Russia Alcoholic Drinks Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel, and Region, 2025-2033

Russia Alcoholic Drinks Market Size and Share:

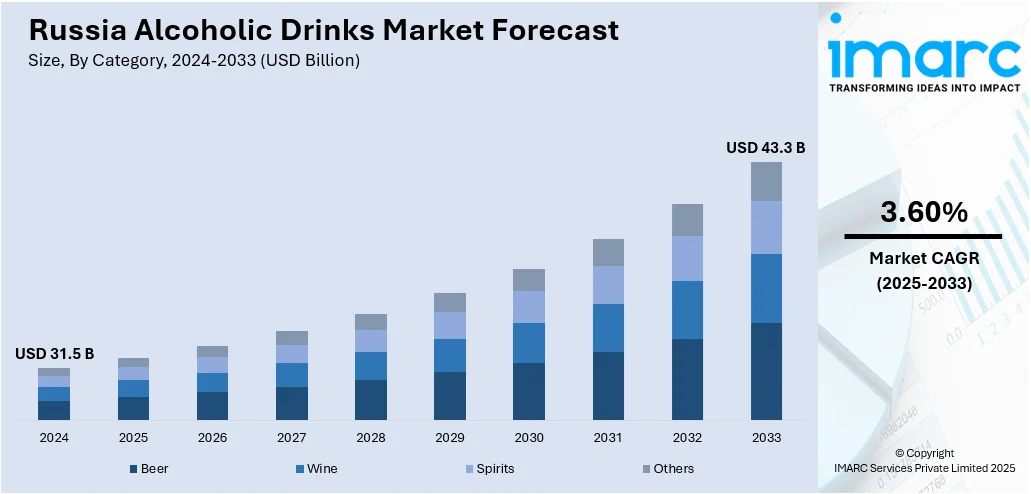

The Russia alcoholic drinks market size reached USD 31.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 43.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. Rising disposable income, premiumization, craft beverage demand, e-commerce growth, domestic production, regulatory changes, health-conscious trends, and cultural drinking traditions are factors increasing the Russia alcoholic drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 31.5 Billion |

|

Market Forecast in 2033

|

USD 43.3 Billion |

| Market Growth Rate 2025-2033 | 3.60% |

The economic, social, and regulatory forces together govern the Russian alcoholic drinks market. Improved disposable income, expanding the middle class of this nation have given impetus to higher demands of premium as well as imported beverages by this market especially with respect to newer alcoholic products more popular with youngsters. Improvements in modernizing and rapid growth of retailing and distribution networks such as the entry of supermarkets, hypermarkets, and even liquor stores made the availability of diverse alcoholic beverages highly accessible which is further creating a positive Russia alcoholic drinks market outlook.

To get more information on this market, Request Sample

Increased purchasing power has combined with newer preferences in this market. For instance, World Economics estimates Russia's 2024 GDP at $8.316 trillion in PPP terms (Purchasing Power Parity) and an initial estimate of $8.432 trillion for 2025. This figure is 38% higher than the official estimate published by the World Bank. Moreover, the slack in foreign imports of Western alcohol has created space for local companies to fill, thereby increasing local whisky production and consumption. Interplay of increased purchasing power with newer consumer preference, regulatory actions, and socio-economic factors defines Russia's alcoholic drinks market dynamics. Furthermore, other cultural traditions drive the Russia alcoholic drinks market, including vodka as an integral part of social and celebratory events. Craft breweries and domestic whiskey distilleries increase consumer choice variety, targeting a younger demographic looking for something more exciting. The e-commerce and online alcohol delivery markets are opening up the marketplace to alcoholic beverages.

Russia Alcoholic Drinks Market Trends:

Government policies and regulations

According to Russia alcoholic drinks market forecast, government regulations have been vital in shaping the Russian alcoholic beverages market. Over the past decade, Russia has implemented strict measures to curb alcohol consumption, such as prohibiting advertising, raising excise taxes, and limiting retail sales hours. These policies have affected growth, pushing consumers toward legally regulated products and generating a demand for premium brands seen as higher quality and value. Additionally, the government has been advocating for anti-alcohol initiatives and implementing stricter quality control regulations to diminish the occurrence of fake alcoholic drinks. Nonetheless, in spite of these initiatives, heavy taxation on alcohol has resulted in a rise in illegal trade and untracked alcohol use. The existence of a black market for alcoholic drinks continues to be a major problem, as certain consumers choose more affordable, untaxed options. Conversely, regulatory actions have fostered local production, leading to an increase in market share for domestic manufacturers. Russia's recent emphasis on import substitution, driven by geopolitical conflicts and economic sanctions, has significantly boosted the development of locally produced alcoholic beverages, enabling domestic brands to flourish as international rivals encounter limitations.

Evolving consumer preferences and premiumization trend

Government regulations have been essential in shaping the Russian alcoholic beverages market. Over the past decade, Russia has implemented strict measures to reduce alcohol consumption, such as prohibiting advertising, raising excise taxes, and imposing limitations on retail sales hours. These policies have influenced growth, pushing consumers toward products that are legally regulated and generating a demand for premium brands thought to offer superior quality and value. Additionally, the government has been actively promoting anti-alcohol initiatives and implementing stricter quality control regulations to diminish the occurrence of counterfeit alcoholic drinks. Nonetheless, in spite of these initiatives, substantial taxes on alcohol have resulted in a rise in illegal trade and unregulated alcohol consumption. The existence of a black market for alcoholic drinks continues to be a major problem, as some buyers choose more affordable, untaxed options. Conversely, regulatory actions have spurred domestic production, leading local manufacturers to grow their market presence. Russia's recent emphasis on import substitution as a result of geopolitical conflicts and economic sanctions has further accelerated the development of locally made alcoholic beverages, enabling domestic brands to flourish while foreign competitors encounter limitations.

Impact of e-commerce and digital transformation

The digital shift within Russia's alcohol industry is greatly affecting market expansion. The growth of e-commerce and online alcohol delivery services has increased the ease of buying alcoholic drinks, especially in city environments. According to the IMARC Group, the Russia e-commerce market is expected to reach USD 283.4 Billion by 2032. Although stringent regulations continue to oversee online alcohol sales, the COVID-19 pandemic hastened the use of digital platforms for ordering and delivering alcoholic beverages. Numerous brands and retailers have adjusted by increasing their presence on e-commerce platforms, providing promotions, customized suggestions, and subscription-based alcohol delivery services. This change is also allowing local producers to connect with a wider audience and compete against global brands. Social media marketing and partnerships with influencers continue to influence consumer decisions, as younger audiences depend on online platforms for discovering products and getting suggestions.

Russia Alcoholic Drinks Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia alcoholic drinks market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on category, alcoholic content, flavor, packaging type, and distribution channel.

Analysis by Category:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirits

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

- Others

Beer is another popular liquor widely consumed in Russia, accounting for a large market share. This segment is driven primarily by the changing taste of consumers; with a growing demand for craft and premium beers, a consumer-centric approach dominates. Though mass-market lagers lead, recent microbrewery and domestic craft beer manufacturers have increased the variety in the market. Non-alcoholic and low-alcohol beers have become increasingly popular recently due to health-focused trends among younger consumers.

The Russian wine market has grown rapidly as consumers became more conscious of healthier alcoholic beverages. Domestic wine production has risen significantly, mainly in the Crimea and Krasnodar regions, supported by favorable policies from the government and embargoes on Western imports. The interest for premium and organic wine among Russian consumers is increasing, while red wine continues to hold the highest market share. Sparkling wine also gained popularity due to social gatherings and celebrations.

The spirits category continues to be the biggest in the Russian alcoholic beverages market, with vodka serving as a conventional mainstay. Nonetheless, shifting preferences have resulted in an increasing demand for whiskey, brandy, and gin, especially among younger and city-dwelling consumers. One significant trend is premiumization, as consumers are moving toward high-quality, crafted, and aged alcoholic beverages. Local distilleries have gained from import limitations, resulting in the emergence of domestically made whiskey and brandy.

Analysis by Alcoholic Content:

- High

- Medium

- Low

The segment with high alcohol content in Russia mainly includes spirits such as vodka, whiskey, brandy, and rum. Vodka continues to be the leading choice because of its strong cultural heritage and low cost. Nonetheless, whiskey and brandy are increasingly favored, particularly by younger and more wealthy consumers looking for high-quality options. Whiskey produced locally has experienced an increase owing to limitations on imports from the West. Even with government rules on alcohol use, strong spirits still flourish, especially in colder areas where stronger drinks are typically favored.

The medium-alcohol category comprises drinks such as wine, fortified wines, and robust beers. The consumption of wine in Russia is on the rise, fueled by a growing fondness for both domestically produced and imported types. The Russian government has been backing local wineries, decreasing dependence on European imports. Fortified wines such as port and sherry are becoming increasingly popular with older age groups.

The low-alcohol market is growing quickly because of rising health awareness and evolving consumer tastes. Light beers, ciders, hard seltzers, and non-alcoholic options are becoming popular, especially among younger individuals and female shoppers. The request for non-alcoholic and low-alcohol drinks is additionally propelled by governmental measures that discourage high alcohol intake. Numerous breweries are launching alcohol-free beers and low-alcohol cocktails to appeal to this expanding market.

Analysis by Flavor:

- Unflavoured

- Flavoured

Unflavored alcoholic drinks, especially vodka, lead the Russian market because of long-established cultural tastes and conventional drinking practices. Vodka, recognized for its mild flavor and elevated alcohol level, is a mainstay in Russian homes and social events. Other unflavored beverages such as whiskey, gin, and rum are also favored, particularly by high-end consumers. This sector gains from robust consumer devotion and extensive accessibility through various retail avenues.

The segment for flavored alcoholic beverages is growing swiftly, fueled by changing consumer tastes and the desire for diversity. Young consumers, particularly in cities, are moving toward flavored spirits, beers, and wines because of their distinctive taste profiles and reduced alcohol content. The increase in flavored vodka, fruit-infused beers, and ready-to-drink (RTD) cocktails has played a role in the growth of this segment.

Analysis by Packaging Type:

- Glass Bottles

- Plastic Bottles

- Others

In the Russian alcoholic drinks market, glass bottles prevail because of their premium attractiveness, resilience, and capacity to maintain the taste and quality of drinks. They are commonly utilized for beverages such as vodka, whiskey, and high-quality wines, since glass does not react and avoids contamination. Consumers link glass packaging to authenticity and luxury, making it the favored option for premium alcoholic drinks. Moreover, glass bottles conform to sustainability trends since they can be recycled and minimize environmental effects.

Plastic bottles are frequently utilized for affordable alcoholic drinks, especially beer and inexpensive spirits, because of their cost efficiency, lightweight design, and sturdiness. They hold popularity in Russia's mass-market sector, where cost-effectiveness and convenience are essential buying influences. Nonetheless, worries about the effect of plastic on beverage quality and environmental sustainability have resulted in tighter regulations, including limits on plastic bottle sizes for alcoholic beverages.

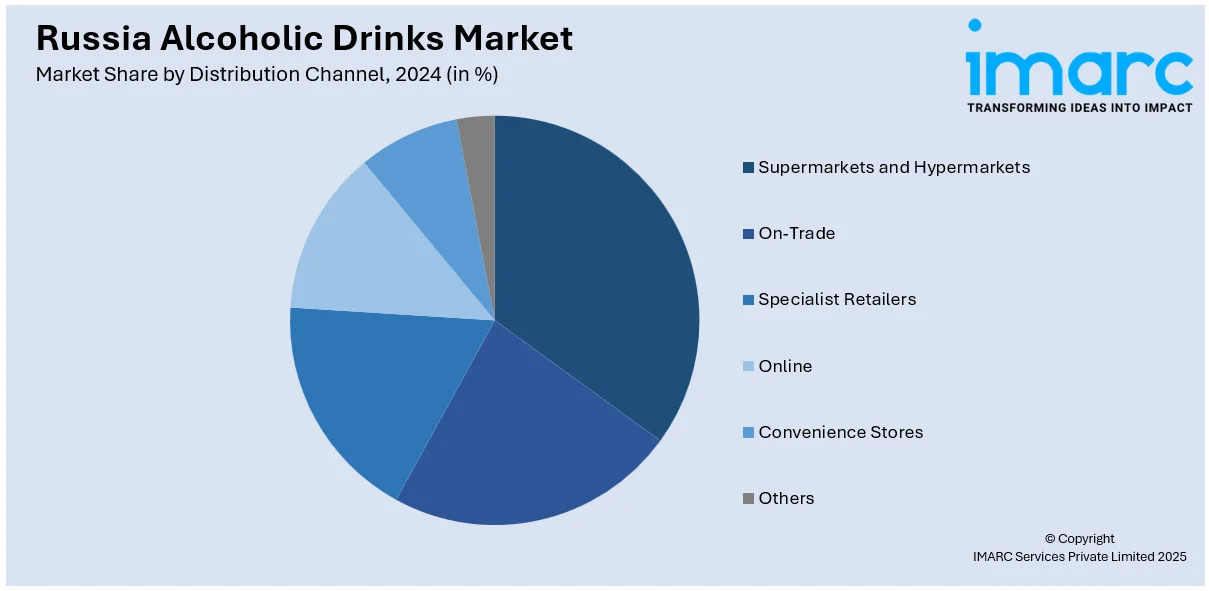

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

In Russia, supermarkets and hypermarkets serve as the primary distribution channels for alcoholic drinks, providing shoppers with a convenient and varied shopping experience. These major retail stores offer a wide range of alcoholic beverages, such as vodka, beer, wine, and high-end spirits, at attractive prices. The availability of both international and local brands in a single place increases options for consumers, and regular discounts and promotions encourage bulk buying.

The on-trade sector, comprising bars, restaurants, and nightclubs, is crucial in influencing alcohol consumption patterns in Russia. Premiumization serves as a significant catalyst in this sector, as consumers are more frequently pursuing top-tier spirits, artisanal cocktails, and foreign wines when they go out to eat or socialize. The emergence of mixology culture and themed bars has increased the appetite for distinctive and handcrafted alcoholic drinks.

Specialized shops concentrate solely on alcoholic drinks, providing a carefully chosen range of high-quality and unique items. These shops serve consumers looking for premium liquors, uncommon wines, and artisanal beers, offering knowledgeable suggestions and tailored services. Numerous specialty retailers additionally organize tasting events and informative workshops, improving the consumer experience and fostering brand loyalty.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Centered around Moscow, the Central Federal District serves as an important center for Russia's alcoholic drinks market. The district's large population and higher disposable incomes lead to strong demand for premium and imported alcoholic drinks. The abundance of bars, eateries, and nightlife spots in Moscow and nearby cities creates a lively on-trade alcohol market.

The Volga Federal District is notable as a top area in Russia for producing alcoholic beverages. From January to October 2020, the district produced more than 229.2 thousand decaliters of wine, the highest in all federal districts. This leading production is bolstered by the district's excellent agricultural conditions, which promote the growth of various crops vital for alcohol production.

The Ural Federal District, known for its industrial economy, offers a distinct environment for the alcoholic beverages market. The urban centers in the district, such as Yekaterinburg, show an increasing interest in various alcoholic drinks, including craft beers and high-quality spirits. The emergence of local breweries and distilleries fulfills the desires of consumers looking for regional tastes and handcrafted items. Economic activities in the industrial sector help create a consistent consumer base that has disposable income to spend on alcoholic drinks.

Competitive Landscape:

Major participants in Russia's alcoholic beverages sector are employing diverse strategies to foster growth and sustain their competitive edge. Firms such as Russian Standard Corporation, Oasis Group of Companies, and MPBK Ochakovo ZAO are emphasizing product diversification to meet changing consumer tastes. This involves the launch of premium and craft drink ranges, along with low-alcohol and non-alcoholic options, in line with the worldwide shift toward health awareness. To increase market access, these firms are broadening their distribution systems, utilizing both conventional retail outlets and the growing e-commerce industry. Partnerships with e-commerce businesses and the creation of exclusive digital platforms enhance easy consumer access, particularly in metropolitan areas. In reaction to the rising demand for locally made drinks, companies are putting resources into local production capabilities, guaranteeing quality assurance and cultivating brand loyalty among consumers who favor domestic goods.

Latest News and Developments:

- 21 October 2024: Allied Blenders and Distillers Limited has partnered with Roust Corporation to launch Russian Standard Vodka in India. The vodka market in India is growing rapidly, with over 13 million cases in volume and a growth rate exceeding 20%. This partnership aligns with ABDL's strategy to offer premium products to Indian consumers and expands Roust Corporation's presence in a key growth market.

- 24 October 2024: Beluga and Lalique are launching their second limited-edition collaboration, Beluga Epicure Series II, in December 2024 for €15,000. The vodka is made using pure spring water and alpha grade grain, resting for 100 days after distillation. Lalique designed a hand-crafted crystal decanter inspired by René Lalique's Bacchantes motif, with only 888 pieces produced.

- 19 December 2023: Anheuser-Busch InBev consented to divest its share in a Russian joint venture to its collaborator, Turkish brewery Anadolu Efes. The Russian subsidiary will be run exclusively by Anadolu Efes.

Russia Alcoholic Drinks Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavours Covered | Unflavoured, Flavoured |

| Packaging Types Covered | Glass Bottles, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia alcoholic drinks market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia alcoholic drinks market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia alcoholic drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Increasing disposable income, premium product demand, craft drink popularity, growth of e-commerce, local production, changes in regulations, health-oriented trends, and cultural drinking customs are driving the Russia alcoholic drinks market.

The Russia alcoholic drinks market is projected to exhibit a CAGR of 3.60% during 2025-2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)