Russia Banking Services Market Report by Type (Retail Banking, Commercial Banking, Investment Banking), Provider (Commercial Banks, Community Banks, Credit Unions, and Others), Service (Investment Services, Insurance Services, Tax and Accounting Services, and Others), and Region 2025-2033

Russia Banking Services Market Overview:

The Russia banking services market size reached USD 246.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 338.8 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The increasing digitalization of financial services, government initiatives to promote cashless transactions, the growing demand for online banking and mobile payment solutions, the expansion of financial inclusion efforts, and the rise in consumer and business loans are some of the major factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 246.4 Million |

|

Market Forecast in 2033

|

USD 338.8 Million |

| Market Growth Rate 2025-2033 | 3.60% |

Russia Banking Services Market Trends:

Rising Digital Transformation

The widespread adoption of online and mobile banking is reshaping the financial landscape in Russia. Consumers and businesses are moving toward digital platforms for convenience and efficiency, leading to significant growth in digital banking services. The rise of fintech innovations and the integration of technologies like AI and blockchain are further enhancing this shift. For instance, in April 2023, Russian state-owned bank VTB (VTBR.MM), announced the launch of a digital bank within the mobile messaging app of leading social network VKontakte, Russia's answer to Facebook, as Moscow tries to find technological solutions to disturbed banking transfers. The development of their technology is especially relevant in the context of geopolitical risks and international restrictions. The digital bank is likely to enable consumers to carry out daily financial transactions like some bill payments, mobile phone top-ups, and money transfers, within the VKontakte app and clients can only be able to access it on mobile.

To get more information on this market, Request Sample

Growing Government Initiatives

The Russian government’s push toward a cashless economy is acting as a major growth-inducing factor. In addition to this, initiatives such as the development of the National Payment Card System and the promotion of electronic payments are reducing cash dependency and encouraging the use of digital payment systems, boosting the overall banking market. For instance, in September 2023, the Moscow City Tourism Committee introduced a virtual 'Foreign Tourist Card' to attract more tourists and address payment-related issues. The number of Indian tourists visiting Moscow is slowly increasing, and initiatives like e-visas are expected to further boost this trend. Similarly, a key focus of the India-Russia annual summit held in July 2024, Moscow between Prime Minister Narendra Modi, and President Vladmir Putin on devising mechanisms for the easy and quick transfer of money between the two countries.

Russia Banking Services Market News:

- In February 2023, twenty Russian banks, including Gazprom, Rosbank, Tinkoff Bank, Centro Credit Bank, and Credit Bank of Moscow, opened rupee vostro accounts with authorized dealer banks in India to enable rupee trade between the two countries, but the mechanism is yet to take off in a big way.

- In September 2023, Russia launched Islamic banking for the first time as a part of a two-year pilot program. Islamic financial institutions have existed in Russia until now with a sizeable Muslim population estimated to be up to 25 million, but for the first time, Russia’s legislation officially endorsed its launch.

Russia Banking Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, provider, and service.

Type Insights:

- Retail Banking

- Commercial Banking

- Investment Banking

The report has provided a detailed breakup and analysis of the market based on the type. This includes retail banking, commercial banking, and investment banking.

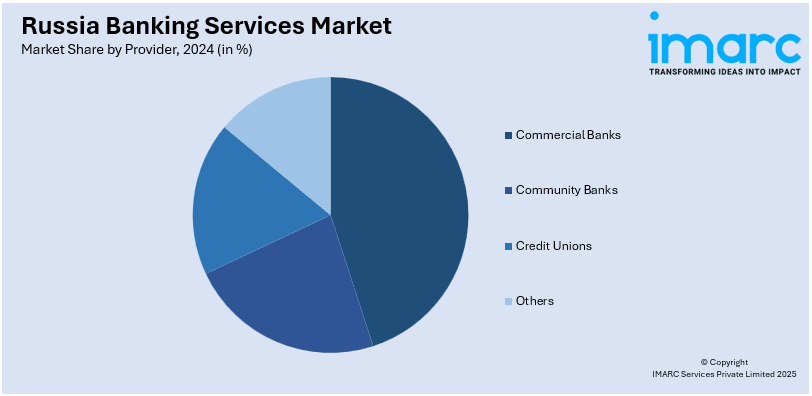

Provider Insights:

- Commercial Banks

- Community Banks

- Credit Unions

- Others

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes commercial banks, community banks, credit unions, and others.

Service Insights:

- Investment Services

- Insurance Services

- Tax and Accounting Services

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes investment services, insurance services, tax and accounting services, and others.

Regional Insights:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Central District, Volga District, Urals District, Northwestern District, Siberian District, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Russia Banking Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Retail Banking, Commercial Banking, Investment Banking |

| Providers Covered | Commercial Banks, Community Banks, Credit Unions, Others |

| Services Covered | Investment Services, Insurance Services, Tax and Accounting Services, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Russia banking service market performed so far and how will it perform in the coming years?

- What is the breakup of the Russia banking service market on the basis of type?

- What is the breakup of the Russia banking service market on the basis of provider?

- What is the breakup of the Russia banking service market on the basis of service?

- What are the various stages in the value chain of the Russia banking service market?

- What are the key driving factors and challenges in the Russia banking service?

- What is the structure of the Russia banking service market and who are the key players?

- What is the degree of competition in the Russia banking service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia banking service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Russia banking service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia banking service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)