Russia Food Service Market Size, Share, Trends and Forecast by Type, Outlet, Location, and Region, 2025-2033

Russia Food Service Market Size and Share:

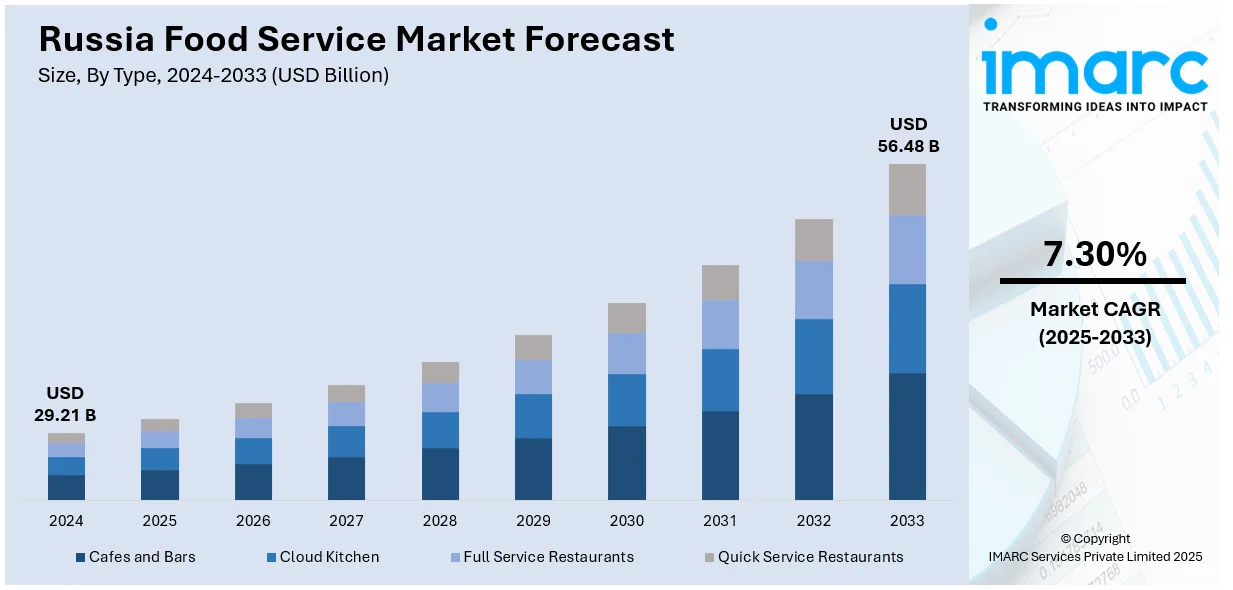

The Russia food service market size was valued at USD 29.21 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 56.48 Billion by 2033, exhibiting a CAGR of 7.30% from 2025-2033. The Russia food service market share is increasing because of the changing consumer preferences for diverse and high-quality dining options, high demand for health-conscious and plant-based foods, and the rise of food delivery platforms. Additionally, a growing interest in local cuisine and innovative dining concepts is shaping the market's dynamic expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.21 Billion |

| Market Forecast in 2033 | USD 56.48 Billion |

| Market Growth Rate (2025-2033) | 7.30% |

Consumers are seeking convenience in their dining choices, which is resulting in a high demand for fast food and quick-service restaurants (QSR). Food delivery services are also growing as people prefer the ease of ordering meals from home or work. This shift towards convenience aligns with a busy lifestyle, making quick and easy access to food more appealing. Moreover, the increasing awareness about health and wellness is resulting in individuals opting for healthier food options. This consists of plant-based foods, low-calorie meals, and nutrient-dense options. The trend is reshaping menus across the food service industry in Russia, prompting establishments to include more organic, gluten-free, and vegetarian dishes to cater to this growing demand.

Apart from this, people are seeking unique and engaging dining experiences. This is leading to the rise of innovative concepts like experiential dining, themed restaurants, and pop-up food events. Establishments are offering not just food, but a full experience that combines entertainment, interactive elements, and Instagram-worthy moments to attract younger, experience-seeking individuals. In addition, technology is significantly influencing the development of the market growth. The growing number of food delivery platforms, mobile apps for ordering, and digital payment systems are transforming the way users interact with food service providers. Automation, self-ordering kiosks, and digital menus are improving efficiency and enhancing the user experience. This integration of tech is offering individuals more convenience and contributing to the Russia food service market growth.

Russia Food Service Market Trends:

Increased Focus on Food Innovation and Culinary Creativity

The growing food innovation and culinary creativity, as consumers continue to seek novel dining experiences, is positively influencing market growth. Restaurateurs are experimenting with new flavors, textures, and cooking techniques to differentiate their offerings and appeal to adventurous palates. This is resulting in an increasing number of restaurants embracing fusion cuisines, molecular gastronomy, and locally inspired reinterpretations of global dishes. Consumers are willing to explore new and unique flavor combinations, creating an opportunity for chefs and food innovators to push the boundaries of traditional Russian cuisine. As a result, food businesses are continually evolving their menus and adopting more creative approaches to satisfy the demand for exciting, unconventional dining experiences. Events like Prodexpo 2026 further amplify this trend, offering a platform for over 1,800 exhibitors to showcase their innovative products and culinary breakthroughs. The exhibition allows businesses to stay ahead of the curve, discover new trends, and launch novel concepts that respond to shifting consumer tastes.

Expansion of Food Retail Chains

Magnit is one of Russia's leading food retail chains, operating over 30,000 stores across 67 regions as of June 30, 2024. The company uses a multiformat model that includes supermarkets, pharmacies, and private-label production. As large retailers continue to increase their presence across the country, they are significantly improving access to both fresh food and ready-to-eat (RTE) meals. This geographical expansion allows food service businesses to cater to a wider client base, ranging from urban centers to remote regions. As more retail outlets open in diverse locations, they often incorporate food service options like in-store cafeterias, takeaways, and meal kits, thereby attracting a larger segment of consumers. Additionally, these expanded networks enable better supply chain efficiencies, reducing costs and ensuring a consistent flow of fresh ingredients to food service operators. The increased regional coverage not only boosts convenience for consumers but also creates more opportunities for food service brands to reach new customers, offering a favorable Russia food service market outlook.

Sustainability and Ethical Consumption Trends

Individuals are becoming more conscientious about the ecological effects of their dietary decisions, prompting food service businesses to adopt more sustainable practices. This includes obtaining ingredients from nearby, sustainable vendors, minimizing food waste, and applying energy-saving cooking methods. The push for sustainability is also influencing consumer behavior, with diners more likely to support businesses that align with their environmental values. Additionally, there is a rise in demand for sustainable packaging, with many restaurants opting for biodegradable or recyclable materials to minimize their environmental footprint. In 2023, 10” Bagasse Clamshell Box QW-B-19 was introduced by Qiaowang, a sustainable food packaging solution made from sugarcane byproduct. It highlighted its eco-friendly properties, including oil and water resistance, and its compliance with food safety regulations. The clamshell was positioned as an ideal alternative to plastic containers for environmentally conscious businesses.

Russia Food Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia food service market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, outlet, and location.

Analysis by Type:

- Cafes and Bars

- By Cuisine

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- By Cuisine

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- By Cuisine

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- By Cuisine

Cafes and bars are popular for their relaxed atmosphere and diverse options, offering specialty coffee, tea, and desserts, while bars and taverns provide premium beverages and light bites. This section addresses various consumer tastes, from informal meet-ups to unique drinks. Bars and pubs usually concentrate on alcoholic beverages within a lively social setting, whereas cafes and tea shops attract individuals looking for lighter snacks and a more tranquil ambiance. Juice and smoothie shops serve health-aware patrons, while dessert bars offer decadent, specialized choices.

Cloud kitchens function with a delivery-only approach, enabling companies to provide meals without the need for a conventional dining area. This model takes advantage of the growing need for food delivery services, allowing brands to connect with a wider audience while maintaining minimal costs. Cloud kitchens can swiftly respond to new trends and consumer desires, providing a range of cuisines while maintaining the ability to adjust operations.

Full-service restaurants offer a comprehensive dining experience with diverse cuisines, such as Asian, European, Latin American, Middle Eastern, North American, and others. These restaurants provide an immersive experience, often with curated menus, fine dining, and attentive service. The variety within full-service restaurants allows consumers to choose dining experiences that align with cultural or culinary interests.

Quick service restaurants (QSRs) emphasize speed and convenience, providing a range of food options including pastries, hamburgers, frozen desserts, meat dishes, pizzas, and more. Their capacity to provide top-notch food at reasonable prices quickly makes them favored by busy shoppers.

Analysis by Outlet:

- Chained Outlets

- Independent Outlets

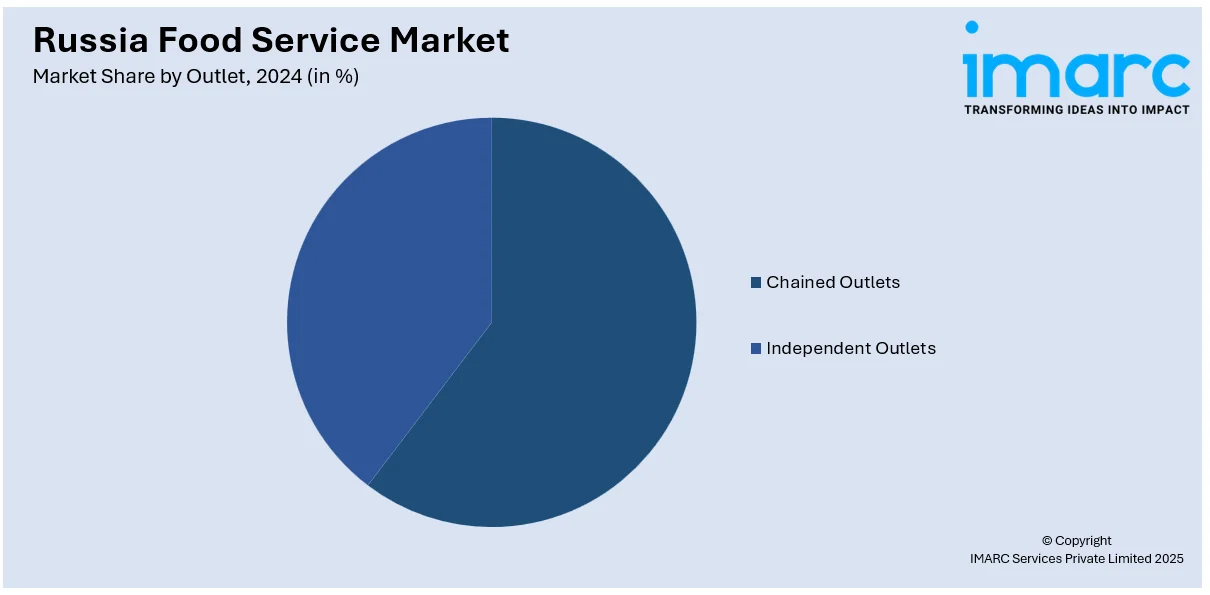

Chained outlets consist of a collection of branded locations run under a single management system. These establishments gain from brand awareness, established operational frameworks, and economies of scale, enabling them to provide uniform quality and service across various locations. Chained establishments typically possess a broader reach and serve a diverse clientele, with menu offerings and prices uniform across their locations. Their achievement is linked to effective marketing efforts, customer loyalty initiatives, and a demonstrated history of client contentment, establishing them as an essential segment in the industry.

Independent outlets function as individual enterprises, frequently providing distinctive, locally customized products. These establishments are recognized for their skill in offering tailored experiences and creative menu selections, serving niche audiences or unique local preferences. Independent outlets generally exhibit greater flexibility compared to chains, enabling them to swiftly adjust to evolving consumer tastes and trends.

Analysis by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

In the leisure segment, food service establishments cater to consumers visiting recreational locations, such as amusement parks, entertainment complexes, and cultural venues. These establishments are designed to enhance the overall leisure experience, offering quick, enjoyable dining options that complement the recreational activities. The focus in this segment is on creating a relaxed, enjoyable atmosphere, with menus that appeal to a variety of tastes and preferences.

Lodging mainly concentrates on hotels, resorts, and various other places to stay. These venues generally provide a diverse selection of dining choices, such as buffet breakfasts, à la carte options, and room service, designed to satisfy the preferences of both local and foreign patrons. This section is shaped by the degree of luxury and the diversity of cuisines available, accommodating various guest tastes and fostering a friendly atmosphere for extended visits.

The retail segment comprises food service establishments situated in shopping centers, supermarkets, and various retail settings. These places are typically created for convenience, providing customers with fast meals, snacks, and drinks while they shop. The food service selections in retail settings generally target busy customers seeking quick, budget-friendly, and enjoyable choices.

Standalone is a self-sufficient food service site that is not affiliated with any major retail, lodging, or entertainment venue. It comprises of tiny cafes, fast-food establishments, and upscale dining spots located in busy locations, including downtown areas, commercial districts, or well-frequented street intersections. Standalone possess the ability to provide a more tailored dining experience, addressing local preferences or specialized markets.

Travel-related food service outlets in Russia can be found in transportation centers like airports, railway stations, and bus terminals. These establishments serve travelers needing fast and easy meal choices while traveling. This section emphasizes providing convenient, portable, and enjoyable food options such as sandwiches, snacks, and drinks.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, which includes Moscow and its neighboring regions, is a vital part of the market. Serving as the political, economic, and cultural hub, this area features a dense array of eateries that include both upscale restaurants and fast food outlets. The market in this area is marked by diverse cuisines, creative dining ideas, and a strong inclination towards both local and international food experiences.

The Volga District is renowned for its diverse culinary heritage and an increasing variety of contemporary dining establishments. The market in this area is influenced by a combination of classic Russian dishes and an increasing interest in international food trends. This area features significant cities such as Kazan and Nizhny Novgorod, where local culinary tastes shape the available dishes. The Volga District is witnessing a rising trend in casual dining and quick-service eateries, fueled by a younger population that craves variety and value.

The Urals District, home to cities like Yekaterinburg, is characterized by a taste for robust, classic Russian dishes, alongside an increasing curiosity for global cuisines. The Urals area is also witnessing a growth in food service establishments that appeal to local preferences as well as the surge of visitors and business travelers, emphasizing casual dining, regional dishes, and comfort food options.

The Northwestern District, which includes cities such as St. Petersburg, is recognized for its deep historical legacy and closeness to Europe. The area showcases a mix of Russian, Scandinavian, and European influences, with an increasing desire for high-end restaurants, cafes, and global brands. St. Petersburg, as a key tourist attraction, experiences significant demand for a variety of dining choices, such as upscale restaurants, international cuisines, and popular cafes.

The Siberian District, recognized for its extensive geographical area, is experiencing growth in its food service industry as urban centers such as Novosibirsk and Omsk develop. The area is shaped by a significant inclination toward traditional Russian and native Siberian dishes, typically emphasizing robust, meat-centered meals.

Others consist of areas beyond the primary districts, like the Far Eastern District, Southern District, and North Caucasian District. These regions are experiencing an increase in local food service choices that accommodate the distinct flavors and cultural customs of each

Competitive Landscape:

Leading companies in the market are focusing on broadening their product lines and diversifying their service models to align with changing consumer preferences. Numerous businesses are putting money into technology to improve customer experiences by utilizing online ordering systems and delivery options, while also refining supply chains for increased effectiveness. Moreover, top companies are adding health-focused and locally sourced ingredients to their menus, addressing the increasing appetite for healthier dining choices. To respond to economic changes, they are seeking affordable options that do not sacrifice quality. The focus on sustainability is increasingly noticeable, as companies implement environmentally friendly methods in packaging and waste disposal. These tactics focus on maintaining client loyalty and setting the stage for sustainable growth in the face of market challenges.

The report provides a comprehensive analysis of the competitive landscape in the Russia food service market with detailed profiles of all major companies.

Latest News and Developments:

- January 2025: The FOOD Expo 2025 is scheduled for March 18 to March 20 at the Crocus Expo IEC in Moscow, Russia. The exhibition will encompass multiple sectors, such as HoReCa, retail, wine, cheese, and mobile solutions. It will showcase more than 350 partners and suppliers, drawing in roughly 20,000 attendees.

- September 2023: Restaurateur Anton Pinskiy and pro-Kremlin rapper Timati revealed that they will take over the Russian branch of Domino's Pizza, rebranding it with a minor change to the logo. The pair had earlier acquired Starbucks' Russian properties and introduced "Stars Coffee" in 2022.

- April 2023: The Russian fast food chain Rostic's reopened its first restaurant in Moscow, replacing KFC. The new owners, Smart Service, rebranded over 100 KFC locations to Rostic's, maintaining the menu and design to ensure a smooth transition for customers.

Russia Food Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia food service market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia food service market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia food service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The food service market in the Russia was valued at USD 29.21 Billion in 2024.

The growth of Russia’s food service market is driven by the increasing preference for diverse dining experiences. Additionally, the growing individual interest in convenience, quick-service restaurants, and delivery services, along with expanding international and local food chains, are contributing to the market expansion and evolution in urban centers.

The Russia food service market is projected to exhibit a CAGR of 7.30% during 2025-2033, reaching a value of USD 56.48 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)