Russia Freight and Logistics Market Size, Share, Trends and Forecast by Logistics Function, End Use Industry, and Region, 2025-2033

Russia Freight and Logistics Market Size and Share:

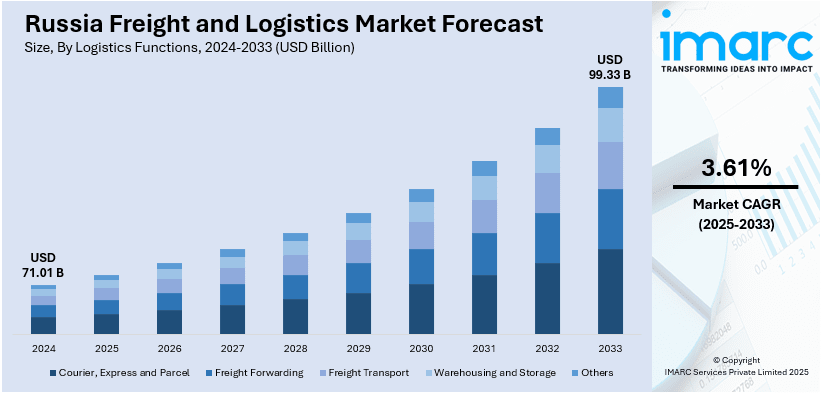

The Russia freight and logistics market size was valued at USD 71.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 99.33 Billion by 2033, exhibiting a CAGR of 3.61% from 2025-2033. The market is driven by significant demand across sectors such as agriculture, manufacturing, oil and gas and retail. E-commerce expansion, infrastructure investments and cross-border trade especially with China and Central Asia are contributing positively to the market growth in Russia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.01 Billion |

| Market Forecast in 2033 | USD 99.33 Billion |

| Market Growth Rate (2025-2033) | 3.61% |

The Russia freight and logistics market is primarily driven by the country’s vast geographic expanse and growing trade activities. As one of the largest transit hubs between Europe and Asia Russia plays an important role in global supply chains while increasing the demand for efficient transportation networks. Infrastructure modernization including the expansion of railways, highways and port facilities is further enhancing connectivity and boosting logistics efficiency. For instance, in January 2025, the Russian government announced an additional subsidy for the railway engineering sector to ensure that the adjustments to the Russian Railways investment program do not affect enterprise workloads. The 2025 investment program is set at 890.9 billion rubles including 257.2 billion rubles for 400 new locomotives and 239 motor-car rolling stock. The government's focus on improving domestic freight corridors and cross-border trade routes is further driving market growth.

Another major key driver in the market is the growing demand for ecommerce and retail logistics. According to industry reports, Russia's online grocery market surpassed ₹1.05 lakh crore (1.2 trillion RUB) in 2024 a 44% annual increase from ₹72,392 crore (824 billion RUB). Online orders reached 788 million up 33%. E-commerce in FMCG grew 35% with regional markets expanding by 40%. The rapid expansion of online shopping in Russia has contributed significantly to the demand for last mile delivery solutions, warehouse automation and distribution centers. Investments in digital logistics platforms, smart tracking technologies and cold chain logistics for food and pharmaceuticals are also accelerating growth. Geopolitical shifts and trade diversification strategies are prompting Russia to strengthen its freight and logistics capabilities ensuring supply chain resilience.

Russia Freight and Logistics Market Trends:

Geopolitical Shifts and Trade Diversification

Russia is actively strengthening trade routes with Asia, the Middle East and BRICS nations to reduce reliance on Western markets amid geopolitical tensions and economic sanctions. Initiatives such as the International North-South Transport Corridor (INSTC) and increased cooperation with China and India are enhancing trade connectivity. For instance, India and Russia are strengthening their cooperation in logistics and supply chains. They are focusing on transport corridors such as the Chennai-Vladivostok Eastern Maritime Corridor and the International North-South Transport Corridor (INSTC). The summit highlighted the importance of energy ties, collaboration in civil aviation, and partnerships in defense technology, with the overarching goal of enhancing trade and interregional connections between the two countries. Investments in new rail, port and logistics infrastructure are facilitating smoother freight movement. Russia is expanding energy exports, agricultural trade and industrial goods exchange with emerging economies reinforcing its position in global supply chains.

Multimodal Transport Growth

Russia is enhancing its multimodal transport network by integrating road, rail, air and sea logistics to improve freight efficiency and reduce costs. Investments in rail corridors such as the Trans-Siberian Railway and expansions in port infrastructure along the Arctic and Far East regions are strengthening trade connectivity. The Northern Sea Route (NSR) is gaining importance as a faster alternative for Asia-Europe shipments. For instance, in August 2023, Russia's Zvezda shipyard announced the launch of two new ice-capable vessels: the 69,000-ton oil tanker Valentin Pikul for Rosneft and the 172,600m³ Arc7 LNG carrier Sergei Witte for Novatek. These ships aim to enhance hydrocarbon transport along the Northern Sea Route reflecting Russia's push for self-reliance amid Western sanctions. Advancements in digital freight management and logistics hubs are streamlining supply chain operations enhancing overall transport efficiency.

Rise in Cross-Border Logistics

Cross-border logistics between Russia, China and Central Asia is witnessing the growing demand mainly due to growing trade volumes. Rail and road freight are becoming key modes with the New Silk Road corridor facilitating faster and more cost-effective transportation. Rail routes like the China-Europe Express are gaining popularity offering an alternative to congested sea routes. Road freight is also expanding connecting Russia with neighboring Central Asian nations enabling smoother access to key markets. For instance, in December 2024, Kazakhstan and Russia announced their plans to establish a cross-border logistics center in Astrakhan enhancing trade ties. The government announced the center will streamline warehousing and transportation aiming to boost efficiency and reduce costs. These logistics solutions support the growing regional economic integration.

Russia freight and logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia freight and logistics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on logistics function and end use industry.

Analysis by Logistics Functions:

- Courier, Express and Parcel

- By Destination Type

- Domestic

- International

- By Destination Type

- Freight Forwarding

- By Mode of Transport

- Air

- Sea and Inland Waterways

- Others

- By Mode of Transport

- Freight Transport

- By Mode of Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- By Mode of Transport

- Warehousing and Storage

- By Temperature Control

- Non-Temperature Controlled

- Temperature Controlled

- By Temperature Control

- Others

The Russia CEP market is segmented by destination type into domestic and international services. Domestic CEP services are growing significantly mainly driven by ecommerce while international services are expanding due to cross-border trade particularly with China and Central Asia. International CEP players are heavily investing in faster delivery networks often using air freight and ground transport. The demand for quicker reliable services is on the rise especially in urban and industrial areas.

Russia’s freight forwarding market is divided by various transport modes including air, sea, inland waterways and others. Air freight is crucial for high-value and time-sensitive goods while sea and inland waterways handle bulk and containerized shipments. With Russia’s vast landmass road transport also plays a significant role in forwarding linking major hubs. Freight forwarding companies are integrating digital technologies to streamline operations offering real-time tracking and data analysis to optimize delivery times and costs.

The Russian freight transport market is segmented by air, pipelines, rail, road and sea and inland waterways. Rail and road are the dominant modes due to Russia’s expansive landmass with rail providing a cost-effective solution for long distances. Air freight is key for high-value and time-sensitive goods while pipelines are primarily used for transporting oil and gas. Sea and inland waterways play a vital role in international trade particularly with neighboring countries and regions.

In Russia warehousing and storage services are categorized by temperature control into non-temperature-controlled and temperature-controlled segments. Non-temperature-controlled warehouses holds the significant Russia freight and logistics market share because they handle general goods, industrial products and bulk items. Temperature-controlled warehouses are growing due to the rise in demand for pharmaceuticals, perishable foods and sensitive goods like electronics. The trend toward automation and smart technologies is prevalent in both categories improving efficiency, stock management and energy use in facilities across the country.

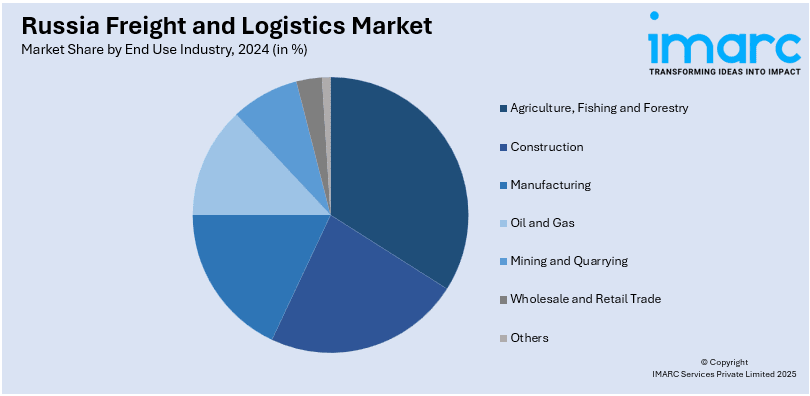

Analysis by End Use Industry:

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas

- Mining and Quarrying

- Wholesale and Retail Trade

- Others

The logistics market for agriculture, fishing and forestry in Russia is critical mainly due to the country's vast natural resources. Freight transport for these industries includes road, rail and sea ensuring the movement of raw materials like grains, seafood and timber. Cold chain logistics also plays a significant role especially in perishable goods like fish and agricultural produce thereby maintaining quality during transport.

The construction industry relies heavily on freight transport including road and rail for moving heavy equipment, building materials and machinery. Logistics services in construction often involve specialized transport solutions due to the size and weight of items. Efficient supply chain management is essential to meet project timelines particularly for large-scale infrastructure developments and ensure timely delivery of materials to remote or urban construction sites.

In Russia's manufacturing sector logistics plays a vital role in transporting raw materials, components and finished goods. Rail, road and sea transport are commonly used to move industrial products and machinery. The sector's increasing reliance on just-in-time delivery methods is boosting demand for reliable and efficient freight services. Warehousing services are key in managing inventory ensuring that production lines are well-supplied without excess stock.

Oil and gas logistics in Russia are crucial with specialized transport systems used to move oil, gas and related equipment. Pipelines dominate the transport of oil and gas but rail and road also play important roles, particularly in remote areas. The sector requires highly efficient logistics to handle large volumes and ensure the timely delivery of resources to refineries and international markets as well as equipment for exploration and drilling operations.

Russia's mining and quarrying sector involves transporting minerals, coal and metals which requires specialized freight solutions. Rail is a key mode of transport due to the large distances between mines and processing facilities. Logistics companies also use heavy-duty trucks and barges for bulk material handling. Efficient and safe transportation of mining resources is critical given the harsh environment and remote locations of many Russian mines.

Logistics in wholesale and retail trade in Russia revolves around the transportation of goods from suppliers to distribution centers and retail outlets. The rapid growth of ecommerce is pushing demand for more efficient CEP services both domestically and internationally. A combination of road, rail and air transport is used, with the need for quick, reliable and cost-effective solutions to meet retail and consumer demand growing significantly especially in urban regions.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is the economic hub of Russia with Moscow as its focal point. It has the highest demand for logistics services mainly due to its large population, high industrial activity and major transportation infrastructure. The region sees significant freight movement especially in ecommerce, manufacturing and retail benefiting from efficient rail, road and air transport networks.

The Volga District is a key logistics region serving as a bridge between European Russia and the Urals. The region is vital for the transportation of agricultural products, oil and gas. Freight transport relies heavily on road and rail with major cities like Kazan and Nizhny Novgorod facilitating trade. The district is also growing in manufacturing and industrial logistics.

The Urals District is a major industrial region rich in natural resources like metals, oil and gas. Rail and road transport are critical for moving raw materials and finished products to major markets. The region’s logistics infrastructure is focused on mining, energy and heavy industry with large freight volumes requiring specialized solutions for efficient distribution to both domestic and international markets.

The Northwestern District is vital for Russia's international trade especially through the port of St. Petersburg. The region is a major gateway for goods entering and leaving Russia with sea freight being dominant. Rail and road transport also play key roles in distributing goods across the district and to other regions particularly in sectors like manufacturing, retail and agriculture.

Siberia’s vast geography requires highly efficient logistics systems particularly rail and road transport to connect remote areas with the rest of Russia. The region is rich in natural resources including oil, gas and minerals and serves as a key hub for their transportation. The harsh climate and long distances make logistics challenging but advanced supply chain management is essential for mining, energy and manufacturing sectors.

Competitive Landscape:

The Russia Freight and Logistics market is competitive with new and incumbent players vying for market share. Dominant market players are large logistics operators offering end-to-end services across modes of transport such as rail, road, air and sea. Advanced technologies such as IoT, AI and automation are being adopted by these operators to enhance operational efficiency enable supply chain visibility and reduce costs. Diversification of services to cater to higher demand from industries like e-commerce, oil and gas and manufacturing is being done by logistics operators offering customized solutions such as cold chain logistics and specialized freight forwarding. Competition is also driven further by growing investments in infrastructure such as rail and port facilities with players competing on the reliability, speed and flexibility of services in a dynamic market scenario.

The report provides a comprehensive analysis of the competitive landscape in the Russia freight and logistics market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Pakistan’s Energy Minister announced a pilot freight train service between Russia and Pakistan via Iran set to launch in March 2025. The government emphasized the strategic partnership with Russia dismissing Western concerns and highlighting plans for direct flights to enhance bilateral connectivity.

- In November 2024, Egypt announced the launch of a new maritime shipping line connecting Dekheila port in Alexandria to Russia's Novorossiysk and St. Petersburg, aimed at transporting agricultural products. Operated by Global Logistics and Fox Shipping the service offers bi-weekly trips and specialized refrigeration support to boost exports to the growing Russian market.

- In October 2024, STF Shipping a new company based in Hong Kong announced the launch of five shipping services between China and the Russian Far East taking over operations from CStar Line. With a fleet of six vessels STF aims to provide timely transportation services despite facing challenges from declining freight rates.

- In July 2024, Russia launched the "Arctic Express No. 1" logistics service connecting Moscow to Chinese ports through a 13,000-km rail-sea route. This new pathway with a transit stop at Arkhangelsk significantly reduces transportation time to 20-25 days, cutting at least 20 days off the Suez Canal route.

Russia Freight and Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia freight and logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia freight and logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight and logistics market was valued at USD 71.01 Billion in 2024.

Key drivers of the Russia freight and logistics market include growing e-commerce demand, increasing cross-border trade with Asia and Europe, significant infrastructure investments, technological advancements in supply chain management, and the rise in industrial and manufacturing activities. Additionally, government initiatives and improvements in transport networks are further fueling growth.

IMARC estimates the freight and logistics market to reach USD 99.33 Billion by 2033, exhibiting a CAGR of 3.61% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)