Russia Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Region, 2025-2033

Russia Car Rental Market Size and Share:

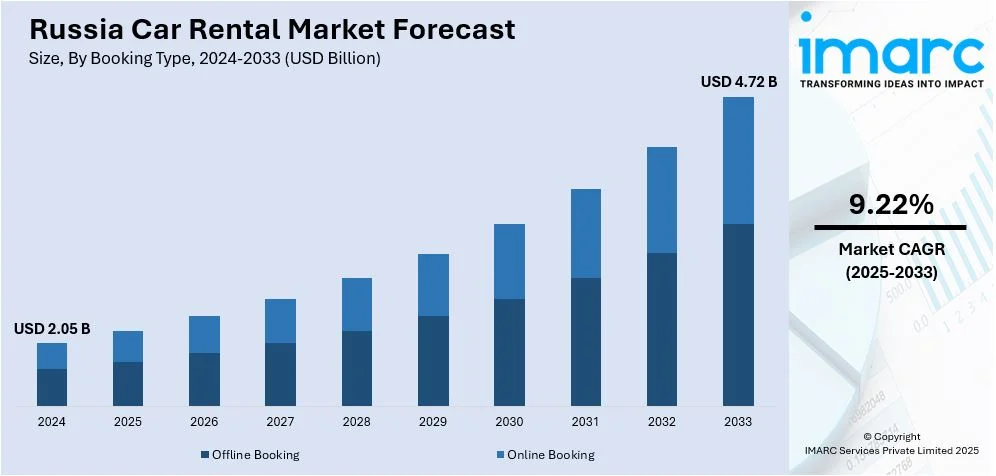

The Russia car rental market size was valued at USD 2.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.72 Billion by 2033, exhibiting a CAGR of 9.22% from 2025-2033. The market share is expanding due to rising domestic and international tourism, increasing business travel, adoption of digital booking platforms, heightened popularity of short-term and subscription-based rentals, growing demand for electric and hybrid vehicles, government infrastructure investments, and affordability-driven consumer preferences, with technology-driven contactless services and corporate leasing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.05 Billion |

| Market Forecast in 2033 | USD 4.72 Billion |

| Market Growth Rate (2025-2033) | 9.22% |

Russia is an enormous country with a rich history, stunning landscapes, and cultural landmarks that attract millions of tourists each year. The flow of foreign tourists to Russia by the end of 2024 rose to 95 percent in comparison to its 2023 levels and will amount to approximately 2.5 million trips, as per the data by the Association of Tour Operators of Russia (ATOR). From the grand architecture of Moscow and St. Petersburg to the natural beauty of Lake Baikal and Kamchatka, both domestic and international travelers explore different regions. As a result, the Russia rental car market demand among tourists keeps rising. It gives them the flexibility to explore destinations at their own pace without relying on rigid train or bus schedules. Renting a car allows them to reach locations where public transportation is either scarce or nonexistent.

Moreover, domestic tourism has been rising due to geopolitical shifts and restrictions on international travel. In January-September 2024, Russia saw 65.5 million domestic tourist trips, an 11% increase from the year 2023. Siberia, southern Russia, and the North Caucasus were the most popular destinations. With many Russians now preferring to explore their own country, the demand for car rentals has surged. The government has also been promoting domestic tourism through initiatives like subsidized travel programs and infrastructure improvements. With ongoing government efforts to develop tourism and improve road infrastructure, this trend is expected to continue, making car rentals a preferred mode of travel for both domestic and international tourists.

Russia Car Rental Market Trends:

Growth in Business Travel and Corporate Leasing

Business travel plays a major role in the Russian car rental market growth. As one of the largest economies in the world, Russia has a significant number of corporate hubs, particularly in Moscow, St. Petersburg, and major industrial cities like Yekaterinburg and Novosibirsk. Large multinational companies, startups, and government organizations frequently require transport solutions for their employees, executives, and business partners. Corporate leasing has become an attractive option for businesses that need a fleet of vehicles but do not want to deal with ownership costs, maintenance, and depreciation. Instead of buying company cars, many firms prefer renting vehicles on long-term contracts. This not only reduces operational expenses but also allows companies to access the latest models with advanced safety and technology features.

Expansion of Digital Booking Platforms and Contactless Services

The rise of digitalization has transformed the car rental industry in Russia, making it easier than ever for customers to book a vehicle through mobile apps and websites. With the proliferation of smartphones and improved internet connectivity, consumers now prefer digital booking over traditional rental offices. For instance, during the first half of the year in 2024, smartphone sales in the Russian market increased by 24%, boosting its major use among the people of the country. This has increased the focus of car rental companies on integrating their services with mobile applications. As a result, major car rental companies have launched intuitive apps that enable customers to browse available vehicles, compare prices, book rentals, and make payments online. Some platforms even offer real-time tracking of vehicle availability, making the entire rental process smooth and hassle-free.

Increasing Demand for Short-Term and Subscription-Based Rental

The way people approach car ownership is changing. Instead of buying cars outright, many Russians, especially younger consumers, are opting for short-term rentals or subscription-based car services. This shift is fueled by various factors, such as rising vehicle costs, maintenance expenses, and the increasing demand for flexible mobility options. Subscription-based car rentals allow users to access a vehicle for a monthly fee without worrying about insurance, maintenance, or depreciation. Customers can switch between different car models depending on their needs, making this an attractive alternative to traditional car ownership. Short-term rentals, often spanning a few hours to a few days, have gained traction in urban areas where people need cars occasionally but do not want the burden of ownership. Ride-sharing and car-sharing services, such as Delimobil and Yandex.Drive, have further popularized this trend.

Russia Car Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia car rental market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on booking type, rental length, vehicle type, application, and end user.

Analysis by Booking Type:

- Offline Booking

- Online Booking

Traditional offline booking remains relevant in Russia, especially among older consumers, corporate clients, and travelers who prefer in-person assistance. Many customers visit physical rental offices at airports, railway stations, and city centers to book vehicles, often valuing personalized service, detailed contract explanations, and direct negotiations on rental terms. Offline bookings are also common for long-term rentals and corporate leasing, where companies establish direct agreements with rental providers. Despite the digital shift, offline booking remains preferred in regions with limited internet access and among customers who distrust online payment methods or require special vehicle requests that are easier to arrange face-to-face.

The rapid growth of digital platforms has made online booking a major segment in Russia’s car rental market, driven by convenience, competitive pricing, and contactless services. Customers use mobile apps and websites to compare vehicles, customize rental durations, and complete transactions within minutes. Online booking is especially popular among younger consumers and international travelers who seek seamless digital experiences, including GPS tracking, AI chat support, and mobile key access. The rise of aggregator platforms, car-sharing apps, and subscription-based services has further accelerated online bookings, making it the preferred choice for short-term rentals and urban mobility solutions.

Analysis by Rental Length:

- Short Term

- Long Term

As per the Russia car rental market outlook, short-term car rentals, typically ranging from a few hours to a few days, are a major part of the market in Russia, catering to tourists, business travelers, and individuals needing temporary transportation. This segment is fueled by urban mobility trends, increasing domestic travel, and the convenience of app-based booking platforms. Airport and railway station rentals see high demand, especially from international visitors, while city-based short-term rentals serve daily commuters and leisure travelers. The growing popularity of ride-sharing alternatives, weekend getaways, and flexible mobility solutions further strengthens this segment, with rental companies expanding their fleet of economy and mid-range vehicles to meet diverse customer needs.

Long-term rentals, typically spanning weeks to months, are widely used by corporate clients, expatriates, and individuals who need extended mobility without the financial burden of ownership. Businesses often lease fleets for employees to avoid maintenance and insurance costs, while professionals relocating for work prefer long-term rentals over purchasing vehicles. Subscription-based car rental models have gained traction, allowing users to access cars for an extended period with added benefits like maintenance, roadside assistance, and insurance included. The rising demand for flexible leasing solutions, particularly in major cities, is driving growth in this segment, making it an attractive alternative to car ownership.

Analysis by Vehicle Type:

- Luxury

- Executive

- Economy

- SUVs

- Others

Based on the Russia car rental market forecast, luxury car rentals cater to high-net-worth (HNW) individuals, corporate executives, and tourists seeking premium vehicles for comfort, prestige, and special occasions. This segment includes brands like Mercedes-Benz, BMW, Audi, and Porsche, often rented for VIP travel, weddings, and high-profile business events. Demand is strongest in major cities like Moscow and St. Petersburg, where affluent customers and business travelers prefer chauffeur-driven or self-drive luxury experiences. Companies also rent luxury cars for client hospitality and executive mobility, with increasing interest in electric luxury vehicles as sustainability becomes a key consideration among premium consumers.

Executive rentals serve business professionals, diplomats, and corporate clients needing high-end yet practical vehicles for business meetings, conferences, and official travel. This segment includes sedans and premium SUVs from brands like Volvo, Lexus, and Tesla, offering advanced safety features, comfort, and prestige without the extravagance of ultra-luxury models. Executive rentals are commonly used by multinational corporations, embassies, and government officials for official duties, with rental firms offering tailored services such as dedicated chauffeurs, airport pickups, and flexible long-term leasing options.

Economy rentals dominate the Russian car rental market, attracting budget-conscious travelers, daily commuters, and individuals seeking affordable mobility solutions. Compact and fuel-efficient models like Hyundai Solaris, Kia Rio, and Volkswagen Polo are widely available, offering cost-effective transportation for short-term and long-term use. This segment is popular among tourists exploring urban and rural areas, students, and businesses needing fleet rentals for employees. The rise of car-sharing services and app-based rentals has further boosted demand, making economy rentals the most accessible and widely used category in Russia.

SUV rentals are in high demand across Russia, driven by the country’s harsh winters, rugged terrains, and growing preference for spacious and durable vehicles. Mid-size and full-size SUVs from brands like Toyota, Nissan, and Mitsubishi are popular for both urban and off-road travel, catering to adventure seekers, families, and business travelers requiring all-weather reliability. The segment also appeals to tourists exploring remote destinations like Siberia and the Caucasus, where road conditions necessitate robust vehicles. Corporate clients and government agencies frequently rent SUVs for field operations, diplomatic visits, and security services, making this a key growth area in the market.

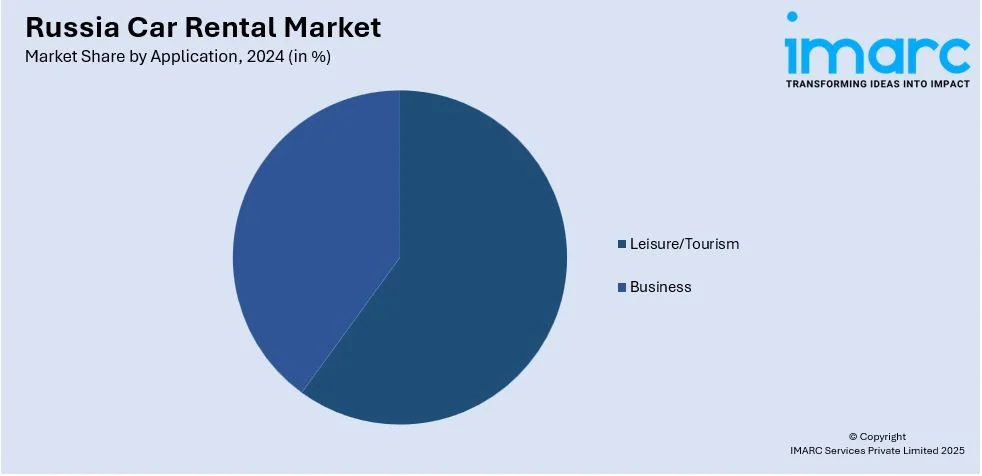

Analysis by Application:

- Leisure/Tourism

- Business

As per the Russia car rental market trends, the leisure and tourism segment is a major driver of the market, fueled by domestic and international travelers exploring cities, historical landmarks, and natural attractions. Tourists prefer rental cars for flexibility and convenience, especially when visiting remote destinations with limited public transport. Popular routes see high rental demand, with economy and SUV models being the most common choices. The rise of self-drive vacations and road trips has further boosted this segment, with digital platforms making it easier for travelers to book rentals in advance. Seasonal peaks, particularly during summer and winter holiday periods, drive fluctuating demand, prompting rental companies to expand their fleets and offer customized travel packages.

Business rentals cater to corporate clients, professionals, and expatriates requiring reliable transportation for work-related travel, corporate meetings, and executive mobility. This segment includes short-term rentals for visiting executives, long-term leases for companies needing fleet solutions, and luxury rentals for high-profile business events. Corporate customers often opt for premium sedans, executive SUVs, and chauffeur-driven services to ensure comfort and efficiency. Business rentals are concentrated in economic hubs where multinational firms, government institutions, and startups require flexible mobility solutions. The growing preference for subscription-based leasing models, which include maintenance and insurance, has further strengthened demand in this segment, making it a vital component of the Russian car rental market.

Analysis by End User:

- Self-Driven

- Chauffeur-Driven

Most of the Russian car rental market share is composed of self-driving rentals. This is a very popular option for tourists, businesspeople, or residents who do not want to rely on public transport, as they prefer to be independent in this respect. Rentals can be short-term or long-term and involve any type of vehicle, from economy cars to more powerful SUVs for longer trips and rough terrain. The combination of developing app-based bookings with increasingly popular contactless access to the vehicle makes these car rentals faster, easier, and fully contactless, allowing customers to pick up and return vehicles without any human interaction. Road trips, domestic tourism, and urban mobility drive demand in this segment, especially by young professionals and tech-savvy travelers who prefer renting to owning a car. Many expatriates and employees who are relocated to another country for work have also started opting for self-drive long-term rentals, viewing it as a more economical and less strenuous alternative to buying a vehicle.

Chauffeur-driven rentals cater to corporate executives, diplomats, tourists seeking premium experiences, and individuals requiring high-end transport for special occasions. This segment is particularly strong where business travelers, government officials, and luxury consumers prefer professional drivers for convenience and status. High-end sedans, SUVs, and luxury cars like Mercedes-Benz, BMW, and Lexus dominate this category, often booked for airport transfers, VIP meetings, and corporate events. Additionally, international tourists who are unfamiliar with local driving regulations or prefer a guided experience opt for chauffeur-driven services, further boosting demand. As business and luxury tourism expand, this segment continues to grow, with rental firms offering customizable packages, bilingual drivers, and premium concierge services.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, home to Moscow and surrounding regions, is the most lucrative car rental market in Russia, driven by high business activity, tourism, and urban mobility needs. Moscow, as the political, financial, and corporate hub, sees strong demand for both self-driven and chauffeur-driven rentals, especially from business travelers, diplomats, and international tourists. Luxury and executive rentals are particularly popular among corporate clients, while economy and SUV rentals cater to domestic travelers exploring nearby attractions like the Golden Ring. The district’s extensive road network and high population density sustain rental demand year-round, with seasonal peaks during business conferences and major events.

The Volga District, an industrial and economic hub, has a growing car rental market driven by corporate leasing, domestic tourism, and government fleet requirements. Business travelers in the automotive, oil, and manufacturing industries frequently rent vehicles for corporate mobility, while tourists visiting cultural and historical landmarks, contribute to leisure rental demand. The region’s improving road infrastructure and economic development initiatives are further expanding the market, with economy and mid-range sedans being the most sought-after rental choices.

The Urals District serves as a major industrial and logistical center, driving demand for both short-term and long-term rentals. Business rentals are prominent in this region due to its strong mining, metallurgy, and energy industries, with companies leasing executive sedans and SUVs for corporate use. Additionally, self-drive rentals are popular among professionals and residents traveling between cities for work. While tourism is not as significant as in other districts, adventure travelers exploring the Ural Mountains and natural reserves contribute to the demand for SUVs and off-road vehicles.

The Northwestern District has a thriving car rental market supported by international tourism, government activities, and cross-border travel. St. Petersburg, Russia’s cultural capital, attracts millions of tourists annually, driving strong demand for short-term self-driven rentals, particularly economy cars and SUVs. Additionally, luxury and chauffeur-driven rentals are widely used for business travel, diplomatic transport, and high-end tourism. The region’s proximity to Finland and the Baltics also fuels cross-border rentals, with many international visitors renting vehicles for road trips. Seasonal fluctuations are significant, with peak rental activity occurring during summer months when tourism surges.

The Siberian District sees steady car rental demand primarily from domestic tourists, corporate clients, and government agencies. Adventure tourism plays a key role, with travelers renting SUVs for road trips to Lake Baikal, Altai Mountains, and remote Siberian destinations. Business rentals are driven by oil, gas, and mining industries, where companies lease rugged vehicles for field operations. Harsh winter conditions increase demand for all-wheel-drive SUVs and high-clearance vehicles, making this segment particularly resilient. Despite lower rental density compared to European Russia, the region’s economic growth and infrastructure development are gradually expanding the market.

Competitive Landscape:

Undergoing the changes in consumer requirements and market variables, the leading players in the market are aggressively broadening their services. With the increase in demand for alternative mobility solutions, businesses focus more on offering flexible rental windows, both short-term rental and long-term lease options. They have further invested in fleet expansions, more aligned to sustainable global trends, including adopting electric vehicles (EVs), hybrid cars, etc. Priority attention is being channeled to digital transformation in the car rental space, enhancing the mobile apps and websites of car rental platforms to provide seamless booking and contactless services. They are also considering out-licensing for partners of ride-sharing and other providers of mobility to penetrate the market of shared mobility. Filling in the network are the regional players while international companies are tiptoeing into the do's and don'ts of Russian operations, especially with present geopolitical tensions.

The report provides a comprehensive analysis of the competitive landscape in the Russia car rental market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, RentMotors, a prominent car rental service operating across Russia and the CIS, has expanded its presence with new rental locations, including in Moscow. The company offers a diverse fleet, ranging from economy cars to premium vehicles, and provides flexible rental terms, including options for international travel.

- In February 2024, Delimobil, one of Russia's leading carsharing companies, held an Initial Public Offering (IPO) on the Moscow Exchange, raising 4.2 billion rubles and becoming the country's first publicly traded carsharing operator. The company boasts a fleet exceeding 18,000 vehicles and serves over 7.1 million members across multiple cities, including Moscow, Saint Petersburg, and Nizhny Novgorod.

- In January 2024, RexRent, formerly operating under the Avis/Budget brand, expanded its fleet by 14%, reaching 1,648 vehicles. The company planned to introduce Chinese-made hybrid cars into its rental lineup in 2024, reflecting a commitment to sustainable transportation options. RexRent offers subscription services, short-term rentals, and operating leases across 20 Russian cities.

Russia Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia car rental market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia car rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia car rental market in the region was valued at USD 2.05 Billion in 2024.

The growth of the Russia car rental market is driven by factors such as increased demand for flexible mobility solutions, rising tourism, a shift towards short-term rentals, the expansion of eco-friendly vehicle options, digital transformation for seamless booking, and the growing popularity of shared mobility services like ride-sharing.

The Russia car rental market is projected to exhibit a CAGR of 9.22% during 2025-2033, reaching a value of USD 4.72 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)