the demand for connected and sensor-based LED fixtures.

The Siberian District offers special opportunities for LED lighting, mainly in the industrial, outdoor, and residential sectors. Due to the extreme climatic conditions in the region, LEDs are more in demand because of their robustness and long lifespan. Mining, oil, and gas industries in cities like Novosibirsk, Krasnoyarsk, and Irkutsk rely on high-performance LED fixtures for energy savings and operational efficiency. Government projects that ensure urban infrastructure development and improve street lighting are further driving market growth. The residential segment is also growing as awareness of LED benefits grows. Logistic and distribution challenges in remote locations facilitate market penetration.

Competitive Landscape:

The market is characterized by high competition, driven by technological advancements, price differentiation, and energy efficiency mandates. The market is competitive across residential, commercial, and industrial segments, and smart lighting integration and customized solutions are highly focused. Companies differentiate through product reliability, distribution networks, and after-sales service. Partnerships and acquisitions help in technology transfer and create a favorable market outlook. Russian LED light manufacturers are focusing on improving energy efficiency to meet both local and international regulatory standards. They are investing in R&D to enhance the longevity and performance of their products, while also exploring new materials to reduce production costs. Local manufacturers are increasing their exports to neighboring countries, capitalizing on Russia’s extensive energy infrastructure.

The report provides a comprehensive analysis of the competitive landscape in the Russia LED lighting market with detailed profiles of all major companies.

Latest News and Developments:

- February 27, 2024: The Expocentre in Moscow hosted the 5th International Exhibition of Construction and Finishing Materials and Technologies. One of the industry leaders in LED lighting solutions, INTILED, showcased cutting-edge solutions for safe and comfortable urban environments as well as façade illumination for retail malls, office buildings, apartment buildings, and residential complexes. INTILED also demonstrated its smart façade lighting solutions, which were highly praised as one of the major product innovations in the LED lighting market, at the round table devoted to the lightning of apartments, buildings, and territories in the section Architectural façade lighting.

- July 11, 2024: Feron introduced the LB-1607, a black-bodied LED lamp designed to integrate with black fixtures seamlessly. This design ensures the lamp's boundaries blend smoothly into the fixture, maintaining a clean and aesthetic appearance without disrupting the overall visual perception. The LB-1607 is available with either a classic matte diffuser, offering a 120° beam angle for uniform illumination, or a lensed diffuser with a 38° beam angle, ideal for accentuating specific objects such as displays or artwork.

- January 23, 2025: RosBuild 2025 organizers highlighted key features of the upcoming exhibition, scheduled for March 11–14, 2025, at Moscow's EXPOCENTRE Fairgrounds. The event will showcase advancements in supplier engagement, customized lighting solutions, electric vehicle charging stations, sports infrastructure, and architectural neon designs. RosBuild 2025 aims to foster direct communication between construction industry professionals and government representatives, promoting the latest construction technologies and high-quality materials within the Russian market.

- January 17, 2025: Arlight unveiled a new range of LED strips designed to offer both stylish and functional lighting solutions for various applications. These LED strips are engineered to provide high-quality illumination, energy efficiency, and versatility, making them appropriate for diverse settings such as residential, commercial, and industrial environments. Arlight's latest offerings aim to meet the evolving demands of modern lighting projects, emphasizing both aesthetic appeal and practical performance.

- January 29, 2025: Arlight announced the launch of their FITOLUX series of LED grow strips, engineered to enhance plant cultivation efficiency. These strips combine red and white LEDs to deliver a spectrum conducive to plant development across all growth stages. Key features include energy efficiency, durability, ease of installation, minimal heat emission, and adjustable brightness to simulate natural light variations throughout the day.

Russia LED Lighting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | LED Lamps and Modules, LED Fixtures |

| Installations Covered | New Installation, Replacement |

| Applications Covered | Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia LED lighting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia LED lighting market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The LED lighting market in Russia was valued at USD 3.39 Billion in 2024.

The key factors driving the market are energy efficiency regulations, government incentives, infrastructure modernization, and rising consumer demand for cost-effective lighting. Increasing adoption in commercial and industrial sectors, advancements in smart lighting, and a shift towards sustainable construction further support growth.

The LED lighting market in Russia is projected to exhibit a CAGR of 10.08% during 2025-2033, reaching a value of USD 8.33 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)