Russia Business Travel Market Size, Share, Trends and Forecast by Type, Purpose Type, Expenditure, Age Group, Travel Type, End User, and Region, 2025-2033

Russia Business Travel Market Size and Share:

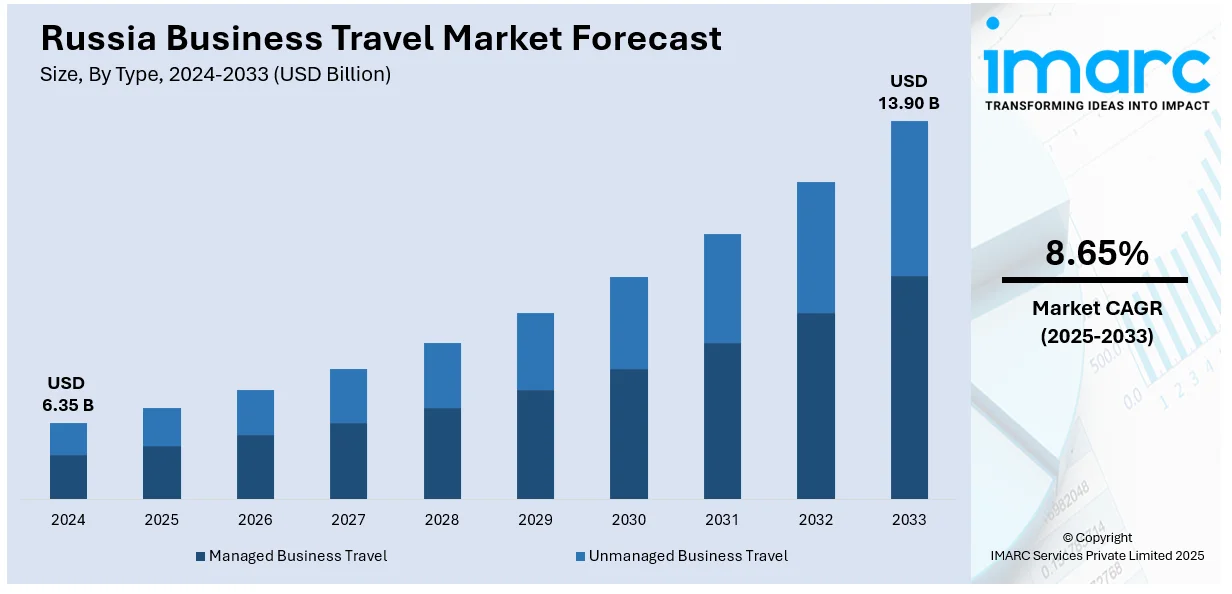

The Russia business travel market size was valued at USD 6.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.90 Billion by 2033, exhibiting a CAGR of 8.65% from 2025-2033. The market is growing due to expanding trade relations with Asia, rising domestic business activities, and infrastructure development. Besides this, the Russia business travel market share is driven by flourishing domestic industries and improved transportation infrastructure, including high-speed rail and airports.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.35 Billion |

| Market Forecast in 2033 | USD 13.90 Billion |

| Market Growth Rate (2025-2033) | 8.65% |

Expansion of trade relations with Asia is driving the market by the increasing cross-border corporate mobility. Strengthening economic ties with China, India, and Southeast Asia is increasing business travel for negotiations and agreements. Russian companies are sending executives to Asian markets for trade discussions, partnerships, and investment opportunities. Asian businesses are expanding operations in Russia, leading to frequent travel for site visits and regulatory meetings. Trade fairs, industry expos, and business summits between Russia and Asia are attracting corporate travelers from both regions. Logistics and transportation agreements are increasing travel demand for supply chain coordination and operational planning. Energy exports to Asian markets are requiring frequent executive travel for contract discussions and project management.

Rising domestic business activities are supporting the market growth by increasing corporate mobility across regions. Expanding industries like energy, manufacturing, and technology are generating frequent business trips for operations and management. Companies are sending employees to different cities for client meetings, site inspections, and corporate expansions. Infrastructure development projects are requiring executives and engineers to travel for planning, supervision, and regulatory approvals. Trade fairs, business expos, and corporate events across Russian cities are driving the demand for domestic business travel. Growing startups and small and medium enterprises (SMEs) are expanding operations, increasing travel for networking, partnerships, and market exploration. Large enterprises are organizing internal meetings, training programs, and leadership summits, driving intercity corporate travel. Financial institutions and consulting firms require employees to travel for investment meetings, audits, and strategic discussions. The development of high-speed rail and air connectivity is enhancing accessibility for business travelers across regions.

Russia Business Travel Market Trends:

Investment in infrastructure development

The government is modernizing airports, expanding rail networks, and upgrading highways for seamless business travel. For instance, in January 2025, Russian authorities announced their plan to develop country’s first fully functional biometric terminal at Sochi International Airport. Developed in partnership with Aerodinamika Holding and Mile on Air, the project aims to automate all pre-flight procedures using biometric technology. This initiative supports Russia’s "Green Digital Passenger Corridor" strategy, which aims to integrate biometrics into major transport hubs by 2030. Moreover, better transportation facilities are reducing travel time, making domestic and international business trips more convenient. Enhanced airport capacities are accommodating higher passenger volumes, facilitating smoother corporate travel experiences. New business districts and commercial centers are attracting enterprises, catalyzing demand for business-related travel. Improved hotel infrastructure is ensuring quality accommodation, catering to business travelers’ comfort and productivity needs. Expansion of conference venues is encouraging international exhibitions, summits, and corporate events across major Russian cities. Upgraded digital infrastructure is supporting remote work while maintaining the necessity for in-person business meetings. Investments in smart cities and innovation hubs are fostering collaborations, increasing travel between technology and business centers. Strengthened connectivity with Asian and European markets is enhancing cross-border corporate engagements and trade missions.

Government initiatives

Policies promoting foreign investments and business-friendly regulations are increasing corporate engagements and travel demand. The government is actively strengthening diplomatic ties, encouraging international trade missions and cross-border collaborations. Visa-free travel agreements with several countries are simplifying entry, improving business travel for foreign professionals. Relaxed visa policies are attracting investors, facilitating easier market entry, and increasing corporate mobility within Russia. In December 2024, Russia announced its plan to introduce visa-free travel for Indian tourists by spring 2025 to strengthen tourism and business relations. This initiative builds on successful visa-free agreements with China and Iran. Currently, Indian travelers use Russia’s Unified E-Visa system for streamlined single-entry visits. The proposed arrangement will simplify travel further, removing visa applications and improving cultural and economic exchanges. Additionally, special economic zones with tax incentives are encouraging companies to expand, leading to more intercity business trips. Massive infrastructure projects are enhancing transportation networks, ensuring smoother and faster business travel across regions. Investments in digital transformation and smart city development are driving corporate travel for technological advancements. Support for international summits, exhibitions, and trade fairs is increasing demand for event-based business travel. Stronger trade relations with Asia and Middle Eastern countries are increasing business travel for negotiations.

Growth of energy and natural resources sector

Expanding oil, gas, and mining industries are creating more business trips for site visits and operations. As per an industry report, Deputy Prime Minister Alexander Novak estimated oil production to reach 505-515 million tons in 2024, at SPIEF. Moreover, frequent travel is necessary for executives, engineers, and consultants to oversee projects and ensure efficiency. Russia’s global energy partnerships require frequent meetings, fostering international business travel for negotiations and agreements. The escalating demand for Russian oil and gas is increasing trade missions and cross-border business engagements. Investments in renewable energy projects are driving travel for research, collaboration, and infrastructure development. New exploration projects in remote regions are increasing business travel for logistical planning and workforce management. Expansion of pipeline and refinery infrastructure is requiring travel for inspections, regulatory approvals, and technological advancements. Conferences, summits, and energy expos are attracting international companies, leading to higher corporate travel demand. Foreign investors in Russia’s energy sector are traveling for discussions, partnerships, and regulatory compliance procedures. Strengthened trade relations with China, India, and Europe are supporting frequent executive visits and corporate trips.

Russia Business Travel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia business travel market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, purpose type, expenditure, age group, travel type, and end user.

Analysis by Type:

- Managed Business Travel

- Unmanaged Business Travel

This segment includes corporate travel managed by specialized agencies or in-house travel departments. Companies use travel management firms to streamline bookings, track expenses, and ensure compliance with corporate policies. It offers benefits like cost control, negotiated airline and hotel rates, and enhanced security measures. Large enterprises prefer managed travel to optimize efficiency and minimize disruptions during business trips. Technology integration, such as automated booking platforms and expense tracking, enhances convenience for corporate travelers.

This segment involves business trips planned and booked independently by employees or small business owners. It is common among startups, freelancers, and companies with flexible travel policies, allowing greater autonomy in travel choices. Travelers book flights, accommodations, and transportation based on personal preferences without corporate intervention. While offering flexibility, unmanaged travel may lead to higher costs due to a lack of negotiated rates. Small and medium-sized enterprises (SMEs) often opt for unmanaged travel due to budget constraints and fewer policy restrictions.

Analysis by Purpose Type:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

Business travel for marketing involves promotional activities, client meetings, and brand representation in different regions. Companies send marketing teams to explore new markets, build relationships, and secure business deals. Traveling for product demonstrations, sales pitches, and networking events helps generate leads and drive revenue growth. Face-to-face interactions enhance trust and negotiation outcomes, making travel essential for marketing success. Industries like pharmaceuticals, technology, and automotive rely on travel for direct customer engagement and market expansion.

Organizations require business travel for internal meetings involving cross-border teams, strategy discussions, and corporate planning. Remote work solutions help, but in-person meetings remain crucial for collaboration, decision-making, and leadership alignment. Large corporations with multiple offices schedule intercity and international meetings to ensure operational consistency. Employee training programs, workshops, and executive retreats also contribute to this segment’s growth. Business travel for internal meetings enhances teamwork, problem-solving, and corporate culture, supporting organizational efficiency.

Trade shows drive business travel by providing companies with opportunities to showcase products and services. Businesses travel to participate in exhibitions, engage with industry professionals, and explore partnerships. These events attract global investors, suppliers, and customers, leading to networking and business expansion. Trade shows enable businesses to gain industry insights, assess competitors, and generate sales leads. Sectors like technology, healthcare, and manufacturing heavily rely on trade shows for visibility and growth.

Companies organize business travel for product launches to introduce new offerings in different markets. Executives, sales teams, and marketing professionals travel to host launch events and media briefings. Travel enables companies to engage directly with customers, distributors, and industry influencers for maximum impact. Live product demonstrations, press conferences, and promotional campaigns benefit from in-person engagement. Industries like consumer electronics, automotive, and fashion frequently invest in travel for global product launches.

Analysis by Expenditure:

- Travel Fare

- Lodging

- Dining

- Others

Travel fare is a major expenditure in business travel, covering flight, train, and local transportation costs. Companies invest in airline tickets, rental cars, and ride-sharing services to facilitate employee mobility. Travel costs vary based on destination, class preference, and corporate travel policies. Business travelers often require last-minute bookings, increasing airfare expenses compared to leisure travel. Organizations negotiate corporate discounts with airlines and transport providers to optimize costs.

Business travelers require accommodations in hotels, serviced apartments, or corporate housing during work trips. Lodging expenses depend on location, duration of stay, and hotel category chosen by businesses. Companies often prefer hotels with professional facilities like discussion rooms, high-speed internet, and workspaces. Large enterprises negotiate long-term agreements with hotel chains to manage lodging costs efficiently. Extended business trips, conferences, and international assignments contribute to high lodging expenditures.

Business travel includes expenses for meals, client dinners, and networking lunches during work trips. Companies provide meal allowances or reimbursements for employees traveling on corporate assignments. Dining expenses vary depending on destination, meal preferences, and corporate budgets for entertainment. Business travelers often dine at high-end restaurants for client meetings and professional engagements. Industries like finance, consulting, and technology frequently allocate significant budgets for business dining.

Analysis by Age Group:

- Travelers Below 40 Years

- Travelers Above 40 Years

Younger business travelers form a significant portion of the corporate travel market, driven by career growth. Professionals in this age group actively participate in client meetings, conferences, and training programs. They are more adaptable to digital travel solutions, preferring mobile apps and automated booking systems. Many startups and multinational corporations send younger employees on work trips to explore new markets. This group often seeks cost-effective travel options, balancing company budgets with convenience.

Senior professionals, executives, and business leaders frequently travel for high-level meetings and strategic decision-making. This group prefers premium travel services including business-class flights and luxury accommodations for comfort and efficiency. Experienced professionals often undertake international travel for mergers, acquisitions, and global business expansions. They require well-structured itineraries, corporate concierge services, and seamless travel experiences to maximize productivity. Industries like finance, consulting, and manufacturing heavily rely on senior executives for global networking.

Analysis by Travel Type:

- Group Travel

- Solo Travel

Business group travel includes corporate teams attending conferences, trade shows, and training programs together. Companies organize group travel for team-building activities, corporate retreats, and large-scale business meetings. Group bookings for flights and hotels often result in cost savings and streamlined travel logistics. Industries like pharmaceuticals, technology, and consulting frequently send teams for international collaborations and project discussions. Coordinated travel enhances networking, knowledge sharing, and business development opportunities.

Solo business travel is common among executives, sales representatives, and consultants handling individual business assignments. Professionals travel alone for client meetings, negotiations, and market research in different cities or countries. Solo travelers require personalized travel arrangements, such as flexible flight schedules and convenient lodging options. Industries like finance, law, and healthcare often involve frequent solo business travel for specialized work engagements. Mobile apps and digital travel tools help solo travelers manage bookings, expenses, and itineraries efficiently.

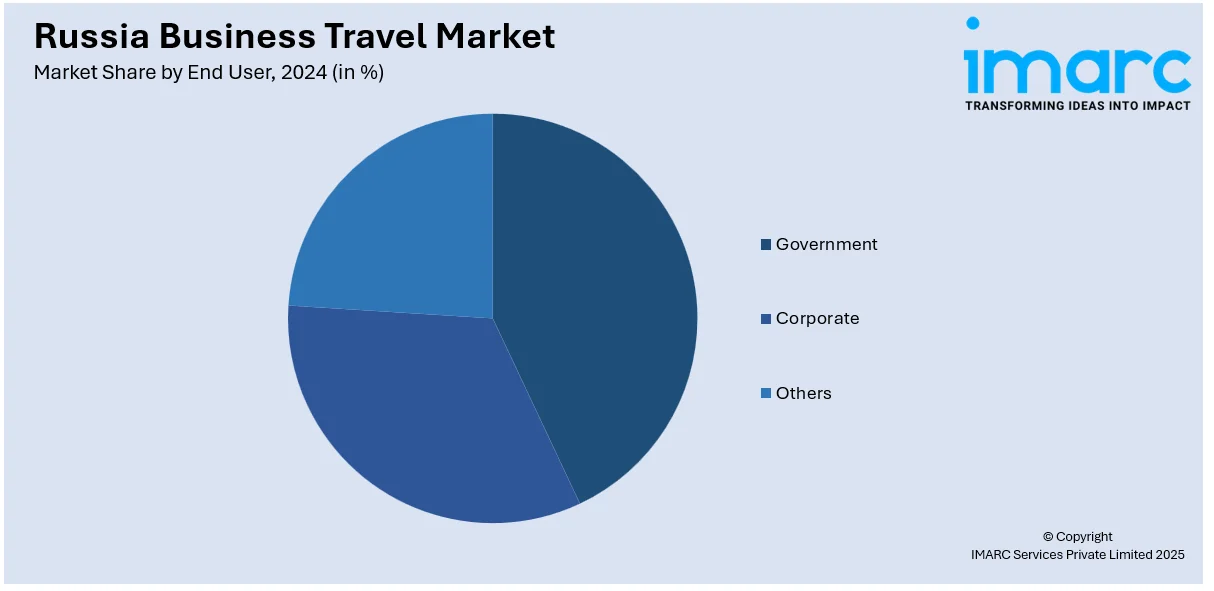

Analysis by End User:

- Government

- Corporate

- Others

Government officials and representatives frequently travel for diplomatic meetings, trade negotiations, and international collaborations. Public sector employees undertake business travel for policy discussions, regulatory meetings, and infrastructure development projects. Governments allocate budgets for official travel, ensuring seamless mobility for administrative and diplomatic functions. Defense, foreign affairs, and economic departments often require extensive international travel for bilateral agreements and summits. Government travel involves high security, protocol-based accommodations, and strategic planning for efficiency.

Corporations form the largest segment in the business travel market, with employees traveling for work-related activities. Companies invest in corporate travel for client meetings, trade shows, product launches, and employee training programs. Large enterprises negotiate travel deals with airlines, hotels, and transport providers to optimize costs. Multinational corporations require frequent international travel for market expansion, business development, and strategic partnerships. Digital solutions including travel management software, help corporations streamline travel planning and expense tracking.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District including Moscow, is Russia’s primary business hub, attracting corporate and government travel. Moscow hosts international headquarters, financial institutions, and major conferences, increasing business travel demand. The region’s strong infrastructure like airports and high-speed rail, supports seamless corporate mobility. Frequent diplomatic meetings, trade agreements, and investor summits drive travel in this district. Companies across industries including finance, technology, and manufacturing, conduct business operations in Moscow.

The Volga District is an industrial and economic hub, with strong automotive, energy, and manufacturing sectors. Business travel in this region is driven by trade fairs, corporate expansions, and industrial site visits. Cities like Nizhny Novgorod and Samara attract investors and professionals for business operations. The district’s growing technology and research sectors contribute to frequent business-related mobility. Transportation improvements, including rail connectivity and airport expansions, facilitate smooth corporate travel.

The Urals District, known for its mining, metallurgy, and energy industries, generates significant business travel. Major cities like Yekaterinburg serve as economic centers, attracting executives, engineers, and industry specialists. Business travelers frequently visit the region for project management, supply chain operations, and investment discussions. The district’s expanding role in logistics and exports increases cross-border business travel. Conferences and trade exhibitions in mining, energy, and manufacturing drive corporate travel demand.

The Northwestern District including St. Petersburg, is a key commercial and trade center in Russia. St. Petersburg hosts international conferences, diplomatic meetings, and corporate summits, driving business travel growth. The region’s proximity to European markets increases cross-border corporate travel and trade engagements. Logistics, shipping, and financial services contribute to strong business mobility in this district. Travel infrastructure including airports and seaports, supports seamless international business travel.

The Siberian District is a resource-rich region, with strong energy, mining, and industrial activities. Business travelers visit this district for site inspections, resource extraction projects, and corporate negotiations. Growing infrastructure developments in cities like Novosibirsk and Krasnoyarsk are increasing business-related mobility. Harsh climate conditions often necessitate specialized travel arrangements for industry professionals. Expansion in logistics, trade, and investment is further driving business travel demand.

Competitive Landscape:

Key players are providing essential services and infrastructure support. Airlines are expanding flight routes, ensuring better connectivity for corporate travelers across domestic and international destinations. Hotel chains are enhancing business facilities, offering premium accommodations, conference rooms, and corporate event spaces. Government agencies are implementing policies to attract investors, simplify visa processes, and promote business tourism. Travel management companies are streamlining corporate travel by offering booking solutions, expense management, and itinerary planning. Business event organizers are hosting international trade fairs, conferences, and exhibitions, increasing business-related travel demand. Railway operators are modernizing high-speed train services, ensuring faster intercity business travel across key economic hubs. For instance, in March 2024, Russia announced two major infrastructure projects: the 7th power unit at Leningrad Nuclear Power Plant (NPP) and a high-speed railway between Moscow and St. Petersburg. The NPP unit, set for 2030. It will enhance regional power supply. The railway, crossing six regions, will cut travel time to 2 hours 15 minutes. Additionally, financial institutions are facilitating business transactions, supporting corporate expansions, and increasing travel for investment opportunities. Oil and gas companies are driving industry-related travel, requiring frequent site visits, negotiations, and workforce mobility. Technology firms are improving digital infrastructure, supporting hybrid work while maintaining the need for corporate travel.

The report provides a comprehensive analysis of the competitive landscape in the Russia business travel market with detailed profiles of all major companies.

Latest News and Developments:

- December 2024: Air Arabia Abu Dhabi introduced a non-stop flight between Koltsovo International Airport in Yekaterinburg, Russia and Zayed International Airport in Abu Dhabi. Operating twice weekly, this new route strengthens the airline’s presence in the Russian market.

- September 2024: China Eastern Airlines launched direct flights between Shanghai and Kazan, Russia, starting September 28, 2024. Operating on Tuesdays, Thursdays, and Saturdays, the new route shortens travel time from over 15 hours to approximately 9.5 hours.

- September 2024: Russian authorities announced their plan to launch direct flights between Saint Petersburg and Sukhumi-Babushara Airport in Abkhazia, Georgia, as the airport undergoes restoration.

- June 2024: The Moscow City Tourism Committee introduced a training program focused on the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector to improve business travel from India, aiming to establish Moscow as a leading destination for Indian business travelers.

- June 2024: Russia is considering charter flights to Senegal for addressing high ticket prices and the lack of direct routes for tourists. Inspired by past successful routes to Gambia, officials see charters as a way to improve travel accessibility.

Russia Business Travel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Managed Business Travel, Unmanaged Business Travel |

| Purpose Types Covered | Marketing, Internal Meetings, Trade Shows, Product Launch, Others |

| Expenditures Covered | Travel Fare, Lodging, Dining, Others |

| Age Groups Covered | Travelers Below 40 Years, Travelers Above 40 Years |

| Travel Types Covered | Group Travel, Solo Travel |

| End Users Covered | Government, Corporate, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, Russia business travel market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia business travel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia business travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The business travel market in the Russia was valued at USD 6.35 Billion in 2024.

The Russia business travel market growth is driven by expanding industrial activities, government initiatives, and infrastructure investments. The energy and natural resources sector are driving corporate travel for site visits and trade negotiations. Government policies, including visa-free travel agreements, are attracting international business travelers. Improved transportation infrastructure, including airports and high-speed rail, is enhancing connectivity. Increasing trade relations with China, Europe, and Asia are supporting corporate mobility.

The Russia business travel market is projected to exhibit a CAGR of 8.65% during 2025-2033, reaching a value of USD 13.90 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)