Russia Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Region, 2025-2033

Russia Footwear Market Size and Share:

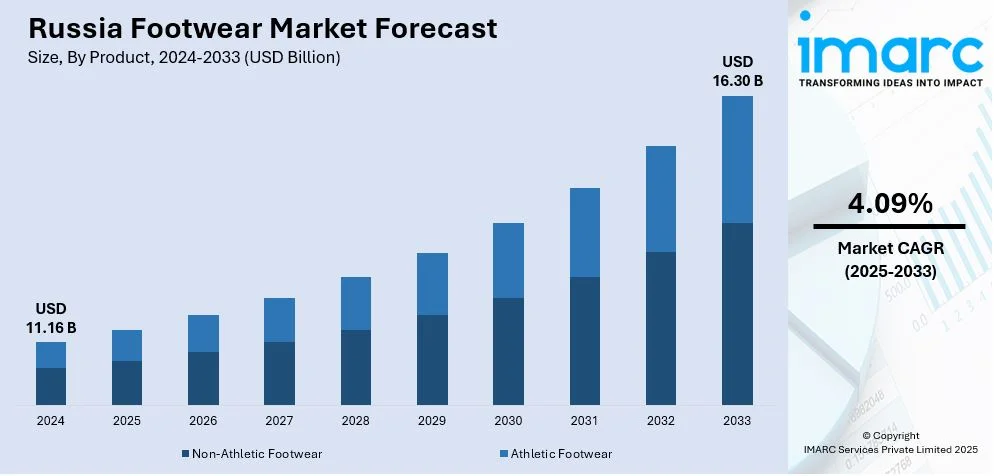

The Russia footwear market size was valued at USD 11.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.30 Billion by 2033, exhibiting a CAGR of 4.09% from 2025-2033. The market share is experiencing steady growth, driven by rising disposable incomes, increasing demand for premium and athleisure footwear, expanding e-commerce channels, evolving fashion preferences, strong winter footwear sales, digital marketing influence, domestic manufacturing support, and greater accessibility to international brands through both physical retail and online platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.16 Billion |

| Market Forecast in 2033 | USD 16.30 Billion |

| Market Growth Rate (2025-2033) | 4.09% |

The Russia footwear market is expanding with the growth of consumer disposable incomes, which enables higher spending on premium and branded footwear, promoting market growth. The influence of Western fashion trends and evolving lifestyle preferences is also encouraging greater demand for diverse footwear categories, such as casual, formal, and sports shoes. International footwear brands are making deep inroads with retail partnerships and online platforms to ensure wider product availability to cater to a wide consumer base. Organized retail and e-commerce channels are also expanding market accessibility, as consumers can now buy footwear at different price segments. Heightening health awareness and fitness participation are fuelling the demand for sports and athleisure footwear, driving sales of performance-oriented shoes. Consumer interest in unique footwear designs is growing with an emphasis on product customization and personalization, supporting premium segment expansion and market diversification. For instance, in December 2024, Vivobarefoot launched VivoBiome, a 3D-printed footwear line using AI-driven design and mobile scanning for personalized fit, emphasizing sustainability with regional production and compostable materials.

The boosting adoption of sustainable and eco-friendly footwear options is shaping product innovation, with manufacturers introducing biodegradable materials and ethically sourced components to appeal to environmentally conscious consumers. The rise in work-from-home culture and hybrid work models is influencing shifts in footwear preferences, boosting demand for comfortable and versatile shoe options. Consumers increasingly want to receive quality and longer life for money paid for boots, thus creating further market expansion with the high number of Russian middle-class members. Social media influence and better use of online marketing are bringing stronger brand value with amplified levels of consumer activity and awareness related to products, further supporting seasonal sales. Rising demand for insulation and waterproof-specific boots in this Russian climate of harsh winters sustains continuous orders for seasonal inventory. Growing interest in home-based manufacturing and government initiatives to promote domestic production have helped bolster competitiveness, where local brands have been able to accelerate market share as demand grows for lower priced but quality footwear.

Russia Footwear Market Trends:

Growing Popularity of Luxury and Premium Footwear

Russia footwear market is witnessing a rise in demand for luxury and premium footwear, mainly driven by rising affluence among urban consumers and the aspirational mindset toward high-end fashion. International luxury brands are opening flagship stores, partnering, and doing exclusive retail collaborations to tap into this segment, which believes in exclusivity and superior craftsmanship. Customers highly want designer shoes that speak about status and elegance and are therefore enhancing in both the men's and women's shoes categories. There is also the demand for exclusive collections and shoes that are especially designed for someone to add personality and individuality to their expression of style. Celebrity endorsements, as well as digital marketing, have also spurred interest in high-end shoes on the part of consumers, hence raising brand engagement across social media channels. As disposable incomes keep increasing, sustained demand for brands recognized worldwide by the masses with a willingness to spend on higher-end footwear ensures that premium footwear is one key growth driver in the segment.

Rising Demand for Athleisure and Performance Footwear

Increasing influence of health-conscious lifestyles and active living trends in Russia is strongly enhancing the demand for athleisure and performance footwear. Consumers intensely incorporate gym workouts, running, and outdoor sports into their regular daily routine and require footwear to be specialized and comfortable with excellent durability and support. International and domestic sportswear brands are capitalizing on this by bringing to market technologically advanced shoes featuring enhanced cushioning, breathability, and energy-return soles. Since athleisure footwear crossovers continue to support boosted popularity, consumers look for versatile options that can be worn for casual or athletic purposes. The heightening preference for stylish yet functional sneakers is prompting footwear companies to expand their product offerings with hybrid designs that combine performance attributes with streetwear aesthetics. As a result, athleisure footwear is becoming a dominant category, driving sustained growth within the market.

Expansion of Online Footwear Retail and Digital Shopping Trends

E-commerce and digital shopping platforms are fast transforming the Russia footwear market forecast by making online retail a channel that is most critical for sales. Consumers prefer more digital shopping, as this can be achieved by convenience, broader product options, and the competitive price they offer. Some leading footwear brands and retailers have already invested in creating seamless omnichannel experiences, integrating virtual try-on features, AI-driven size recommendations, and interactive shopping interfaces to create high customer engagement. Mobile commerce and app-based buying are further boosting online sales as consumers can browse a wide variety of footwear products from local and international brands. Online-exclusive collections of footwear and direct-to-consumer business models are changing the competitive landscape, compelling companies to enhance their digital presence. Social media platforms and influencer marketing are playing a pivotal role in shaping purchase decisions, reinforcing digital retail as a major driver of growth in the Russia footwear industry.

Russia Footwear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia footwear market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, material, distribution channel, pricing, and end user.

Analysis by Product:

- Non-Athletic Footwear

- Athletic Footwear

Non-athletic footwear in Russia is growing due to rising demand for fashion-forward designs, luxury brands, and casual footwear. Consumers seek stylish yet comfortable options, with increasing interest in eco-friendly and locally manufactured shoes. Digital marketing and influencer promotions further drive sales, while e-commerce expands accessibility across urban and rural areas.

Athletic shoes are in huge demand due to fitness, sports, and athleisure trends. Consumers demand comfort, durability, and performance-enhancing features. International brands dominate the market, but local manufacturers are making inroads. E-commerce, celebrity endorsements, and digital engagement strategies significantly influence purchase decisions and will continue to drive the growth of the market.

Analysis by Material:

- Rubber

- Leather

- Plastic

- Fabric

- Others

Rubber footwear continues to be a consumer favorite in Russia, mainly as winter and out-of-door footwear. Abrasion resistant and waterproof, while being low on cost, makes rubber shoes, boots, or soles widespread. It owes to harsh conditions of weather as industrial purposes along with new generations of lighter rubber alternatives which better comfort and offer sustainability.

Leather footwear is the premium segment due to its durability, elegance, and comfort. Consumers prefer the genuine and synthetic leather shoes for formal, casual, and winter wear. Both domestic and international brands focus on high-quality craftsmanship, while a rise in disposable incomes and the latest fashion trends drive demand for luxury and handmade leather footwear.

Plastic footwear, such as PVC and EVA-based products, is preferred for its affordability, water resistance, and versatility. It is widely used in casual, beach, and work footwear. Heightening concerns over sustainability are pushing brands to explore recycled plastic materials to reduce environmental impact while maintaining durability and cost-efficiency.

Fabric footwear is on the rise, especially in casual and athleisure. It is light to wear, breathable, and, most importantly, fashionable for the younger consumer. In terms of demand, sneakers, slip-ons, and more sustainable fabric substitutes top the list. The technological advance of water-resistant and durable fabrics also improves the usability for various weather conditions.

The "others" category consists of mixed material footwear, synthetic alternatives, and innovative eco-friendly composites. The accelerating demand for biodegradable and vegan materials due to growing interest in sustainability is another factor driving demand. Hybrid footwear, where different materials are used to create footwear for improved comfort, durability, and performance, is also becoming highly important in Russia's developing footwear market.

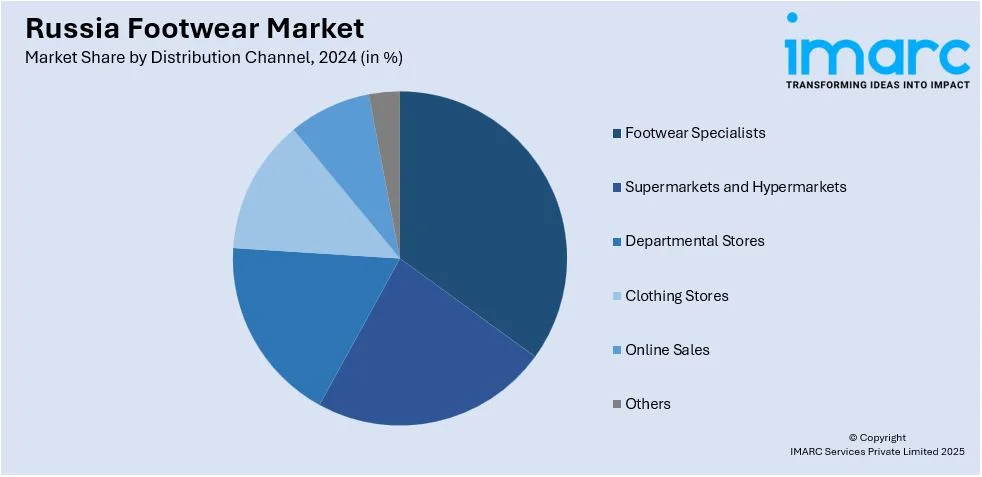

Analysis by Distribution Channel:

- Footwear Specialists

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Online Sales

- Others

Footwear specialists dominate the Russian market by offering a wide range of styles, premium brands, and expert services. Consumers prefer these stores for high-quality selections, personalized fittings, and after-sales support. Both domestic and international specialist retailers expand their reach through exclusive collections and enhanced in-store experiences.

Supermarkets and hypermarkets offer affordable and mass-market footwear to budget-conscious consumers. They are convenient, bundling footwear with household shopping. Private labels and seasonal promotions are driving sales, and store expansions in suburban and rural areas further accelerate market penetration.

Departmental stores attract middle- and high-income consumers seeking premium and branded footwear. These stores provide diverse selections in a single location, enhancing customer experience. Strategic partnerships with luxury and international brands, loyalty programs, and seasonal discounts contribute to steady sales growth.

Clothing stores highly integrate footwear sections, offering complementary fashion choices. Fast fashion retailers leverage trends to drive impulse purchases. Consumers prefer these stores for trendy, affordable options that match their apparel selections. Expanding store networks and frequent new collections maintain strong demand.

Online sales are rapidly growing due to convenience, competitive pricing, and vast product variety. E-commerce platforms and brand websites leverage AI-driven recommendations, virtual try-ons, and seamless return policies to attract customers. Flash sales, influencer marketing, and flexible payment options further enhance digital sales growth.

Some others are direct-to-consumer (DTC), street vendors, and specialty stores. DTC brands use social media and customized marketing for a higher margin. Niche boutiques sell handmade, eco-friendly, or premium footwear. Street vendors are always in demand for low-cost footwear, especially for the rural and informal market segment.

Analysis by Pricing:

- Premium

- Mass

Premium footwear in Russia is driven by rising disposable incomes, brand-conscious consumers, and demand for luxury, designer, and high-quality materials. International brands dominate, but domestic manufacturers are gaining recognition for craftsmanship. Customization, limited editions, and eco-friendly luxury options attract affluent buyers. E-commerce and exclusive in-store experiences further enhance premium sales.

Mass footwear is the largest segment, which caters to budget-conscious consumers who look for affordability and practicality. Supermarkets, hypermarkets, and online platforms drive accessibility, while local brands compete with international players on price and quality. Seasonal demand, bulk discounts, and growing e-commerce penetration support sustained market growth in this category.

Analysis by End User:

- Men

- Women

- Kids

Men hold a strong position in the Russian footwear market, with strong demand for formal, casual, athleisure, and winter footwear. Consumers prioritize durability, comfort, and style, driving sales of leather shoes, sneakers, and boots. International brands and domestic manufacturers compete in both premium and mass segments, with e-commerce and brand collaborations boosting market expansion.

Women represent a rapidly growing segment, influenced by evolving fashion trends, increased disposable income, and digital marketing. Demand for stylish, high-quality, and comfortable footwear spans luxury, casual, athleisure, and winter categories. Online shopping, influencer endorsements, and sustainability-focused collections further drive market growth among female consumers.

The steady demand for kids’ footwear can be attributed to parents' needs who wants durable, affordable, and orthopedically correct shoes. Demand in terms of seasonal requirements includes winter boots for warm, cozy use and breathable summer shoes. Growing licensed character footwear, school shoes, and environmentally friendly materials further mirror consumer demand for such a product category.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The largest footwear market in Russia is Central District, mainly due to the high level of urbanization and strong consumer purchasing power, besides the presence of major retail hubs like Moscow. Premium, athleisure, and fashion footwear see strong demand, while e-commerce penetration and international brand accessibility further boost growth in this region.

Steady footwear demand exists in Volga District, as it is fueled by a rising middle class and expanding retail infrastructure. Domestic and international brands sell to consumers who look for affordable and mid-range footwear. Seasonal variations and industrial workwear also contribute to the sales of footwear in this district.

Urals District sees strong demand for durable and winter footwear due to its colder climate. Industrial and safety footwear are key segments, serving the region’s mining and manufacturing industries. Urban centers like Yekaterinburg drive premium and casual footwear sales, supported by amplifying retail and e-commerce expansion.

The Northwestern District is also near European markets, which impacts the consumer's choice of international footwear brands. St. Petersburg, being a style capital, fuels demand for trendy, premium, and casual footwear. Harsh winters also ensure that sales of insulated and weather-resistant footwear are maintained at high levels.

Siberian District has a strong market for winter and outdoor footwear due to its extreme climate. Functional, insulated, and waterproof shoes dominate sales. Growing urbanization in cities like Novosibirsk is driving demand for casual and athleisure footwear, with online shopping expanding accessibility to national and international brands.

Others include the Far Eastern and Southern regions, where footwear demand is shaped by varying climates and economic conditions. The Far East sees rising trade with Asia, influencing footwear imports, while the Southern region has stronger demand for lightweight and summer footwear due to its warmer weather.

Competitive Landscape:

The Russia footwear market is marked by intense competition between domestic manufacturers, international brands, and private-label companies trying to increase market share through innovation in products, pricing strategies, and expansion in distribution. The premium and luxury segments are dominated by established global brands, with strong brand recognition and exclusive retail partnerships that help attract affluent consumers. Mid-range and budget players are engaged in a race among domestic manufacturers who are promoting products as cheap, durable, and climate-friendly for winter-specific shoes. Growing dominance of the e-commerce retail segment is causing intense competition since it provides deep discounts, extensive range of product options, and direct-to-consumer (DTC) models, thus targeting more price-sensitive consumers. Companies are also investing more in sustainable materials, athleisure innovations, and digital marketing to create niche market spaces for themselves. The rise of fast-fashion footwear brands is further intensifying market dynamics, while government support for local production is enabling domestic players to strengthen their presence. The competitive landscape remains dynamic, driven by evolving consumer preferences and technological advancements.

The report provides a comprehensive analysis of the competitive landscape in the Russia footwear market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Tamaris announced an active expansion in the Russian footwear market, planning 15 new store openings. The brand launched its first men's collection and introduced digital retail innovations. Tamaris aims to strengthen its presence, competing with local and international brands while emphasizing quality, comfort, and contemporary style.

- In April 2023, Russian footwear manufacturer Technolux LLC announced plans to open a shoe factory in Uzbekistan. Initially producing 80,000 pairs annually, the facility aims to scale up to 120,000 pairs monthly. Focused on children’s footwear, the company plans to expand into women’s shoes and export.

Russia Footwear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia footwear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia footwear market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The footwear market in the Russia was valued at USD 11.16 Billion in 2024.

The Russia footwear market is growing due to rising disposable incomes, increasing demand for premium and athleisure footwear, expanding e-commerce penetration, strong winter footwear sales, evolving fashion trends, growing health awareness, digital marketing influence, domestic manufacturing support, and the availability of international brands through retail partnerships and online platforms.

The Russia footwear market is projected to exhibit a CAGR of 4.09% during 2025-2033, reaching a value of USD 16.30 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)