Rubber Processing Chemicals Market Report by Type (Antidegradants, Accelerators, Flame Retardants, Processing Aids, and Others), Application (Tire, Non-Tire), End-Use (Tire and Related Products, Automotive Components, Medical Products, Footwear Products, Industrial Rubber Products, and Others), and Region 2025-2033

Global Rubber Processing Chemicals Market:

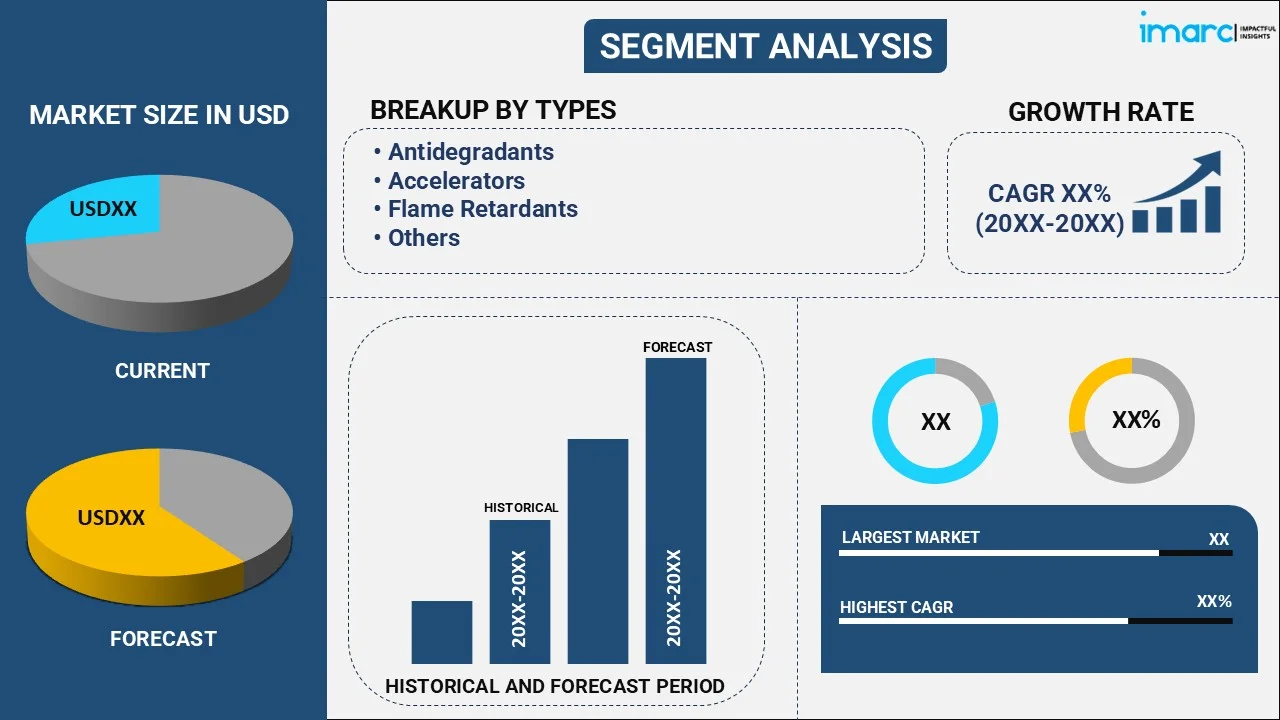

The global rubber processing chemicals market size reached USD 5.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.56% during 2025-2033. The growing in automotive industry, expansion of infrastructure projects, ongoing technological advancements, and the growing emphasis on sustainability, are primarily driving the market's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.4 Billion |

|

Market Forecast in 2033

|

USD 8.3 Billion |

| Market Growth Rate (2025-2033) | 4.56% |

Rubber Processing Chemicals Market Analysis:

- Major Market Drivers: The growing utilization of synthetic rubber products is among the key factors driving the growth of the market. Additionally, the expanding automotive sector is acting as another major growth-inducing factor.

- Key Market Trends: The thriving construction, electronics, aerospace, medical, and footwear industries are boosting product adoption in the manufacturing of rubber-based sealants, insulating agents, roofing materials, and floor coverings. In addition to this, the development of chemicals with improved ease of handling, along with rapid urbanization, is projected to drive the market further.

- Competitive Landscape: Some of the prominent rubber processing chemicals market companies include BASF SE, Akzo Nobel N.V., Arkema S.A., Behn Meyer Holdings AG, China Petroleum & Chemical Corporation, Eastman Chemical Company, Emerald Performance Materials LLC, Emery Oleochemicals Group, Lanxess AG, Merchem Limited, Solvay Group, Sumitomo Chemical Company, and Vanderbilt Chemicals LLC, among many others.

- Geographical Trends: According to the rubber processing chemicals market dynamics, Asia Pacific is dominating the overall market’s growth. The automotive industry is a major consumer of rubber products, and with the rise in vehicle production and sales in the region, the demand for rubber processing chemicals is growing. These chemicals are essential for enhancing the performance, durability, and safety of automotive tires and components.

- Challenges and Opportunities: Fluctuations in the prices of raw materials and high competition among key players are hampering the market's growth. However, rapid industrialization and infrastructure development in emerging markets provide significant growth opportunities for RPC suppliers.

To get more information on this market, Request Sample

Rubber Processing Chemicals Market Trends:

Rising Automotive Industry Demand

The automotive sector is a significant consumer of rubber products, especially tires. As vehicle production and sales rise, so does the demand for RPCs used in tire manufacturing and other automotive components. For instance, according to an article published by the Society of Indian Automobile Manufacturers, from April 2022 to March 2023, the auto industry produced a total of more than 2,59,00,000 vehicles, comprising passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles, compared to 2,30,00,000 units in April 2021 to March 2022. These factors are expected to propel the rubber processing chemicals market in the coming years.

Expansion of Infrastructure and Construction Projects

Expansion of infrastructure and construction projects. For instance, according to Statista, as of May 2022, China's infrastructure projects in development or implementation were worth more than US$ 5 Trillion. Similarly, in FY23, the Ministry of Road Transport and Highways constructed national highways extending 10,331 km. Infrastructure development, including roads, bridges, and buildings, requires durable rubber products. This growth in infrastructure projects necessitates the use of RPCs to enhance the properties of rubber materials. These factors further positively influence the rubber processing chemicals market forecast.

Sustainable Innovations

There is a rising focus on sustainability and eco-friendly products. The development and use of bio-based or recyclable rubber processing chemicals align with these trends, driving growth in this segment of the market. For instance, in July 2024, Dow introduced NORDEL REN Ethylene Propylene Diene Terpolymers, a bio-based version of Dow's EPDM rubber compound utilized in automotive, infrastructure, and consumer applications at the 2024 German Rubber Conference, thereby boosting the rubber processing chemicals market revenue.

Global Rubber Processing Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global rubber processing chemicals market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type, application, and end-use.

Breakup by Type:

- Antidegradants

- Accelerators

- Flame Retardants

- Processing Aids

- Others

Antidegradants hold the majority of the total market share

The report has provided a detailed breakup and analysis of the rubber processing chemicals market based on the type. This includes antidegradants, accelerators, flame retardants, processing aids, and others. According to the report, antidegradants hold the majority of the total market share.

According to the rubber processing chemicals market outlook, antidegradants are indeed a significant component of the Rubber Processing Chemicals (RPC) market. These chemicals are crucial because they help to prevent the degradation of rubber due to factors like heat, oxygen, and ozone exposure. By maintaining the integrity and extending the lifespan of rubber products, antidegradants play a key role in the rubber industry. Antidegradants, such as antioxidants and antiozonants, are essential for ensuring the durability and performance of rubber products. Growth in infrastructure projects, such as road construction and public transportation systems, often involves rubber products like seals, gaskets, and bearings. This drives the need for antidegradants to ensure the reliability and longevity of these components.

Breakup by Application:

- Tire

- Non-Tire

Tire currently accounts for the majority of the global market share

The report has provided a detailed breakup and analysis of the rubber processing chemicals market based on the application. This includes tire and non-tire. According to the report, tire currently accounts for the majority of the global market share.

According to the rubber processing chemicals market overview, the expansion of the automotive industry, driven by increasing vehicle production and sales, directly boosts the demand for tires. This, in turn, drives the need for rubber processing chemicals to ensure the quality and performance of tires. Moreover, innovations in tire technology, such as the development of high-performance, fuel-efficient, and all-weather tires, require advanced rubber processing chemicals. These chemicals are essential for achieving the desired properties, such as improved grip, durability, and resistance to wear and tear.

Breakup by End-Use:

- Tire and Related Products

- Automotive Components

- Medical Products

- Footwear Products

- Industrial Rubber Products

- Others

Tire and related products exhibit a clear dominance in the market

A detailed breakup and analysis of the rubber processing chemicals market based on the end-use has also been provided in the report. This includes tire and related products, automotive components, medical products, footwear products, industrial rubber products, and others. According to the report, tire and related products exhibit a clear dominance in the market.

Increased vehicle production and sales drive higher demand for tires, which in turn increases the need for rubber processing chemicals used in tire manufacturing. Moreover, as vehicles age, the demand for replacement tires grows, further boosting the need for rubber processing chemicals. Apart from this, development of tires with enhanced performance characteristics, such as better grip, handling, and durability, drives demand for advanced tire technologies.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

Asia Pacific currently dominates the global market

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, others); and the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, others). According to the report, Asia Pacific currently dominates the global market.

According to the rubber processing chemicals market statistics, significant investments in infrastructure projects, such as roads, highways, and public transportation, drive demand for rubber products and the chemicals used in their processing. Moreover, the growing urban areas increase the demand for various rubber products, including tires and construction materials, which in turn boosts the need for RPC. Besides this, Asia-Pacific is a major hub for automotive manufacturing. Increased vehicle production, including passenger cars, commercial vehicles, and motorcycles, drives demand for tires and other rubber components. For instance, India's annual automobile production in FY23 was 25.9 million units. India is a strong market in terms of both domestic demand and exports.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major market companies have also been provided. Some of the key players in the market include:

- BASF SE

- Akzo Nobel N.V.

- Arkema S.A.

- Behn Meyer Holdings AG

- China Petroleum & Chemical Corporation

- Eastman Chemical Company

- Emerald Performance Materials LLC

- Emery Oleochemicals Group

- Lanxess AG

- Merchem Limited

- Solvay Group

- Sumitomo Chemical Company

- Vanderbilt Chemicals LLC

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Rubber Processing Chemicals Market Recent Developments:

- August 2024: The Rubber Board's Executive Director established a digital database of rubber chemicals, machinery manufacturers, and suppliers in India.

- July 2024: Dow introduced NORDEL REN Ethylene Propylene Diene Terpolymers, a bio-based version of Dow's EPDM rubber compound utilized in automotive, infrastructure, and consumer applications at the 2024 German Rubber Conference.

- March 2024: LANXESS presented its range of rubber additives and solutions for the tire industry at the Tire Technology Expo 2024.

Rubber Processing Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Antidegradants, Accelerators, Flame Retardants, Processing Aids, Others |

| Applications Covered | Tire, Non-Tire |

| End-Uses Covered | Tire and Related Products, Automotive Components, Medical Products, Footwear Products, Industrial Rubber Products, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | BASF SE, Akzo Nobel N.V., Arkema S.A., Behn Meyer Holdings AG, China Petroleum & Chemical Corporation, Eastman Chemical Company, Emerald Performance Materials LLC, Emery Oleochemicals Group, Lanxess AG, Merchem Limited, Solvay Group, Sumitomo Chemical Company, Vanderbilt Chemicals LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the rubber processing chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global rubber processing chemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the rubber processing chemicals industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global rubber processing chemicals market was valued at USD 5.4 Billion in 2024.

We expect the global rubber processing chemicals market to exhibit a CAGR of 4.56% during 2025-2033.

The rising utilization of rubber processing chemicals to enhance numerous properties of rubber-based products, such as resilience, hardness, heat and abrasion resistance, etc., to make them commercially useful, is primarily driving the global rubber processing chemicals market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary closure of numerous end-use industries for rubber processing chemicals.

Based on the type, the global rubber processing chemicals market can be segmented into antidegradants, accelerators, flame retardants, processing aids, and others. Currently, antidegradants hold the majority of the total market share.

Based on the application, the global rubber processing chemicals market has been categorized into tire and non-tire, where tire currently accounts for the majority of the global market share.

Based on the end use, the global rubber processing chemicals market can be bifurcated into tire and related products, automotive components, medical products, footwear products, industrial rubber products, and others. Among these, tire and related products exhibit a clear dominance in the market.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global rubber processing chemicals market include BASF SE, Akzo Nobel N.V., Arkema S.A., Behn Meyer Holdings AG, China Petroleum & Chemical Corporation, Eastman Chemical Company, Emerald Performance Materials LLC, Emery Oleochemicals Group, Lanxess AG, Merchem Limited, Solvay Group, Sumitomo Chemical Company, Vanderbilt Chemicals LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)