Russia Cosmetics Market Size, Share, Trends and Forecast by Product Type, Category, Gender, Distribution Channel, and Region, 2025-2033

Russia Cosmetics Market Size and Share:

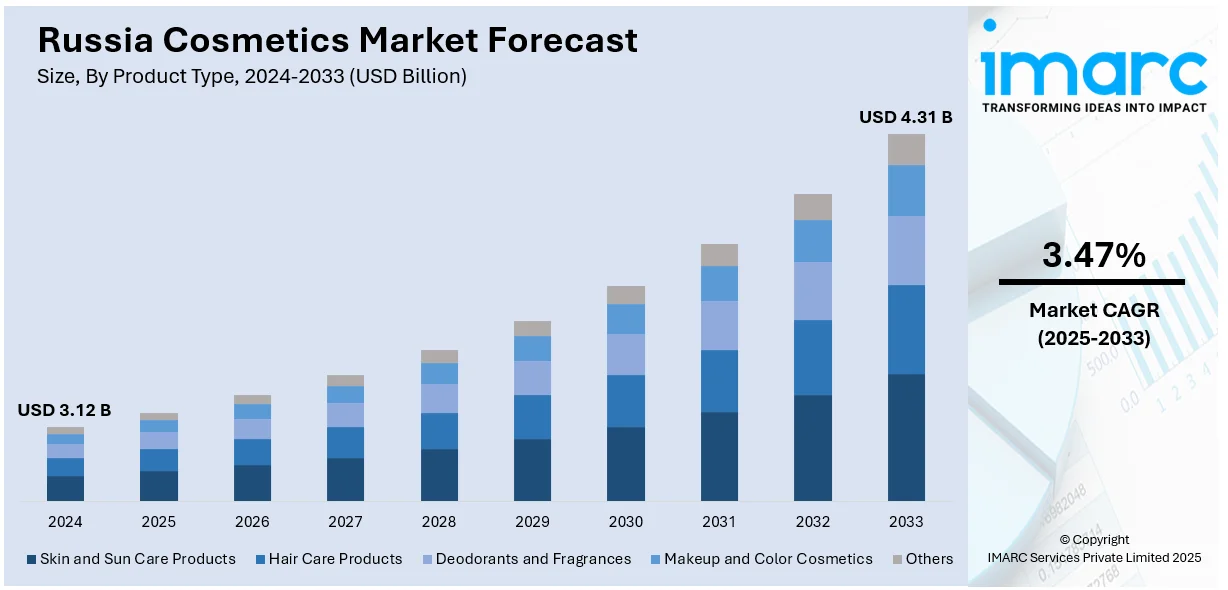

The Russia cosmetics market size was valued at USD 3.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.31 Billion by 2033, exhibiting a CAGR of 3.47% during 2025-2033. The market is driven by the growing user awareness and preference for premium cosmetic products among the masses and increasing employment of digital market strategies. The proliferation of e-commerce platforms, and rising popularity of natural and organic cosmetics that are free from harmful chemicals represent other growth-inducing factors are impelling the Russia cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.12 Billion |

|

Market Forecast in 2033

|

USD 4.31 Billion |

| Market Growth Rate 2025-2033 | 3.47% |

The cosmetics market in Russia is driven by a combination of economic, cultural, and technological factors. Rising disposable incomes and urbanization have significantly influenced consumer spending patterns, encouraging higher expenditure on personal care and beauty products. Russian consumers, especially in urban centers like Moscow and St. Petersburg, are gradually beauty-conscious and responsive to trends, which fuels consistent demand across skincare, haircare, fragrance, and makeup segments. A notable shift toward health and sustainability has also contributed to rising demand for natural, organic, and cruelty-free cosmetics. This aligns with broader global trends and reflects growing environmental and ethical awareness among Russian consumers. Moreover, the market benefits from strong competition between well-established multinational companies and local players, which drives innovation, competitive pricing, and product variety.

The Russia cosmetics market growth is also driven by the influence of social media platforms, beauty bloggers, and influencers, which has amplified awareness of global beauty standards and product innovations, thus making consumers more receptive to trying new cosmetics. Additionally, e-commerce has expanded access to a wider range of products, allowing even consumers in remote regions to explore both international and domestic brands conveniently. For instance, in February 2023, Unilever announced that it would continue to operate in Russia under stringent restrictions. Gravityl was introduced by Givaudan Active Beauty to combat aging symptoms, such as skin drooping. Additionally, from February 15 to 17, Clariant showcased its most recent developments at the PCHi (Personal Care and Homecare Ingredients) show in Guangzhou, China. Additionally, increased male grooming, demand for gender-neutral products, and the expansion of retail channels, both physical and digital, continue to support the market’s growth across diverse consumer demographics.

Russia Cosmetics Market Trends:

Expanding E-commerce and Digital Marketing Strategies

According to ECDB, which is a specialized eCommerce data analytics company, Russia represents the 9th largest market for eCommerce with a predicted revenue of USD 76,592.4 million by 2024. Most of the people in the country prefer shopping online as it is affordable and easy due to the availability of products at competitive prices. E-commerce platforms give individuals access to purchasing goods from both local and international brands. In addition, digital marketing and social media campaigns have been particularly effective in increasing user engagement with our products as well as encouraging brand loyalty. Cosmetic brands are capitalizing on influencer collaborations, behind the scenes videos, and targeted ads to expand their reach in Russia. Apart from the increasing brand visibility, these digital channels offer brands information about what their customers like and don’t like so they can serve them better. The advanced use of technological advances like augmented reality (AR) for virtual try-ons and personalized recommendations are only improving this online shopping experience, which is making it gain more popularity amongst customers on e-commerce platforms.

Increasing Awareness and Preference for Premium Products

The growing awareness among Russian people about personal grooming and skincare is impelling the market growth. The increasing exposure to global beauty trends, fueled by social media and beauty influencers, is catalyzing the demand for high-quality, premium cosmetic products. People are now more informed about the ingredients and benefits of various beauty products, encouraging them to opt for those that offer better results and align with their preferences. According to the Russia cosmetics market forecast, this shift is particularly evident among the younger demographic, which is more inclined toward experimenting with new products and brands. Additionally, the rise in disposable income and changing lifestyles have enabled people to spend more on luxury and sustainable cosmetics, contributing to the market growth.

Innovation and Sustainability in Cosmetic Products

People are increasingly seeking products that are not only effective but also environment friendly and ethically produced. This shift in user preference is driving cosmetic companies to invest in research and development (R&D) to create innovative formulations and sustainable packaging solutions. Natural and organic cosmetics, free from harmful chemicals, are gaining popularity as consumers become more conscious of their health and environmental impact. Brands are responding by launching eco-friendly product lines and adopting sustainable practices throughout their supply chains. Furthermore, the emphasis on clean beauty and transparency in ingredient sourcing has prompted companies to provide detailed information about their products, fostering trust and loyalty among consumers. Innovation is also evident in the development of multifunctional products that offer multiple benefits, catering to the growing demand for convenience and efficiency. These advancements not only meet the evolving consumer demands but also position brands as responsible and forward-thinking, enhancing their competitiveness in the market. According to an article published by The Green Beauty Community in 2024, one of the major ways clean beauty brands are transforming the industry is by shifting consumer perceptions, as people are becoming more informed about the ingredients in their beauty products.

Russia Cosmetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia cosmetics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, category, gender, and distribution channel.

Analysis by Product Type:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products dominate the Russian cosmetics market, holding 70.2% of the market share in 2024. This is due to the growing consumer awareness about skincare routines, anti-aging solutions, and protection from harsh climatic conditions. The long winters and skin-damaging cold weather increase demand for moisturizers, serums, and protective creams. Additionally, urban pollution and lifestyle changes are pushing consumers toward daily skin maintenance, driving both premium and mass-market purchases. This trend is further fueled by increased product availability through e-commerce and pharmacy retail channels.

Hair care products are in high demand in Russia as consumers prioritize scalp health, hair strengthening, and color maintenance. The popularity of hair coloring and styling, especially among younger consumers, drives consistent usage of shampoos, conditioners, and treatments. Harsh weather and indoor heating conditions contribute to hair dryness, prompting frequent use of nourishing products. Additionally, a strong salon culture and rising interest in organic and multifunctional hair solutions further boost the segment’s prominence in the cosmetics market.

Deodorants and fragrances hold a large share in the Russian cosmetics market due to daily hygiene practices and cultural preferences for personal scent expression. Consumers across demographics view perfumes and body sprays as essentials, not luxuries. International and local brands offer a wide range of options, from affordable sprays to premium eau de parfums. Seasonal promotions, gifting traditions, and the growing presence of unisex and niche fragrance lines contribute to steady demand across urban and rural markets, which is further creating a positive impact on the Russia cosmetics market outlook.

Makeup and color cosmetics maintain a strong foothold in Russia due to cultural emphasis on appearance, beauty trends driven by social media, and widespread use among women of all ages. Products like foundations, lipsticks, and eyeliners are frequently used for both daily wear and social events. The growing influence of beauty influencers, international fashion, and local product innovation ensures continuous engagement. Despite occasional economic shifts, demand remains stable due to affordability and aspirational consumer behavior.

Analysis by Category:

- Conventional

- Organic

Conventional cosmetics dominate the market with 67.2% of the market share due to their widespread availability, affordability, and strong brand recognition. These products cater to mass-market consumers and are supported by extensive retail distribution through supermarkets, pharmacies, and online platforms. Russian consumers are loyal to familiar brands offering effective, multi-functional solutions at competitive prices. Additionally, the consistent marketing and innovation by global and local players keep conventional cosmetics relevant and accessible, ensuring their continued leadership in overall market share.

Organic cosmetics are gaining significant traction in Russia as health-conscious consumers increasingly seek clean-label, chemical-free alternatives. Rising awareness about ingredient safety, coupled with environmental and ethical concerns, has driven interest in natural and organic products. This shift is especially notable among younger, urban buyers who value sustainability and skin-friendly formulations. Local organic brands and certified international products are expanding rapidly, backed by growing retail support and social media-driven education, solidifying their place among top-performing segments.

Analysis by Gender:

- Men

- Women

- Unisex

Women dominate the market holding a market share of 88.3% in 2024. They form the core consumer base in Russia’s cosmetics market, traditionally driving demand for skincare, hair care, makeup, and fragrance products. Russian women value appearance and are highly responsive to beauty trends, fueling consistent spending across all age groups. The influence of social media, celebrity endorsements, and beauty influencers further boosts engagement. With a wide variety of local and global brands catering to female preferences, the women’s segment maintains the largest and most stable market share.

The cosmetics segment for men is expanding in Russia due to growing awareness about grooming, skincare, and personal hygiene among male consumers. Increasing acceptance of male-focused beauty routines, especially in urban areas, is driving demand for products like facial cleansers, beard care, and anti-aging solutions. Marketing campaigns targeting men and the rise of gender-specific brands have also contributed to this growth. As social norms shift, more men actively participate in self-care, solidifying the segment’s strong market presence.

Unisex cosmetics are gaining popularity in Russia as consumers increasingly favor minimalist, inclusive, and versatile products. These offerings appeal to households seeking shared usage and to younger generations who prefer gender-neutral branding. Categories like skincare, deodorants, and hair products are commonly designed for all users, making them accessible and practical. Additionally, the rise of ethical consumerism and functional benefits over traditional gender targeting supports the growing demand for unisex formulations, reinforcing their strong position in the market.

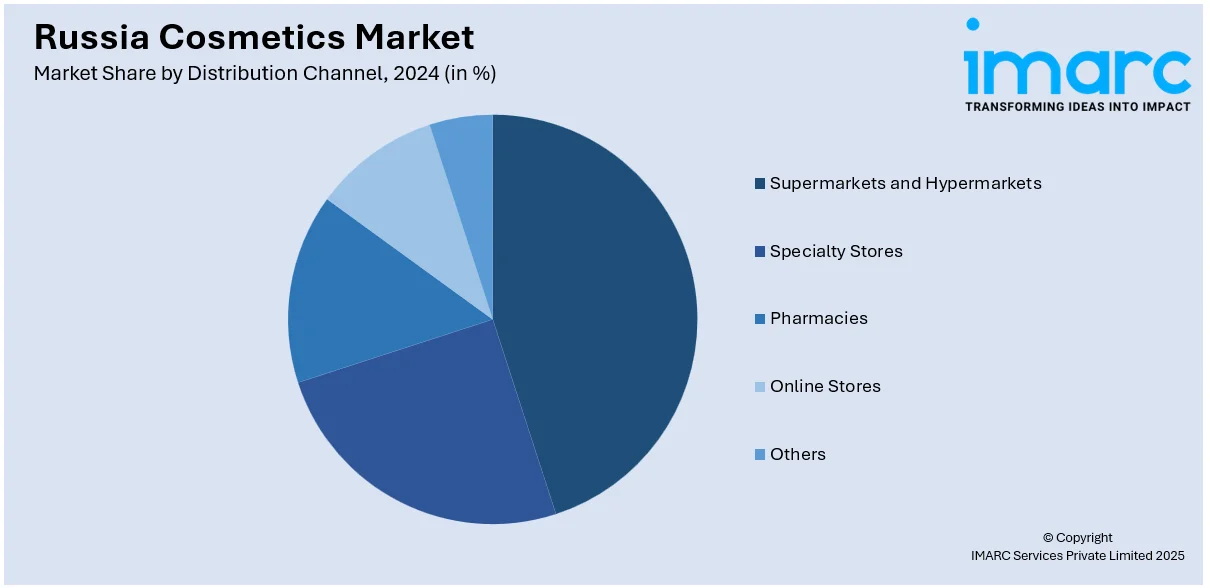

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Specialty stores accounts for 32.0% of the market share in 2024. These stores are preferred in Russia for their curated product selections, expert customer service, and premium shopping experience. These outlets often carry mid to high-end cosmetic brands and provide personalized consultations that build trust and loyalty among consumers. Shoppers seeking specific skincare, makeup, or hair care solutions frequently visit these stores for product variety and exclusivity. Their ability to showcase both international and niche brands supports their strong position in the market, especially in major cities.

Supermarkets and hypermarkets hold a significant share in the Russian cosmetics market due to their wide accessibility, competitive pricing, and convenience. Consumers frequently purchase everyday beauty and personal care products during regular shopping trips. These stores offer a broad assortment of mass-market brands, regular promotions, and loyalty programs that drive foot traffic. Their strong presence across urban and rural areas makes them a key distribution channel for both local and international cosmetic products, ensuring consistent market dominance.

Online stores are rapidly gaining share in the Russian cosmetics market due to growing internet penetration, mobile commerce, and convenience-driven shopping habits. Consumers appreciate the ease of browsing product reviews, comparing prices, and accessing a wide variety of brands from home. E-commerce platforms often offer exclusive deals, fast delivery, and seamless return policies. The influence of digital marketing, social media, and beauty influencers further boosts online cosmetics sales, especially among younger, tech-savvy demographics across the country.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central district holds the leading position with a significant share of 41.2% in 2024. The Central District, especially Moscow, drives the cosmetics market through its high urban population, affluent consumers, and strong retail infrastructure. The concentration of international brands, flagship stores, and beauty salons supports rapid product adoption. Consumer exposure to global beauty trends and demand for premium skincare and makeup propel market growth. Additionally, a well-developed e-commerce ecosystem and beauty influencer culture further enhance product visibility and accessibility, making the Central District a hub for cosmetics innovation and consumption.

Competitive Landscape:

The Russian cosmetics market features a competitive landscape dominated by a mix of international giants and strong domestic brands. Key global players such as L’Oréal, Procter & Gamble, and Unilever maintain significant market presence through broad product portfolios and aggressive marketing strategies. Simultaneously, local companies like Natura Siberica and Faberlic have built loyal consumer bases by emphasizing natural ingredients and affordability. E-commerce and specialty retail channels have intensified competition, offering consumers greater brand variety and price transparency. Social media influencers and beauty bloggers play a critical role in shaping consumer preferences, further driving brand competition. Innovation in organic products, sustainable packaging, and tailored skincare solutions continues to be a key differentiator, making the market dynamic, brand-driven, and increasingly segmented by consumer lifestyle and values.

The Russia cosmetics market report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Cosmetics manufacturer WNT Production Group expanded into oral care by launching the production of toothpastes, sprays, mouthwashes, and foams at the Ysipovo industrial park. The company has invested RUB 1 billion, with overall cosmetic production capacity having risen by 70% over the past year.

- March 2025: Aeroflot introduced new in-flight amenity kits featuring cosmetic items like face cream, hand cream, and lip balm across various travel classes. Business and Comfort Class passengers will receive updated kits tailored to flight duration, while routes to leisure destinations will include eco-conscious cosmetic packaging and reusable bags.

- March 2025: Vkusvil, a Russian supermarket chain, introduced its first cosmetics stand inside its store at the Mega Khimki shopping center in Moscow. The move marks the brand's expansion into the cosmetic segment, with ambitions to further diversify its in-store offerings.

- October 2024: Unilever finalized the sale of its Russian subsidiary, including four factories and its operations in Belarus, to Arnest Group. Founded in the 1970s, Arnest Group is a Nevinnomyssk-based manufacturer of perfumes, cosmetics, and household products.

- February 2024: Love Co announced its entrance in the Russian market in partnership with Kristina Bykova, with plans to establish retail chains in several major Russian cities.

Russia Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, Others |

| Categories Covered | Conventional, Organic |

| Genders Covered | Men, Women, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia cosmetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia cosmetics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetics market in Russia was valued at USD 3.12 Billion in 2024.

The Russia cosmetics market is projected to exhibit a CAGR of 3.47% during 2025-2033, reaching a value of USD 4.31 Billion by 2033.

Key factors driving the Russia cosmetics market include rising beauty consciousness, increased disposable income, expanding e-commerce channels, and growing demand for natural and organic products. Urbanization, social media influence, and the presence of both global and local brands also contribute to market growth by shaping consumer preferences and purchasing behavior.

The Central District holds the largest share in the Russia cosmetics market due to urbanization, rising disposable incomes, premium brand demand, beauty awareness, tourism, and retail infrastructure development.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)