Rugby Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Rugby Apparel Market 2024, Size and Trends:

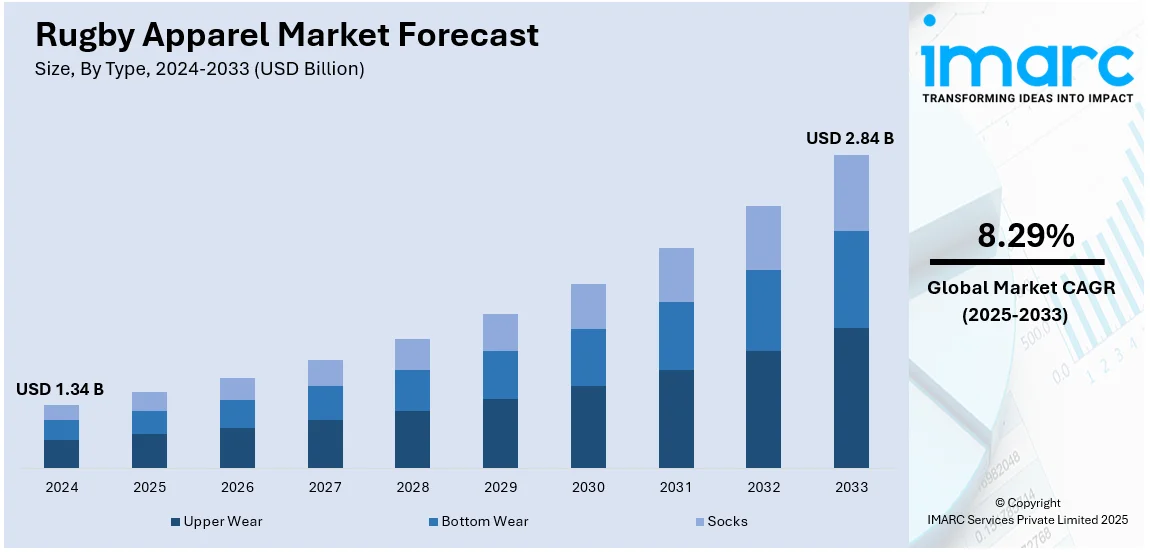

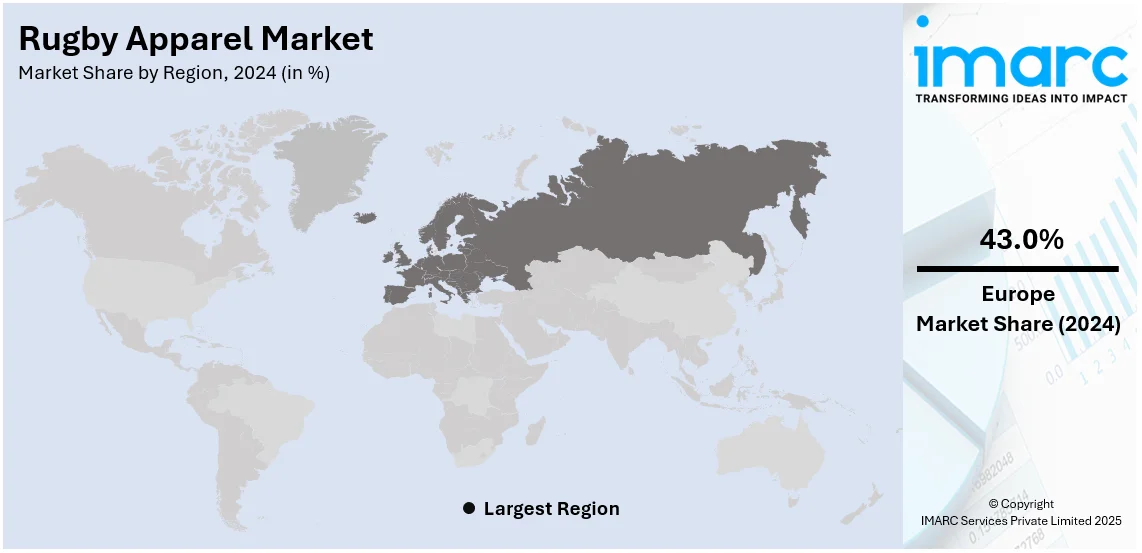

The global rugby apparel market size was valued at USD 1.34 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.84 Billion by 2033, exhibiting a CAGR of 8.29% during 2025-2033. Europe currently dominates the market, holding a significant market share of 43.0% in 2024. The rising number of rugby tournaments and increasing product demand among fans is propelling the market growth. Besides this, introduction of eco-friendly products is a key factor influencing the rugby apparel market share in apparel market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.34 Billion |

| Market Forecast in 2033 | USD 2.84 Billion |

| Market Growth Rate (2025-2033) | 8.29% |

Advancements in fabric technology are significantly driving the market by enhancing performance and durability. Moisture-wicking fabrics help players stay dry by efficiently absorbing sweat and improving overall comfort during matches. Stretchable and lightweight materials provide better flexibility, allowing players to move freely without restriction during high-intensity gameplay. Enhanced durability features ensure rugby jerseys and shorts withstand frequent tackles, pulling, and rough playing conditions over time. Compression technology integration in rugby gear aids muscle recovery, reducing fatigue and minimizing the risk of sports-related injuries. Breathable mesh panels improve ventilation, preventing overheating and maintaining optimal body temperature during rigorous training sessions. Anti-microbial treatments in modern fabrics prevent bacterial growth, reducing odor and ensuring better hygiene for players. Water-resistant coatings in some rugby gear protect players from rain, ensuring comfort during adverse weather conditions. Smart textiles with embedded sensors provide real-time performance data, improving player training and injury prevention strategies, which is strengthening the market growth.

The United States rugby apparel market demand is driven by the expansion of international brands. Global sportswear companies like Macron are partnering with USA Rugby and Major League Rugby, increasing market competition. In October 2024, USA Rugby partnered with Macron, naming the Italian brand as its official sportswear partner for the USA Eagles. This collaboration marks Macron’s expansion into the US market, providing teamwear for all USA men’s and women’s national teams. The partnership reflects a growing trend of international brands investing in US rugby, strengthening the sport’s profile and apparel offerings nationwide. These partnerships introduce high-performance rugby apparel, offering advanced materials and superior durability for both professional players and fans. International brands bring technological innovations, such as moisture-wicking fabrics and compression wear, improving athletic performance and comfort. Increased brand presence enhances rugby’s visibility, attracting new customers and expanding the sport’s commercial appeal across the United States. Exclusive merchandise collections and team sponsorships help global brands engage with American rugby fans, influencing apparel sales. Growing investments from international companies create better product availability, offering diverse and high-quality rugby gear nationwide.

Rugby Apparel Market Trends:

Rising number of rugby tournaments

The increasing number of global rugby tournaments, including the Rugby World Cup, Olympics, Men's International Championship, and Six Nations, is driving market expansion. Rugby apparel enhances player performance, prevents injuries, and improves movement due to its lightweight, breathable, stretchable, and moisture-absorbing properties. Rising demand from fans and sports enthusiasts supporting their teams is further impels the market growth. The growing participation in women's rugby tournaments is also increasing demand for specialized apparel designed for female players. For instance, registered female players have risen by 33.9% to 319,966, with a 53.2% surge in overall female participation. The introduction of eco-friendly apparel made from sustainable materials like organic cotton and recycled polyester is positively impacting the market. These materials reduce waste, minimize water pollution, and conserve energy, aligning with sustainability trends. Advanced products offering antimicrobial properties and UV protection are further influencing product adoption.

Expansion of e-commerce channels

Rising customer spending power, widespread e-commerce availability, and aggressive promotional strategies are driving market expansion. In 2022, over 2.3 Billion customers made at least one online purchase, highlighting e-commerce’s growing influence. Online platforms provide rugby fans global access to official merchandise without geographic restrictions or retail limitations. Leading brands utilize digital storefronts to showcase extensive product ranges. Direct-to-consumer (D2C) models strengthen brand engagement with rugby enthusiasts and professional players. Customization options including personalized jerseys with names and numbers, enhance customer appeal. Exclusive online discounts, limited-edition collections, and pre-order availability create urgency, increasing conversion rates. Subscription-based models support customer retention by offering regular product updates and personalized recommendations. Mobile commerce expansion enables seamless rugby apparel purchases via smartphones, driving impulse buying behavior. Artificial intelligence (AI) integration refines product recommendations, improving the digital shopping experience. These factors collectively support the continued growth of the rugby apparel market.

Sponsorship & brand collaborations

Sponsorship and brand collaborations are significantly expanding the market through strategic partnerships worldwide. Sportswear giants are securing sponsorships with national teams and leagues. These sponsorships ensure high visibility for branded rugby apparel during international tournaments and domestic competitions. Official team jerseys, training kits, and merchandise generate strong demand through fan loyalty and engagement. Collaborations between apparel brands and professional rugby clubs enhance product credibility and market penetration. In September 2024, the Red Roses, England’s women’s rugby team, named Crew Clothing their official formalwear outfitter. This marks their first exclusive partnership and Crew Clothing’s first all-female sponsorship deal. Crew will create formal attire for team events and appearances, with the collection set to debut at the 2025 Guinness Women’s Six Nations. Exclusive partnerships allow brands to introduce advanced fabric technologies tailored to rugby players’ performance needs. Limited-edition collections and co-branded apparel lines attract enthusiasts, influencing sales through premium product offerings. Sponsorship deals also extend to grassroots rugby programs, increasing brand awareness among young athletes. Customization options for fan apparel, including team logos and player names, drive additional revenue growth.

Rugby Apparel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rugby apparel market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Upper Wear

- Bottom Wear

- Socks

Upper wear stand as the largest component in 2024, holding 53.2% of the market. Rugby jerseys provide durability, moisture-wicking properties, and breathability, ensuring player comfort and mobility. Major brands continuously innovate jersey designs, incorporating lightweight and stretchable fabrics for enhanced movement. Sponsorship deals prominently feature team jerseys, increasing demand among fans and players alike. Official team kits including jerseys, receive high visibility during professional tournaments and international championships. Fans purchase replica jerseys to showcase team support, significantly contributing to upper wear sales growth. Customization options, such as name printing and number personalization, further driven customer interest in upper wear. Increasing awareness about performance-enhancing apparel technologies makes jerseys a preferred choice for professional and amateur players. The shift toward sustainable materials like recycled polyester is catalyzing innovation in rugby jerseys. Social media promotions and celebrity endorsements amplify demand for branded upper wear collections. Limited-edition jerseys launched during major tournaments create urgency, increasing sales among rugby enthusiasts.

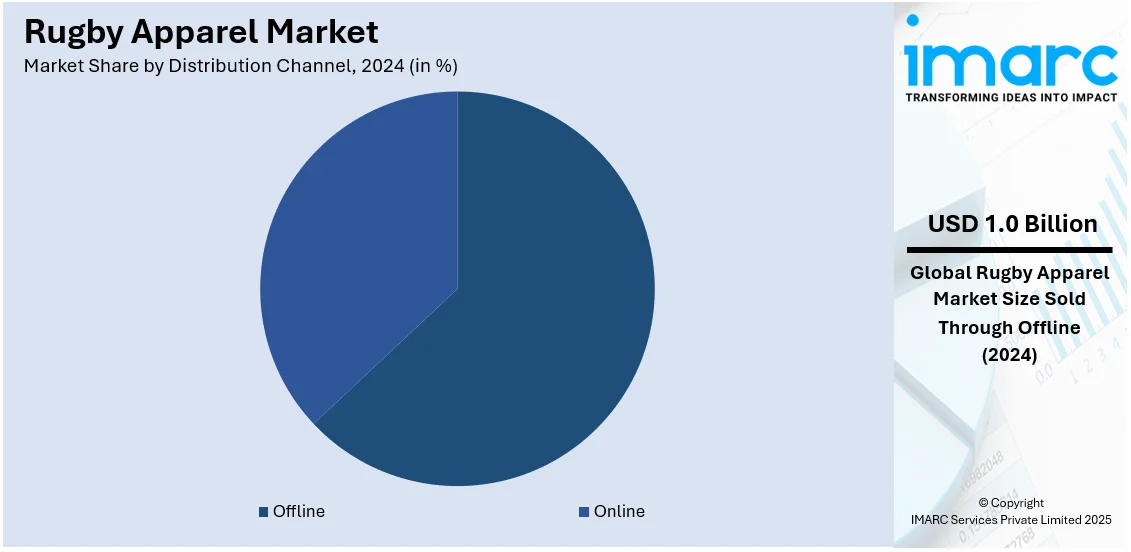

Analysis by Distribution Channel:

- Offline

- Online

Offline leads the market with 62.8% of market share in 2024. Physical stores allow customers to assess fabric quality, fit, and durability before purchasing. Sporting goods retailers and specialty rugby stores provide expert guidance, improving customer confidence in product selection. Major brands establish exclusive retail stores to offer personalized shopping experiences and official merchandise. Rugby clubs and training academies source apparel directly from offline suppliers, ensuring bulk sales. Stadium merchandise shops drive strong demand during live tournaments, capitalizing on fan engagement. Offline stores facilitate instant purchases without delivery wait times, increasing convenience for last-minute buyers. Strong retailer networks ensure product availability across multiple regions, influencing offline sales dominance. Shoppers trust established sporting goods retailers for authentic, high-quality rugby apparel purchases. Promotional in-store events, discounts, and seasonal sales attract customers, increasing foot traffic in physical stores. Many offline retailers offer customization services for jerseys, enhancing customer engagement and brand loyalty. Rugby training centers and academies prefer offline procurement for team uniforms and equipment.

Analysis by End User:

- Men

- Women

Men leads the market with 59.8% of market share in 2024. Rugby has historically been male dominated, leading to greater demand for men’s rugby apparel. Major tournaments like the Rugby World Cup and Six Nations primarily feature men’s teams, influencing apparel sales. Sponsorship deals and merchandise collaborations focus largely on men’s rugby teams and athletes. Men’s rugby jerseys, shorts, and training gear account for the highest sales among apparel categories. Clubs and universities maintain larger men’s rugby teams, driving bulk purchases for uniforms and gear. Male players require durable, stretchable, and moisture-wicking apparel for enhanced on-field performance and injury prevention. Fan merchandise sales are higher among male audiences, supporting market growth in this segment. Rugby brand endorsements feature male athletes, reinforcing the demand for performance-enhancing apparel. Although women’s participation is growing, men’s rugby remains more commercially significant, influencing market trends. The introduction of high-performance fabric technologies continues to drive interest in men’s rugby apparel. E-commerce platforms prioritize men’s rugby apparel collections, reflecting stronger demand.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 43.0%. Countries like the United Kingdom, France, and Ireland have deeply rooted rugby traditions, driving apparel demand. Major tournaments including the Six Nations Championship and European Rugby Champions Cup, influence apparel sales. Rugby clubs in Europe generate significant revenue from licensed merchandise and sponsorship deals. European teams secure major endorsements from global sports brands, increasing visibility and customer interest. Fan engagement with club merchandise fuels demand for jerseys, training gear, and supporter apparel. In November 2024, the British and Irish Lions revealed their 2025 tour jersey, showcasing a deeper red hue, a woven pattern representing the four-nation union, and a classic 'grandad' collar. Chief executive Ben Calveley explained that the color adjustment was made to design a jersey that is more wearable for fans beyond match settings. Moreover, regional governing agencies are investing in rugby infrastructure, encouraging participation and increasing apparel sales. High customer spending power in Europe supports the premium pricing of branded rugby apparel. Stadium-based retail outlets in the region benefit from strong matchday sales during rugby tournaments. E-commerce growth in the region ensures seamless access to official merchandise, increasing market penetration. European customers prioritize sustainable and high-performance apparel, driving innovation in rugby clothing materials. International brands establish regional headquarters in Europe, reinforcing distribution networks and brand presence.

Key Regional Takeaways:

United States Rugby Apparel Market Analysis

The increasing adoption of rugby apparel in the United States aligns with the country’s expanding sports culture. Reports indicate that 242 million people in the US participated in sports or fitness activities in 2023. Rugby’s growing trend at the grassroots and college levels is driving demand for high-quality apparel. Both amateur and professional players seek performance-enhancing jerseys, shorts, boots, and protective gear. Rising awareness about health benefits by playing rugby is encouraging more participation, expanding the market for specialized apparel. The growth of men’s and women’s rugby leagues is further strengthening demand for rugby-specific clothing. Increased investments in training programs and competitive rugby events are increasing interest in performance-driven sportswear. Retailers and brands are capitalizing on this trend by offering innovative, durable, and comfortable rugby apparel. Social media promotions and sponsorships are also contributing to increased customer engagement with rugby merchandise. As rugby continues gaining recognition in the US, apparel sales are expected to rise across multiple distribution channels. The sport’s development as both a competitive and recreational activity supports consistent market expansion. These factors position rugby apparel as an emerging segment within the broader US sportswear industry.

Asia Pacific Rugby Apparel Market Analysis

The adoption of rugby apparel in the Asia-Pacific region is closely tied to the rise of e-commerce. As per the IBEF, India’s e-commerce market reached a GMV of USD 60 billion in 2023, reflecting a 22% increase from the previous year. Growing smartphone penetration and internet access are encouraging customers to buy rugby apparel online, expanding market reach. E-commerce platforms provide easy access to rugby gear, offering competitive prices and a diverse product selection. Countries like Japan, Australia, and New Zealand are witnessing increased demand for specialized rugby apparel. Online retailers benefit from this trend by offering exclusive collections tailored to amateur and professional players. The availability of international brands through e-commerce is expanding choices for shoppers, enhancing product accessibility. Digital promotions, targeted advertising, and influencer marketing are further influencing online rugby apparel sales. Subscription models and customization options for jerseys are also contributing to rising online purchases. As rugby gains momentum across the region, e-commerce continues to drive market expansion. The shift towards digital shopping has made rugby apparel more accessible, contributing to the sport’s growing presence in the region.

Latin America Rugby Apparel Market Analysis

In Latin America, rising disposable income is a key factor driving the growing adoption of rugby apparel. Reports indicate that the region’s total disposable income is projected to increase by nearly 60% from 2021 to 2040. Higher spending power is encouraging players to invest in premium sports apparel, including rugby gear. This trend is increasing demand for performance-oriented and stylish rugby apparel, appealing to both players and enthusiasts. In countries like Argentina and Uruguay, where rugby has a strong presence, affordability of specialized gear has improved. More individuals can now purchase high-quality jerseys, shorts, and protective equipment, strengthening market growth. The expansion of rugby clubs and grassroots programs is also contributing to rising demand for rugby apparel. As economic conditions improve, rugby merchandise sales are expected to rise across retail and e-commerce platforms. International brands are capitalizing on this trend by introducing advanced, durable, and comfortable rugby apparel. Local manufacturers are also expanding offerings to cater to the growing rugby community. Sponsorships, tournaments, and increased fan engagement further support rugby apparel market growth in the region.

Middle East and Africa Rugby Apparel Market Analysis

The growing adoption of rugby apparel in the Middle East and Africa is closely linked to the expansion of the region’s textile industry. In 2022, the UAE textile market surpassed USD 10 billion and is expected to grow by over 5% annually in the medium term. Advancements in textile manufacturing and a rising focus on sportswear production are significantly increasing the availability of high-quality rugby apparel. Local manufacturers are now meeting the demand for specialized rugby gear including jerseys, shorts, and protective equipment. Additionally, as rugby becomes prevalent in countries like South Africa, Kenya, and the UAE, the production of high-performance apparel is supporting the sport’s growth. The development of the textile industry is also improving accessibility and affordability, further driving the widespread adoption of rugby apparel.

Competitive Landscape:

Major brands like Adidas are developing advanced fabrics enhancing performance, durability, and comfort. In July 2024, Adidas launched the futuristic Kakari RS rugby boots, featuring cutting-edge Fusionskin leathers and innovative stitching patterns. The new design revamps tooling systems, offering enhanced performance and comfort. Stepping away from the classic Kakari Z.1, the Kakari RS is set to lead the charge in rugby footwear. Sponsorship deals with professional rugby teams increase brand visibility and customer engagement worldwide. Customization options including team logos and player names, attract both athletes and passionate rugby fans. Investment in sustainable materials like recycled polyester and organic cotton aligns with evolving customerr preferences. Extensive research and development (R&D) efforts introduce moisture-wicking, stretchable, and antimicrobial fabrics for superior functionality. E-commerce platforms serve as key distribution channels, expanding global access to rugby apparel collections. Direct-to-consumer (D2C) sales strategies enable stronger brand-customer relationships and personalized shopping experiences. Social media marketing and athlete endorsements improves brand credibility, hence, influencing purchasing decisions. Exclusive online discounts, limited-edition releases, and loyalty programs strengthen customer retention and sales growth.

The report provides a comprehensive analysis of the competitive landscape in the rugby apparel market with detailed profiles of all major companies, including:

- Adidas AG

- Badger Rugby Limited

- Decathlon SA

- Grays of Cambridge (International) Ltd.

- KOOGA New Zealand

- Macron S.p.A.

- Nike Inc.

- O'Neills Irish International Sports Company Ltd.

- Pentland Brands Limited

- Puma SE

- Under Armour Inc.

Latest News and Developments:

- January 2025: Mizuno introduced the Alpha II Elite boots, showcasing a sleek metallic design with neon yellow, red, and blue accents. Engineered for speed and lightweight performance, these boots weigh just 185g, ensuring superior fit, comfort, and agility. The shimmering upper and iridescent logo enhance their standout appeal on the pitch. This launch follows the earlier special edition ‘Made in Japan’ version.

- September 2024: Saracens revealed their new Castore away kit for the 2024/25 season, created in collaboration with fans through Socios.com. Over 3,000 Fan Token holders voted on the jersey’s color scheme and design via Socios app polls. Four lucky fans attended an exclusive early-access reveal event on July 31st, celebrating a nearly two-year process. The red, black, and white jersey, featuring the Saracens logo, will be worn by players in the upcoming season.

- July 2024: Canterbury of NZ launched the Stampede boot collection, designed for power and speed on the field. Featuring the Flightbeam 2.0 outsole, the boots enhance traction and stability while offering a wider toe box and heel support for an improved fit. Available in black and orange, they empower forwards to "unleash chaos,".

- June 2024: Adidas and New Zealand Rugby (NZR) mark 25 years of partnership with new jerseys for the 2024 international season. The designs feature a bold black base with silver accents celebrating the milestone. Key elements include an enlarged fern emblem, the adidas logo, and iconic three stripes. The all-white collar returns, paying tribute to past World Cup-winning jerseys.

Rugby Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upper Wear, Bottom Wear, Socks |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Men, Women |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Badger Rugby Limited, Decathlon SA, Grays of Cambridge (International) Ltd., KOOGA New Zealand, Macron S.p.A., Nike Inc., O'Neills Irish International Sports Company Ltd., Pentland Brands Limited, Puma SE, Under Armour Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, rugby apparel market outlook, and dynamics of the market from 2019-2033.

- The rugby apparel market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rugby apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rugby apparel market was valued at USD 1.34 Billion in 2024.

The rugby apparel market is projected to exhibit a CAGR of 8.29% during 2025-2033, reaching a value of USD 2.84 Billion by 2033.

The rugby apparel market growth is driven by rising global participation, increasing fan engagement, and major tournaments like the Rugby World Cup. Sponsorships and brand collaborations with professional teams enhance market visibility and sales. Advancements in fabric technology including moisture-wicking and stretchable materials, improve player performance and comfort. E-commerce expansion ensures wider accessibility, while sustainability trends drive demand for eco-friendly materials.

Europe currently dominates the rugby apparel market, accounting for a share of 43.0% in 2024. Countries like the UK, France, and Ireland drive demand through professional tournaments like the Six Nations. Sponsorships, club merchandise, and fan engagement fuel apparel sales across all segments. High customer spending supports premium rugby apparel purchases, while e-commerce enhances accessibility. Stadium-based retail sales thrive during major events, influencing market revenue.

Some of the major players in the rugby apparel market include Adidas AG, Badger Rugby Limited, Decathlon SA, Grays of Cambridge (International) Ltd., KOOGA New Zealand, Macron S.p.A., Nike Inc., O'Neills Irish International Sports Company Ltd., Pentland Brands Limited, Puma SE, Under Armour Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)