Russia Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Russia Cold Chain Logistics Market Size and Share:

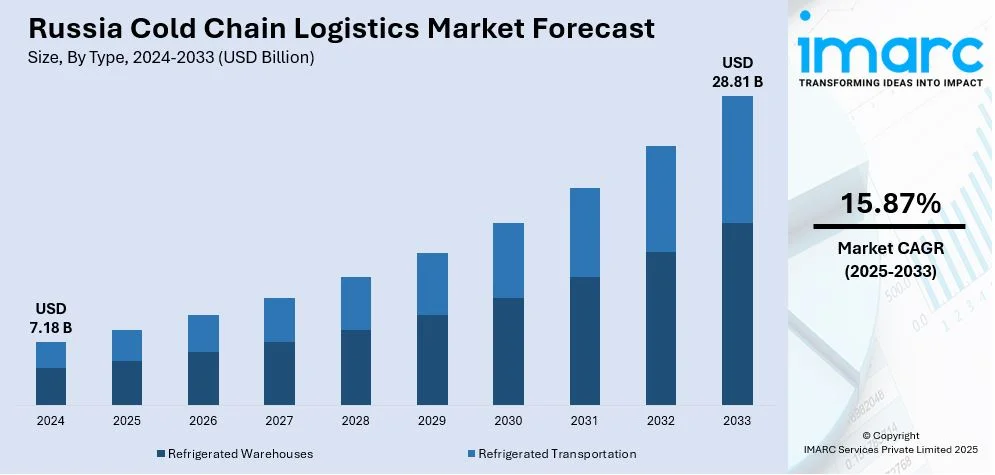

The Russia cold chain logistics market size was valued at USD 7.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 28.81 Billion by 2033, exhibiting a CAGR of 15.87% from 2025-2033. Russia's cold chain logistics market is driven by rising demand for temperature-sensitive pharmaceuticals, increasing frozen food consumption, and expanding e-commerce grocery deliveries. Infrastructure investments, government regulations on food safety, and technological advancements in refrigeration further propel growth. Harsh climatic conditions and long transportation distances emphasize the need for efficient cold storage solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.18 Billion |

| Market Forecast in 2033 | USD 28.81 Billion |

| Market Growth Rate (2025-2033) | 15.87% |

Russia's market for cold chain logistics is highly influenced by demand, which is increasing with growing economies of temperature-controlled pharmaceutical storage and distribution. Health care industry expansion, increasing trend of chronic diseases, and increased demand for vaccines, biologics, and specialty drugs require the majority of facilities to be robust cold infrastructure. Tough regulations and policies necessitate temperate management to preserve the integrity of the product, which is increasing investments in refrigerated transportation and storage facilities. In addition, the government's thrust on local pharmaceutical production under the "Pharma 2030" strategy is raising demand for efficient cold chain logistics. Advances in real-time monitoring technologies enhance supply chain reliability, thereby ensuring compliance and reducing losses resulting from temperature deviations.

The growing popularity of frozen and perishable food products, driven by changing consumer lifestyles and increased disposable income, is a key driver for Russia’s cold chain logistics market. The growing demand for ready-to-eat meals, dairy products, and seafood has driven higher investments in refrigerated transportation and storage. Simultaneously, the booming e-commerce sector, fueled by online grocery platforms and meal kit services, necessitates efficient last-mile cold chain solutions. Major retailers and logistics providers are expanding temperature-controlled warehouses and adopting advanced tracking systems to maintain freshness. Harsh climatic conditions further emphasize the need for reliable cold storage infrastructure, ensuring seamless food distribution across vast geographical regions.

Russia Cold Chain Logistics Market Trends:

Expansion of Cold Storage Infrastructure

Russia's cold chain logistics market is witnessing immense growth in the construction of cold storage infrastructure driven by the surging demand for temperature-sensitive goods like pharmaceuticals, dairy products, and frozen foods. Big logistics companies and retailers are putting significant investments in modernized cold storage facilities, such as those that have automated temperature control, real-time monitoring, and energy-efficient refrigeration systems. Strategically located cold storage hubs-well, particularly in major urban centers, including Moscow and St. Petersburg-would improve overall efficiency in delivery. Cold storage capacity expansion plans in remote locations aim to be part of making the entire nationwide supply chain stronger. Government aid to domestic food production and manufacturing of pharmaceutical products is also bolstering infrastructure development to ensure higher quality and higher standards of stringent safety regulations.

IoT and Blockchain Integration for Enhanced Supply Chain Transparency

The adoption of IoT and blockchain technologies is transforming Russia’s cold chain logistics sector by improving supply chain transparency, security, and efficiency. IoT-enabled sensors and RFID tracking devices provide real-time temperature and humidity monitoring, ensuring optimal storage conditions throughout transportation. Blockchain technology enhances traceability, reducing fraud and ensuring compliance with stringent food safety and pharmaceutical regulations. These advancements enable logistics providers to maintain end-to-end visibility, reducing spoilage and improving inventory management. The integration of AI-driven predictive analytics further optimizes route planning and warehouse operations, minimizing disruptions. As global and domestic companies prioritize digital transformation, the implementation of IoT and blockchain is becoming a standard practice in Russia’s cold chain logistics.

Growth of E-Commerce and Last-Mile Cold Chain Solutions

Increasing e-commerce in the Russian grocery and meal delivery sector is driving the demand for last-mile cold chain solutions. As online grocery marketplaces, especially SberMarket and Ozon Fresh, witnessed a high rate of growth, investments in temperature-controlled delivery fleets and micro-fulfillment centers have multiplied. Hybrid delivery models in companies, consisting of dark stores and refrigerated locker systems, allow for efficient order fulfillment quickly. Innovations such as electric refrigerated vehicles and AI-driven logistics platforms are added to make the delivery process even more efficient and ensure quality of fresh products. Thus, in terms of the trend of increased convenience and same-day deliveries for Russia's digital retail landscape, last-mile cold chain capabilities of the logistics providers continue to improve and evolve.

Russia Cold Chain Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia cold chain logistics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

Based on the Russia cold chain logistics market report, refrigerated warehouses in Russia are expanding due to rising demand for frozen food, pharmaceuticals, and perishable goods. Investments in automated temperature control, real-time monitoring, and energy-efficient refrigeration enhance storage efficiency. Strategic locations in urban centers and remote regions support supply chain resilience and compliance with stringent food safety regulations.

Refrigerated transportation is growing as e-commerce grocery deliveries, pharmaceutical shipments, and frozen food distribution expand. Advancements in temperature-controlled vehicles, IoT-based tracking, and route optimization improve efficiency. Logistics providers invest in electric refrigerated trucks and hybrid delivery models, ensuring seamless cold chain operations despite Russia’s vast geography and extreme climatic conditions.

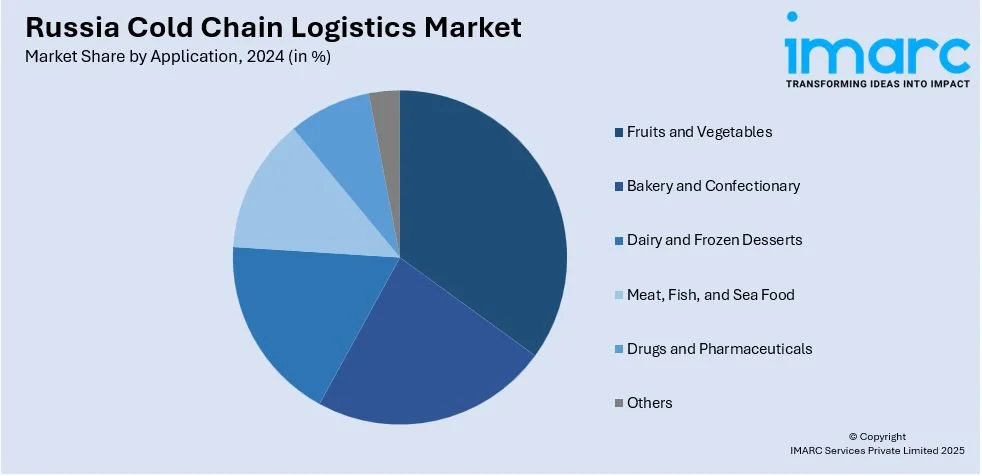

Analysis by Application:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

Cold chain logistics for fruits and vegetables in Russia maintains freshness, minimizes spoilage, and prolongs shelf life. Controlled temperature and humidity storage prevent degradation during long-distance transportation. Growing consumer demand for fresh produce and increased imports drive investments in refrigerated warehouses and advanced transportation solutions for efficient supply chain management.

Temperature-controlled logistics are crucial for bakery and confectionery products to maintain texture, taste, and quality. Chocolates, pastries, and baked goods require precise temperature management to prevent melting or staleness. The rising popularity of premium and imported confectionery products fuels demand for advanced refrigerated storage and efficient cold chain distribution networks.

Russia's expanding dairy and frozen dessert market depends on efficient cold chain logistics to preserve product quality. Milk, cheese, ice cream, and yogurt require strict temperature control to prevent spoilage. Increasing consumption, especially in urban areas, is fueling investments in cold storage facilities and refrigerated transport for dependable distribution.

Cold chain logistics for meat, fish, and seafood is crucial due to their perishable nature. Maintaining strict temperature control helps prevent bacterial growth and ensures food safety. Rising demand for frozen meat and seafood, along with increased imports and exports, drives investment in modern refrigerated storage, transport solutions, and compliance with safety regulations.

Pharmaceutical cold chain logistics guarantee the safe storage and transportation of vaccines, biologics, and temperature-sensitive medications. Compliance with strict regulatory guidelines necessitates real-time monitoring, IoT-based tracking, and specialized refrigerated transport. Growing healthcare demand and domestic pharmaceutical production drive investments in advanced temperature-controlled logistics infrastructure across Russia.

The others segment includes cold chain logistics for floral products, chemicals, and specialty food items requiring precise temperature control. Demand for refrigerated transport and storage for cosmetics, biotech products, and specialty beverages is rising. Expanding global trade and stringent quality regulations further drive cold chain infrastructure development in Russia.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, including Moscow, is Russia’s primary logistics hub, with the highest concentration of cold storage facilities and distribution centers holding a significant Russia cold chain logistics market share. Strong demand for pharmaceuticals, frozen food, and fresh produce fuels infrastructure expansion. Advanced refrigerated transportation networks ensure seamless supply chain operations across urban and surrounding regions.

The Volga District is a key agricultural and industrial region, requiring efficient cold chain logistics for meat, dairy, and fresh produce. Expanding food processing industries and rising demand for frozen foods drive investments in refrigerated warehouses. Improved transportation links enhance distribution efficiency across domestic and export markets.

The Urals District, known for its harsh climate, relies heavily on cold chain logistics for frozen food, pharmaceuticals, and perishable imports. Growing industrial activity and increasing retail expansion drive the need for modernized refrigerated storage and transportation solutions, ensuring consistent supply chain operations in extreme weather conditions.

The Northwestern District, including St. Petersburg, serves as a major trade gateway, necessitating robust cold chain logistics for food imports, seafood, and pharmaceuticals. The presence of key ports enhances refrigerated cargo handling, while urban demand for fresh and frozen products drives continuous investments in temperature-controlled storage and distribution.

The Siberian District, characterized by vast distances and extreme temperatures, requires specialized cold chain logistics to ensure food security. Expanding e-commerce grocery services and rising frozen food demand are driving the development of cold storage facilities and temperature-controlled transportation, supporting efficient distribution in remote areas.

Other regions, including the Far East and Southern Districts, are witnessing growing investments in cold chain logistics due to rising agricultural exports and seafood production. Expanding trade routes and increasing demand for temperature-sensitive goods, particularly in coastal and border areas, drive the development of advanced refrigerated transport and storage infrastructure.

Competitive Landscape:

Russia's cold chain logistics market is highly competitive and has key players expanding its infrastructure and technological capabilities to keep up with the increasing demands. X5 Logistics is a subsidiary of X5 Retail Group that operates in several temperature-controlled warehouses and a large number of distribution centers across Russia, supporting supermarket chains. Magnit Logistics is an important organization for distributing products in cold chain lines with its retail stores, thereby managing the supply chain effectively. Ghelamco and Iceberry Logistics specialize in frozen food logistics and provide modern warehousing and transport solutions. The international firms that have recently gained entry include DHL Supply Chain and Maersk Logistics. These global firms provide pharmaceuticals and food export cold chain services. Further investment in automation, IoT tracking, and last-mile delivery solutions intensify the competition in this industry.

The report provides a comprehensive analysis of the competitive landscape in the Russia cold chain logistics market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2023, Ruscon inaugurated a new container terminal at the Orlovka railway station near Volgograd, boasting a capacity of 30,000 TEUs per year. This development aims to bolster the efficiency of cold chain logistics in the region.

Russia Cold Chain Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia cold chain logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia cold chain logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia cold chain logistics market was valued at USD 7.18 Billion in 2024.

The Russia cold chain logistics market was valued at USD 28.81 Billion in 2033 exhibiting a CAGR of 15.87% during 2025-2033.

The Russia cold chain logistics market is driven by rising demand for temperature-sensitive pharmaceuticals, increased frozen and fresh food consumption, and expanding e-commerce grocery services. Infrastructure investments, technological advancements in refrigeration, and government initiatives supporting logistics modernization further accelerate growth, ensuring efficient supply chains across vast and climatically diverse regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)