Russia Cleaning Services Market Report by Type (Window Cleaning, Vacuuming, Floor Care, Maid Services, Carpet and Upholstery, and Others), End Use (Residential, Commercial Spaces, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, and Others), and Region 2025-2033

Russia Cleaning Services Market Overview:

The Russia cleaning services market size reached USD 6.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.3 Billion by 2033, exhibiting a growth rate (CAGR) of 7.01% during 2025-2033. The growing focus on health and hygiene to prevent the transmission of various diseases, advancements in technology to maintain strict hygiene standards, and rising importance of cleanliness in healthcare environments to avoid infections are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.1 Billion |

| Market Forecast in 2033 | USD 11.3 Billion |

| Market Growth Rate 2025-2033 | 7.01% |

Russia Cleaning Services Market Trends:

Growing Focus on Health and Hygiene

Businesses, schools, and homes in Russia are focusing on maintaining cleanliness as a top priority to prevent the transmission of illnesses, such as influenza and norovirus, guaranteeing a safe environment. According to the Smorodintsev Research Institute of Influenza, a total of 70 (1.0%) out of 7,101 patients had positive respiratory samples for influenza from May 13-19, 2024. This included 4 cases of untyped influenza A in 3 cities and 66 cases of influenza B in 17 cities. The rising need for professional cleaning companies due to the importance of regular and comprehensive cleaning services in upholding public health standards is bolstering the market growth. This trend is evident not only in urban areas but also in smaller towns, where the importance of professional cleaning for health reasons is getting recognized. In addition, the growing demand for disinfection and sanitization services as organizations look for holistic approaches to uphold cleanliness and safety is positively influencing the market.

Increasing Geriatric Population

As of 2023, the World Bank reported that there are around 23,243,136 individuals in Russia who are 65 years or older. The increasing number of elderly individuals in Russia is driving the demand for healthcare institutions like hospitals, nursing homes, and assisted living facilities. These establishments need to maintain strict hygiene standards to avoid infections and protect the health of patients. Specialized cleaning solutions tailored to healthcare environments are essential for upholding high standards, making professional cleaning services indispensable. This trend emphasizes the importance of cleanliness in healthcare environments and showcases the crucial function of professional cleaning services in supporting public health. Through strict hygiene protocols, these services protect at-risk populations, highlighting the important role cleaning companies play in the overall efficacy and productivity of the healthcare sector.

Technological Advancements in Cleaning Services

New technologies, including automated cleaning robots, upgraded cleaning solutions, and environment-friendly products, are changing long-established cleaning methods. These technologies improve cleaning quality, decrease time and labor, and make professional services more attractive. Robotic floor cleaners and efficient vacuum systems offer in-depth cleaning with little need for human involvement, ideal for commercial areas. Moreover, the combination of the internet of things (IoT) and smart technologies enables immediate monitoring and scheduling, providing clients with improved visibility and ease of use. By adopting these advanced technologies, cleaning companies are able to provide better services and attract more clients. In 2023, the first cleaning robot named "Pixel" was introduced in Moscow. The locally developed robot was capable of wet cleaning and sweeping sidewalks, working up to 16 hours a day.

Russia Cleaning Services Market News:

- November 2024: The CleanExpo Moscow will take place from November 19-21, 2024, in Krasnogorsk at the Crocus Expo International Exhibition Center. Organized by MVK International Exhibition Company, this annual event will showcase professional cleaning products, sanitary technology, and hygiene innovations.

- March 2024: Becar Asset Management from Russia ventured into the cleaning services sector in Tashkent, Uzbekistan by partnering with Dako company. The decision was a component of a larger plan to grow their activities in Central Asia.

Russia Cleaning Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Window Cleaning

- Vacuuming

- Floor Care

- Maid Services

- Carpet and Upholstery

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes window cleaning, vacuuming, floor care, maid services, carpet and upholstery, and others.

End Use Insights:

- Residential

- Commercial Spaces

- Institutional

- Government

- Healthcare Facilities

- Hospitality

- Aviation

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential, commercial spaces, institutional, government, healthcare facilities, hospitality, aviation, and others.

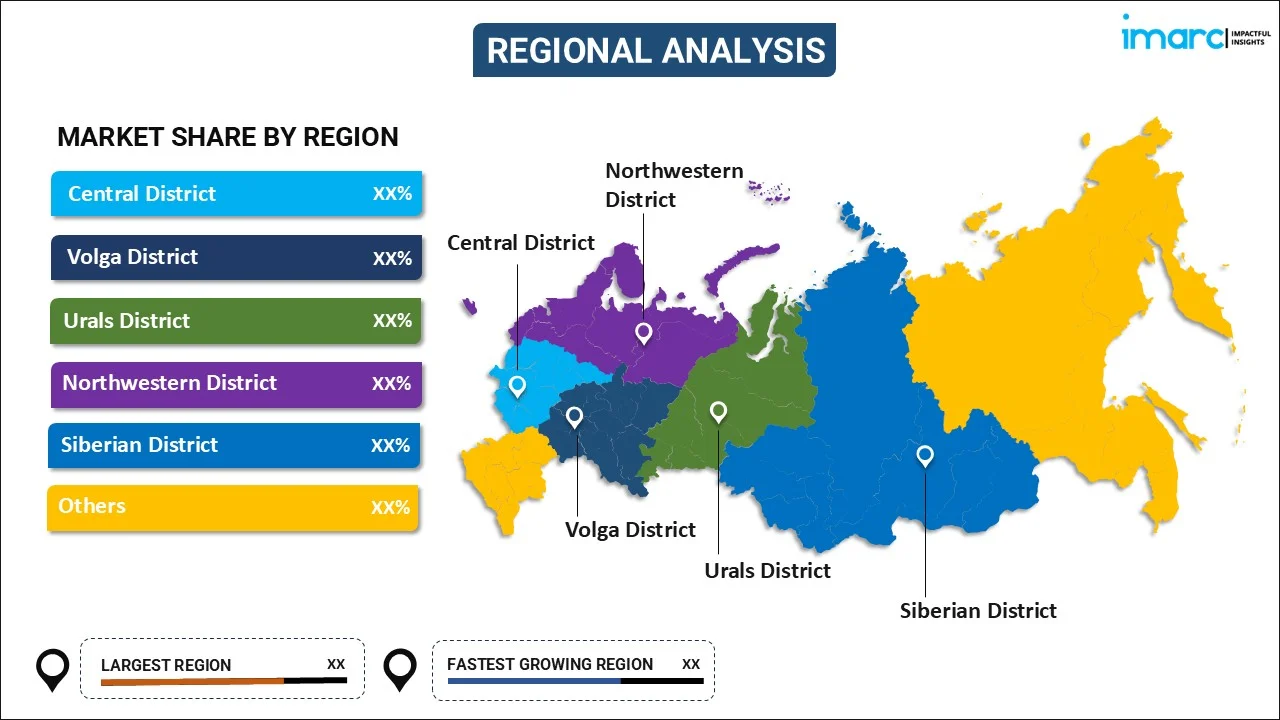

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Cleaning Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Window Cleaning, Vacuuming, Floor Care, Maid Services, Carpet and Upholstery, Others |

| End Uses Covered | Residential, Commercial Spaces, Institutional, Government, Healthcare Facilities, Hospitality, Aviation, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia cleaning services market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Russia cleaning services market?

- What is the breakup of the Russia cleaning services market on the basis of type?

- What is the breakup of the Russia cleaning services market on the basis of end use?

- What are the various stages in the value chain of the Russia cleaning services market?

- What are the key driving factors and challenges in the Russia cleaning services?

- What is the structure of the Russia cleaning services market and who are the key players?

- What is the degree of competition in the Russia cleaning services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia cleaning services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia cleaning services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia cleaning services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)