Russia Dairy Products & Eggs Market Report by Product Type (Milk, Cheese, Yogurt, Butter, Cream, Dairy Desserts, Eggs, and Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others), and Region 2025-2033

Russia Dairy Products & Eggs Market Overview:

The Russia dairy products & eggs market size reached 37.6 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 56.9 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The rising consumer demand for high-quality, locally produced dairy and eggs, increasing government support, ongoing advancements in production technology, escalating health consciousness, urbanization, and expanding retail networks are some of the key factors contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

37.6 Million Tons |

|

Market Forecast in 2033

|

56.9 Million Tons |

| Market Growth Rate 2025-2033 | 4.20% |

Russia Dairy Products & Eggs Market Trends:

Increasing consumer demand for high-quality products

With the increasing demand for good quality dairy products and eggs, Russian consumers are concentrating more on quality and nutritional values while selecting the foodstuffs. Change in the consumer food behavior has led to increased demand for nutritional value for food products. In addition to this, with the increment in disposable income, people have been able to spend more for high-end commodities, which also contributes to market growth. Organic and locally produced dairy products are also increasingly popular as they become more conscious of food safety and sustainability. Producers have been improving the quality of their products since consumers are getting more aware, and it results in an extremely competitive market with diverse dairy and egg products made to a very high quality, which further enhances the growth of this market.

Government support and investment in agriculture

The governing body in Russia has been actively promoting the agricultural sector through a variety of initiatives focused on increasing domestic production and reducing dependence on imports. Subsidies, tax incentives, and low-interest loans have been offered to promote investment in dairy farming and egg production. This support has allowed producers to modernize their operations, adopt advanced farming techniques, and improve productivity. In addition to this, infrastructural development and transportation and storage facilities have improved the efficiency of the supply chain for dairy and egg products from the government side. These actions will enhance production capacity and the steady supply of high-quality products, thereby allowing the market expansion. As a result, the Russia dairy products and eggs market price is expected to stabilize, reflecting increased local production and improved supply chain dynamics.

Technological advancements in production and distribution

These have seen dairy farming greatly improved with innovation, for example, through the introduction of automatic milking systems, precision feeding, and improvements in animal health management. All these allow for a more productive farm by having milk and eggs of good quality, as well as being cost-effective to produce. There have also been further innovations in processing and packaging that enhance shelf life and the safety of dairy products and eggs, hence increasing appeal among consumers. Modern logistics and distribution systems have streamlined the supply chain to such an extent that goods now reach the consumer faster and in better conditions. Other e-commerce sites and online services for grocery delivery have emerged as well, catering to the convenience needs of the customers by offering large varieties of dairy and egg products, which, in turn has increased market demand.

Russia Dairy Products & Eggs Market News:

- September 2024: WorldFood Moscow 2024, the 33rd International Exhibition for Food & Drinks, was held from September 17-20 at Crocus Expo in Moscow. The exhibition was a link for international food and beverage producers to connect with critical Russian buyers coming from retail, wholesale, and the HoReCa industry. Various product categories were offered, including dairy, meat and poultry, and drinks.

- July 2024: DairyTech Russia 2025, an international exhibition for milk and dairy production, will take place from January 21-23, 2025, at Crocus Expo in Moscow. The event showcases equipment, technologies, and services for the dairy industry, attracting professionals from across Russia and abroad.

- May 2024: Vaganovo, a dairy enterprise in Russia, started building the largest dairy farm in the Kemerovo region, investing 18 billion rubles. The facility will accommodate 18,000 cattle and generate 240 tons of milk daily, with the goal of satisfying local demand and exploring export possibilities.

- May 2024: Russia said it would raise its dairy export share in the global market by increasing supplies by 15-20% annually, with a significant push into Arab countries, particularly Algeria, and southeast Asia.

- January 2023: Molvest launched Russia's first milk protein concentrate production facility in Kalach, Voronezh Region, costing about 2 billion rubles. New production line processes 200 tons of milk per day, producing a concentrate of milk proteins at 85%, which lowers importation by 25%. High demand for such a concentrate will arise in baby food, sports nutrition, and more.

Russia Dairy Products & Eggs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

To get more information on this market, Request Sample

- Milk

- Fresh Milk

- UHT Milk

- Flavored Milk

- Cheese

- Yogurt

- Butter

- Cream

- Dairy Desserts

- Eggs

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes milk (fresh milk, UHT milk and flavored milk), cheese, yogurt, butter, cream, dairy desserts, eggs, and others.

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online retail, and others.

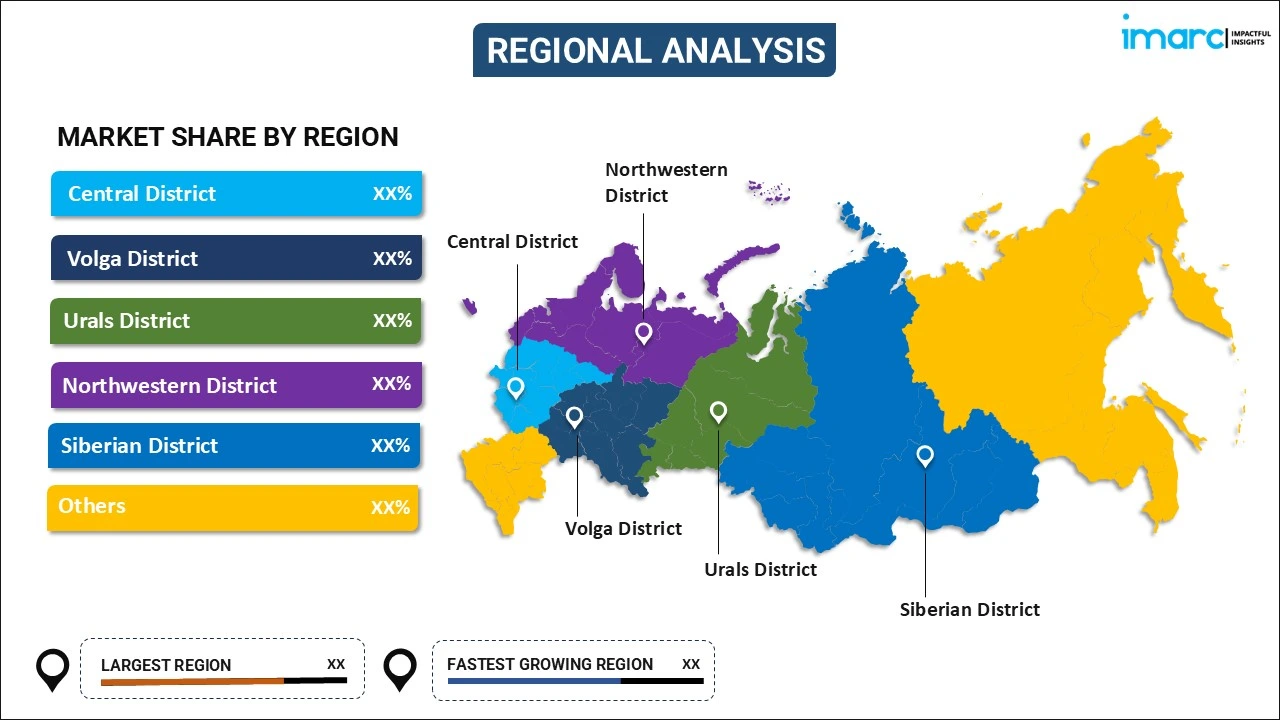

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Dairy Products & Eggs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia dairy products & eggs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia dairy products & eggs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia dairy products & eggs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

IMARC estimates the Russia dairy products & eggs market to exhibit a CAGR of 4.2% during 2025-2033.

Key factors driving the Russia dairy products and eggs market include the increasing consumer preference for healthy and nutritious food options, alongside the rising demand for locally produced products. Additionally, government support for the agricultural sector, advancements in dairy farming technologies, and a growing focus on product innovation and variety are further offering a favorable market outlook.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)