Russia Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

Russia Carbon Black Market Size and Share:

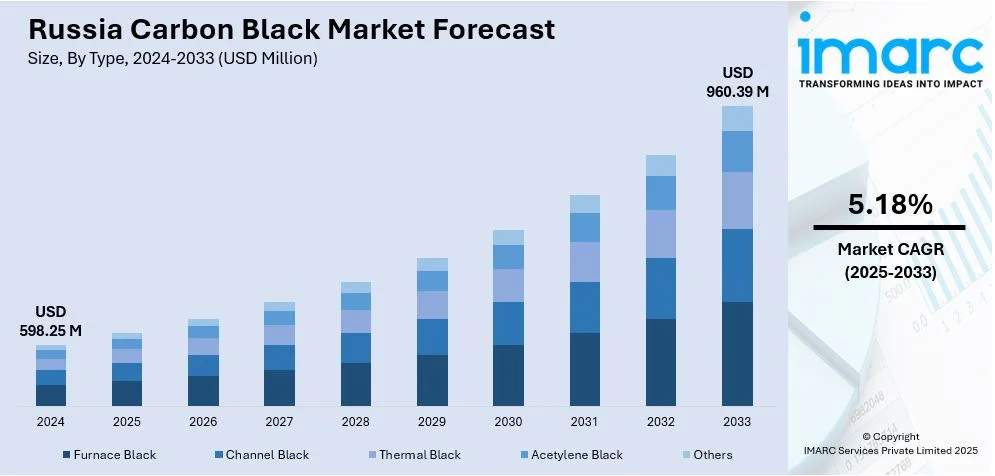

The Russia carbon black market size was valued at USD 598.25 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 960.39 Million by 2033, exhibiting a CAGR of 5.18% from 2025-2033. Increasing demand from the automotive and tire industries, growing applications in plastics and coatings, rising infrastructure development, government initiatives to boost domestic production, technological advancements in sustainable manufacturing, expansion of export opportunities, and increasing use in electronics and battery materials are key drivers of Russia's carbon black market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 598.25 Million |

| Market Forecast in 2033 | USD 960.39 Million |

| Market Growth Rate (2025-2033) | 5.18% |

The Russia carbon black market size is expanding significantly due to the increasing automotive industry, where carbon black is a key component in tire manufacturing, improving durability and performance. For instance, on December 26, 2024, First Deputy Prime Minister Denis Manturov declared that the Russian auto industry and manufacturing are expected to expand by 30–40% in 2024. About 980,000 vehicles, of which 750,000 are cars, are produced domestically, and the entire market is anticipated to reach 1.8 million vehicles, including 1.5 million cars. This represents a substantial rise over 2023, when 724,000 vehicles were produced and 1.32 million were sold. Moreover, escalating investments in infrastructure and construction projects have also fostered demand for carbon black in coatings, paints, and sealants, which in turn is fostering the market. Additionally, the growth of the plastics and rubber industries is further supporting market expansion, as carbon black is widely used as a reinforcing agent. Besides, rising domestic production capacity and ongoing technological advancements in manufacturing processes have enhanced supply chain efficiency and product quality in the Russian market.

The Russia carbon black market share is also rising as the government’s favorable initiatives are promoting industrial growth and self-sufficiency which has led to an increased domestic consumption of carbon black in multiple sectors. For instance, on February 4, 2025, Prime Minister Mikhail Mishustin presided over a strategic meeting that was centered on putting macroeconomic policies into place to guarantee steady growth. He underlined the creation of instruments to support a supply-side economy and the tight coordination between the government and the Bank of Russia. Apart from this, the rise in exports due to competitive pricing and strategic trade agreements has positioned Russia as a key supplier in global markets. Also, stringent environmental regulations are encouraging the adoption of sustainable production practices, driving innovation in low-emission carbon black manufacturing. Additionally, growing research and development activities focused on advanced materials and specialty carbon black applications are contributing to market diversification.

Russia Carbon Black Market Trends:

Increasing Focus on Specialty Carbon Black Production

The Russia carbon black market is witnessing a shift towards specialty carbon black production, driven by demand from industries such as electronics, aerospace, and high-performance coatings. Specialty carbon black offers improved conductivity, UV protection, and superior dispersion properties, making it valuable in advanced applications. For instance, a paper was published on February 4, 2025, described how carbon black nanoparticles were made from green algae and are used to improve UV protection. The researchers achieved an 85% yield by successfully synthesizing carbon black nanoparticles using a hydrothermal technique. When these nanoparticles were added to polymer matrices, the composites' UV shielding effectiveness was 50% higher than that of conventional materials. According to the study, biogenic carbon black has the potential to be used as an environmentally benign addition to increase UV resistance in a number of applications. Russian manufacturers are also investing in research and development to produce high-purity and tailor-made carbon black grades. This trend is further supported by the growing need for lightweight, durable materials in automotive and industrial sectors, encouraging innovation and technological advancements in production processes.

Expansion of Domestic Production and Self-Sufficiency Initiatives

Russia is actively expanding its domestic carbon black production to reduce reliance on imports and strengthen its industrial base. The government has implemented policies supporting local manufacturers through tax incentives, subsidies, and infrastructure investments. For instance, on May 7, 2024, Russian President Vladimir Putin pledged to make Russia self-sufficient in important industries before taking office for a fifth term. Amidst Western sanctions, he placed a strong emphasis on bolstering technological independence, improving defense capabilities, and rebuilding the economy. In addition, Putin emphasized Russia's economy's resilience, claiming that it would keep growing in spite of outside influences. Major Russian producers are increasing production capacities to meet both domestic and international demand. The focus on self-sufficiency is also driving collaborations between local refineries and carbon black manufacturers to secure raw material supply. This expansion aligns with the broader goal of reducing dependency on foreign suppliers amid geopolitical and economic shifts.

Adoption of Sustainable and Low-Emission Manufacturing Technologies

Environmental regulations and sustainability initiatives are influencing the carbon black market in Russia, prompting the adoption of low-emission production technologies. Companies are investing in energy-efficient furnace processes and emission control systems to minimize environmental impact. The use of alternative feedstocks, such as bio-based or recycled carbon sources, is gaining traction as industries seek greener solutions. This trend is further reinforced by increasing corporate commitments to sustainability and carbon neutrality, pushing manufacturers to integrate cleaner technologies and optimize resource utilization while maintaining competitive production costs.

Russia Carbon Black Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia carbon black market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, grade and application.

Analysis by Type:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

Furnace black is widely used in market due to its cost-efficient large-scale production and versatility. Used extensively in tire manufacturing, industrial rubber products, and coatings, its high reinforcement properties improve durability and wear resistance. Russia's strong automotive and infrastructure sectors drive demand, while local production ensures supply stability. Additionally, its role in conductive applications, such as plastics and batteries, is expanding with advancements in energy storage and electronic components, further solidifying its market importance.

Channel black holds a niche but significant role in the Russian carbon black market, primarily for specialized applications like high-quality inks, coatings, and conductive polymers. Its fine particle size and high structure enhance pigment dispersion and electrical conductivity, making it valuable for the growing electronics and printing industries. Though production is limited compared to furnace black, imports and domestic demand persist for high-performance applications where superior tinting strength and conductivity are required. Regulatory shifts favoring low-emission manufacturing may further influence its market position.

Thermal black is essential for non-reinforcing applications in Russia’s rubber, plastics, and coatings industries. With its low structure and larger particle size, it provides flexibility and improved processing in mechanical rubber goods, insulation materials, and high-durability seals. Demand remains steady due to its use in pipelines, gaskets, and wire coatings, all crucial to Russia’s industrial and energy sectors. As sustainability becomes a priority, advancements in cleaner thermal black production methods could shape its future role in the market.

Analysis by Grade:

- Standard Grade

- Specialty Grade

Standard grade carbon black plays a crucial role in Russia's carbon black market, primarily serving as a reinforcing filler in tire manufacturing, industrial rubber products, and plastics. Given the strong presence of Russia's automotive and industrial sectors, demand for this grade remains steady. It enhances durability, tensile strength, and resistance to wear, making it essential for cost-effective, high-volume applications. Additionally, its role in paints, coatings, and inks contributes to market stability, driven by consistent demand from construction and packaging industries.

Specialty grade carbon black is vital for high-performance applications in Russia, particularly in conductive materials, coatings, and advanced polymers. It offers superior dispersion, UV protection, and electrical conductivity, making it essential for lithium-ion batteries, electronics, and high-end plastics. The increasing focus on renewable energy and advanced manufacturing fuels demand for specialty grades, especially in aerospace and automotive industries. While production costs are higher, the premium pricing and specialized applications ensure steady market growth, positioning specialty grades as key drivers of technological advancements in Russia.

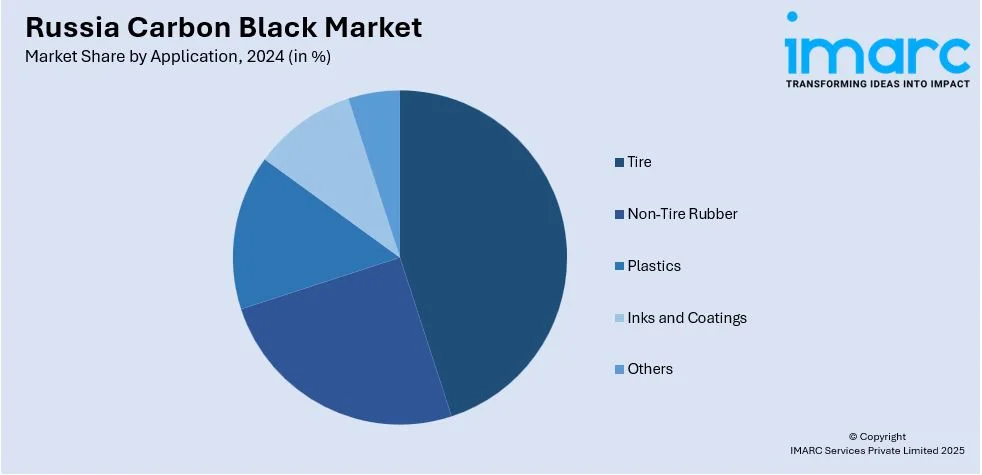

Analysis by Application:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

The tire industry dominates Russia's carbon black market, as carbon black is essential for reinforcing rubber compounds, improving tensile strength, and enhancing wear resistance. It increases durability in passenger, commercial, and off-road tires, making them more resistant to abrasion and extreme conditions. Russia's strong automotive and industrial sectors drive demand for high-performance tires, further boosting carbon black consumption. Additionally, the growing focus on fuel-efficient and all-weather tires is increasing the need for advanced carbon black grades, supporting long-term growth in the Russian rubber industry.

The non-tire rubber sector plays a crucial role in Russia’s carbon black market, as it includes critical products such as industrial belts, hoses, seals, and conveyor belts. Carbon black enhances the mechanical properties of rubber, making these products more resistant to heat, chemicals, and abrasion. In sectors like mining, oil & gas, and manufacturing, durable rubber components are essential, increasing carbon black demand. Furthermore, Russia’s growing infrastructure and industrial expansion require high-performance rubber materials, further driving carbon black consumption in non-tire applications.

The plastics industry is a significant consumer of carbon black in Russia, primarily for pigmentation, UV stabilization, and electrical conductivity. It is widely used in plastic films, pipes, automotive parts, and packaging materials to improve durability and resistance to environmental factors. Russia’s increasing polymer production, coupled with demand for lightweight and high-performance plastics, continues to support carbon black usage. In sectors like construction, automotive, and electronics, carbon black improves the functionality of plastics, ensuring longer lifespan and better mechanical properties in various applications.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District is a key hub in Russia's carbon black market due to its strong industrial base and well-developed transportation infrastructure. Major cities like Moscow and Tula host tire manufacturing and rubber processing industries, driving demand for carbon black as a reinforcing filler. The presence of large petrochemical plants ensures a steady supply of feedstock, while proximity to domestic and European markets enhances distribution efficiency. Additionally, stringent environmental regulations in this region are pushing manufacturers to adopt advanced production technologies, influencing market dynamics.

The Volga District plays a crucial role in Russia's carbon black industry due to its extensive oil refining and petrochemical activities. Home to major industrial cities like Nizhny Novgorod, Kazan, and Samara, the region supplies key raw materials, such as feedstock oils, for carbon black production. Additionally, the district houses some of Russia's largest rubber and tire manufacturers, including those catering to the automotive sector, which is a primary consumer of carbon black. Its well-developed transport networks facilitate efficient supply chain operations, further strengthening its market position.

The Urals District is a strategic contributor to the carbon black market due to its metallurgical and chemical industries. Cities like Yekaterinburg and Chelyabinsk are home to tire and rubber manufacturers that rely on carbon black for reinforcement and durability. The region's access to oil refining by-products ensures a stable raw material supply, while its proximity to both European and Asian markets supports export potential. Additionally, industrial diversification in the Urals is increasing demand for specialty carbon black grades used in coatings, plastics, and high-performance rubber applications.

The Northwestern District influences Russia's carbon black market through its strong trade connections with Europe and its focus on innovation in material sciences. St. Petersburg, the district's economic center, hosts major automotive and chemical industries that require high-quality carbon black for tires, coatings, and polymers. The region's well-established logistics network supports both domestic distribution and exports, making it a key transit point for international trade. Moreover, its advanced research institutions contribute to the development of new carbon black formulations, aligning with global trends in sustainable and high-performance materials.

The Siberian District plays a vital role in Russia's carbon black market due to its rich natural resource base and growing industrial activities. Cities like Novosibirsk and Krasnoyarsk have emerging rubber and plastics industries that require carbon black for reinforcement and conductivity applications. Additionally, Siberia's expanding road infrastructure and logistics capabilities are increasing demand for durable tires, further driving carbon black consumption. The region's access to vast oil and gas reserves supports feedstock availability, while ongoing investments in industrial development are expected to boost carbon black production and usage in the coming years.

Competitive Landscape:

The carbon black market is highly competitive, driven by increasing demand from industries such as automotive, construction, and electronics. Market players focus on product innovation, sustainability, and capacity expansion to gain a competitive edge. The rise in tire manufacturing and growing applications in plastics and coatings further intensify competition. Technological advancements, including sustainable production methods, are reshaping the market landscape. Additionally, regional expansions and strategic partnerships play a crucial role in market positioning. Regulatory frameworks and environmental concerns also impact competition, pushing companies toward greener alternatives and efficient production processes.

The report provides a comprehensive analysis of the competitive landscape in the Russia carbon black market with detailed profiles of all major companies.

Russia Carbon Black Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia carbon black market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia carbon black market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia carbon black market was valued at USD 598.25 Million in 2024.

Increasing demand from the automotive and tire industries, growing applications in plastics and coatings, rising infrastructure development, government initiatives to boost domestic production, technological advancements in sustainable manufacturing, expansion of export opportunities, and increasing use in electronics and battery materials are key drivers of Russia's carbon black market.

The Russia carbon black market is projected to exhibit a CAGR of 5.18% during 2025-2033, reaching a value of USD 960.39 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)