Rubber Tired Gantry Crane Market Size, Share, Trends and Forecast by Type, Power Supply, Application, and Region, 2025-2033

Rubber Tired Gantry Crane Market Size and Share:

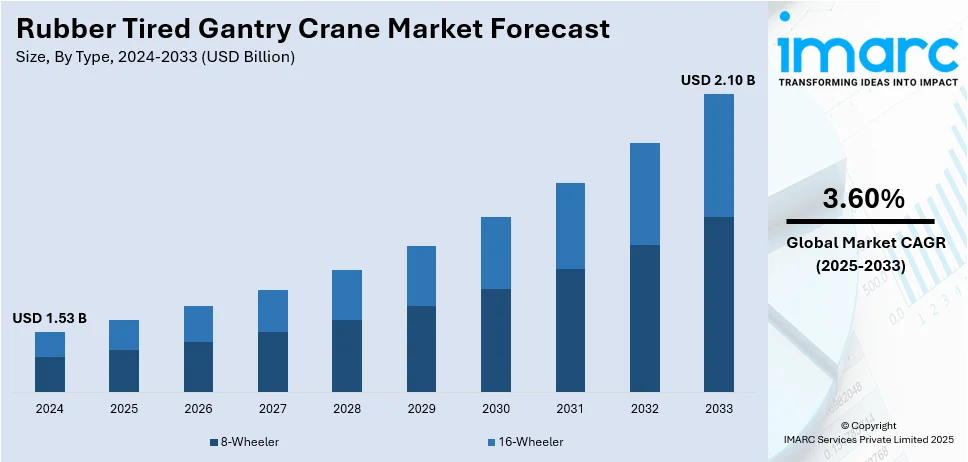

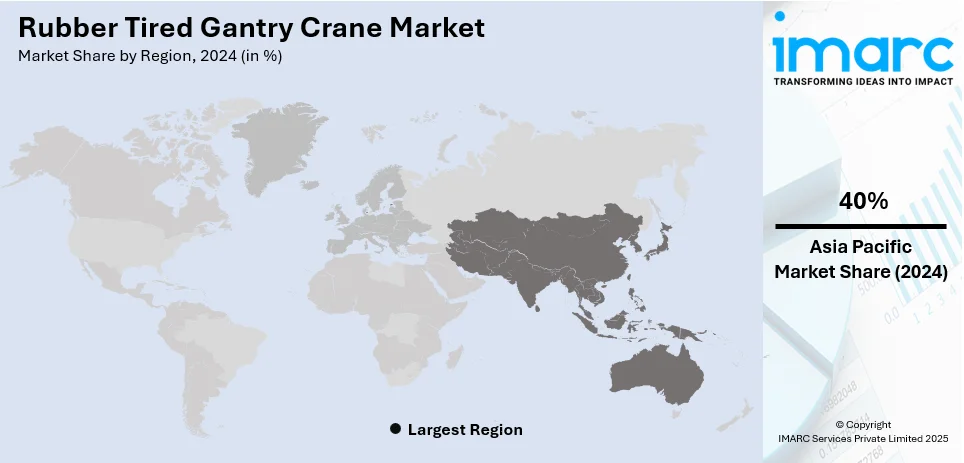

The global rubber tired gantry crane market size was valued at USD 1.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.10 Billion by 2033, exhibiting a CAGR of 3.60% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 40% in 2024. The market is driven by increasing port automation, rising global trade volumes, growing containerization, demand for fuel-efficient and hybrid RTGs, infrastructure expansion in emerging economies, and stricter environmental regulations encouraging the adoption of electric and hybrid models for reduced emissions and operational efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.53 Billion |

|

Market Forecast in 2033

|

USD 2.10 Billion |

| Market Growth Rate (2025-2033) | 3.60% |

The expansion of international trade and containerized cargo transportation is a key driver of the rubber tired gantry (RTG) crane market. As global supply chains grow, ports and intermodal terminals require efficient handling equipment to manage increasing container volumes. RTG cranes offer high stacking capabilities and operational flexibility, optimizing yard space and reducing congestion. Additionally, trade agreements and economic growth in emerging markets drive port expansions, increasing demand for advanced cargo-handling solutions. The shift towards larger container ships also necessitates enhanced port infrastructure, further accelerating RTG crane adoption to improve productivity, turnaround times, and overall terminal efficiency.

The U.S. RTG crane market is driven by expanding port infrastructure and rising container traffic with 86.50% market share. Large ports, such as Los Angeles, Long Beach, and Savannah, are investing in updated equipment to make operations more efficient and less polluting. The transition to electrified and hybrid RTG cranes is also in line with strict environmental policies encouraging green port operations. Automation trends also enhance market growth by making operations more productive and lowering labor expenses. Furthermore, government efforts towards supply chain resilience and the growth of trade are factors in greater demand for sophisticated cargo-handling technologies, thus making RTG cranes an essential element of U.S. port upgrading.

Rubber Tired Gantry Crane Market Trends:

Electrification and Hybrid Technology Adoption

A major trend in the Rubber Tired Gantry (RTG) crane market is the growing adoption of electrification and hybrid technologies, driven by sustainability objectives and increasingly stringent environmental regulations. Ports worldwide are increasingly adopting electric and hybrid RTG cranes to cut fuel consumption and carbon emissions. Hybrid RTG cranes, which integrate diesel generators with battery storage, can achieve up to 74% fuel savings compared to traditional diesel models, significantly reducing operational costs. Additionally, advancements in battery technology and improvements in grid infrastructure are accelerating the adoption of fully electric RTG cranes, enhancing energy efficiency and supporting global decarbonization initiatives across major port operations.

Automation and Remote-Controlled Operations

The integration of automation and remote-controlled operations is transforming RTG crane functionalities. Ports are adopting smart crane technologies to boost operational efficiency, minimize human error, and enhance safety. Automated RTG cranes, featuring advanced sensors, cameras, and AI-driven software, ensure precise container handling with minimal manual input.

Remote-controlled RTG cranes further enhance productivity by allowing operators to manage multiple cranes from centralized control rooms, reducing the need for on-site personnel. Additionally, the adoption of remote-controlled ship-to-shore cranes has been associated with a 20% increase in productivity. This trend is particularly strong in regions with high labor costs, where automation significantly improves cost efficiency and scalability, ultimately optimizing terminal operations and cargo throughput.

Expansion of Smart Port Infrastructure

The increasing adoption of smart port infrastructure is influencing RTG crane market growth. Ports are integrating digital solutions such as IoT-enabled monitoring systems, predictive maintenance, and real-time data analytics to optimize crane performance and minimize downtime. Smart RTG cranes provide enhanced visibility into container movements, improving logistics coordination and reducing bottlenecks. As ports transition toward intelligent, interconnected systems, RTG cranes with advanced telematics and cloud-based fleet management solutions are becoming essential for seamless operations. This trend aligns with global efforts to enhance port efficiency, maximize space utilization, and ensure sustainable cargo-handling practices, further driving RTG crane modernization.

Rubber Tired Gantry Crane Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rubber tired gantry crane market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, power supply, and application.

Analysis by Type:

- 8-Wheeler

- 16-Wheeler

16-wheeler trucks dominate the market with a 62.0% share due to their high load-carrying capacity, making them essential for heavy cargo transportation. These trucks are widely used in logistics, construction, and industrial sectors for moving large shipments efficiently. Their ability to transport bulk goods over long distances with minimal trips enhances cost-effectiveness and operational efficiency. Additionally, increasing infrastructure development and global trade expansion drive demand for high-capacity transport solutions. Ports, warehouses, and distribution centers rely on 16-wheelers for seamless container movement. Despite the rise of alternative transport solutions, their versatility, durability, and ability to handle diverse freight types keep them at the forefront of the logistics industry.

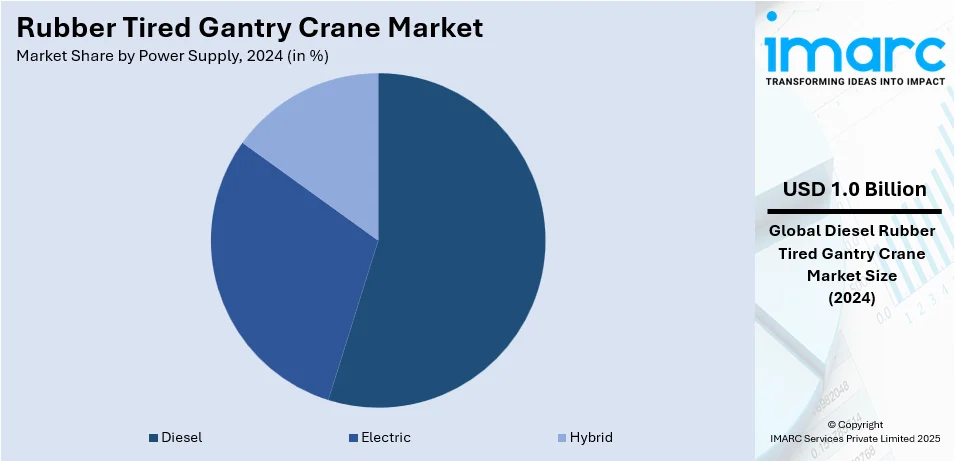

Analysis by Power Supply:

- Diesel

- Electric

- Hybrid

Diesel-powered Rubber Tired Gantry (RTG) cranes hold the largest market share at 54.6% due to their widespread use in ports and container terminals. Their high power output, reliability, and ability to operate in high-load conditions make them a preferred choice for heavy cargo handling. Diesel RTG cranes offer flexibility, as they do not require fixed power infrastructure, making them ideal for large-scale operations. Despite the shift toward electrification, many ports continue using diesel variants due to lower upfront costs and established fueling infrastructure. However, stringent emission regulations are pushing operators to adopt hybrid or retrofitted diesel-electric alternatives to enhance fuel efficiency and reduce environmental impact.

Analysis by Application:

- Construction

- Oil and Gas

- Shipbuilding

- Power and Utilities

- Others

The construction sector dominates the market growth due to increasing infrastructure projects, urban expansion, and rising demand for efficient material handling solutions. Large-scale construction activities, including commercial and residential developments, require advanced RTG cranes for handling heavy precast materials and steel components with precision. Growing investments in smart cities and megaprojects further boost crane adoption. Additionally, the shift toward modular construction techniques increases reliance on RTG cranes for streamlined logistics and efficient site operations. The demand for automated and hybrid cranes is also rising, as construction firms prioritize sustainability and cost-effective solutions. As urbanization accelerates, the sector continues to be a key driver of market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the largest market share, accounting for 40%, due to its dominant position in global trade and extensive port infrastructure development. The region is home to major shipping hubs, including China, Japan, South Korea, and Singapore, where high container traffic drives demand for advanced RTG cranes. Government investments in port expansion and modernization projects further support market growth. Additionally, the shift toward automation and electrification in cargo handling is accelerating due to stringent environmental regulations. With increasing trade volumes, rapid industrialization, and rising e-commerce activity, ports in Asia Pacific are adopting energy-efficient and technologically advanced RTG cranes to enhance operational efficiency and sustainability.

Key Regional Takeaways:

North America Rubber Tired Gantry Crane Market Analysis

The North America rubber tired gantry (RTG) crane market is expanding due to rising container traffic, port modernization efforts, and increasing demand for automated cargo handling solutions. The transition to electrified and hybrid RTG cranes is accelerating, driven by strict environmental regulations focused on reducing carbon emissions. Ports in the U.S. and Canada are investing in energy-efficient crane systems to enhance operational productivity while minimizing fuel consumption. Additionally, the integration of IoT-based monitoring, predictive maintenance, and remote-control technologies is improving efficiency and reducing downtime. Automation is a key trend, with ports adopting remote-controlled and AI-driven RTG cranes to optimize terminal operations. The region's increasing trade volumes and infrastructure investments further support market growth. Government initiatives promoting sustainable port operations are also accelerating the transition toward greener alternatives. As North American ports continue upgrading their fleets, demand for advanced RTG cranes with enhanced automation, connectivity, and eco-friendly features is expected to rise significantly.

United States Rubber Tired Gantry Crane Market Analysis

The U.S. Rubber Tired Gantry (RTG) Crane market is experiencing steady growth, driven by increasing container traffic and port expansion projects. Major ports, including Los Angeles, Long Beach, and Savannah, are investing in modern RTG cranes to enhance operational efficiency and meet rising trade demands. The adoption of electrified and hybrid RTG cranes is accelerating due to stringent environmental regulations aimed at reducing emissions. Additionally, automation and remote-controlled crane technologies are gaining traction to improve productivity and reduce labor costs. Government initiatives supporting infrastructure upgrades and supply chain resilience further drive demand, making the U.S. a key market for RTG crane advancements. Increasing investments in smart port technologies, including IoT-enabled fleet management and predictive maintenance solutions, are also shaping market growth. As trade volumes continue to rise and sustainability becomes a priority, manufacturers are focusing on innovation to offer energy-efficient, high-performance RTG cranes. The growing emphasis on port modernization and efficiency enhancement makes the U.S. an attractive market for RTG crane manufacturers.

Europe Rubber Tired Gantry Crane Market Analysis

Europe's RTG crane market is driven by increasing port automation, stringent environmental policies, and rising trade activities. Ports across the region are rapidly adopting electrified and hybrid RTG cranes to comply with strict emissions regulations and reduce operational costs. The push for sustainability has led to significant investments in battery-powered and grid-connected RTG cranes, particularly in countries with ambitious decarbonization targets. Smart port initiatives, including AI-driven logistics and IoT-enabled monitoring systems, are enhancing operational efficiency and optimizing container handling. Additionally, automation is gaining momentum as ports integrate remote-controlled and semi-autonomous RTG cranes to improve safety and reduce dependency on manual labor. The demand for advanced crane technologies is further driven by increasing trade volumes and supply chain digitalization efforts. With ongoing infrastructure developments and port expansion projects, Europe remains a key market for technologically advanced and eco-friendly RTG crane solutions.

Asia Pacific Rubber Tired Gantry Crane Market Analysis

The Asia Pacific RTG crane market is expanding rapidly, fueled by increasing maritime trade, large-scale port infrastructure projects, and rising containerization. Countries like China, India, and Japan are investing heavily in port modernization to accommodate growing cargo volumes. The demand for electrified and automated RTG cranes is surging as governments implement stricter emission norms and promote smart port initiatives. The region is also witnessing high adoption of IoT-enabled crane systems for predictive maintenance and efficiency optimization. As major shipping hubs continue to expand, Asia Pacific remains a dominant market for RTG crane manufacturers focusing on innovation and sustainability.

Latin America Rubber Tired Gantry Crane Market Analysis

Latin America's RTG crane market is driven by increasing trade activities and port infrastructure improvements. Countries such as Brazil, Mexico, and Chile are investing in modernizing container terminals to handle rising cargo volumes. The adoption of hybrid and electrified RTG cranes is gradually increasing as ports aim to improve energy efficiency and meet environmental standards. Automation trends, including remote-controlled operations, are also emerging to enhance productivity and reduce operational costs. Despite economic fluctuations, ongoing government initiatives to boost trade and logistics infrastructure support market growth, making Latin America an evolving market for RTG crane advancements.

Middle East and Africa Rubber Tired Gantry Crane Market Analysis

The Middle East and Africa RTG crane market is expanding due to rising port investments and increasing trade activities. Countries like the UAE, Saudi Arabia, and South Africa are upgrading port infrastructure to enhance cargo handling capabilities. The shift towards hybrid and electric RTG cranes is gaining momentum, driven by sustainability initiatives and the need for cost-efficient operations. Automation and IoT integration are becoming more prevalent as ports focus on efficiency and modernization. With growing maritime trade and logistics development, the demand for advanced RTG cranes is expected to increase across key regional ports.

Competitive Landscape:

The RTG crane market is highly competitive, with several global and regional manufacturers focusing on technological advancements, sustainability, and automation. Companies are investing in research and development to enhance energy efficiency, reduce emissions, and improve crane productivity. The market is witnessing increased adoption of electrified and hybrid RTG cranes, driven by stringent environmental regulations and operational cost reduction strategies. Manufacturers are also integrating IoT-enabled monitoring systems, automation, and predictive maintenance solutions to improve performance and reduce downtime. Strategic partnerships with port operators, infrastructure investments, and after-sales service expansions further intensify competition. Additionally, increasing port modernization projects worldwide are fostering demand for innovative, high-capacity, and technologically advanced RTG cranes.

The report provides a comprehensive analysis of the competitive landscape in the rubber-tired gantry crane market with detailed profiles of all major companies, including:

- Anupam Industries Limited

- ASCOM SPA, Bedeschi S.p.A.

- Cargotec Oyj

- Konecranes Oyj

- Liebherr-International AG

- Mi-Jack Products (Lanco International Inc.)

- Paul Vahle GmbH & Co. KG

- Reva Industries India Pvt. Ltd.

- Sany Heavy Industry Co. Ltd

- Shanghai Zhenhua Heavy Industries Company Limited

- TNT Crane & Rigging.

Latest News and Developments:

- In January 2025, Hutchison Ports Thailand expanded its fleet at Terminal D, Laem Chabang Port, with new remote-controlled, electric-powered cranes. The addition includes four quay cranes and eight rubber-tired gantry cranes, enhancing efficiency and reducing emissions. With a 24-row outreach and advanced safety features, these cranes improve cargo handling and monitoring through a centralized control system. Terminal D now operates 14 quay cranes and 36 RTGs, supporting mega vessel operations.

- In May 2024, Paceco initiated a trial for the world's first hydrogen fuel cell rubber-tired gantry (RTG) crane at the Port of Los Angeles. Developed with Mitsui E&S, the H2-ZE RTG Transtainer Crane became operational on May 15, marking a milestone in zero-emission cargo handling. Paceco’s Troy Collard highlighted its role in reducing industry emissions, thanking pilot partners for their support in advancing sustainable port technology.

- In February 2024, Kobe-Osaka International Port Corporation, under the leadership of President Takafumi Kido, has launched a pioneering demonstration project at Hanshin Port, commissioned by Japan’s Ministry of Land, Infrastructure, Transport, and Tourism. This initiative will feature the world’s first hydrogen-fueled RTG crane by converting its diesel generator to a hydrogen engine. The project will be implemented at Kobe International Container Terminal (KICT), operated by Mitsui O.S.K. Lines, marking a significant advancement in sustainable port operations.

Rubber Tired Gantry Crane Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | 8-Wheeler, 16-Wheeler |

| Power Supplies Covered | Diesel, Electric, Hybrid |

| Applications Covered | Construction, Oil and Gas, Shipbuilding, Power and Utilities, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anupam Industries Limited, ASCOM SPA, Bedeschi S.p.A., Cargotec Oyj, Konecranes Oyj, Liebherr-International AG, Mi-Jack Products (Lanco International Inc.), Paul Vahle GmbH & Co. KG, Reva Industries India Pvt. Ltd., Sany Heavy Industry Co. Ltd, Shanghai Zhenhua Heavy Industries Company Limited and TNT Crane & Rigging, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rubber tired gantry crane market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rubber tired gantry crane market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rubber tired gantry crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rubber tired gantry crane market was valued at USD 1.53 Billion in 2024.

The rubber tired gantry crane market was valued at USD 2.10 Billion in 2033 exhibiting a CAGR of 3.60% during 2025-2033.

The rubber tired gantry crane market is driven by increasing port modernization, rising container traffic, and growing demand for automated and energy-efficient cargo handling solutions. Stricter environmental regulations are accelerating the shift toward hybrid and electric RTG cranes, while advancements in IoT, AI, and remote monitoring enhance operational efficiency and productivity.

Asia Pacific currently dominates the market with 40% owing to growing port modernization, rising container traffic, and the need for automated, energy-efficient cargo handling drive the rubber-tired gantry crane market. Stricter environmental regulations boost hybrid and electric RTG adoption, while advancements in IoT, AI, and remote monitoring improve operational efficiency, reducing downtime and enhancing overall productivity in port operations.

Some of the major players in the rubber tired gantry crane market include Anupam Industries Limited, ASCOM SPA, Bedeschi S.p.A., Cargotec Oyj, Konecranes Oyj, Liebherr-International AG, Mi-Jack Products (Lanco International Inc.), Paul Vahle GmbH & Co. KG, Reva Industries India Pvt. Ltd., Sany Heavy Industry Co. Ltd, Shanghai Zhenhua Heavy Industries Company Limited and TNT Crane & Rigging, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)