Russia Beer Market Size, Share, Trends and Forecast by Product Type, Packaging, Production, Category, Distribution Channel, Region, 2025-2033

Russia Beer Market Size and Share:

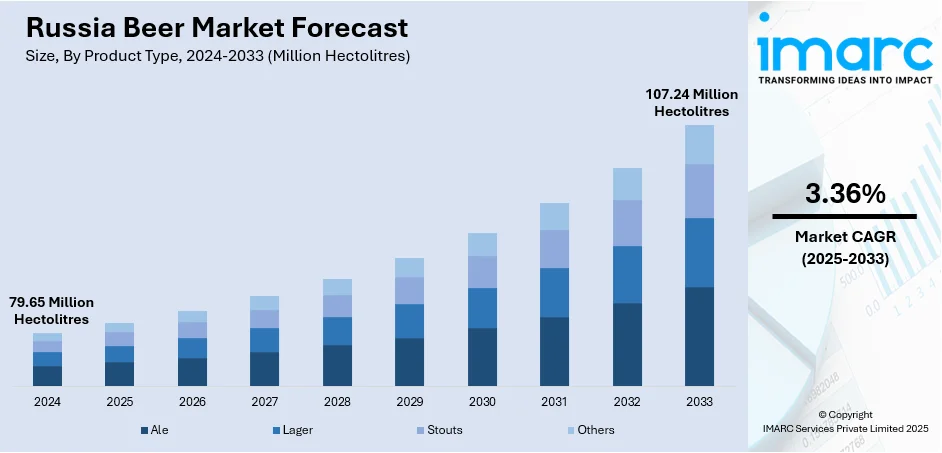

The Russia beer market size has reached a volume of 79.65 Million Hectolitres in 2024. Looking forward, IMARC Group estimates the market to reach a volume of 107.24 Million Hectolitres by 2033, exhibiting a CAGR of 3.36% from 2025-2033. The market is driven by rising demand for local craft beers, supported by favorable government policies that encourage domestic production. Consumers are increasingly shifting toward non-alcoholic and low-alcohol beer options due to health awareness. Additionally, the growth of e-commerce platforms has expanded access to a wider variety of beer products, enhancing consumer convenience. Regional beer festivals and cultural events also boost interest in unique, locally brewed options, contributing to the Russia beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 79.65 Million Hectolitres |

| Market Forecast in 2033 | 107.24 Million Hectolitres |

| Market Growth Rate (2025-2033) | 3.36% |

One of the dominant drivers of the Russian beer market is the growing consumer taste for premium and craft beer brands. With rising incomes and urban consumers becoming increasingly discerning, consumers have a growing appetite for quality, flavorful beer versus commodity brands. Craft breweries are opening up all over the country, with emerging unique tastes and locally brewed styles that attract younger, more experimental consumers. This is also supported by an increasing global trend towards artisanal and small-batch offerings. Russian consumers become increasingly brand-conscious and are prepared to pay a premium for authenticity and quality, with their increased expenditure driving the value of the overall beer market even as per capita alcohol consumption declines.

To get more information on this market, Request Sample

Health consciousness is another major factor shaping Russia’s beer market, boosting the demand for non-alcoholic and low-alcohol beers. A growing portion of the population, especially among younger consumers, is reducing alcohol intake due to health, fitness, and lifestyle reasons. In response, breweries have expanded their portfolios to include flavorful non-alcoholic options that replicate the traditional beer experience. Government campaigns promoting responsible drinking and stricter alcohol advertising laws have further encouraged this shift. Additionally, innovations in brewing skill have improved the taste and quality of non-alcoholic beers, making them more appealing. This trend aligns with global movements toward wellness and moderation, contributing significantly to both volume and value Russia beer market growth.

Russia Beer Market Trends:

Increasing demand for Local Craft Beers

In Russia, the interest in craft beers has been one of the strongest Russia beer market trends. Russian customers increasingly tend towards individualized and craft products, with the result that small-scale breweries have spread all over Russia. Craft beers, with their unique taste and in most cases in batches produced locally, target a niche product segment paying more attention to quality than quantity. This is driven by the popularity of locally made ingredients and the appeal of supporting local business. This change in consumer preference is one of taste, but also one of experience, as many breweries provide tours and tasting to increase consumer involvement. By the year 2020, the Russian retail sales of craft beer were 10% of the total, which underscored its increasing significance in the overall beer market, according to Flanders Investment and Trade. Emphasis on authenticity and tradition, along with the popularity of beer festivals and craft beer events, has also deepened craft beers as a pivotal driver in Russia's beer market.

Government Regulations Favoring Domestic Production

Governmental policies and regulations in Russia increasingly support the local production of beer, an important driver in the market. To counter economic sanctions and to stimulate the domestic economy, the government of Russia has introduced a number of measures supporting local manufacturers in the form of advantageous taxation and subsidies. For example, in 2023, a new excise tax regime was introduced by the government which drastically cut down the tax liability of small and medium-sized breweries, enabling them to invest in production and impelling the Russia beer market outlook. The government also curtailed imports of foreign beers, thereby making local brands more competitive. The emphasis on encouraging local production is in accordance with overall economic objectives and has seen a more dynamic and autonomous beer market in Russia. These regulatory reforms are set to continue promoting growth in the industry, with additional local breweries arising and increasing their spread around the nation.

Shifting Consumer Preferences Toward Non-Alcoholic Beers

Another major driver of the Russian beer market is the changing preference for non-alcoholic beers among consumers. This is mainly fueled by health-oriented consumers that are looking for something other than the classical alcohol-containing beverages. Non-alcoholic beer provides the same taste and feeling of beer with no link to the resultant health risks, hence an appealing beverage for a large number of consumers. According to Flanders Investment and Trade, the Russian non-alcoholic beer market has experienced remarkable growth, with sales in 2020 growing by 14% alone. This growth is fueled by increased awareness regarding health and wellness, as well as government campaigns encouraging moderation in drinking. Most of the Russian beer manufacturers have reacted to this demand by diversifying their product lines with non-alcoholic versions, which currently occupy about 15% of the overall beer market in Russia. The variety of more flavors and the health-conscious image of non-alcoholic beer as a healthy alternative have helped fuel its popularity.

Russia Beer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia beer market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product type, packaging, production, category, and distribution channel.

Analysis by Product Type:

- Ale

- Lager

- Stouts

- Others

Lager holds the majority share at 63.2% in the Russian beer market, driven by its smooth taste, affordability, and widespread consumer acceptance. As a light, easy-to-drink beer, lager appeals to a broad demographic, including casual and frequent drinkers. Its versatility makes it suitable for various occasions, from everyday consumption to social gatherings. Large-scale breweries primarily focus on lager production due to its high demand and efficient brewing process, ensuring consistent supply across the country. The style’s familiarity and long-standing presence in Russian culture further solidify its popularity. Retailers and bars also promote lager heavily, offering a wide range of local and international brands. These factors collectively reinforce lager’s dominant position in Russia’s diverse beer landscape.

Analysis by Packaging:

- Bottle

- Metal Can

- Others

Based on the Russia beer market forecast, the bottled beer accounts for the majority share at 58.5% in the Russian beer market due to its strong consumer preference, traditional appeal, and wide availability. Bottles are perceived as offering better quality and taste preservation compared to cans or kegs. They are also considered more suitable for social and home consumption, especially in gatherings or meals. The packaging is seen as more premium and environmentally friendly, enhancing its popularity. Major breweries prioritize bottled beer in their product lines, supported by efficient bottling infrastructure and logistics. Retail channels, especially supermarkets and convenience stores, are well-equipped to stock and display bottled products. This accessibility, combined with cultural familiarity, sustains bottled beer’s dominance in both urban and rural regions across Russia.

Analysis by Production:

- Macro-Brewery

- Micro-Brewery

- Others

Macro-breweries represent the majority share of the Russian beer market due to their large-scale production capabilities, extensive distribution networks, and strong brand recognition. These breweries can produce beer in high volumes at lower costs, allowing them to offer competitive prices that appeal to mass-market consumers. Their established presence across the country ensures widespread availability in supermarkets, convenience stores, and local outlets. Macro-breweries also invest heavily in advertising and promotional campaigns, reinforcing brand loyalty and consumer trust. Additionally, they often produce a wide range of beer types—from standard lagers to low-alcohol and flavored variants—catering to diverse consumer preferences. Their ability to meet consistent quality standards and maintain stable supply chains further secures their dominant position in Russia’s beer industry.

Analysis by Category:

- Standard

- Premium

Standard beer holds the majority market share at 70.8% in Russia, driven by its affordability, widespread availability, and strong consumer preference for familiar, traditional tastes. This segment appeals to a broad demographic, particularly price-sensitive and middle-income consumers who prioritize value over novelty. Major domestic breweries produce a wide range of standard beers, ensuring consistent quality and competitive pricing. Standard beers are deeply embedded in Russian drinking culture and are often purchased for regular consumption rather than special occasions. Distribution through supermarkets, convenience stores, and local outlets further supports high sales volume. While premium and craft segments are growing, standard beer remains dominant due to its established presence, trusted brands, and alignment with everyday social and cultural drinking habits.

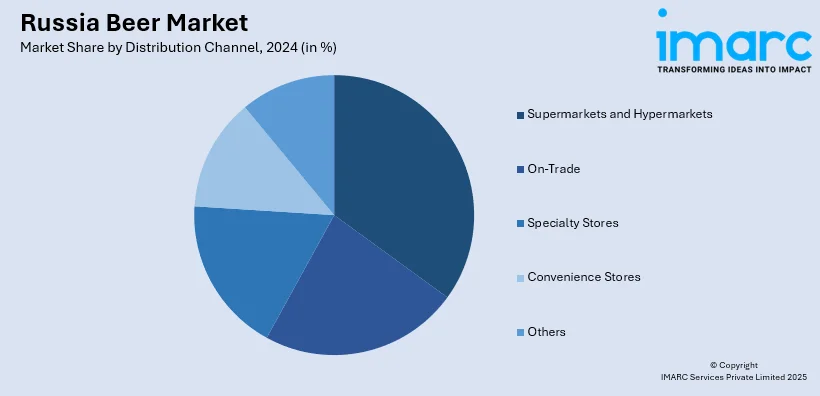

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trade

- Specialty Stores

- Convenience Stores

- Others

Supermarkets and hypermarkets dominate the Russian beer market with a 43.2% share due to their wide accessibility, extensive product variety, and competitive pricing. These retail channels offer consumers convenience and the ability to compare multiple brands and beer types in one location. Their strong presence in urban and semi-urban areas makes them the go-to option for everyday beer purchases. Additionally, supermarkets frequently run promotions and discounts, which appeal to price-sensitive customers. The modern retail format also allows better display and marketing of premium and craft beers, encouraging trial and repeat purchases. Efficient supply chains and partnerships with both domestic and international brewers ensure consistent product availability, reinforcing supermarkets’ dominant role in shaping consumer buying habits in the Russian beer market.

Breakup by Region:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The Central District, including Moscow, leads the Russian beer market due to its high population density, urbanization, and strong retail infrastructure. The region shows a high preference for premium and craft beers, supported by affluent consumers and a thriving nightlife, making it a key hub for beer consumption and distribution.

Additionally, the Volga District has a strong brewing tradition and is home to several major beer producers. With a mix of urban and rural populations, it shows steady demand for mid-range and economy beer brands. Regional loyalty and local production help drive consistent sales, especially in cities like Nizhny Novgorod and Samara.

Moreover, the Urals District benefits from a robust industrial base and a growing urban population, contributing to moderate beer consumption. Demand is driven by working-class consumers favoring affordable and mainstream beer options. While craft beer is slowly gaining ground, traditional brands still dominate the market, supported by local manufacturing and distribution channels.

Besides this, the Northwestern District, including St. Petersburg, is a cultural and economic hub with a strong craft beer scene. Young, urban consumers drive demand for premium, imported, and artisanal beers. Its proximity to European markets influences preferences and boosts the popularity of diverse beer styles, supporting a dynamic and competitive regional market.

Despite its remote location and harsher climate, the Siberian District has a stable beer market due to strong regional brands and loyal consumer bases. Consumption leans toward affordable beers, though urban centers like Novosibirsk show increasing interest in premium and craft varieties. Logistics challenges slightly limit rapid market expansion in the region.

Competitive Landscape:

The competitive landscape of the Russian beer market is characterized by the dominance of large-scale producers, supported by strong distribution networks and brand loyalty. These players control the majority of market share, particularly in the standard and economy segments. However, the market is becoming increasingly diversified with the rise of regional breweries and a growing craft beer movement. Consumer preferences are shifting toward premium, non-alcoholic, and flavored options, prompting companies to innovate and expand their product portfolios. Regulatory constraints, such as advertising restrictions and excise duties, add competitive pressure. The expansion of modern retail channels, especially supermarkets and e-commerce, also intensifies competition. Overall, the market is dynamic, with innovation, pricing, and regional targeting serving as key competitive strategies.

The report provides a comprehensive analysis of the competitive landscape in the Russia Beer market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Baltika Brewing Company launched an Expert Advisory Council, led by Taimuraz Bolloyev, to develop Russia’s beer and non-alcoholic beverage policy. The council unites industry and cross-sector experts to create a strategic framework, address regulatory gaps, and promote collaboration for sustainable industry growth.

- April 2025: Von Ebert Brewing celebrated its 7th anniversary with two collaboration beers, a 5.0% ABV German-style Pilsner and a 6.8% West Coast IPA, crafted with Russian River Brewing Company. The brewery expanded production to 20,000 barrels annually, boosting distribution of its popular Northwest craft beers in cans and draft.

- January 2025: Russian President Putin took control of AB InBev’s Russian joint venture, transferring shares to local entity Vmeste. AB InBev, holding 25% of Russia’s beer market with brands like Klinskoe, faces challenges amid regulatory pressures and declining consumption, reflecting broader asset seizures of foreign firms in Russia.

- December 2024: Moscow approved Carlsberg’s USD 322 Million sale of its Russian subsidiary Baltika Breweries to VG Invest, led by Baltika insiders. After Russia’s 2023 seizure and temporary management of Baltika, the deal ends disputes, with Carlsberg regaining some control of regional assets amid ongoing challenges in Russia’s beer market.

- October 2024: AB InBev and Anadolu Efes revised their joint venture plans after Russian regulatory hurdles blocked ABI's exit from its Russian stake. Anadolu Efes will take over Russian operations, while ABI acquires Ukrainian interests. The USD 1.1 Billion impairment highlights challenges in Russia’s volatile beer market amid geopolitical tensions.

Russia Beer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Hectolitres |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ale, Lager, Stouts, Others |

| Packagings Covered | Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Categories Covered | Standard, Premium |

| Distribution Channels Covered | Supermarkets And Hypermarkets, On-Trade, Specialty Stores, Convenience Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Russia beer market has reached a volume of 79.65 Million Hectolitres in 2024.

The Russia beer market is projected to exhibit a CAGR of 3.36% during 2025-2033, reaching a volume of 107.24 Million Hectolitres by 2033.

The Russia beer market is driven by rising demand for craft and premium beers, growing health consciousness boosting non-alcoholic options, supportive government policies, and expansion of online and retail sales channels. Changing consumer preferences and urban lifestyles also contribute to the market's steady growth and diversification across regions and demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)