Russia Diabetes Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Russia diabetes Market Size and Share:

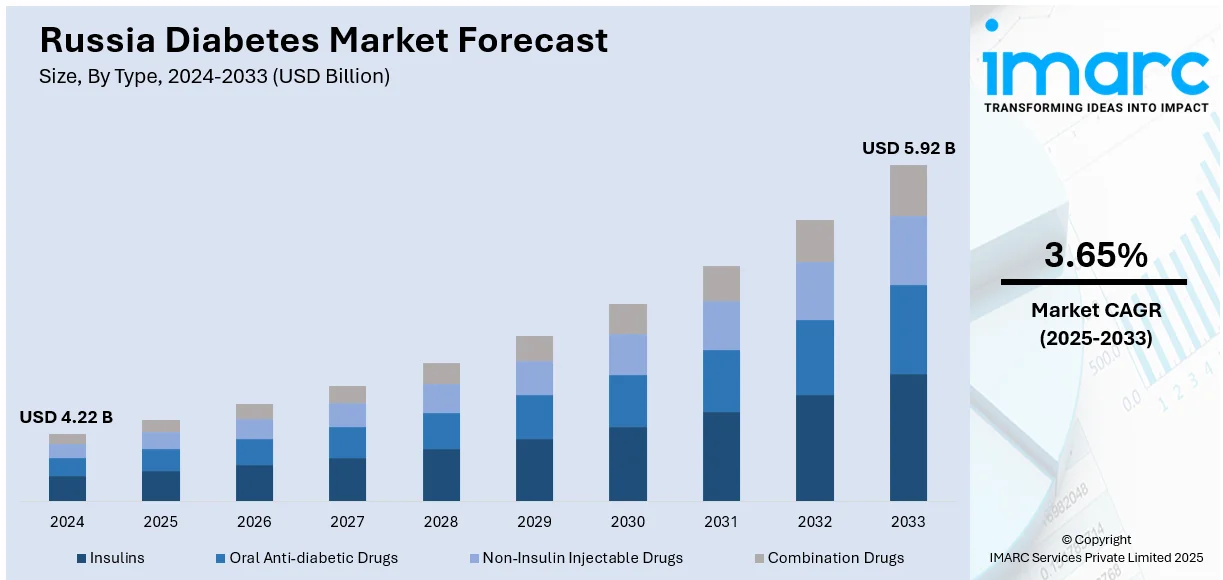

The Russia diabetes market size was valued at USD 4.22 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.92 Billion by 2033, exhibiting a CAGR of 3.65% from 2025-2033. The market is expanding due to rising prevalence of diabetes, an aging population base, and increasing healthcare awareness. Government initiatives and investments in healthcare infrastructure support market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.22 Billion |

| Market Forecast in 2033 | USD 5.92 Billion |

| Market Growth Rate (2025-2033) | 3.65% |

Increasing prevalence of diabetes due to rising urbanization, sedentary lifestyles, and unhealthy dietary habits are the main drivers for the Russia diabetes market. The aging population of the nation also further drives the demand for diabetes management solutions. In addition, further government focus on healthcare infrastructure and policies intended to make drugs and diagnostics accessible are further fuelling this market’s growth. For instance, in November 2024, the Russian government allocated 5.5 billion rubles to combat diabetes mellitus across regions as announced by the government. This funding aims to enhance early diagnosis, provide necessary medications and establish regional endocrine centers. The initiative also focuses on timely diabetes detection particularly in children emphasizing preventive health measures. These factors open up opportunities in both local and international pharmaceuticals.

Technological advances in the field of diabetes care including novel devices for insulin delivery, CGM systems and digital health solutions are the key drivers. Rising awareness of the need for early diagnosis and management is creating more proactive patient behavior and health-care provider response. Increasingly broadened reimbursement policies for diabetes treatment further fuel this market by opening healthcare access to a wider population. These developments are promoting steady growth in the diabetes market.

Russia Diabetes Market Trends:

Government Support

The Russian government has been increasing the coverage of healthcare policies and reimbursement programs for the improvement of access to diabetes care and medication. This is achieved through increasing funding for chronic diseases such as diabetes for a more comprehensive range of therapies and essential medication subsidies. Reimbursement programs aim to alleviate the burden of costs for patients thus making life-saving treatments more accessible. The government is strengthening public healthcare infrastructure and promoting early diagnosis and management which benefits the patients in better diabetes care. For instance, in October 2023, the Russian government addressed key issues including enhanced medical care for diabetic patients with over 2.3 billion Roubles allocated for new endocrinology centres. These efforts foster market growth by making available treatments new to the patients with increased compliance towards their medication.

Growth in Digital Health Solutions

The growth of digital health solutions in Russia's diabetes market is driven by the increasing adoption of telemedicine, mobile apps, and digital monitoring tools. Telemedicine platforms enable remote consultations allowing patients to manage their condition without frequent in-person visits. Mobile applications help patients track blood glucose levels, medication schedules, and lifestyle factors providing real-time insights for better disease management. Continuous glucose monitoring (CGM) devices and insulin management apps are also gaining traction offering patients and healthcare providers precise data for personalized care. In line with the growing trend of digital health solutions innovative developments are also emerging in Russia's healthcare sector. For instance, in March 2024, Russian scientists at Omsk State Technical University developed a next-generation Holter monitor that will enable real-time heart rhythm monitoring via smartphone applications. This innovative device enhances user comfort and aims to deliver immediate diagnostic results. This shift towards digital tools enhances patient engagement improves outcomes and aligns with global trends in healthcare innovation.

Increased Patient Awareness

In Russia, there has been a significant increase in efforts to raise awareness about diabetes through public health campaigns and educational initiatives. These campaigns focus on the importance of early diagnosis, promoting regular screening and highlighting lifestyle changes to prevent the onset of diabetes. Government and non-governmental organizations are collaborating to disseminate information about the risks associated with diabetes and the available treatment options. The population has become more health-conscious and thus earlier diagnosis with better long-term results. Awareness also increases demand for diabetes care products and services furthering the growth of the market.

Russia Diabetes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia diabetes market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Insulins

- Basal or Long Acting Insulins

- Bolus or Fast Acting Insulins

- Traditional Human Insulins

- Biosimilar Insulins

- Oral Anti-diabetic Drugs

- Biguanides

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- SGLT-2 Inhibitors

- DPP-4 Inhibitors

- Sulfonylureas

- Meglitinides

- Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Amylin Analogue

- Combination Drugs

- Insulin Combinations

- Oral Combinations

Oral anti-diabetic drugs holds the largest Russia diabetes market share due to their widespread use in type 2 diabetes management. These medications including biguanides, SGLT-2 inhibitors, DPP-4 inhibitors and sulfonylureas are preferred for their convenience, cost-effectiveness and non-invasive administration. Increasing diabetes prevalence driven by sedentary lifestyles and unhealthy diets fuels demand for oral therapies. Advancements in combination drugs that improve glycemic control further support market growth. Government reimbursement programs and increasing awareness of early diabetes management are fueling the uptake of oral anti-diabetics. Their delay in insulin dependency makes them a first-line treatment which strengthens their market leadership.

Analysis by Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

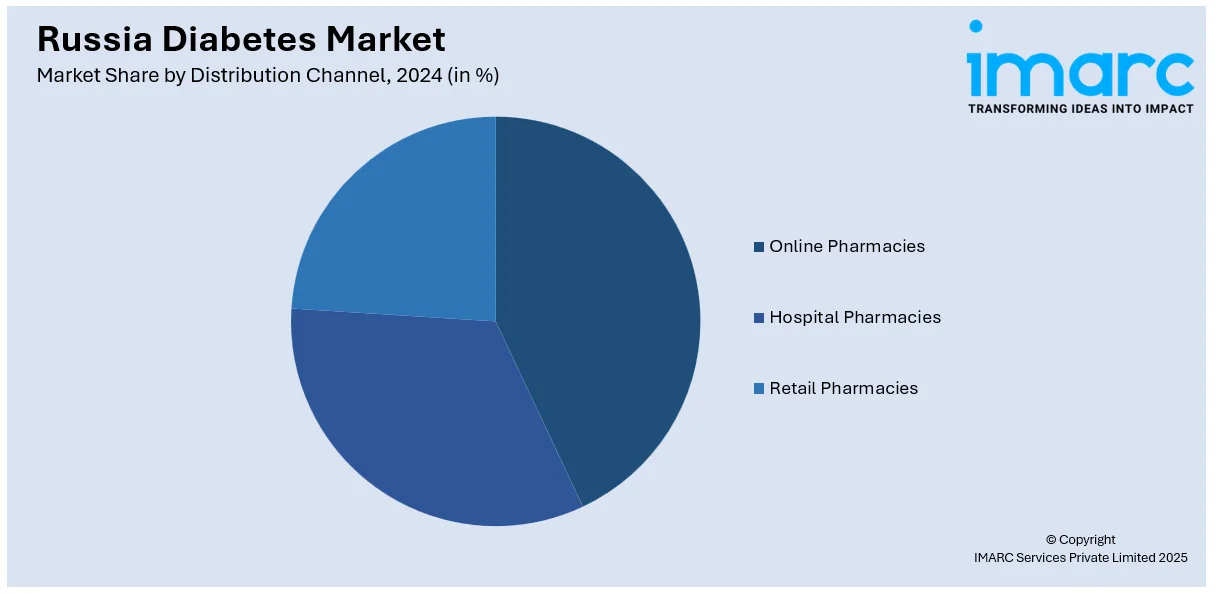

Online pharmacies are becoming increasingly popular in Russia's diabetes market because they are convenient, accessible and affordable. They provide a broad range of diabetes drugs such as oral anti-diabetics, insulin and combination drugs often with doorstep delivery and subscription services. The increasing adoption of ecommerce platforms and telemedicine has further increased online sales are making diabetes drugs more accessible especially in remote areas. Government regulations, digital prescriptions and discounts further drive adoption making online pharmacies a growing segment in Russia’s diabetes drug distribution network.

Hospital pharmacies play a crucial role in Russia’s diabetes drug market particularly for patients requiring specialized insulin therapies and injectable medications. They cater to individuals with severe diabetes cases, complications and in-patient treatments ensuring immediate access to prescription drugs under medical supervision. Many government and private hospitals stock a comprehensive range of anti-diabetic medications including biosimilar insulins and GLP-1 receptor agonists. The integration of insurance reimbursements and government healthcare programs strengthens hospital pharmacies' role in diabetes management and drug accessibility.

Retail pharmacies remain the primary distribution channel for diabetes drugs in Russia offering easy access to prescription and over-the-counter medications. They provide a wide variety of oral anti-diabetic drugs, insulin and combination therapies for patients managing type 1 and type 2 diabetes. Many pharmacies offer loyalty programs, personalized consultations and in-store glucose monitoring services increasing consumer trust and convenience. With the increasing rate of urbanization retail pharmacies remain to be the most common and the preferred channel for the demand of drugs for diabetes treatment in Russia.

Regional Analysis:

- Central Region

- West Siberian Region

- Northwestern Region

- Ural Region

- North Caucasus Region

- Rest of Russia

The Central Region leads Russia's diabetes market due to its high population density, urbanization and advanced healthcare infrastructure. Major cities including Moscow drive demand for diabetes drugs, insulin therapies and innovative treatment options. The presence of specialized diabetes clinics, research institutions and government healthcare programs enhances drug accessibility. With rising sedentary lifestyles and obesity rates the demand for oral anti-diabetics, biosimilar insulins and combination drugs is increasing.

The West Siberian Region is experiencing rising diabetes cases due to changing dietary habits, aging populations and low physical activity levels. Limited healthcare access in remote areas increases reliance on retail and online pharmacies for diabetes drug distribution. Government initiatives to expand healthcare facilities and improve insulin accessibility are driving market growth. The adoption of oral anti-diabetic drugs and biosimilar insulins is increasing particularly in urban centers like Novosibirsk and Omsk.

The Northwestern Region including Saint Petersburg has a well-established healthcare infrastructure and high awareness about diabetes prevention and management. The demand for advanced diabetes treatments such as GLP-1 receptor agonists and SGLT-2 inhibitors is rising. Government support for diabetes care programs and increasing investments in hospitals and research facilities contribute to market expansion. Online and hospital pharmacies play a crucial role in ensuring drug availability particularly for insulin-dependent patients.

The Ural Region is witnessing an increasing prevalence of type 2 diabetes driven by dietary shifts, obesity and a growing elderly population. Cities like Yekaterinburg have a strong presence of retail pharmacies and hospitals ensuring diabetes drug availability. The region sees a growing demand for insulin and oral anti-diabetic medications with government healthcare programs supporting accessibility. Expanding digital health solutions and telemedicine platforms are improving patient adherence to diabetes management plans.

The diabetes burden in the North Caucasus Region is moderate but rising primarily driven by dietary and physical inactivity components and limited access to healthcare services in rural areas. The market is dominated by retail and hospital pharmacies with access to oral anti-diabetic drugs and conventional insulin formulations. Government subsidies and diabetes awareness programs are improving treatment adherence. Expansion of healthcare infrastructure in cities such as Grozny and Makhachkala is increasing access to modern treatments for diabetes.

The Rest of Russia includes vast rural areas with limited healthcare access making online and retail pharmacies essential for diabetes drug distribution. The prevalence of undiagnosed diabetes cases remains high increasing the need for awareness programs and early diagnosis initiatives. Government healthcare reforms and mobile health services aim to improve insulin and oral drug availability. Urban centers in this region are seeing growing adoption of newer diabetes treatments including SGLT-2 inhibitors and biosimilar insulins.

Competitive Landscape:

The Russian diabetes market is highly competitive with a growing presence of both global and local players. International pharmaceutical companies dominate the market offering a range of insulin products, oral medications and advanced treatment options. Local manufacturers are also gaining ground by providing cost-effective alternatives while focusing on increasing accessibility and affordability of diabetes care. The market is witnessing innovations in digital health solutions such as mobile apps and continuous glucose monitoring devices creating new avenues for growth. Government policies aimed at improving healthcare infrastructure and expanding reimbursement programs for diabetes treatments further intensify competition driving companies to enhance product offerings and invest in research and development. This competitive landscape fosters continual advancements in diabetes care and management across the region.

The report provides a comprehensive analysis of the competitive landscape in the Russia diabetes market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Promomed, a Russian company, announced the commencement of a clinical trial for the first Russian generic version of Eli Lilly's tirzepatide, aimed at treating obesity and diabetes. The trial, involving 173 volunteers in Moscow, will assess the drug's safety and immunogenicity.

- In May 2024, Dr Reddy's Laboratories LLC in Russia announced a distribution agreement with Novartis Pharma LLC for anti-diabetes products Galvus and Galvus Met. The deal, with no upfront fees allows Dr Reddy's to leverage these products in retail while aiming to expand into the cardio space in the future.

- In December 2023, PROMOMED GROUP announced receiving an authorization from the Russian government to produce Kvinsenta, a semaglutide-based drug for diabetes treatment. This permits the company to utilize Novo Nordisk's patents. Over 120,000 packages have been supplied, supporting patient needs and aligning with Russia's national pharmaceutical security strategy.

Russia Diabetes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Online Pharmacies, Hospital Pharmacies, Retail Pharmacies |

| Regions Covered | Central Region, West Siberian Region, Northwestern Region, Ural Region, North Caucasus Region, Rest of Russia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia diabetes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia diabetes market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia diabetes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diabetes market was valued at USD 4.22 Billion in 2024.

Rising diabetes prevalence, driven by urbanization, sedentary lifestyles, and unhealthy dietary habits, is a key driver. An aging population, increased government healthcare spending, and reimbursement programs are improving access to diabetes care. Advancements in insulin delivery, CGM systems, and digital health solutions further support market expansion. Growing awareness campaigns and improved early diagnosis programs are also fueling market growth.

IMARC estimates the diabetes market to exhibit a CAGR of 3.65% during 2025-2033, reaching USD 5.92 Billion by 2033.

Oral anti-diabetic drugs dominate the Russia diabetes market as they are the first-line treatment for type 2 diabetes, offering cost-effectiveness, ease of administration, and broad accessibility. Medications like biguanides, SGLT-2 inhibitors, and DPP-4 inhibitors improve glycemic control while delaying insulin dependency. Government reimbursements and growing awareness further drive adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)