Russia Courier, Express, and Parcel (CEP) Market Size, Share, Trends and Forecast by Service Type, Destination, Type, End-Use Sector, and Region, 2025-2033

Russia Courier, Express, and Parcel (CEP) Market Size and Share:

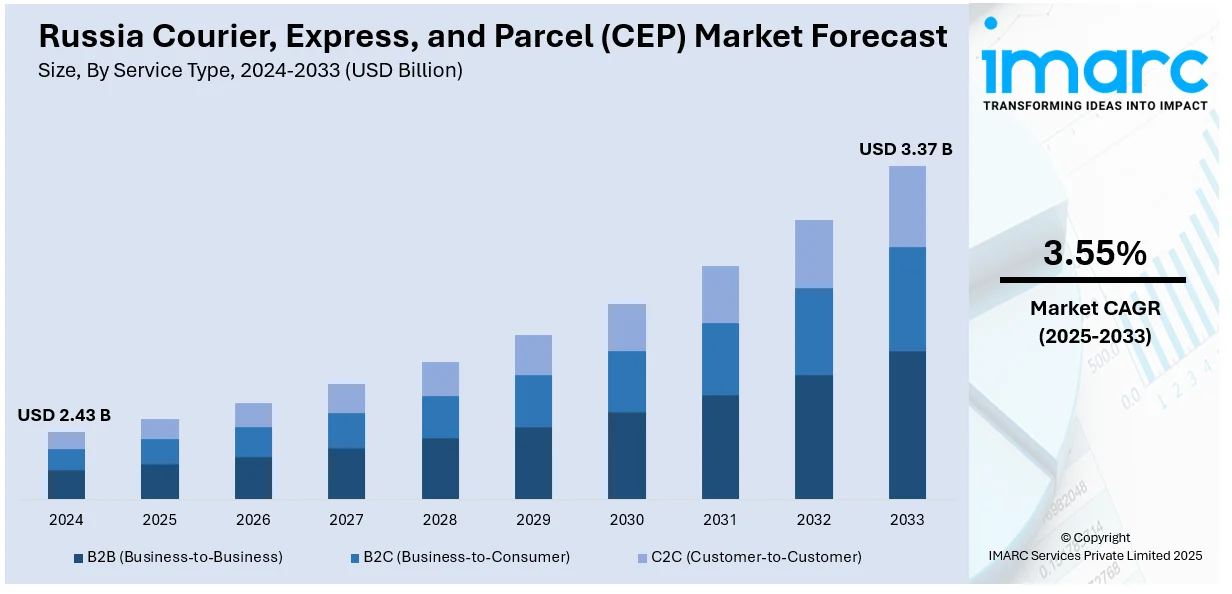

The Russia courier, express, and parcel (CEP) market size was valued at USD 2.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.37 Billion by 2033, exhibiting a CAGR of 3.55% from 2025-2033. The market is expanding rapidly, driven by e-commerce growth, technological advancements, and increasing demand for fast deliveries. Investments in automation, digital tracking, and last-mile logistics enhance efficiency. Rising cross-border trade and sustainability initiatives further shape market dynamics, fostering innovation and competitive expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.43 Billion |

| Market Forecast in 2033 | USD 3.37 Billion |

| Market Growth Rate (2025-2033) | 3.55% |

Cross-border trade plays a crucial role in the growth of Russia’s CEP market, driven by increasing international e-commerce transactions and expanding global trade networks. Rising demand for efficient international shipping has led to investments in streamlined customs processes, digital tracking, and enhanced logistics infrastructure. Major logistics providers are improving cross-border freight services, optimizing delivery routes, and forming strategic partnerships to ensure faster and more reliable shipments. Additionally, trade agreements and regulatory advancements are facilitating smoother parcel movement across borders. For instance, in July 2024, Russia along with India announced plans to fortify infrastructure for transportation and logistics. Both the countries are actively emphasizing on the Northern Sea Route, International North-South Transport Corridor, and Chennai-Vladivostok Eastern Maritime Corridor. This strategic move targets to improve the transport corridors' efficacy as well as stability in Eurasia. The nations are striving to establish partnership in advancing shipping between India and Russia through the Northern Sea Route. Moreover, as global commerce expands, cross-border logistics continues to be a key growth factor for Russia’s CEP market.

Technological advancements and digitalization are significantly transforming Russia’s CEP market by streamlining operations and enhancing delivery efficiency. AI-powered route management, tracking based on real-time, and automation of warehousing solutions are improving parcel movement and reducing operational costs. For instance, in September 2024, Wildberries unveiled WB Automation, a new business division focused on warehouse automation. This initiative will offer solutions utilizing both the company’s proprietary technologies and partner products specifically adapted for the Russian market. The marketplace aims to enhance logistics efficiency through innovative automation systems. Furthermore, the adoption of electric vehicles and sustainable packaging solutions is also driving industry growth, aligning with global environmental trends. Additionally, government initiatives to improve transport infrastructure and cross-border trade agreements are strengthening international logistics capabilities. As businesses seek faster and more efficient shipping solutions, investment in advanced logistics technologies and sustainable practices continues to accelerate market demand.

Russia Courier, Express, and Parcel (CEP) Market Trends:

Expansion of E-Commerce Logistics

The notable growth of e-commerce in Russia is driving significant changes in the CEP market, with increasing demand for fast and efficient deliveries. For instance, as per industry reports, Russia has emerged as the 8th biggest e-commerce industry, with its total revenue anticipated to reach around USD 86,603.5 Million by the year 2024. Moreover, online retailers and marketplaces are investing in advanced logistics solutions, including automated sorting centers, route optimization technologies, and last-mile innovations. Besides, the rise of express and same-day delivery services is reshaping consumer expectations, pushing courier companies to enhance efficiency. Additionally, the integration of smart lockers and pickup points is improving delivery convenience, particularly in urban areas. As e-commerce continues to expand, logistics providers are scaling operations to meet evolving market demands.

Adoption of Digital and AI-Driven Solutions

Technological enhancements, including artificial intelligence (AI) and digital tracking, are transforming the Russian CEP market. AI-powered route optimization, automated sorting, and predictive analytics are improving delivery speed and cost efficiency. For instance, in August 2024, the governmental organizations of Moscow announced to provide digital profile to couriers in order to boost safety of delivery services. Moreover, consumers increasingly expect real-time shipment tracking, prompting logistics companies to invest in digital platforms and mobile applications. Contactless delivery solutions and chatbot-driven customer support enhance user experience. Additionally, blockchain-based supply chain transparency is gaining traction, ensuring secure and reliable parcel movement. The continued adoption of digital solutions is set to enhance operational efficiency and service quality across the industry. For instance, as per industry reports, cargo shipments across Russia showcased year-on-year elevation by 5.5% during the year 2024.

Growth of Sustainable and Green Logistics

Sustainability is becoming a key focus in Russia’s CEP market, with logistics providers adopting eco-friendly initiatives to reduce their carbon footprint. Moreover, as per industry reports, Russia has set objectives to lower their greenhouse gas emissions by the year 2030, attaining net zero label by around year 2060. This development will further boost green logistics trend. As a result, companies are integrating electric and hybrid delivery vehicles, optimizing routes to minimize emissions, and using biodegradable packaging. Green logistics hubs and energy-efficient warehouses are also being developed to promote sustainability. Consumers and businesses increasingly prioritize environmentally responsible delivery options, driving further investment in sustainable practices. As regulatory frameworks evolve, logistics firms are expected to expand their commitment to greener operations, aligning with global sustainability standards and corporate social responsibility goals.

Russia Courier, Express, and Parcel (CEP) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia courier, express, and parcel (CEP) market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service type, destination, type, and end-use sector.

Analysis by Service Type:

- B2B (Business-to-Business)

- B2C (Business-to-Consumer)

- C2C (Customer-to-Customer)

B2B services account for a substantial portion in the market share of CEP across Russia mainly due to increase in corporate logistics, industrial supply chains, and wholesale trade. For supply chain upgrading, just-in-time manufacturing, and retail distribution, companies rely on efficient parcel movement. Express delivery continues to grow increasingly in demand, in temperature-maintained logistics, and handling of bulk shipments. In addition, investments are mainly made in terms of tailored delivery solutions, automation, and route efficacy. Several industries are included in such developments, like health care, automobile, and manufacturing.

Fast growth in B2C (business-to-consumer) services is driven by fast-growing e-commerce and increased customer need for user-friendly and quick deliveries. Higher parcel volumes are being driven through online subscription-related services, e-retailers, and marketplaces. Furthermore, they require efficient last-mile logistics. Companies, therefore, are heavily spending on tracking systems based on real-time, automated sorting centers, and smart lockers for improved delivery efficiency. The growth of same-day as well as express delivery is coupled with increasing popularity in B2C logistics in the CEP market of Russia.

C2C (customer-to-customer) services are gaining traction with the rise of online marketplaces, second-hand sales, and peer-to-peer transactions. Individuals rely on courier networks for seamless shipment of goods, including personal items and small parcels. The expansion of digital platforms and mobile-based courier solutions enhances accessibility, improving delivery convenience. Growing demand for secure, cost-effective, and flexible shipping options continues to drive innovation in C2C logistics, particularly in urban and suburban areas.

Analysis by Destination:

- Domestic

- International

Domestic deliveries are prominent the Russian market for courier, express, and parcel (CEP), driven by the expansion of e-commerce, growing retail demand, and business-to-business (B2B) logistics. With an extensive geographic area, efficient parcel movement within the country relies on well-developed road, rail, and air networks. Major cities like Moscow, Saint Petersburg, and Novosibirsk serve as key distribution hubs, ensuring seamless last-mile delivery. Companies are investing in automation, route optimization, and warehouse expansion to enhance efficiency. Rising demand for express and same-day deliveries, particularly in urban areas, continues to shape the domestic logistics landscape, fostering competition among courier providers.

International shipments play a crucial role in Russia’s CEP market, particularly with increasing cross-border trade and global e-commerce expansion. The country’s strategic location between Europe and Asia facilitates parcel movement across key trade routes. Major logistics providers focus on enhancing customs clearance, improving air and maritime freight capacity, and adopting digital tracking solutions for seamless international delivery. Cross-border partnerships and warehouse infrastructure upgrades are driving efficiency, ensuring faster and more reliable shipping. Demand for international express services is growing, particularly in business sectors and online retail, further strengthening Russia’s incorporation with the global logistics network.

Analysis by Type:

- Air

- Ship

- Subway

- Road

Air transport holds a critical share in Russia’s CEP market, especially for premium-value and time-sensitive shipments. Major logistics hubs like Moscow, Saint Petersburg, and Yekaterinburg facilitate rapid parcel movement across vast distances. Increasing demand for express delivery services, coupled with expanding e-commerce and cross-border trade, is driving investments in air cargo capacity, automation, and digital tracking solutions to enhance efficiency and speed.

Ship transport exhibits a notable role in Russia’s CEP market, especially for bulk shipments and international trade. With key ports such as Saint Petersburg, Vladivostok, and Novorossiysk, maritime logistics support cost-effective delivery solutions for heavy goods and cross-border shipments. The integration of digital tracking and port infrastructure upgrades is improving operational efficiency. Ship transport remains essential for long-distance and intercontinental parcel movement, complementing other delivery modes in the logistics network.

Subway transport is an emerging segment in Russia’s CEP market, primarily used for urban last-mile delivery in high-density areas like Moscow. Leveraging existing metro networks, logistics providers can bypass road congestion, ensuring faster and more reliable deliveries. This mode is particularly useful for small parcels and e-commerce shipments. The adoption of automated parcel lockers in metro stations is further enhancing convenience, reducing delivery times, and supporting the growing demand for efficient urban logistics.

Road transport is most critical Russia’s CEP market due to its flexibility, cost-effectiveness, and extensive coverage. A well-developed highway network connects major cities and remote areas, supporting efficient parcel movement. Demand for same-day and express deliveries is driving investment in electric vehicles, route optimization technologies, and last-mile innovations. Road transport remains the preferred mode for domestic deliveries, ensuring seamless logistics operations for businesses and consumers across the country.

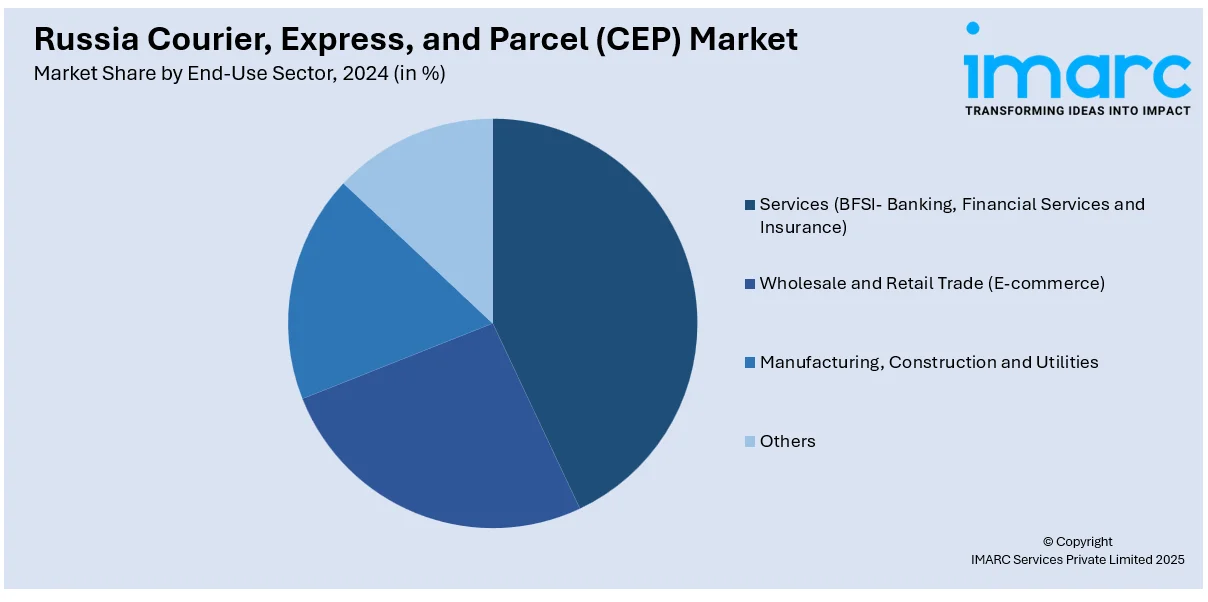

Analysis by End-Use Sector:

- Services (BFSI- Banking, Financial Services and Insurance)

- Wholesale and Retail Trade (E-commerce)

- Manufacturing, Construction and Utilities

- Others

The BFSI sector plays a critical role in Russia’s CEP market, boosted by the accelerating requirement for secure and time-sensitive document deliveries. Banks, financial institutions, and insurance companies rely on CEP services for transporting confidential paperwork, credit cards, and legal documents. The sector’s growing digital transformation has led to rising demand for swift and efficient courier solutions, particularly for last-mile deliveries. Enhanced security measures, real-time tracking, and regulatory compliance are key factors influencing service providers to optimize delivery networks for BFSI clients.

The wholesale and retail trade sector, particularly e-commerce, is a major contributor to Russia’s CEP market, fueled by the rapid growth of online shopping and digital marketplaces. Consumers expect fast and reliable deliveries, increasing the demand for express and same-day shipping services. Logistics providers are investing in warehouse automation, route optimization, and last-mile delivery solutions to meet growing e-commerce requirements. The expansion of cross-border trade and online sales promotions further drives parcel volumes, reinforcing the need for efficient logistics infrastructure.

The manufacturing, construction, and utilities sectors significantly contribute to the CEP market by requiring efficient logistics solutions for transporting spare parts, machinery, and essential equipment. Industrial supply chains depend on reliable courier services to ensure uninterrupted operations and minimize downtime. The growing adoption of just-in-time (JIT) inventory management in manufacturing further increases demand for express deliveries. Construction firms require time-sensitive shipments for project materials, while utility providers depend on CEP services for distributing critical components. Investments in specialized logistics solutions, including freight integration and temperature-controlled transport, enhance delivery efficiency in these sectors.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central district holds the substantial Russia courier, express, and parcel (CEP) market share due to its elevated population density and strong economic activities. As home to Moscow, the country’s key logistics hub, the region benefits from well-developed transportation infrastructure and high demand for e-commerce deliveries. Major logistics companies concentrate operations here, ensuring rapid parcel movement and efficient last-mile delivery. The growing retail sector, rising online shopping trends, and increasing business-to-business (B2B) shipments further drive market growth in this region.

The Volga district is a key contributor to Russia’s CEP market, supported by its diverse industrial base and expanding e-commerce penetration. With major cities like Nizhny Novgorod, Kazan, and Samara, the region experiences steady demand for parcel deliveries from both businesses and consumers. Strong manufacturing and automotive industries fuel B2B shipping volumes, while improving logistics infrastructure enhances efficiency. Expanding warehouse networks and digitalization of supply chains are further strengthening CEP services in this region.

The Urals district plays a crucial role in Russia’s CEP market, driven by its industrial and mining sectors. Cities like Yekaterinburg and Chelyabinsk serve as key logistics centers, facilitating parcel movement across the region and beyond. The district’s strategic location between European and Asian markets supports cross-regional trade and logistics expansion. Increasing investment in infrastructure, coupled with the rising adoption of digital logistics solutions, is improving delivery efficiency. The demand for express and same-day deliveries is growing, particularly in business and e-commerce segments.

The Northwestern district, anchored by Saint Petersburg, is a vital hub for international and domestic parcel shipments. Its proximity to European markets enhances cross-border trade, making it a key region for express delivery services. The area’s strong retail sector and rising online shopping trends are boosting demand for fast and reliable logistics solutions. Investments in warehouse automation, digital tracking, and last-mile delivery innovations are enhancing operational efficiency. The growing importance of temperature-controlled logistics also supports market expansion, particularly in pharmaceuticals and perishable goods.

The Siberian district is actively experiencing steady expansion in the CEP market, fueled by increasing e-commerce adoption and improving transportation networks. Despite geographical challenges, major cities like Novosibirsk, Krasnoyarsk, and Omsk serve as key distribution centers for parcel movement across the vast region. Investments in air and rail logistics are enhancing connectivity, reducing delivery times for both domestic and cross-border shipments. The rising demand for courier services in remote areas is encouraging logistics companies to expand their service coverage and invest in advanced delivery solutions.

Competitive Landscape:

The market is intensely competitive, led by major domestic players like Russian Post or CDEK, alongside global firms. For instance, revenue of Russian Post reached USD 281.6 Million, while CDEK revenue elevated by 27% in the year 2024. In addition, market competition is driven by e-commerce growth, demand for faster deliveries, and advanced logistics solutions. Beside this, companies invest in automation, digital tracking, and last-mile delivery innovations to enhance efficiency. Furthermore, service diversification, competitive pricing, and expanding distribution networks are key strategies. Logistics firms prioritize cost-effective, high-speed delivery models to meet growing consumer expectations and strengthen market positioning.

The report provides a comprehensive analysis of the competitive landscape in the Russia courier, express, and parcel (CEP) market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, CDEK, a Russia-based courier delivery services provider, announced plans to introduce its own platform for advertising, aiming to become first logistics firm with its own platform for applications related to advertising. This is planned to be launched in February 2025.

- In May 2024, Russia unveiled plans to establish its first terminal for liquefied petroleum gas (LPG) terminal on the coast of Pacific Ocean by late 2025, with significant investments from China. The Russian Direct Investment Fund, in collaboration with Chinese petrochemical firm Haiwei, is financing the project in Russia's Far East. The terminal, designed for LPG exports, will have 1 million metric tons of annual capacity. Initial investments amount to USD 95.61 million, while total funding is projected to reach approximately USD 409.74 million.

Russia Courier, Express, and Parcel (CEP) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | B2B (Business-To-Business), B2C (Business-To-Consumer), C2C (Customer-To-Customer) |

| Destinations Covered | Domestic, International |

| Types Covered | Air, Ship, Subway, Road |

| End-Use Sectors Covered | Services (BFSI- Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-Commerce), Manufacturing, Construction and Utilities, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia courier, express, and parcel (CEP) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia courier, express, and parcel (CEP) market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia courier, express, and parcel (CEP) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia courier, express, and parcel (CEP) market was valued at USD 2.43 Billion in 2024.

The market is driven by the expansion of e-commerce, rising cross-border trade, and increasing demand for fast and reliable deliveries. Investments in logistics infrastructure, digital tracking solutions, and last-mile delivery innovations further enhance market growth, alongside growing consumer expectations for efficient shipping services.

IMARC estimates the Russia courier, express, and parcel (CEP) market to reach USD 3.37 Billion by 2033, exhibiting a CAGR of 3.55% from 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)